Buying a lottery ticket is an invigorating experience.

For a split second, you picture a life-changing windfall and all of the rewards that come with it. Fast cars, luxurious homes, exotic vacations…you name it.

If you’re a pragmatist, this comes in the form of a fleeting thought that is quickly dismissed by your inner voice of reason.

If you are an optimist, you recognize that a small chance is still a chance.

If you are a degenerate gambler, you get carried away, dismiss all reason, and become consumed by the idea of six random numbers changing your life.

Regardless of which camp you find yourself in, all mentalities have one thing in common: they are focused more on reward than risk.

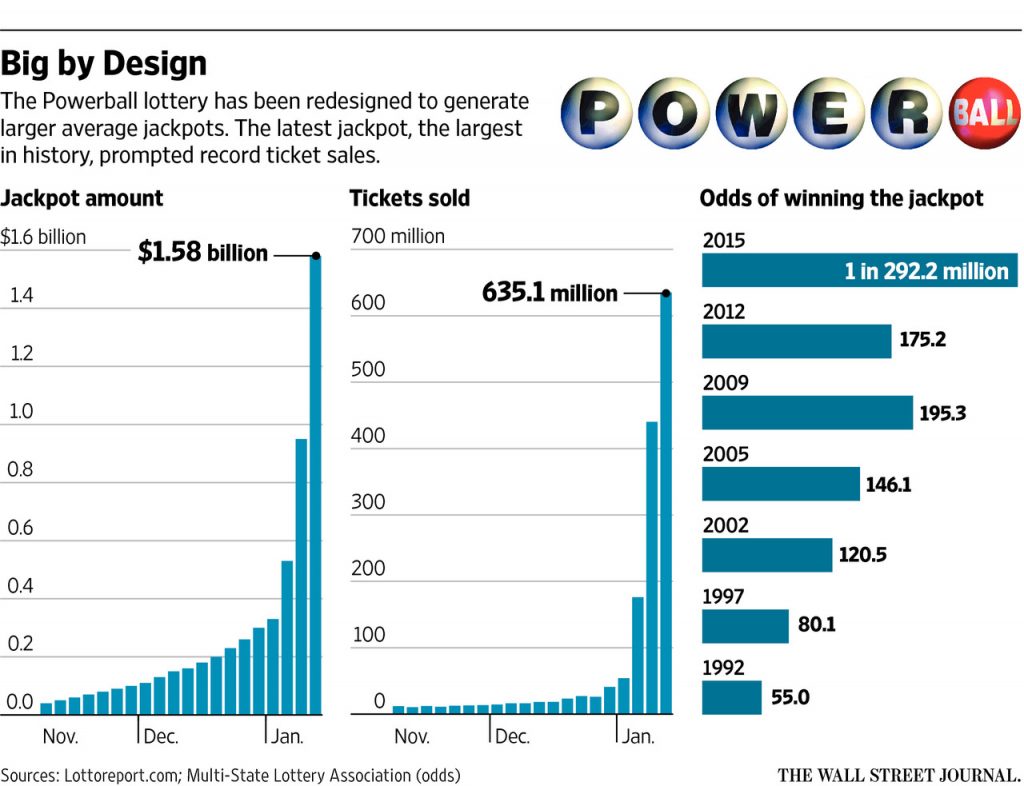

You wouldn’t even buy a lottery ticket if you considered your risk. The chances of winning the lottery are roughly 1 in 300 million. But this doesn’t stop millions of Americans from spending billions of dollars on lottery tickets every single year.

Why? Because they focus on the reward instead of the risk.

The same is true of many traders (especially new traders).

New traders focus more on potential rewards (profits) than they do on potential risks (losses). Most traders come to the market to pursue profits, so why be a downer and focus on the risk?

Risk is a very real part of trading and neglecting its presence does not make it go away. Risk management is just as important as chasing profits (if not more important).

In an industry where so many fail, your first objective is to develop the habits that keep you in the game. There will be plenty of time to maximize profits, assuming you don’t take yourself out of the game early.

In this article, we are going to discuss the nature of risk, the different types of risk, and how traders should approach risk.

Do not dismiss this article as “theory.” It is not.

Risk management may be the single skill that contributes to your longevity and success as a trader. Let’s get to it.

The Role of Risk in the Markets

Risk is an essential component of the markets. In fact, risk is an essential component of just about anything worth pursuing.

If you are pursuing an above-average lifestyle, there is no escaping risk. Here are just a few examples:

- If you want a better career, you go to college. You risk the money spent on tuition for the chance to make more in lifelong wages.

- If you want to be your own boss, you start a business. You risk your investments in the business for a chance of personal freedom and profits.

- If you want to retire comfortably, you invest in the market. You risk your initial capital for the chance of compounding gains and building your nest egg.

The list can go on and on.

While risk is prevalent, you shouldn’t embrace it blindly. You should always be hesitant about accepting risk. Furthermore, you should be diligent in your pursuit to minimize risk.

- Going to college can be a worthwhile pursuit, but racking up six figures in student loans for out-of-state tuition probably isn’t a responsible decision (especially if you are pursuing a college major with average salary potential).

- Starting a business without doing market research, conducting a SWOT analysis, and formulating a marketing strategy probably isn’t the best use of the requisite investment.

- Throwing your retirement funds into volatile investments that you don’t understand probably isn’t a great way to retire comfortably.

As traders, our goal is to mitigate risk. Before we dive deeper into risk mitigation strategies, let’s get a better understanding of how risk can impact you as a trader.

The Profitability Equation

Risk is one of the critical (and often overlooked) components of the profitability equation.

To illustrate the point, let’s look at the equations for the expected value of an individual trade and for a trader’s career. Expected value is a calculation that accounts for the value of multiple outcomes.

Here’s how the equation looks when you analyze a trade:

Trade Profitability = (Potential Profit x Probability of Profit) – (Potential Loss x Probability of Loss)

So, for example, if you had a 50% chance of making $1,000 and a 50% chance of losing $500, the expected value of the trade would be $250 ($1000*0.5 – $500*0.5).

There are two key takeaways here:

- The potential profit should outweigh the potential loss

- The probability of success/failure acts as a coefficient that can have a significant impact on the outcome

As traders, we look for favorable risk/reward opportunities where the probability of success is higher than the probability of failure.

