Part 4 of the Beginner’s Guide to Day Trading is finally here! This week, we are going to discuss short selling stocks. We’ve been going over a lot of valuable information for aspiring day traders. As mentioned in previous posts, although this guide is for beginners, there is something to learn for everyone! If you missed the previous video courses, check them out now!

We are also proud to announce the launch of the Day Trading Encyclopedia, a tool for traders to look up market terminology and all things related to day trading.

Before we dive into the next lesson, let’s do a quick recap of what we have learned so far. If you still don’t understand any of the following topics, feel free to go back through the videos. You can leave a comment on this post if you have any further questions.

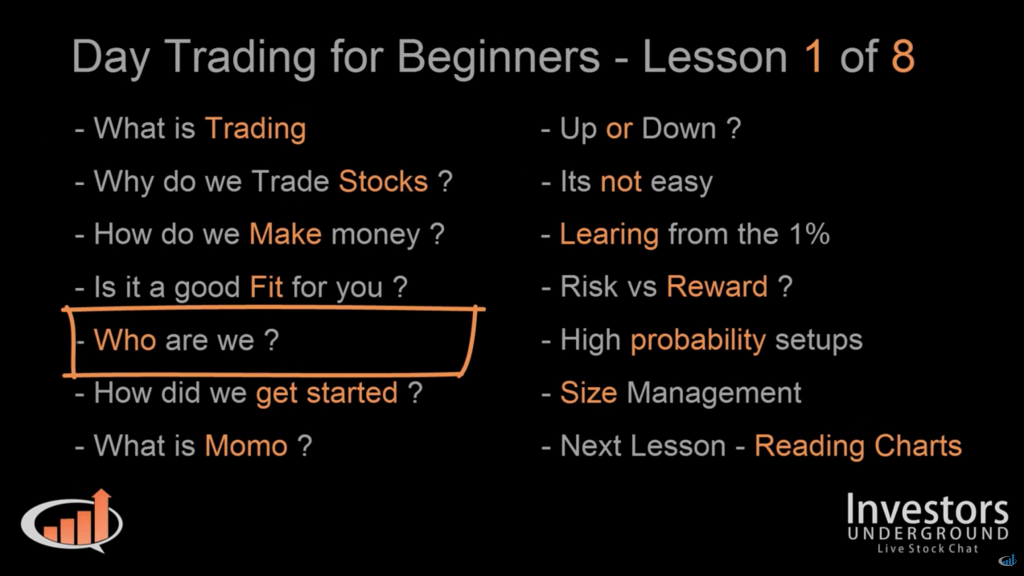

Learn How to Day Trade Lesson #1: Day Trading for Beginners

In the first video from this beginners series, we cover a lot of the basics of day trading. We cover the following topics:

- What is Day Trading? – For those who are completely new to day trading, we explain how day trading works and how beginners should get started.

- Is Day Trading Right for You? – We all want to make money; that’s a given. That said, do you have what it takes to become a day trader? We discuss some of the key characteristics of successful day traders.

- Momentum Trading – Most people who have an interest in day trading are somewhat familiar with the stock market. For most people, this familiarity comes from dabbling in investing. Day trading is much different than investing. We are looking to take advantage of a stock’s momentum, therefore our approach is based around finding momentum stocks.

- Risk Management – Successful day traders know that managing risk is just as important as developing a solid strategy. We discuss a few ways you can manage risk as well as a few rules you should follow to protect your capital.

- High Probability Setups – Even though this initial video serves as a foundation to future lessons, we start discussing some of the profitable setups that you can search for in the stock market.

- Position Sizing – Believe it or not, choosing position sizes is a big part of being a successful day trader. We teach you all about scaling in and out of trades and how you can choose proper position sizes.

