So, you want to be a day trader?

The question is….do you have what it takes?

Everyone wants to be a successful trader. Who wouldn’t?

The ability to turn money into more money appeals to just about everyone. Combine that with limitless profit potential and the freedom to be your own boss, and trading may be one of the best careers out there.

If you’re reading this post, I probably don’t need to pitch you on the benefits of trading. The question is not, “do you want to be a successful trader?” It’s, “how will you get there?”

This is where many new traders jump the gun. They are inspired by all of the successful traders they see and they dive into the markets head-first. They start pressing buttons and swimming with sharks before they have any clue what they’re doing.

They are dangerously unequipped.

If you want to be a successful trader, you need to equip yourself with the right tools. We’ve spent plenty of time discussing actual trading tools in our free beginners course.

Today, we are going to discuss some of the intangibles – the foundational processes that will determine your likelihood of success.

Let’s get to it.

Get Your Head on Straight

Before we dive into the foundational components of trading, it’s important to make sure you have the right mindset.

Day trading is a SKILL SET that requires education, practice, and optimization. Here are some harsh truths you need to accept before we move forward:

- You will NOT start making money right away.

- Day trading is NOT easy.

- You can NOT start buying stocks and hope for the best.

If you are chasing easy money, look elsewhere (good luck!). You will probably stop reading this post in about two minutes anyway.

If you’re ready to put in the work, I’m going to show you the exact process you need to follow if you want to become a successful day trader.

This is the exact 6-step process that every successful trader follows – there are no shortcuts.

1. Learning

Every worthwhile skill has a learning curve.

If you want to start writing songs, you don’t just pick up a guitar, make some noises, and collect a check from a record label. You study music theory, learn some chords, practice consistently, and eventually develop your musical skillset.

Trading is no different.

Trading is a SKILLSET that requires education and practice.

The first step towards becoming a successful trader is learning. While that may seem obvious, many new traders try to circumvent this step by placing trades right away. This flawed approach is the equivalent of trying to write a song without knowing how to play an instrument.

If you want to become a successful trader, spend as much time learning as possible. You can start with a trading course, YouTube Videos, blog posts, or whatever resonates with you.

As you start learning, you can put your skills to the test with paper trading. Paper trading is a great way to test your skills without risking your money. It’s also a great learning tool. Chances are, as you begin to paper trade, you’ll realize there are dozens of other things you need to research.

Learn, paper trade, and repeat until you feel comfortable risking real money.

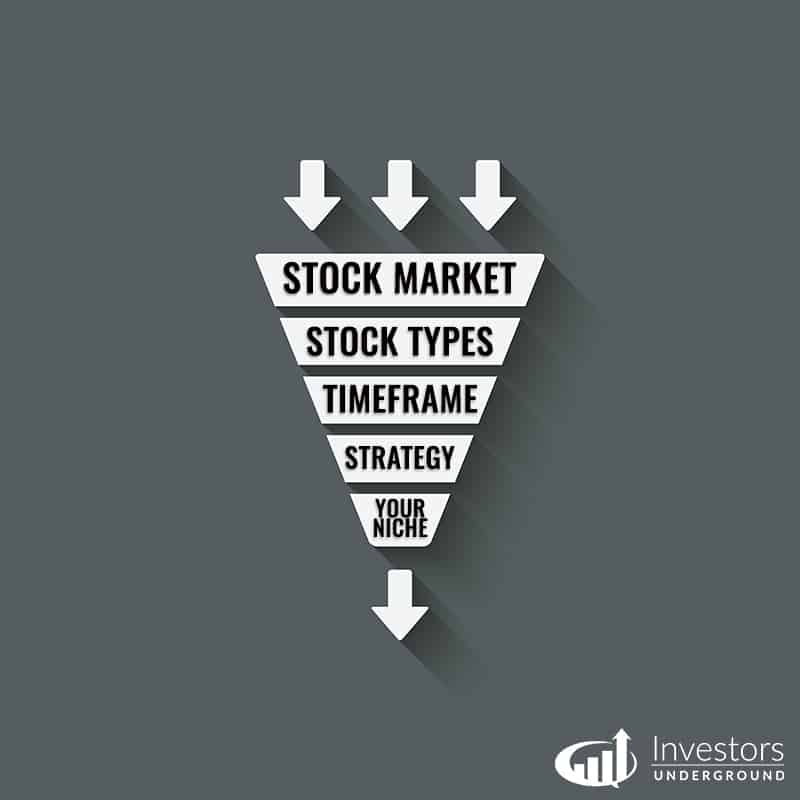

2. Developing Your Strategy (Finding Your Niche)

There are a thousand ways to make a buck in the market.