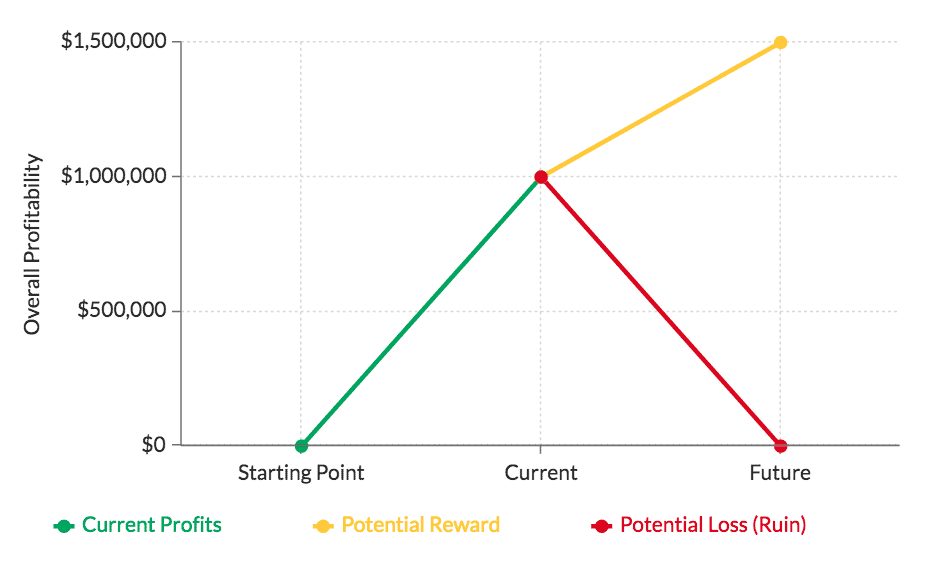

Over time, this helps us control the profitability equation of our career. It looks like this:

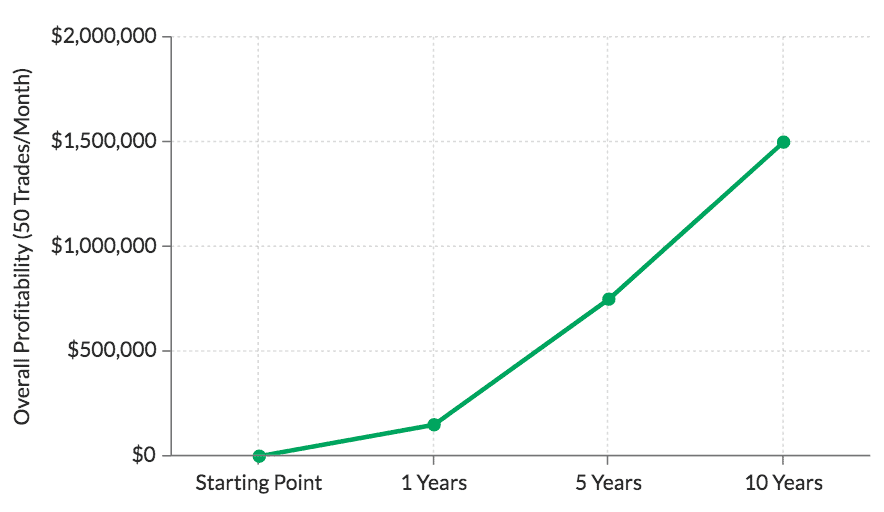

Overall Profitability = [(Average Win x Win Rate) – (Average Loss x Loss Rate)] x # of Trades

If you win 50% of the time and your average win is $1,000 with an average loss of $500, the expected value of any given trade is $250 ($1000*0.5 – $500*0.5). Multiply that by the number of trades and that is how profitable you will be over time. At 50 Trades per month, a trader will make roughly $12,500 per month. Multiply this over time and you would get a profit chart as follows:

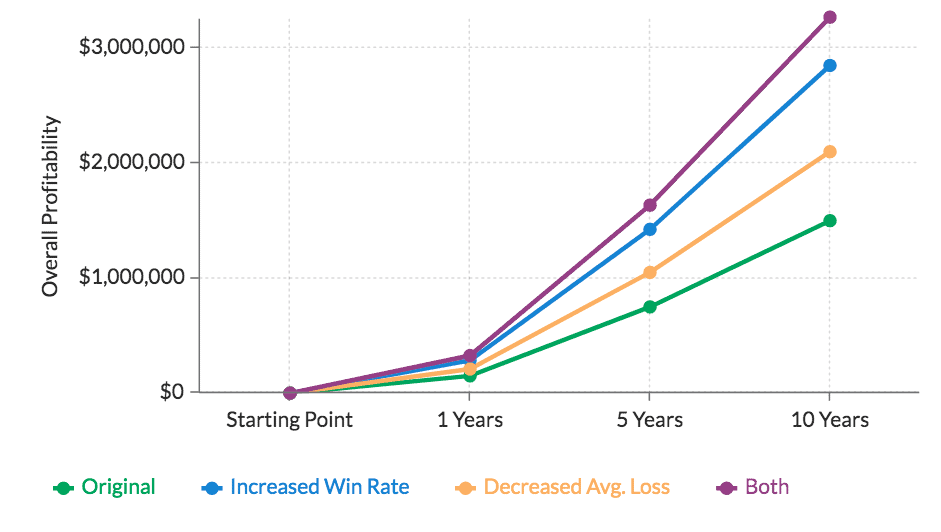

How does risk management impact this equation?

- If you increase your win rate to 65%, the expected value of any given trade is $475 ($1000*0.65 – $500*0.35)

- If you decrease your average loss to $300, the expected value of any given trade is $350 ($1000*0.5 – $300*0.5)

- If you increase your win rate to 65% AND decrease your average loss to $300, the expected value of any given trade is $545 ($1000*0.65 – $300*0.35)

Compound that over time and you can see how risk management plays a major role in your profitability (for further reading, check out this post).

The Givens: Uncontrollable Risk vs. Controllable Risk

Risk is endemic to the stock market. There’s no escaping it. That said, not all risk is created equal.