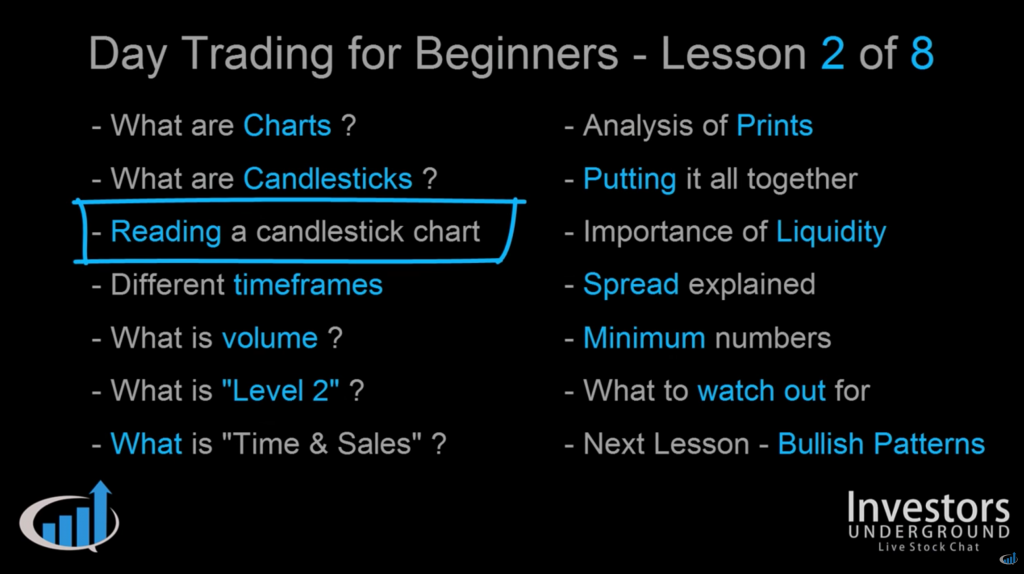

Learn How to Day Trade Lesson #2: Introduction to Technical Analysis

The second video in the series is heavily focused on technical analysis, the main decision-making tool day trader’s utilize.

- Introduction to Candlestick Charting – A candlestick chart is the main chart type utilized by most day traders. We teach you how to read these charts like a pro!

- Volume – Day traders are attracted to stocks with high volume. We explain the importance of volume in day trading and what you should look for.

- Level 2 Analysis – Level 2 screens serve as the perfect complementary tool to candlestick charts. We show you how to use these screens to gauge supply and demand in the markets so you can plan better entries and exits.

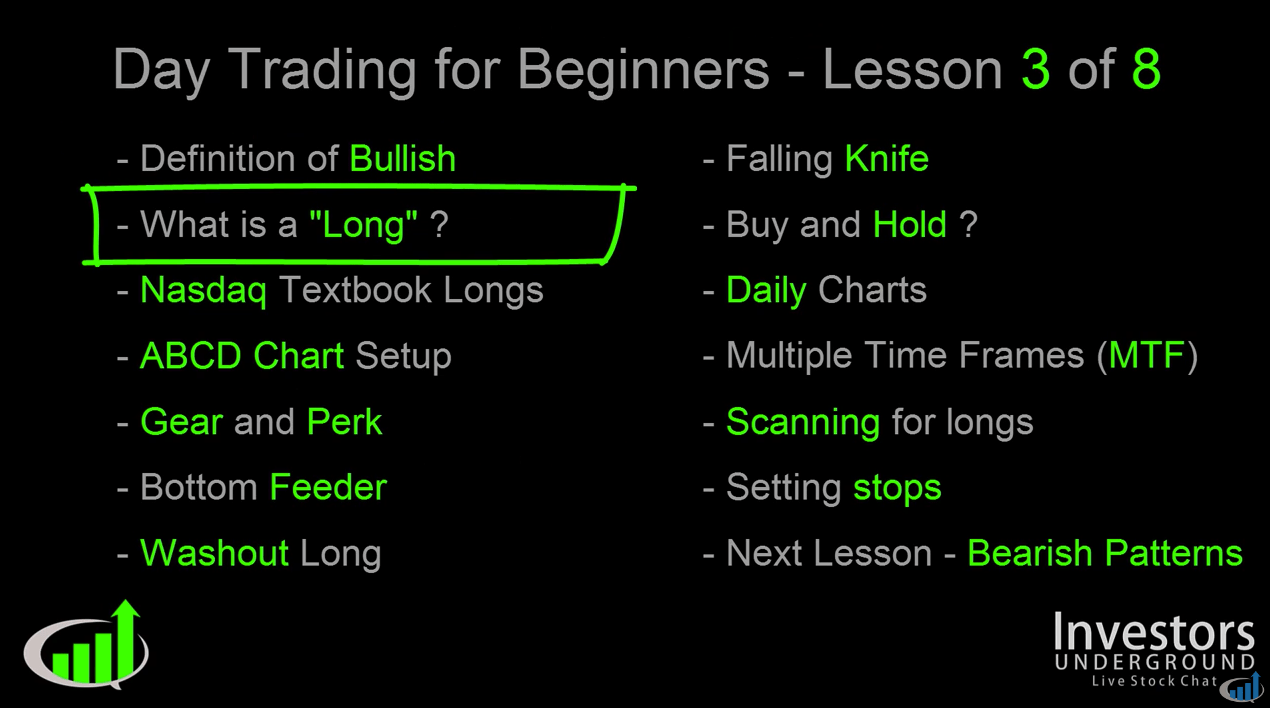

Learn How to Day Trade Lesson #3: Introduction to Long Trades

The third video lesson is focused primarily on long setups (trades where you buy low and sell high).

- Definition of Long Trades – We introduce the topic of long trades and what you should look for.

- The ABCD Chart Pattern – The ABCD chart pattern is one of our favorite patterns at Investors Underground. Why? Because it works! We explain how you can spot ABCD setups and use them in your daily trading.