Every successful trader has their own unique trading style that is custom-tailored to their strengths.

Some traders specialize in large caps while others specialize in small caps.

Some traders are primarily short-biased while other traders are primarily long-biased.

There’s no perfect strategy. A good strategy is one that gives you an edge. Focus on your strengths. Which setups do you understand? What type of trades does your schedule allow for? What type of research are you most comfortable with?

Successful traders have structure. They avoid “shiny object syndrome” by creating niche strategies that keep them in their lanes. You need to do the same.

I recently explained how I like to categorize my trades (and how costly it is when I trade outside my niche).

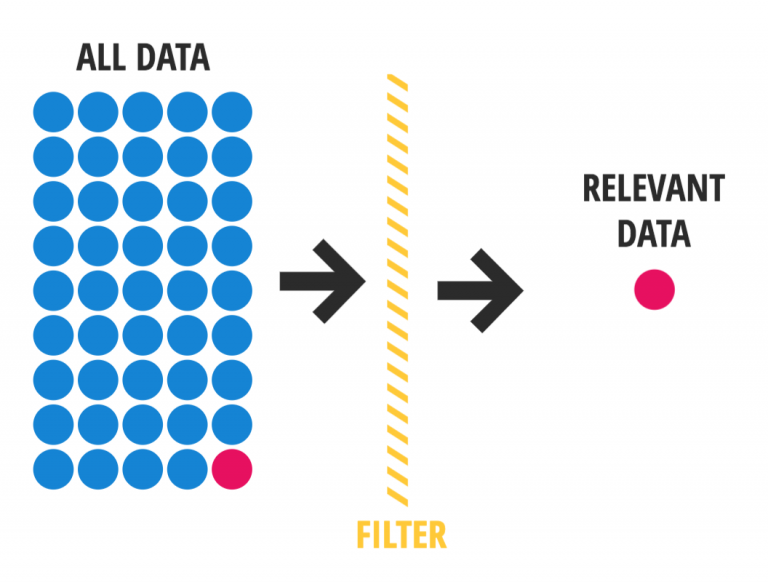

3. Scanning

Once you have a foundational understanding of the market and you’ve decided on your niche, it’s time to start finding stocks that meet your criteria.

Once again, this is where many new traders stray from the path. They start looking for hot stocks in all the wrong places. They scour Twitter, Facebook, and message boards looking for hot stock picks from other traders. They start buying into the stories companies tell and start focusing on all of the wrong things.

A recent example is Tesla. Tesla ran from ~$350/share to over $2,200/share in less than six months. A move like this tempts new traders into long-term speculation. Will this company revolutionize the industry? Will I regret not buying this stock in a year? What does Johnny Stock Picker have to say about this company?

All of these are pointless questions. The only question you need to answer is, “do I have a trade on my hands?” Nothing else matters. If you’ve properly defined your strategy (as discussed in point 2), this should be an easy question to answer.

Remember, your goal is to avoid shiny object syndrome. The best way to do this is to search for the specific stocks that meet your criteria.

This is where scanning comes in. Scanning allows you to use a set of criteria to find the exact stocks you are interested.

Let’s say you decided your strategy was to “buy stocks that are breaking above their 50-day highs on abnormal volume.”To find stocks that meet these criteria, you would simply enter the settings into your scan. These settings will vary by platform, but they could look something like this:

- Last Price > 50-Day High

- Day’s Volume > 20-Day Average Volume

The scanner would return a list of stocks that met these criteria.

Scans help you find the stocks that YOU are interested in. You should be using stock scanners to start building your daily watch lists.

4. Picking Your Stocks

Once you create a scan, you need to start filtering the results to find the best trading setups.

A scanner helps you find a few dozen stocks in a sea of thousands of publicly traded companies. It’s your job to filter those results down to a few of the best opportunities to start trading.

The goal is to come to the market with a game plan. The keyword here is “plan.” A list of stocks is NOT a game plan. You need to decide how you want to actually trade those tickers. You’ll notice on Sunday Scans I don’t simply say “watch $XYZ.” I share the exact game plan for how I plan to trade the stock.