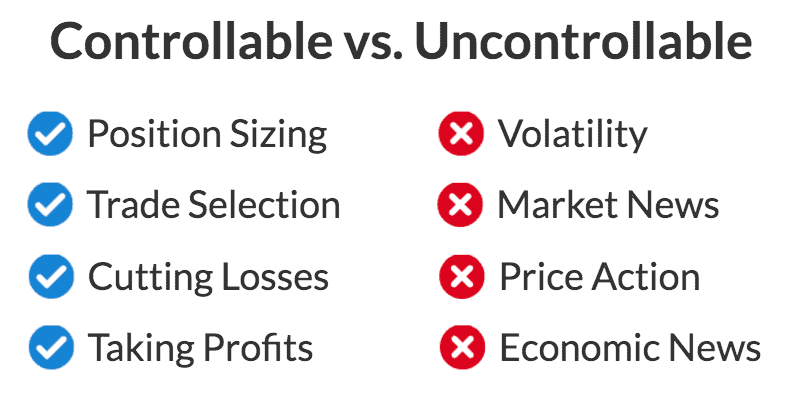

Before we dive into the definitions of good risk and bad risk, let’s get one thing clear. Risk comes in two forms: uncontrollable risk and controllable risk.

Uncontrollable risk is the risk that is 100% out of your control. This risk exists no matter what you do. For example, when you enter a long position a stock’s price can go down. What the stock does is not in your control. Economic news may hit, company news may hit, or the stock may go down for no apparent reason. There’s no escaping this.

Controllable risk is the risk that you choose to take on and have full control over for the most part. For example, if you enter a position and it turns against you, it is within your power to sell that position before the stock goes down even further.

As traders, we accept the uncontrollable risk and manage the controllable risk. Let’s take a closer look at what separates good risk from bad risk.

Different Types of Risk

Stock market risk comes in many forms, all of which can be categorized as controllable or uncontrollable. Avoid mistaking the two categories. Mistaking uncontrollable risk for controllable risk is arrogance; mistaking controllable risk for uncontrollable risk is negligence.

Traders expose themselves to risk every single day. Our goal is to take on acceptable risk and avoid unacceptable risk.

Rule #1: Acceptable Risk is Asymmetric

The main difference between gambling and trading comes from the flexibility of odds. In games of chance (gambling), you cannot flip the odds in your favor. In trading, you can.

If you bet on a coin flip, there is absolutely nothing you can do to change the 50/50 odds. If you are looking for a trade, there are a few things you can do to shift the odds in your favor.

There’s no doubt that certain types of trading can have 50/50 outcomes, or worse. Shrewd traders are not interested in these scenarios.

Successful traders focus on high probability opportunities in which risk is asymmetric to the reward. This asymmetry of risk ties back to the expected value equation we discussed above. There are two critical components:

- Potential Reward > Potential Risk

- Probability of Success > Probability of Failure

The first speaks to trade management, the second speaks to strategy.

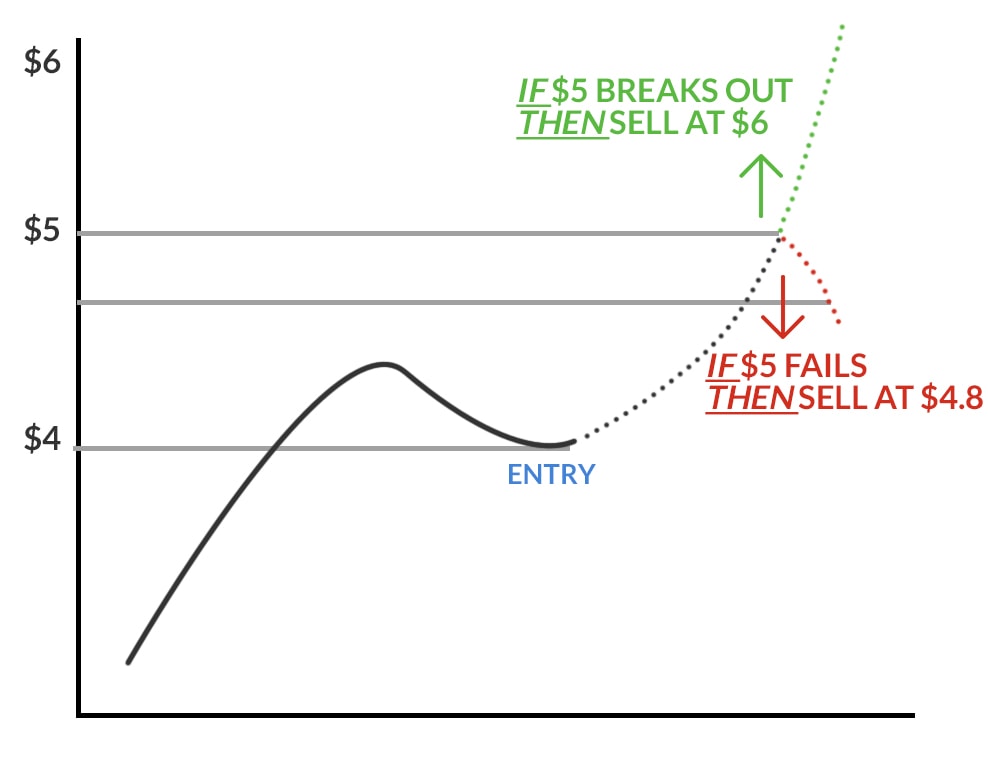

Potential risk is your stop loss (i.e. where you cut the trade if you are wrong). Potential reward is your profit target (i.e. where you take profits if you are right). If you risk $100 for the chance to make $300, you have a good risk/reward ratio.

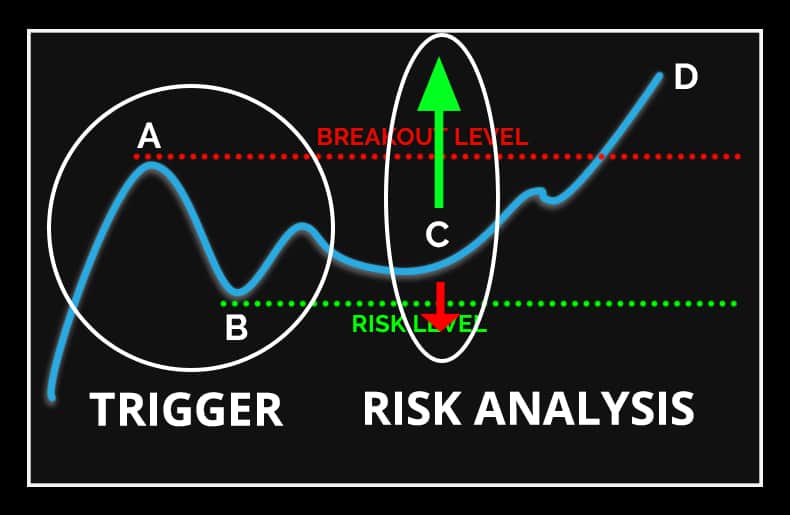

Probabilities of success and failure are more difficult to quantify but they are not entirely random. These odds can be shifted in your favor by focusing on high-probability trading setups.

