Earlier this month, we hosted a free webinar with SpeedTrader to discuss the most effective trading strategies for 2018. Initially, the replay was going to be for members only, but we’ve had a lot of requests so we are making it public!

We discussed a LOT of actionable trading strategies in this webinar so you should definitely watch the whole thing. Here are some of the trading strategies we discussed:

- Timeless Trading Principles (9:45)

- How to Find Your Trading Niche (16:30)

- Money Management (21:15)

- What is NOT Working in 2018 (26:30)

- Best Strategies for 2018 (35:40)

- Actionable Chart Patterns (39:45)

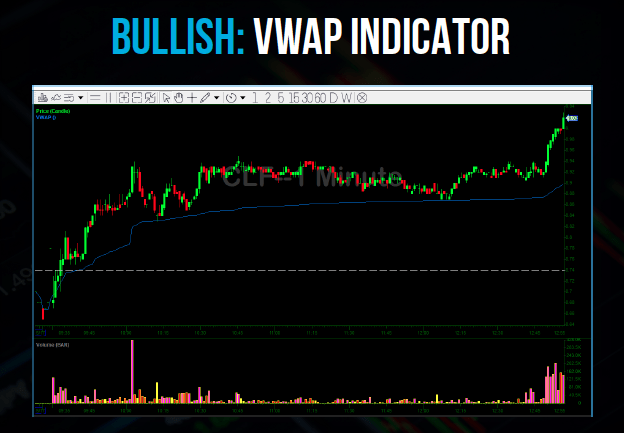

- Using the VWAP Indicator (51:30)

Timeless Day Trading Principles

The market is always changing and successful traders adapt. For example, shorting low float stocks may be effective in certain mark conditions and calamitous in others. That said, there are certain timeless trading principles that are always relevant.

You need to learn these principles if you want to make it.

The Stock Market is Always Right

This principle is straightforward, yet so many traders are tempted to defy it. Admitting your wrong isn’t easy and some traders hold onto losing positions with the assumption that they are right and the market is wrong. Write this down, read it, and then read it one more time. The stock market is ALWAYS right.

This isn’t a question of whether or not the market is rationale – that’s a different story. That being said, price action doesn’t lie, and even if your idea is right, your timing needs to be right as well.

Take my recent trade on $HEAR for example. I was dead right and I had 100% conviction. I mentioned in chat that I was convinced that this was going $15-17 + but … I started in early, ignored a few failed follow through momentum moves (ie: it tried to reverse, stuffed and came back) but stayed in anyway because I “knew” I was right.

The stock ended up going to $10.85 before $11.60 break out into close but wasn’t enough. Despite minimizing the loss and the stock hitting $18 the next day – the market was right. The market told the story and I ignored it. Being WRONG is right sometimes. You just need to learn to accept it.

The story ended well because the next day it hit $18 and I was able to get involved in the low 11s and capture a good portion of the meat of the move. But, the lesson is most important. I likely would have had more confidence, more size, more conviction day two had I respected what the market was telling me the prior day.

You don’t need to be right the first time to have a profitable trade. If you have a good trade idea, make sure you wait for the right timing.

Treat the market with respect and it will respect you back!

You Are Accountable for Yourself!

Trading isn’t a choice. It’s the result of proving to yourself that you can follow a plan and be wrong. That’s it, it’s that simple.

The majority of traders who fail don’t fail because they can’t find winners, it’s because they can’t take losses.

Losses compound – and compound quickly. It’s human nature to want to average down on a trade we were wrong on because it appears like it’s the only way out – but truthfully it’s the worst thing you can do!

Keep a close trading pal or two in your circle, someone who isn’t going to judge you when up any different than when you’re down. You need someone that can be there to pick you up when you’re down and someone to give you a high five when things are good. The more public you make your trades the more pressure you’re going to have to perform. Trading is hard enough don’t make it harder.

Every Successful Trader Has a Niche

Traders should double down on their strengths and narrow their focus.

As they say, “Jack of all trades – master of none.”

This is very important in many regards. When I first started I always wanted to be involved in the market. Every second I needed to buy sell buy sell buy sell.

Less is more.

Find out what you’re good at – that’s through trial and error.

We talk about a bunch of different setups in our educational courses and we have a wide range of trading styles in the chat room.

Once you familiarize yourself with some basic sets ups and strategies, you can start to narrow your focus. Don’t try to catch every move – focus on the best ones. Learn how to make your most profitable trades even more profitable and try to eliminate trades that result in losses.

Traders always want to be doing something, but doing less can be the more profitable decision.

After analyzing all of my trades, I discovered that:

- On my post profitable days, I only traded 3-4 stocks.

- On my least profitable days, I traded 15+ stocks

When You’re Trading Your Worst, Act Like You’re Best

This is the most important thing we are going to talk about today. What does this mean?

It’s human nature to want to make up for bad trades. It’s human nature to want to fix it all in one shot. It’s human nature to feel like it’s not enough and we need more.