- Gearing and Perking – As day traders, we are focused on reading a chart as if it is telling a story. Gearing and perking is a pattern that can be used as an indicator for a move to come.

- Washout Longs and Bottom Feeders – We give you to chart setups you can utilize to start placing long trades as a stock is reversing or bouncing off of its lows.

- The Importance of Multiple Time Frames – Although day traders are mostly focused on intraday trading activity, it’s still important to understand the bigger picture. We introduce the concept of analyzing charts across multiple time frames.

- Stop Losses and Trade Management – We talked about risk management in the first video of the series. In this segment we go over how you can apply these risk management strategies to long chart setups.

So, now that we’re all caught up, let’s get to this weeks video lesson! We have a great video in store for you this week. We are introducing the concept of short selling stocks and different setups you can look for.

Learn How to Short Sell Stocks

Short Selling Video Overview

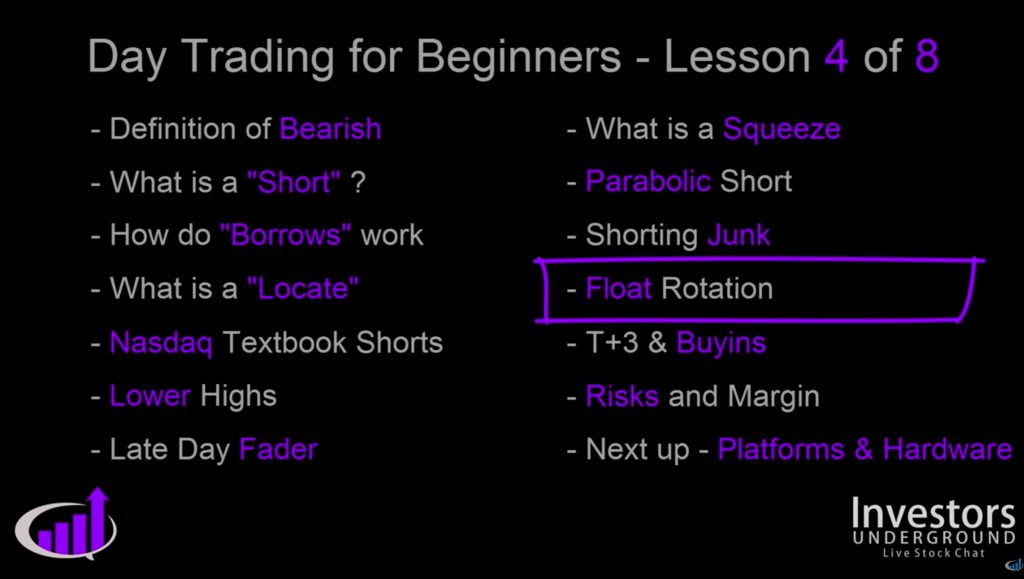

We go over everything you need to know about short selling in this video! Here are a few of the topics we discuss.

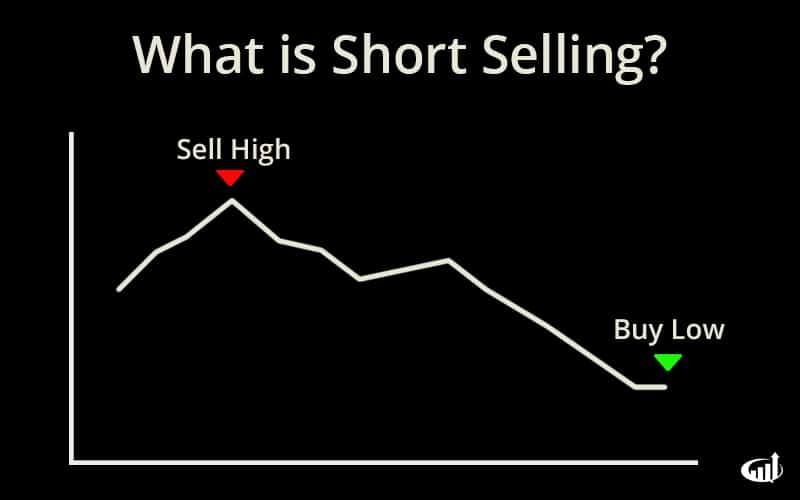

What is Short Selling?

Short selling is a new concept to many traders. Most people are familiar with the “buy low, sell high” strategy that most investors utilize, however few are aware of the fact that you can sell high and buy low. Short selling stocks allows you to profit from a stock as it is dropping in price. Essentially, you borrow shares from your broker to sell and you are responsible for returning those shares at a later point. If the trade works in your favor, you will buy the shares at cheaper price than you sold them for.