A high-probability setup is one in which the chances of success are higher than the chances of failure. These probabilities can be calculated (or estimated) by analyzing historical performance. For example, if, historically, a 52-week breakout had a 70% chance of leading to a 10% move to the upside, this setup would be considered a “high-probability setup.” Every trader has their own definition of a high-probability setup and most traders specialize in a select few.

It should be noted that high-probability setups do not guarantee success – they simply favor it. A setup that works 70% of the time still fails 30% of the time. This risk of failure is mitigated with a favorable risk/reward ratio. The ABCD pattern is a good example. It has a high probability of working out (as in A, B, and C usually lead to D), but risk is also controlled (buy at C, risk to B, sell at D).

Before you take on any trade, make sure the trade has asymmetric risk.

Unacceptable Risk Comes in Many Forms

Unacceptable risk could be simply defined as risk that is not asymmetric. If you have 50/50 odds, you don’t have a trade; you have a gamble.

Unacceptable risk comes in many forms, but one of the most dangerous is the unknown. In the previous section, we discussed the process of giving yourself an edge in the market by focusing on favorable risk/reward ratios and taking advantage of high-probability setups. The approach aims to define risk. Randomness and unknown factors are the antitheses of this approach.

Don’t know your risk level? Risk is amplified. Don’t know why a stock is moving? Risk is amplified. Don’t feel comfortable with a trade but take it any way? Risk is amplified.

If you don’t have an edge, you don’t have a trade. Simple as that. This is one of the reasons why traders avoid trading earnings. What is your edge? You don’t know what the company will report and you don’t know how the market will react.

Here are some examples of other situations in which risk is disregarded and, therefore, unacceptable:

- Buying a stock without a risk management plan

- Neglecting a key event (i.e. earnings, economic news, etc.)

- Buying on FOMO

- Buying a stock where risk outweighs rewards

- Entering an account-threatening position

Unacceptable risk should be avoided at all costs.

Risk Measurement

Now that we’ve discussed the different types of risk, it’s time to bridge the gap between theory and practice. This is how we apply the lessons above to our actual trades.

Rule #2: Know Your Risk

Risk should always be known BEFORE you enter a position. This makes risk both controllable and manageable. Taking a $1,000 loss isn’t the end of the world if you planned for it in advance. Taking a surprise $1,000 loss can be devastating. Good losses are planned losses.

Define your risk before you enter a trade. Period.

If your defined risk is $200, your loss should not exceed $200. The risk is fully in your control. Simply stop out when losses hit $200.

Defining your risk is simple. Here is the equation:

Risk = (Entry Price – Stop Price) x Position Size

If you enter at $5/share, plan to stop out at $4.5/share, and purchase 1000 shares, your risk is $500.

Match Risk to Conviction

There are no golden rules of risk management.

First off, every trader is different. A loss that wipes out one trader may be acceptable for another.

Second, every trade is different.

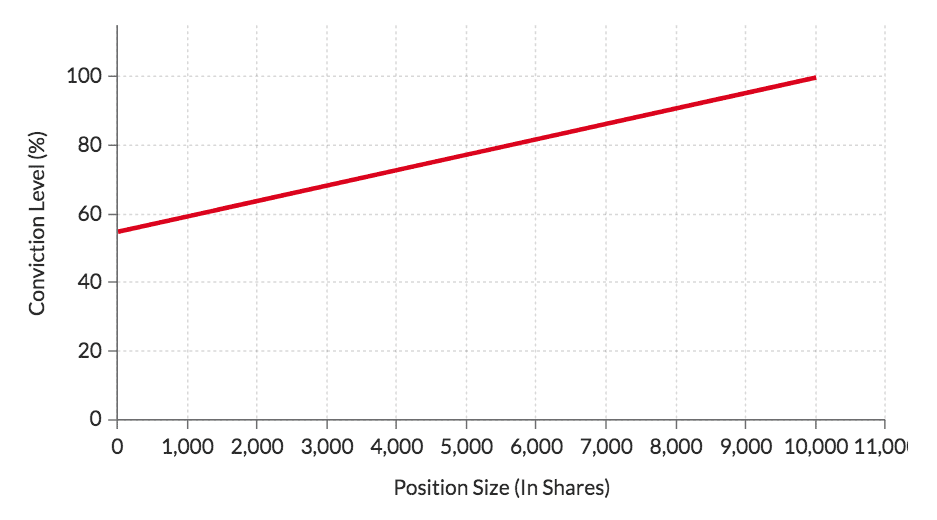

We discussed the importance of high-probability setups above. The probability of a trade playing out in your favor can impact your risk appetite. For example, if a trade has a 60% chance of working out in your favor, you may be cautious. If a trade has an 80% chance of working out in your favor, you may step on the gas.

Your risk should be aligned to the probabilities of the trade and nothing else. For example, you may find that you only risk $200 on “7/10” setups and $500 on “10/10” setups.

You may also choose to scale into a trade based on your conviction level.

Risk should match conviction and conviction should be informed by probability.

The Psychological Component of Risk

Risk on paper looks different than risk in reality.

Take the saying that “the market always goes up” for example. This may be comforting in theory, but less so in reality. Historically, the statement is true, but the market also goes through long periods where it does not go up. It may drop 50% over the course of a few years. Can you stomach a 50% decline?

What works on paper doesn’t always work well in reality. As another example, if you make $120,000/year post-taxes, you can afford a $5,000/month mortgage. But can you deal with the stress of 50% of your income going to an expensive mortgage?

When determining your risk threshold, make sure to consider the psychological component. You may be able to manage a certain level of risk, but can you stomach it?

Risk Management

By this point, two things should be clear:

- Acceptable risk is asymmetric

- Risk should be defined before entering a position

Now, it’s time to discuss the actual process of managing risk (i.e. managing a trade).

Rule #3: Control Your Risk Exposure

In trading, there are times to take “risk on” and times to take “risk off.”

When you are in a position, risk is on.

When you hold cash, risk is off.

