Whenever the markets go wild, participants become frenzied.

Rationality goes out the window and emotions take over.

While the responses are chaotic, most people just want an answer to the question, “what should I do now?”

I’m not here to give you advice on your 401k or tell you which companies to scoop up at “bargain” prices.

What I can say is that this market is GREAT for traders.

We LOVE the volatility, be it to the upside or the downside. Volatility creates trading opportunities so it should go without say that, as traders, we welcome the kind of “chaos” that drives investors crazy.

Of course, increased volatility brings increased risk and how you conduct yourself will determine how profitable you are.

Here are some lessons traders should keep in mind whenever the market goes wild.

1. The Market Can Always Go Lower

The market tends to be short-sighted. Whenever we experience a pullback, we forget how far we’ve come.

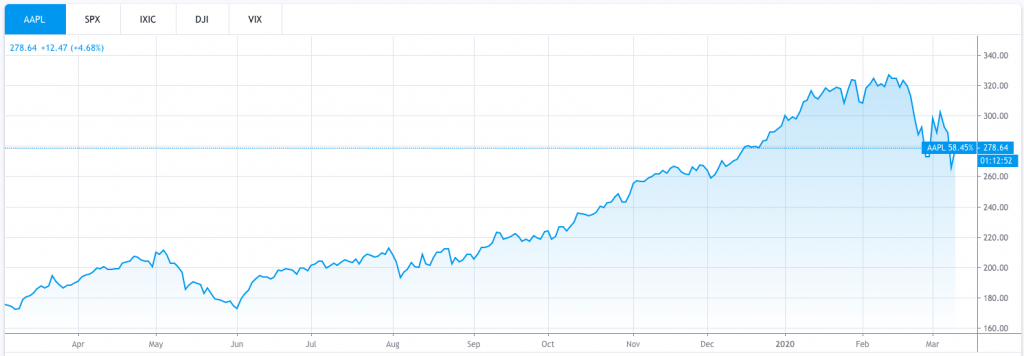

Take AAPL as an example.

The stock pulled back 20% at the beginning of 2020. Seems drastic right?

Yes and no.

Even after the recent pullback, the stock is still up over 80% since 2019.

Buying the dip has worked for the past decade, but that doesn’t mean it will always work. Furthermore, that strategy relies heavily on your ability to time the bottom of the dip. Will the market pull bck 10%? 20%? 30%?

Get it right and you have a hell of a trade. Get it wrong and you will pay the price.

When in doubt, avoid trying to catch bottoms altogether.

Remember, the market can always go lower and the market does NOT have to bounce.

2. Don’t Fight the Trend

Traders do best when they follow the trend but for some reason they always try to time reversals.

Markets going down? Let’s catch the bottom!

Stocks going parabolic? Time to short!

Take the recent SPY move as an example. The market came off of highs of ~340 and hit recent lows of ~270. During that drop, so many traders tried to time the bottom and got run over. There was 70 points of downside and traders couldn’t help but fight the trend.

While there is money to be made when momentum shifts, there is MUCH more money to be made by joining a trend.

Why try to catch a falling knife when you can place a trade in favor of gravity?

3. Don’t Get Sucked Into the Mentality of the Masses

If you want to be a successful trader, you need to trade your own plan. You can learn from others and respect their insights, but you should not allow them to be overly influential.

When everyone is on the same side of a trade, there is no edge.

For example, when everyone is short, stocks become more prone to a short squeeze and the hypothesis of the masses is nullified.

Similarly, when everyone has a panicked reaction to the market, selling increases and the drawdown is intensified.

Just remember tomorrow morning.

That same trade you want.

Everyone else does too.

I don't even need to mention the ticker.

But, if everyone doing same thing ….

Where is your edge?

Make sure you have it.

That's all that matters.

Catch you guys first thing!

— Nathan Michaud (@InvestorsLive) March 4, 2020

Learn to think for yourself.

This should not be conflated as a promotion for fighting the trend (which we discussed above) nor should it be misinterpreted to mean that you should do the opposite of what everyone else is doing.

Just remember to think for yourself and be cautious of the influence that others may have on your trades. This leads to the next point.

4. The Pundits Are Reactive

Flip on CNBC, Bloomberg or any financial news station and you will find commentary on what is happening now.