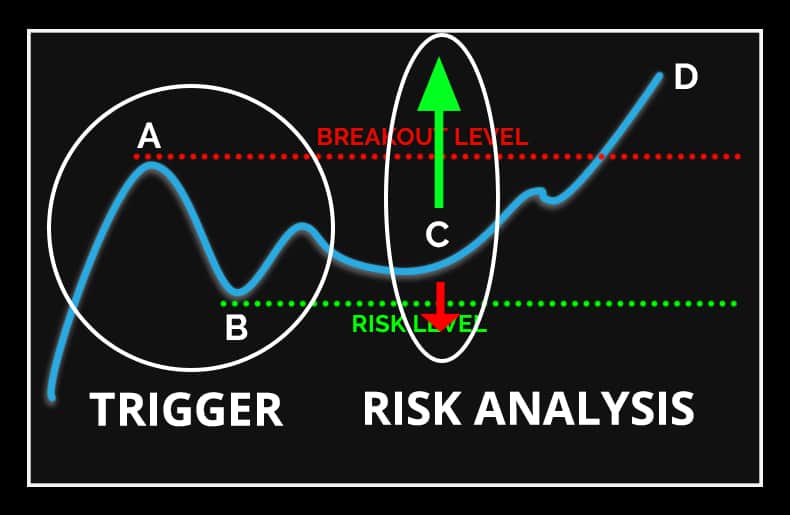

A trading game plan has a few key components:

- The Trigger + Rationale – Why are you trading this stock at this time?

- The Entry – What price will you buy the stock at?

- The Exit – When will you sell the stock for a profit? When will you cut losses?

If your trade plan doesn’t include those three components, you don’t have a trade. Don’t even think about buying a stock without being able to answer those questions.

Here’s a really simple example of how this looks on a chart:

The trigger is the formation of the ABCD pattern. The rationale is that these patterns have favorable risk/reward and favor a move to the upside. The entry is Point C, the stop loss is Point B, and the profit target is point D.

The trade is well-planned and easy to execute.

5. Executing Your Trades

If you plan your trades properly, execution should be the easy part. In the example above, we outlined an entire trading game plan. The entry price, stop loss, and profit target are all decided before the trade is executed.

When it comes time to execute the trade, you just need to follow your plan.

For example, let’s assume you have the following plan:

- Entry Price – $6.5

- Stop Loss – $6

- Profit Target – $8

In this case, you would buy at $6.5 and see how the stock reacts. If the stock drops to $6 or climbs to $8, you sell. Otherwise, you sit on the position. There’s no room for greed or fear to overwhelm you if you plan from the get-go.

You simply create your plan, execute it, and then analyze the results.

6. Reviewing Your Trades

Closing out a position is not the end of a trade. A review process should take place after the trade is executed.

You should get in the habit of reviewing your trades on a regular basis.

Day trading is an endless process of refinement and optimization. There is always room for improvement.

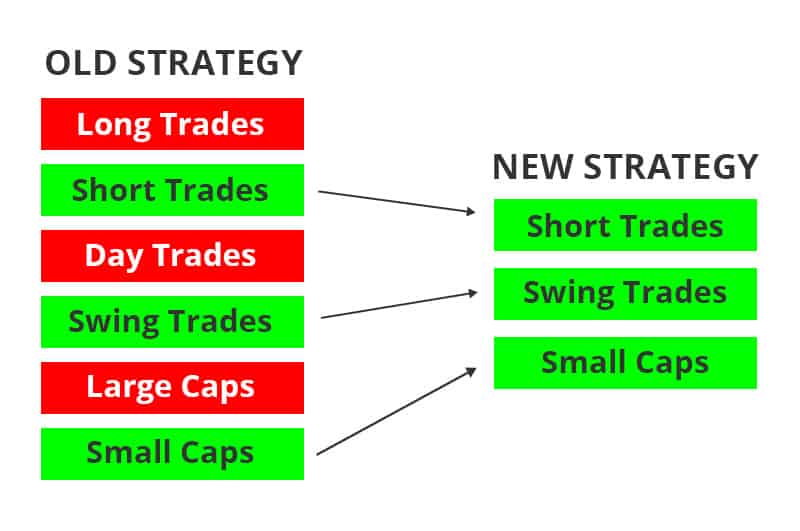

Fortunately, if you’ve been trading for a while, you already have a lot of the data you need to start improving your trading strategy. You just need to review the results of your current strategy to identify points of strength and weakness. From there, you can double down on your strengths and work to minimize your weaknesses.