A big part of trading is determining when risk should be on and when risk should be off. Every buying and selling decision ties back to this objective.

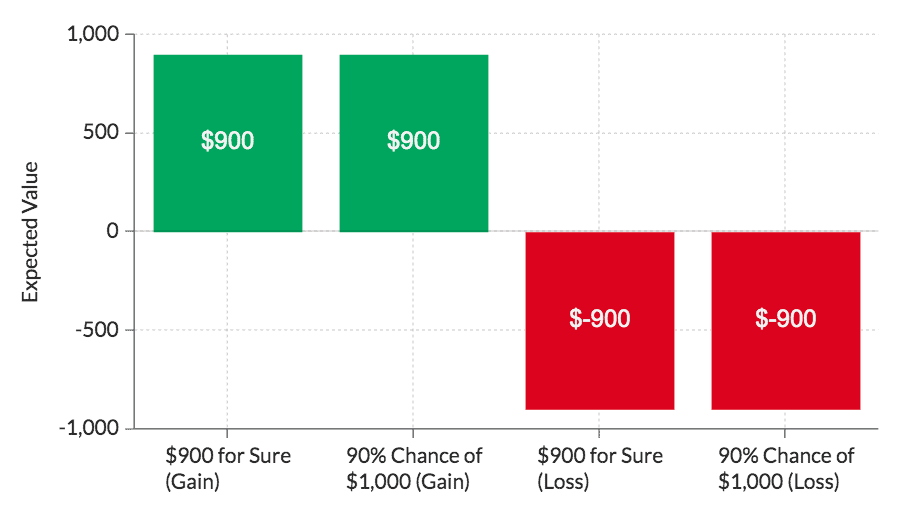

Of course, we are hardly as rational as we would like to believe. We often treat risk differently when we are winning than we are losing. Take the following example from Nobel-prize winner Daniel Kahneman’s Thinking Fast and Slow:

PROBLEM 1: Which do you choose? Get $900 for sure OR 90% chance to get $1,000

PROBLEM 2: Which do you choose? Lose $900 for sure OR 90% chance to lose $1,000

If you are like most people you took the sure thing for Problem 1 ($900) and the gamble for Problem 2 (90% chance to lose $1,000).

Traders often carry this mentality into their trading, becoming risk-averse with winners and risk-seeking with losers (of course, many traders have a gambling mentality and may have taken the gamble for both options).

Let’s look at a more practical approach.

Taking Risk Off (Losers)

Taking risk off in a losing position is simple. You simply stop out according to plan (the plan that you better have made beforehand!).

If you buy a stock at $5.50 and set a stop at $5 (mental or hard stop), you sell at $5. Simple as that.

We could make this section longer, but it would be unnecessary. Dealing with losses is as simple as sticking to your original plan.

Follow this rule and you will do better than the majority of traders.

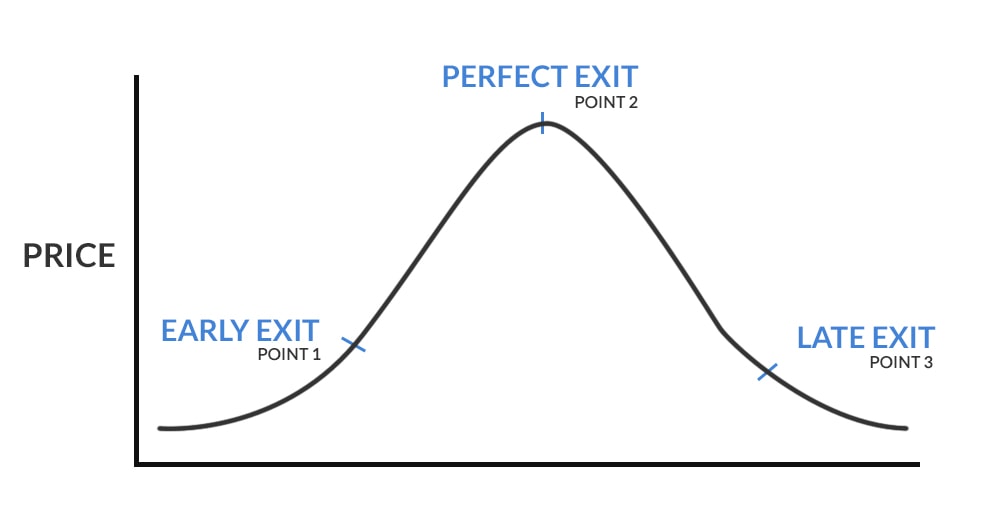

Taking Risk Off (Winners)

Taking risk off in a winning position is a bit more complex.

Most traders fall into one of two camps:

- Selling too early (risk-averse)

- Selling too late (risk-seeking)

The first group is a good representation of the phenomenon presented in Kahneman’s problems listed above. They take profits quickly because they value a sure thing over the potential for more.

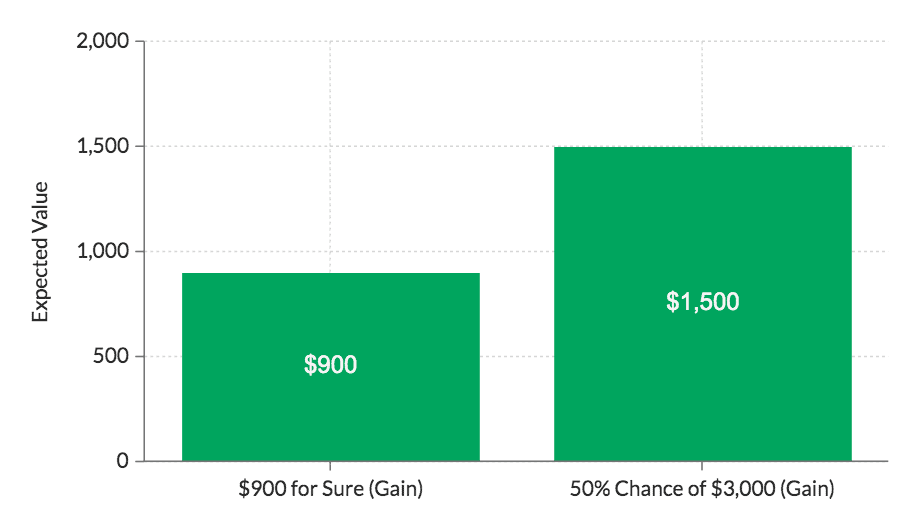

The second group defies Kahneman’s example because they rework it. These traders don’t see the decision as, “get $900 for sure OR 90% chance to get $1,000.” Instead, they see it as, “get $900 for sure OR a 50% chance to make $3,000+”. This completely rebalances the expected value equation in favor of the gamble.