The commentary is highly reactive as it is intended to rationalize current market behavior.

When the market is going down, you will hear talk of recessions, economic slowdown, etc.

When the market is going up, you will hear talk of company growth, low unemployment, etc.

Reactive commentary is far more prevalent than predictive commentary.

Keep that in mind whenever you hear discussions of bear markets, recessions, or the end of the world.

Traders need to think two steps ahead – don’t get sucked into the latest narrative.

5. The Rules Change

In times of exceptional volatility, traditional trading rules don’t always work.

The strategies you generally rely on may not be as effective.

Take support/resistance as an example. When the market is in panic mode, these levels may be disregarded.

We can see American Airlines powered through its four year support level like it was nothing.

Of course, you shouldn’t neglect your rules entirely, but you should recognize that panic triggers irrationality and irrationality changes the rules of the game.

You need to adapt your trading style.

Recognize that you are trading in a different environment and make the proper adjustments.

6. Avoid FOMO

When the market is going wild, it can seem like a “once-in-a-lifetime” opportunity.

Maybe you’ve seen other traders share screenshots of exceptional profits, or maybe you have regret from the last time you missed a major opportunity.

Curb that mentality right there.

FOMO (fear of missing out) NEVER PAYS.

If you’re scrambling to find opportunities so you don’t “miss out,” you are trading for the wrong reasons.

Let the opportunities come to you.

7. There Will ALWAYS Be Another Trade

This next lesson also serves as a great mantra for every trader out there.

It is applicable in any situation where you feel frustrated by the markets (i.e. losses, missed opportunities, etc.).

There will ALWAYS be another trade.

Your trading career will not be defined by a single trade.

If you miss out on an opportunity, move on and look for the next one.

If you fumble a trade, move on and look for the next one.

8. Don’t Get Greedy

Hindsight trading is 20/20. It’s easy to look back on how a trade could have went.

Often times, these hindsight analyses distort traders’ perspectives and causes them to mishandle future trades.

Traders focus on what could have happened or how much they could have made and they get greedy.

You know when you’re pleased with yourself after taking a 20% gain on a breakout only to be disappointed when the stock runs up another 100%?

“If I had held that position I could have made an extra $10k”

Don’t get greedy.

In times of high volatility, you need to be extra cautious. Your risk management machine should be running in full gear.

9. Nail and Bail

Tying into the last point, make sure you don’t overstay your welcome on a trade.

Nail and bail. Don’t stay and pray.

In this market, being too patient can hurt you.

When you find yourself on the right side of a trade, start locking in some gains. You can always scale back in later if the move continues.

This is a trader’s market. Don’t turn winning trades into losers.

10. It’s Better to be Late Than Early

We discussed the concept of FOMO earlier.

Often times, traders feel the need to get into a trade quickly so they don’t miss out.

In this market, it is dangerous to be early (especially when you’re fighting a trend).

It’s better to be $0.20-$0.50 late than it is to be $2-$5 early.

Don’t focus on catching bottoms; focus on making money.

11. Take Smaller Positions

Stocks have incredible range right now.

We’re seeing stocks make intraday moves that would normally take weeks.

This increase in volatility means you can take smaller position sizes and still make money.

If you use your standard position size in a highly volatile market, you are exposing yourself to additional risk.

Don’t be afraid to take smaller positions.

Not only will this help you manage risk, but it will also help you to be more patient and allow the trades to pan out.

12. Don’t Turn a Day Trade Into an Investment

Make sure you define a timeframe for every trade.

It’s okay to day trade, it’s okay to swing trade, and it’s okay to invest.

The problem comes when you mix up your game plan.

If you turn a day trade into a swing trade into an investment, you’ve strayed from your plan.

Define your timeframe before you enter a position.

It’s very easy to start rationalizing once you are in a position. You may be looking for an intraday bounce and decide to hold overnight because a stock is “down too much.”

Stick with your initial thesis and avoid mixing up day trades and investments.

If you're trading this volatility – trade it.

If you're buying for long term – buy for long term.

Many folks turn a trades into an investments.

Many folks turn investments into trades.

Make your plan and stick with it.

The flip flop is where you get in trouble.