For example, let’s assume you analyze your trades and notice the following trends:

- Long Trades (Average P&L): $-50/trade

- Short Trades (Average P&L): $100/trade

- Day Trades (Average P&L): -$100/trade

- Swing Trades (Average P&L): $200/trade

- Large Cap Stocks (Average P&L): –$50/trade

- Small Cap Stocks (Average P&L): $150/trade

You could clearly see that you do best when you swing trade short positions in small cap stocks. This information can be used to refine your strategy.

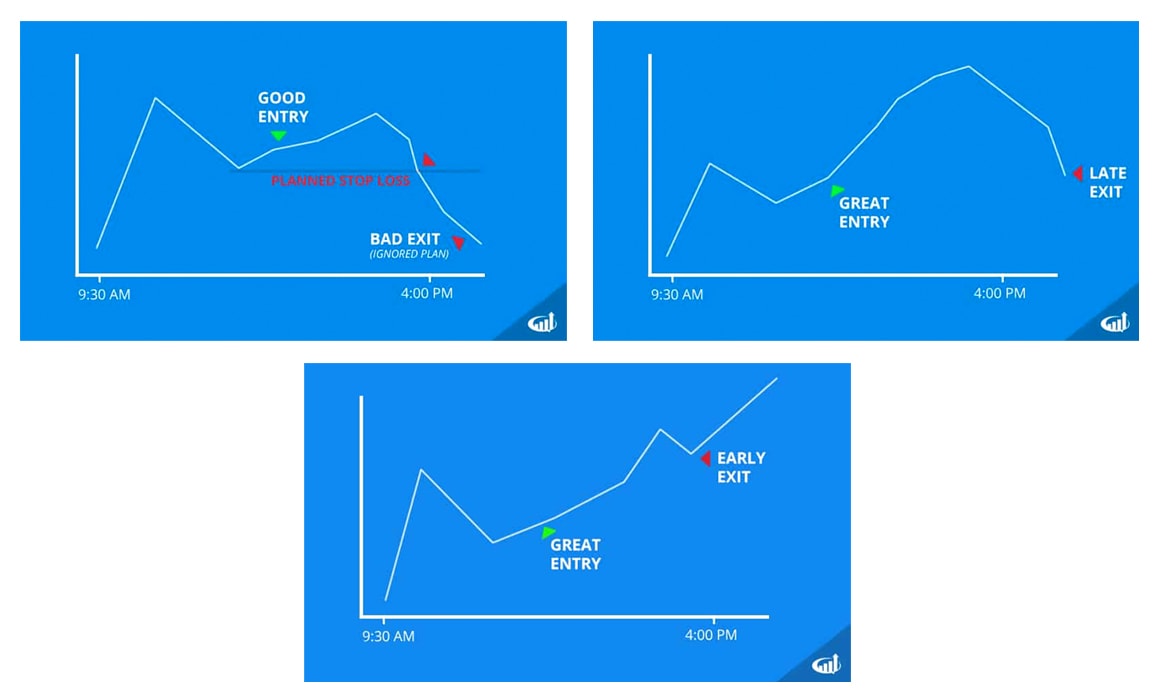

You could dig even deeper into your trades and analyze the execution itself:

- Did you choose a good setup?

- Did you get a good entry?

- Did you follow your plan?

- Did you exit too late/early?

This process of analysis and optimization will have compounding results. As you get in the habit of reviewing your trades and improving your strategy, you will gradually become more and more profitable.

Take Action

The best traders know the importance of being methodical and strategic. Do follow the 6-step process outlined above?

LEAVE A COMMENT and let us know:

- Which step of the process you’re working on now

- How you follow the 6-step process (i.e. your strategy, scanning process, etc.)

This is awesome help thank you

Currently trying to master 5. Step 6 I would think will never end

Thanks for the info. How do you prepare for next day? What specific factors are you using to target stocks the next morning?

Nate – when you say SCAN for the stocks your looking to possibly trade… is this SCAN part of the interface I would find within Think or Swim??

I really admire your outlook on how broad the market is and don’t limit the ability to making money only one way or style. Like being long bias or short bias. There really are many ways to be succussful.

Nate, tnx on the outline process on the 6 steps. recognizing my trading thought process all over again this has been very educational for me. Huge take away. now i go to work and master this methodology.

nice one !!

ok thanks