So, which group is right?

It’s hard to say….

Both groups struggle with greed and patience. We all do.

The first group (those who sell too early) may be impatient. The second group (those who sell too late) may be greedy.

Both groups will prosper in different conditions.

Finding the perfect balance of greed and patience is difficult, but it is crucial to your success.

The perfect exit doesn’t exist but this doesn’t excuse the mismanagement of a trade. Risk can be mitigated using the same strategy we talked about for losers. Follow your plan and take profits where you said you would. Your plan may include contingencies for different situations.

The reason why many traders stray from the exit plans is that they face the “what if” factor. What if I sell now and the stock keeps going up?

Once again, this is a struggle with balancing greed and patience.

Perhaps the best option is to frame the situation in the same format as Kahneman’s problems listed above. When phrased as hypotheticals, the problems are relatively easy to answer with confidence.

Which do you prefer: A guaranteed $1,000 or a 50% chance to make $2,000?

Of course, you can’t calculate the odds exactly, but it presents an effective thought experiment. How would you feel if you made the wrong choice? Would you be more upset if you took the guaranteed $1,000 and the stock went on to yield $2,000 OR would you be more upset if you took the gamble and ended up with $0 (or a loss)?

Neither answer is objectively right but one answer IS right for YOU.

After you’ve made the decision a few times, you should go back and analyze the results.

- If you chose the sure thing, are you leaving a lot of profits on the table?

- If you took the gamble, did a lot of your profits dissipate or turn into losses?

The answers to these questions will help you refine and optimize your approach for future trades.

Defining Your Maximum Risk Threshold

There are dozens of great expressions related to preparation. For our purposes, the following is well-suited:

Hope for the best. Plan for the worst.

Thus far, a bulk of this article has been focused on planning and control. While the strategies laid out are realistic and actionable, sometimes things don’t go as planned.

Traders are humans, not robots, and mistakes happen. Emotions creep in and sometimes we stray from our game plans. What starts as a $300 predefined risk can be rationalized into $500, $1,000, and so on.

The best advice is to avoid these situations entirely. Traders should strictly adhere to the game plans they set forth. Of course, this advice is just about useless once you’ve already strayed from your initial plan.

In these cases, you need a Plan B – a failsafe to keep you in the game.

Talk to any successful trader and you will find that most of them can point to a time when they took a massive, gutwrenching loss. These traders know about risk management, they pursue high-probability setups, and they understand the importance of cutting losses early, yet they are not impervious to error. As they say, the best-laid plans often go awry...

Before you find yourself in a career-threatening situation, you need to define your maximum risk threshold – your “oh sh*t” number. This number dictates when you exit a position no matter what. No “what if’s”, no “but maybe’s”, NOTHING. You sell and walk away. Simple as that.

This number is carved in stone. It is your absolute maximum “acceptable” loss. For example, if your “oh sh*t number” is $5,000 and you are down $5,000, you cut the position. You don’t wait until $5,500, you don’t wait a few more minutes – YOU SELL. You already strayed from your initial plan – don’t let it happen again.

It doesn’t matter what happens after you cut the loss. it doesn’t matter if you sell and the stock turns in your favor a minute later. It’s not your concern. Your failsafe will keep you alive another day.

Every career-ending loss starts as a manageable loss. A $50,000 loss starts as a $1,000 loss before growing to $5,000, $10,000, and so on. Nobody thinks it will happen to them – until it does…

Taking a big loss hurts. Taking yourself out of the game hurts even more.

Swallow your pride, ditch your rationalizations, take your loss, and move on.

Risk Anomalies

Risk measurement and probabilities are based on historical data. This data helps us make smarter decisions, but it doesn’t paint the full picture. History only tells what has happened. It cannot tell us what will happen.

We need to expect the unexpected.

Rule #4: There Are No Rules

Traders do not operate in a world of certainty.

Trading calculations and probabilities are not “rules,” but estimations based on historical data. For example, hypothetically speaking, let’s say that 100 years of market data showed us that two green days are always followed by a third green day. Does that mean that a stock that was green the past two days is guaranteed to be green tomorrow? Absolutely not. No such definitives exist in the world of trading.

New data is presented daily.