💪

— Nathan Michaud (@InvestorsLive) March 6, 2020

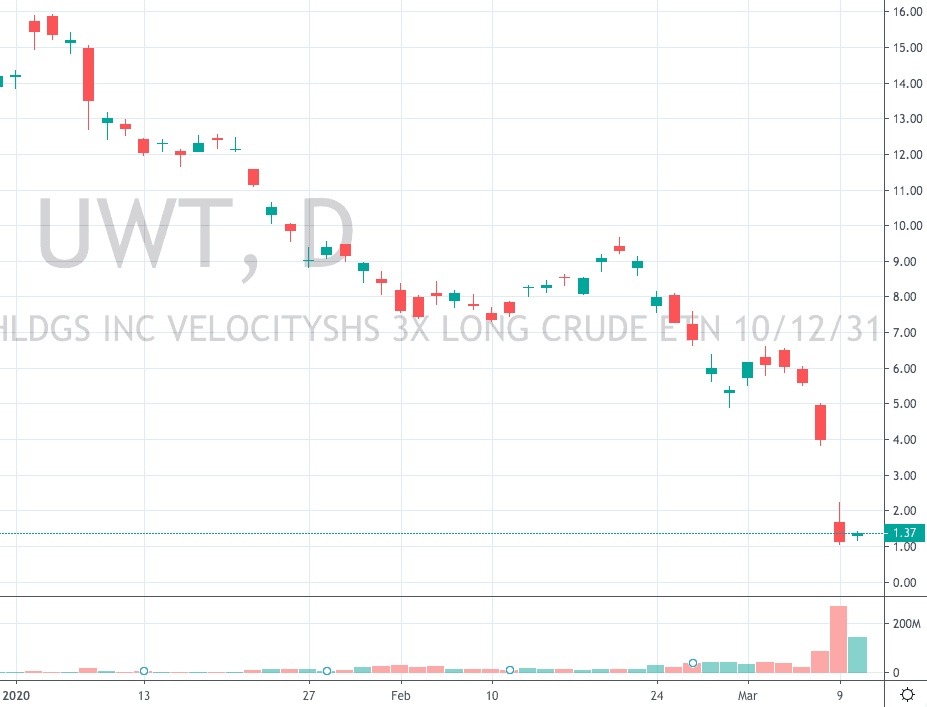

13. Avoid What You Don’t Know

Market volatility brings new opportunities.

Take recent events as an example. We saw crazy opportunities in coronavirus stocks, biotech, options, and ETFs.

It’s only natural for traders to want a piece of the action but these “new” opportunities can be a trader’s worst enemy.

Many traders start trading stocks (or other financial instruments) that they don’t understand.

There are plenty of other stocks out there.

You either have edge or you don't.

If you don't – AVOID.

Had a convo in the lounge today (our off topic room) about trying to "figure things out"

Nothing make sense – just trade.

Trend is you friend.

Traders market.

— Nathan Michaud (@InvestorsLive) March 5, 2020

ETFs are a great example. If you trade ETFs as if they were regular stocks, you could be in for a nasty surprise. You may get stuck in a leveraged oil ETF without knowing why it’s moving the way it is.

Stick with a simple rule of thumb – if you don’t understand what you’re trading, don’t trade it.

14. Cash is a Position

Lastly, it’s important to remember that cash is a position.

When in doubt, don’t trade.

Same thing I said on the video last night – wise words of @mcuban

"When you don't know what to do, do nothing"

— Nathan Michaud (@InvestorsLive) March 9, 2020

It’s better to end the day flat than it is to lose money.

Think about how many people would kill for a flat day when they look at their 401k’s and see they are down 10% on the day.

Don’t feel the need to trade for the sake of it. Your goal is to keep yourself in the game for another day.

Great stuff, thank you!

Thank you for the great suggestions..

Awesome…so much to learn!!

Thanks Nate, good stuff man.

Appreciate this.

thank you for the lessons 🙂

Thank you

Thank you nate! love this sort of stuff.

We can never hear this too many times! Thank you!

So important for us newbies as well, got me to the right mindset. Thanks Nate!

good stuff, you are awesome

Thanks you

I want the money!

Thanks Nate!

Awesome post Nate cheers

Amazing stuff. I hear no lies