When you’re on the hottest run you’ve ever had as a trader, a $1k gain will make you happy. Yet, when you lose $7k on a bad trade and then you’re up $1k on your next trade, you’re still not happy.

When you’re stuck in a rut or trading after taking big losses, you can act irrationally. You’re no longer objective in your approach to trading. Instead, you’re focused on making back a loss or proving something to yourself. This is a recipe for disaster.

If you don’t believe this happens, just wait. Point is – AS A TRADER YOU NEED TO IMMEDIATELY GET BACK TO WHAT YOU WERE DOING WHEN YOU WERE ON HIGHS DOING EVERYTHING RIGHT. There’s a reason you were trading well at this point, and you should seek to emulate this approach when you’re down.

Focus, if you nail the trade lock some in, don’t worry – trade well profits follow. Force and try to make it all back – get ready to head back to the bank to wire more in if you’re not broke yet 😊

Money Management

Preserving capital is crucial.

Losses are good. Huh? What?

Yes, it’s NOT taking losses that cost you the opportunity to trade.

Take them!

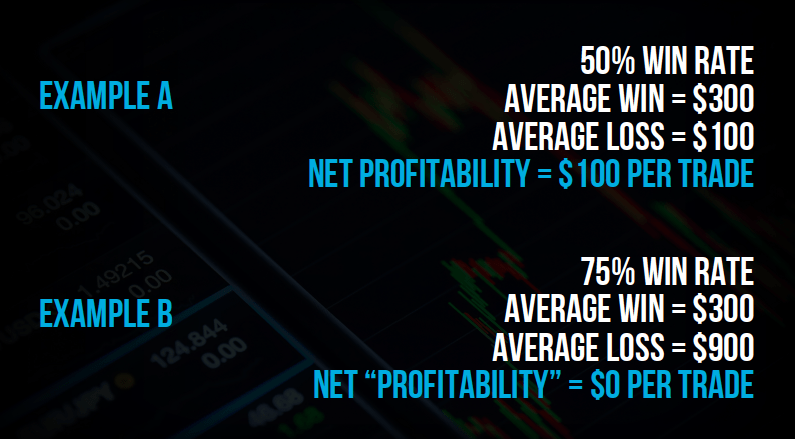

You don’t need to be right every trade – if you go into each trade with the anticipation that the risk is about a third or a forth the anticipated reward than technically 1 win should knock out 2 or 3 losses.

Many traders are blinded by the potential rewards and neglect the potential losses. If you make this all about money, you’ll fail. Even the great traders I know all zone in on $$ but truthfully someone is ALWAYS GOING TO MAKE MORE!

Focus on developing your skillset, preserving your capital, and building a sustainable process.

We recently compared this process to how Tom Brady approaches football (I know everyone out there loves Tom Brady).

Brady focuses on refining every aspect of his game.

If he went to the games each day thinking about how he can throw the most touchdowns (ie: get the biggest PnL), he’d likely have the most interceptions of his career.

Put in the work, and let the results do the talking.

There Are No Universal Trading Rules

We get a lot of the same questions from new traders:

- What % Do I Put Into Trades?

- How much capital do I need to trade?

- Is short selling better than going long?

There are no definitive answers. You need to focus on what works best for you.

EVERYONE IS DIFFERENT and you shouldn’t take personal advice from someone who doesn’t know your particular sitaution.

Figure it out. If you’re trading with moneyyou can’t lose you shouldn’t be trading “sketchy” names and that means all these low float crazy runners – heck 1 out of 500 may halt like LFIN but when you’re stuck in one you’ll be glad you followed the rules.

For me it’s less about the % but rather the risk at hand.

If I size into a position it’s because I have a padding, I’m far away from my average. Sure there are times I will take a high conviction trade but I know when/where to be wrong and that A+ set up with a 90% hit rate is worth the risk that 10% it may be wrong. But, most times – sizing into a position is done w/ houses $$ a padding and letting it work.

One weakness I have which I’ve been working on over the last 6 months is – I’ve really been working on properly sizing into names with a lot more shares than I’d typically trade but my biggest draw back has been sizing back down properly. Each step of the way there is a learning curve.

Max stop losses are great – what is the number that would take you out of the game? $5K? $10K? $50k? Well, when you’ve broken EVERY Rule known to mankind and still in the trade – NEVER and I mean NEVER break this one – make a plan now? What is it? Once you’re out you’re out.

What’s Not Working in 2018

Before we get to strategies that work in 2018, I want to cover some strategies that are NOT working. There are a lot of marketers out there who leave new traders with misconceptions about what is and isn’t possible in the markets. Knowing what NOT to do can save you months of time and money.

Penny Stocks

Penny stocks are not as hot as they used to be. I’ve noticed a lot more longer term type trades that work incredibly, like the old days – but it’s about position trading and letting them work. Cody, one of our moderators, has done well with these especially the pot stocks but – they are not as liquid as years past and rarely if ever do I trade them.

This doesn’t mean that the penny stock markets are dead, but if you’re just getting started, why not work on developing a more sustainable strategy?