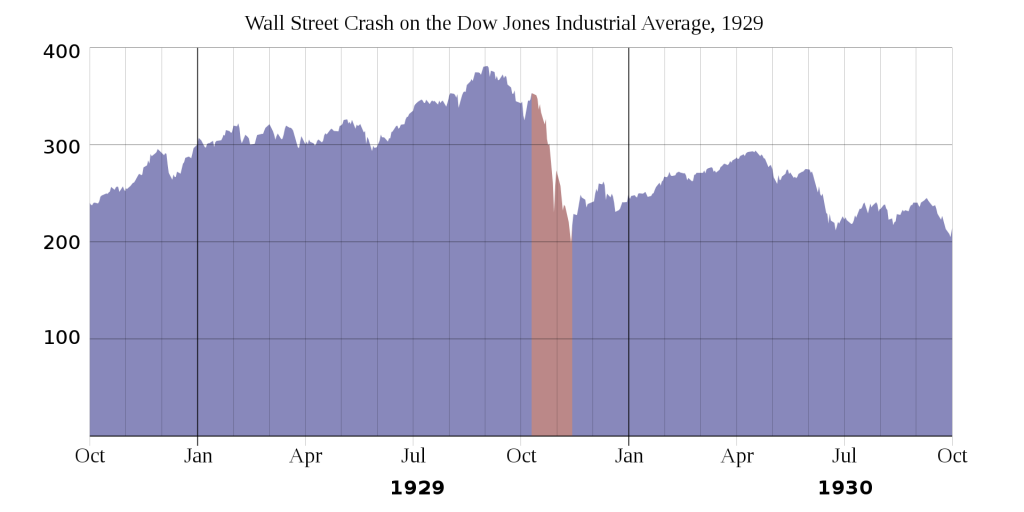

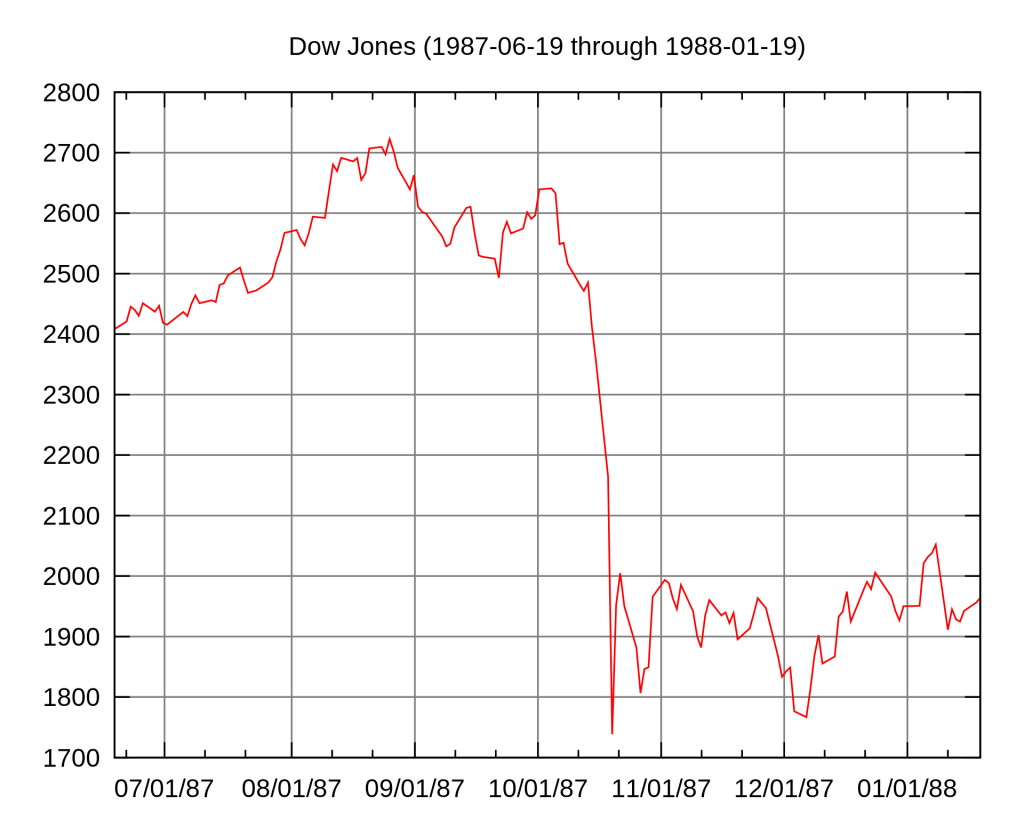

In 1929, the market plummed 12.82% in a single day. The damage continued for weeks to come.

Traders should incorporate historical data into their analyses but they should not assume that historical data predicts future data with 100% accuracy. If you went into the 1987 crash assuming the most the market can dip in a day is 12.82%, you would have been run over as your dip buys plummeted even further.

The same goes for stocks any game plan.

Support and resistance generally hold….until they don’t.

Stocks generally trade in a certain price range…. until they don’t.

Expect the unexpected and remember that the data you use to make trading decisions is not infallible.

Black Swans and the Turkey Problem

The term “black swan” refers to an event that is unpredictable and generally has extreme consequences.

There is an underlying assumption that is made whenever this term is used. Classifying events as “unpredictable” means that WE could not foresee them. This issue stems from the fact that we believe we can predict events even though we have limited data (all of which is historical).

This speaks to the problem of induction – making assumptions based on the data we do have. The term “black swan” stems from the historical presumption that “all swans are white.” The existence of a single black swan negates the presumption. The statement “all swans are white” goes from true to false with a single piece of data. The same can happen to your trade theses.

The term “black swan” was popularized by Nassim Taleb, a former options trader who has written some of the most influential work on risk, randomness, and probability. In his book, The Black Swan, Taleb illustrates the concept with the example of “The Turkey Problem.”

Consider a turkey that is fed every day, every single feeding will firm up the bird’s belief that it is the general rule of life to be fed every day by friendly members of the human race ‘looking out for its best interests,’ as a politician would say. On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief.

The turkey is fed daily, has no reason to distrust humans, and then BOOM – Thanksgiving Day changes everything.

Things aren’t always what they seem…

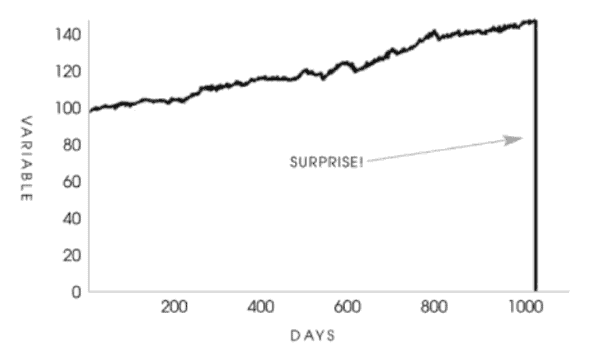

Here is the Turkey Problem chart from The Black Swan.

Look familiar? If you’ve been trading for awhile, you may have seen a few charts like this.

What traders refer to as “black swans” actually happen all of the time.

