There is no such thing as a “plug and play” day trading system. Period.

Many traders come to the market looking for the elusive “fast track” to success. You know, the non-stop path to endless riches, luxurious vacations, and a life characterized by pure freedom. It doesn’t exist.

The path towards becoming a consistently profitable day trader is marked with blood, sweat, and tears. Straying from the metaphors for a second, this journey requires hard work, trial and error, and a relentless pursuit for greatness. I’ll say it time and time again until the lesson is fully ingrained in your head.

In order to become a successful day trader, you need to think for yourself and constantly strive for improvement. It’s not easy but it’s doable. Your goal should not be to get rich; your goal should be to develop a skill.

Of course, this isn’t to say that you shouldn’t learn from other traders. In fact, you should be taking advantage of the opportunity to learn from the experience of other traders. That being said, you should view this educational material as the support you need to improve your own skill set as opposed to a free ride to trading success. This is the very foundation of all education. If you go to college for a degree in business, you will learn how to run a successful business. Your teachers will not actually create a successful business for you – I think we can all agree that this would be a naive assumption. The same logic holds true for day trading. You can learn from trading education, such as the courses we offer, but you are still responsible for taking action.

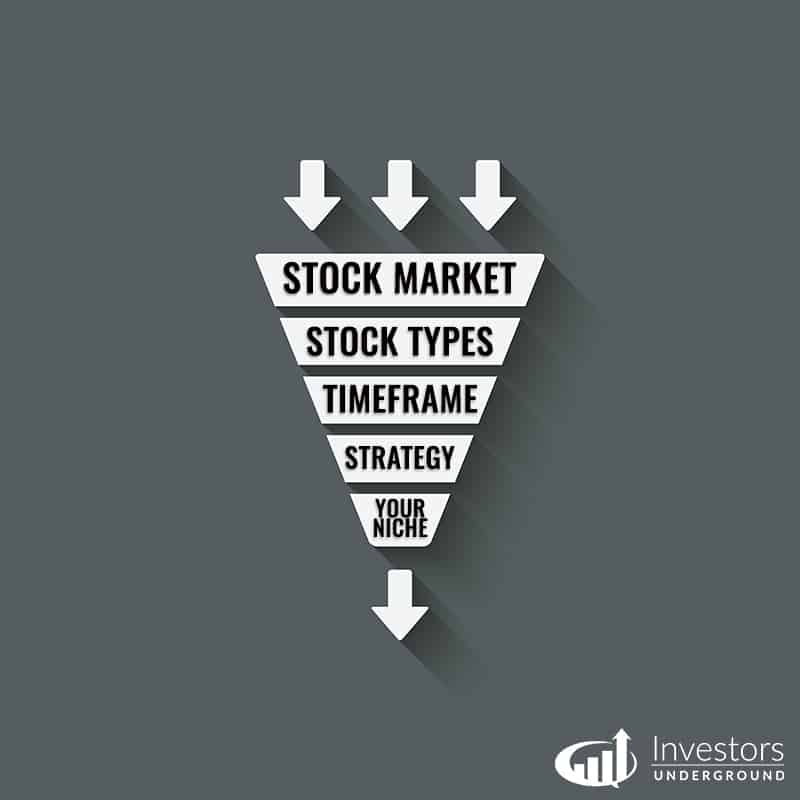

As you strive to become a better day trader, you should be focused on finding your own niche. You will not get rich by simply mimicking another day trader’s approach to the markets. You need to develop a strategy that resonates well with you.

Here are a few reasons why:

Focus

We’ve discussed how important focus is when it comes to trading. When you find your niche, you can narrow down your focus. You know which types of plays to focus on and which type to ignore. This allows you to make the most of your efforts.

Troubleshooting

If you’re simply following another trader, you will not know what to do when things go awry. Trades will not always go as planned and sometimes you will need to pivot from your original plan. If you bought a stock just because you were following someone else, you won’t know what to do if the stock goes against – you’ll still be waiting on a sell alert. When you develop your own strategy, you will have a plan for what to do if things go as planned and when to bail if they don’t.

Confidence

You’ll never be a confident trader if you always rely on the input of another trader. You need to develop your own opinions and have confidence in them. Confidence gives you the ability to spot opportunities and take action. This doesn’t mean you will always be right. It simply means that you can create your own hypothesis, take action, and react to the market accordingly.

So, how do you find your niche?

Focus on your strengths! If you are good at understanding a business and reading through business filings, you may consider a more fundamental approach to trading. If you are better at reading charts and analyzing numbers, you may prefer technical trading.

If you already have a trading history, go back and look at your trades. Do you do better on short trades or long trades? Do you make more money on swing trades or day trades? By focusing on both your trading history and personal strengths, you can begin to focus your energies on the areas where you can be most successful.

We have plenty of successful traders at Investors Underground, and most of them use unique strategies. We’re not all trading the exact same strategies. Of course, there are similarities between the strategies, however each successful trader utilizes a unique strategy that they have fine tuned over the years. You can see the differences and similarities of these traders’ systems in our new Momo Traders book.

As always, if you have any questions, just post them below in the comments.

Day trading IU style, with the chat room, the videos and transparency is slowly becoming a “must look into” thing to do. Here, overseas, away from the SEC´s sphere of influence, and a language barrier the size of the Grand Canyon, your articles, such as this one are valuable as heck. This one, simple and to the point, are truly gems. Thanks Nate, Cam and your crew. Keep up the good work.