How Borrows and Locates Work

As mentioned above, when you short sell a stock, you are borrowing shares to sell. This begs the question of, “who would let you borrow their shares?” In many cases, a broker is able to lend you the shares. This is possible due to the fact that everyone who has a position in a stock has a different game plan. An investor may buy AAPL with plans to hold it for a year. This investor is not worried about intraday price fluctuations. Now, let’s assume a day trader believe AAPL will drop a few points during market hours. This day trader may borrow the shares from the investor (through his/her broker), sell them at the market open, buy them at the market close, and return them by the end of the day. This whole process relies heavily on a broker having shares available to short. So, what happens if they don’t? Brokers can borrow shares from other sources. This is what is referred to as a “borrow,” and the process of finding these shares is referred to as a “locate.” In this scenario, you pay your broker a fee to help you locate shares of a stock you want to short.

Textbook Short Setups

Just like long-biased traders, short sellers need to find high probability setups that allow them to make educated predictions about a stock’s price action. In the world of day trading, short sellers don’t just short a stock because they think it is a bad company or overvalued. They look for prime chart setups. In this segment of the video, we discuss a few different chart setups that will allow you short sell a stock with a set risk/reward. Learning these bearish patterns is incredibly important to your success as a short-biased day trader.

What is a Short Squeeze

By now, you should be aware of the fact that short sellers are in possession of borrowed shares that they will have to return at one point. So, what happens if the trade goes against them? Often times, if the general consensus of the market is bearish, yet a stock’s price action is bullish, shorts can get trapped. This trap is known as a “short squeeze.” Shorts get trapped in a position and have to return the shares they borrowed before their losses accumulate. This creates a vicious cycle for all bearish participants in a stock. When a short seller returns the shares they borrowed, it’s known as “covering” a position. When a position is covered, shares are purchased and returned to the broker. Since covering is buying a stock, this forces the stock’s price to increase even further, which may force even more short sellers to liquidate their positions. The result of these short squeezes is a stock that continues to increase in price, even if there is no fundamental justification for the price movement.

Parabolic Shorts

When a stock exponentially increases in price, it’s known as a parabolic move. While these parabolic moves can be justified, they are often over exaggerated and do not reflect a realistic valuation of the underlying company. If you’ve been day trading for awhile, you’ve probably seen a stock run a few hundred percent in a few days (or even within a single day). This provides a great opportunity for short sellers who want to take advantage of the stock’s drop in price as it returns to a more realistic price per share. Timing is everything with parabolic shorts. In this segment of the video, we discuss how you can spot parabolic shorts and how you can trade them without exposing yourself to unnecessary risk.

Float Rotation

A stock’s float is the amount of shares available for public trading. These are the shares you see being traded on a daily basis. Float rotation is a phenomenon that occurs when a stock’s float is traded so many times that the shares keep switching hands. Why is this important? When a stock’s shares keep changing hands, it affects buying and selling activity. Essentially, market participants are getting refreshed as the stock makes it’s move upwards. In this segment, we go into more detail about what float rotation is, how to spot stocks that are candidates for float rotation moves, and what you need to be aware of when trading these stocks.

Risks and Margin

It’s important to remember that when you are short selling a stock, you are BORROWING shares. This is the same as borrowing money and should be approached accordingly. Another important thing to keep in mind about short selling is that a short trade has a theoretically infinite risk. Think of it this way. If you buy a stock at $5/share for a long trade, the most you can lose is $5/share if the share price drops to 0. If you short sell a stock at $5/share, you can lose $10/share as the share price goes to $15, $20/share as the share price goes $25, etc. Before entering the world of short selling, you need to be prepared to manage this risk. Many traders end up losing all of their money AND owing their broker money from short trades gone wrong. In this segment of the video, we’ll talk about a few things you should look out for and how you can mitigate risk when managing short positions.

Day Trading for Beginners: Video Stock Market Course

In case you want to re-watch the video series and brush up on your day trading knowledge, you can view all of the videos in the playlist below!

Great video, Cam. Do you have any suggestions for managing risk if you short a stock overnight? Thanks!

Just remember to make sure you are holding the name short for proper reasons, not because it got away from you not because you’re sitting on a loss and stubborn to take it etc…

Make sure it’s part of your plan. I tend to stay away from low float cheap stocks with heavy momentum especially crowded names for over night. Pharmaceutical and names that have been rumored to have buy outs or talks etc. are good to stay away from.

Other than that if it’s part of your plan at the end of the day it’s YOUR plan. Typically if I hold over I am using 1/4 the size I would use intraday.

Thanks, Nate!

Way to go Nate!!!! So pump and dumps are drying out? What about black swans? Those out of the ordinary trades. Since they are such a great opportunity, please consider mentioning somewhere in this beginners series. Great stuff, really. I am betting my future and my financial freedom on you. No pressure LOL!!!!

I have a $14000 account that I want to use for short selling. Do you reccomend trade zero or interactive brokers ?