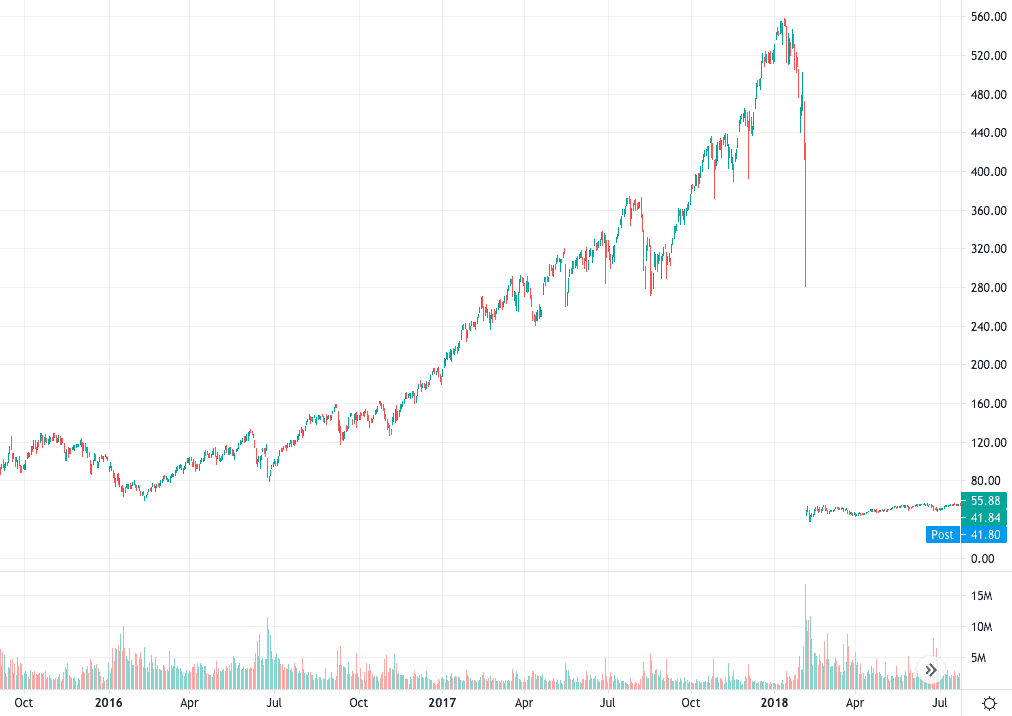

Take the example of SVXY, an ETF that was short VIX futures contracts. It went almost straight up (with a few significant drops) from its inception in 2012. Here is the chart:

The VIX was relatively stable and SVXY generated nice returns with minimal volatility. This all changed in February 2018 when the ETF lost 90% of its value in a few days:

The SVXY ETF was short VIX futures and the VIX ran over 100% in a day – the rest is history. SVXY still hasn’t recovered and a similar ETF, XIV, was completely wiped out.

This move was considered to be a “black swan” and in a way it was. That said, it wasn’t entirely unprecedented. Had investors considered what happens to an ETF that is short the VIX when the VIX goes up 100%, this situation may have been more predictable.

The point here is not that traders should spend their time obsessing over black swan risk. Traders should simply expect the unexpected and avoid getting lulled into the comfort of “the way things are.”

Be smarter than the turkey. Things change all of the time. Things are different every time.

Many investors know the quote from Sir John Templeton that states:

“The four most dangerous words in investing are, it’s different this time.”

Perhaps this quote is best countered by a tweet that says:

The twelve most dangerous words in investing are: “The four most dangerous words in investing are, it’s different this time.”

When Risk is Completely Unacceptable

By this point, we’ve talked a lot about risk. We know the difference between controllable risk and uncontrollable risk, we know what defines acceptable risk, and we know how to approach risk.

There is one type of risk that is never acceptable – that which holds the possibility for ruin.

Once again, Nassim Taleb says it best:

In a strategy that entails ruin, benefits never offset risks of ruin.

No trade is worth the risk if the risk is ruin. It doesn’t matter how good it looks. Even if you risk 100% for the chance to make 100,000%, it’s not worth it.

Warren Buffett has a great perspective on this topic as well:

Never risk what you have and need for what you don’t have and don’t need.

You can’t advance your life without taking a bit of risk, but certain risk is never worth taking.

Here are two rules that should never be broken:

- Don’t trade with money you can’t afford to lose

- Never accept a trade if the risk is ruin

If you are trading with your rent money you are risking what you have and need for what you don’t have and don’t need (i.e. extra spending money). Either trade smaller or wait until you have more disposable capital saved up.

If you take a wildly risky, speculative trade, you may run the risk of ruin. Here are just a few of many examples:

- If you leverage your account 4-to-1 intraday and use all of your buying power, a 25% drop in your positions will wipe you out of the game.

- If you go “all-in” on short-term options, the contracts may expire worthless and wipe you out completely.

- If you short a parabolic stock with no stop, you will get margin called and may owe more money than you even have.

- If you average down on an OTC penny stock, you may find yourself out of capital to average down with as the stock creeps towards zero.

These lessons don’t just apply to new traders. Many experienced traders are guilty of this as well. They make millions of dollars and give it all back just as fast. They risk what they have and need (potentially, a comfortable nest egg) for what they don’t have and don’t need (even MORE trading profits).

Be smart. Be calculated. Be patient. Be humble. Avoid greed.

Learning From Risk

The repercussions of unmeasured risk and unfollowed rules offer some of the best trading lessons. Try not to learn them the hard way.

“Cut losses early” resonates, but an unmanageable loss stings so badly you never forget the lesson.

“Know your risk in advance” makes sense, but seeing your account down 10X more than you expected really drills the lesson in your brain.

“Expect the unexpected” seems like a sound strategy, but a 90% loss truly enforces its importance.

Some lessons need to be learned the hard way, but others don’t. Lessons in poor risk management do not need to be garnered through firsthand experience.

Study risk and study the markets. Accept that risk is prevalent and learn to find a way to trade comfortably.

Create your own rules for risk management and adapt when needed.

Always remember that “risk” isn’t just a word. It’s a reality of trading and should be handled responsibly.

This has been part of my problem. Not cutting loses quickly enough and selling winners to soon. Its a learning process

Thanks again…. good “Memorial Day” reading and review.

Thank you for taking the time to write this article. I really needed to read it. I have started the day trading lessons you have posted on youtube. I also enjoy the Sunday videos also. I have only been trading for 5 months and feel like I have been trading for 10 years. (Because I have read tons of articles and watched tons of YouTube videos.) I am one of those type of people that once something has caught my attention. I study and study and study it. And this whole stockmarket has really caught my attention. I am a small business owner. And have loved business since I was in kindergarten. Sorry for rambling. Once again thank you for your time.

John

This is great! I really appreciate your perspective and wisdom. I’ve been trading for 3 years, and this is really helpful.

Very good information!

Thank you…. this article is Gold for any new or old trader!

Yes, thank you for your insight

Always appreciate your perspective, thanks Nate! A very in depth look, as always.

Thank you!

I wish I had seen this a year ago. So good, so true! Thank you so much. It’s never too late to learn!

Thank you for sharing and I will start implementing those rules going forward on my journey. This is really helpful

Thanks for this perspective . When you put it in a way that clear in mind of a person that looking to trade in the markets. Why risk a chance to ruin or blow up a account for a long shot with NO certainty. Its like playing the lotto .

Thank you for this well written article!

Thx Nate. This is pretty much the whole enchilada for me.

Loved this article, as many others you put out. Appreciate all you do.

all traders need to read this once a year to keep on track we can get a big head lol