Chasing Alerts

There are so many services now that push their profits, their PnL’s and really entice the weak at heart to join. Think about it – if you join someone who is pushing you with how they turned $6 bucks into $1.7 trillion, you’re monetarily focused. This is a recipe for disaster. STOP NOW. You will not make money by following another trader.

Any time you follow someone in a trade on a low float or any other momentum name for that matter you’re becoming part of the crowd. The market has a way of dealing with them even if it goes higher later on – it’ll stuff, slam and regroup later on but all with the intent of getting the crowd out. When you’re part of a crowd it comes down to FIFO (like accounting) first in, first out.

What’s Working in 2018

Now, let’s get to what’s actually working in 2018. I highly recommend watching the webinar because we go into more depth and provide LOTS of chart examples

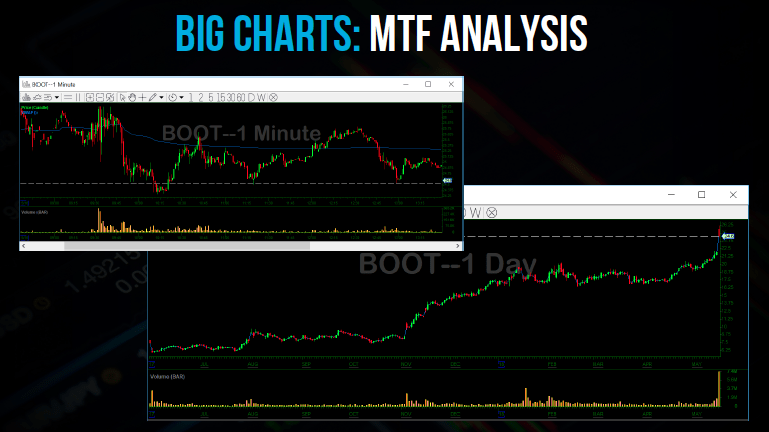

MTF Analysis and “Big Charts”

Traders often get caught up with the intraday charts and forget the bigger picture. It’s important to focus on multiple time frames (MTF). A chart that is set up to breakout intraday AND on the daily chart can make for a big move.

Not everything is a day trade. I’ve been working a lot more on swing trading in my IRA – taking big picture trades after good news or trends that confirm off weak opens getting absorbed. Some examples are charts like HEAR / I / TNDM and many more where they have their initial moves and then dips get scooped up each morning/day and close green.

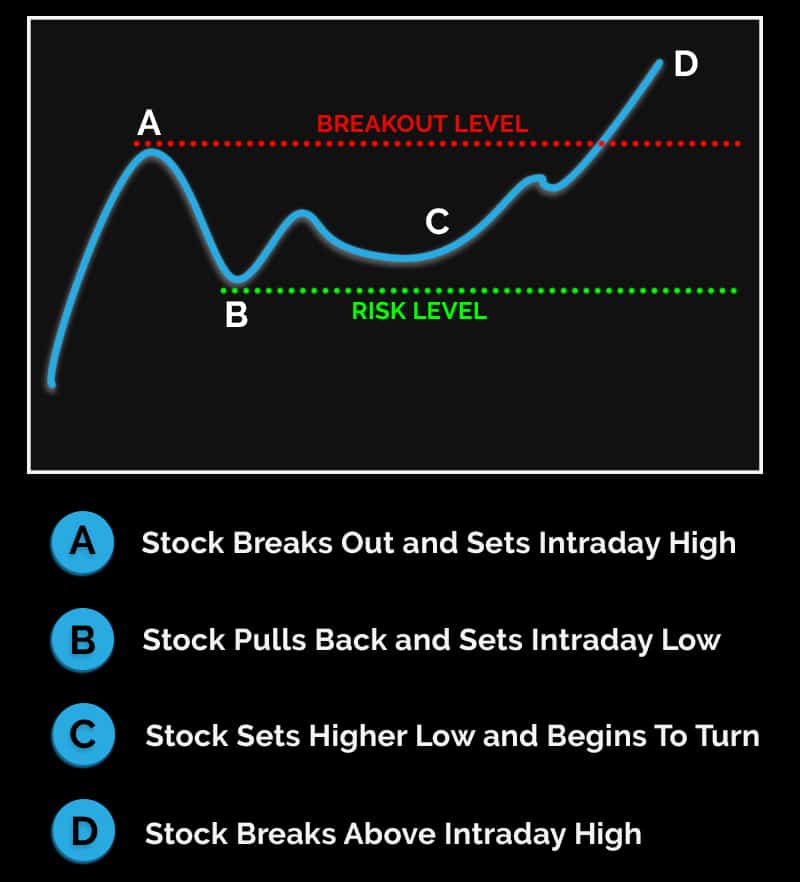

ABCD Pattern

The ABCD pattern is still one of the top trading patterns and one of the best set ups for new traders to focus on. This is a bullish breakout pattern that can be used for both day trades and swing trades.

The ABCD pattern is a great setup because it has set risk and a high probability of working in your favor.

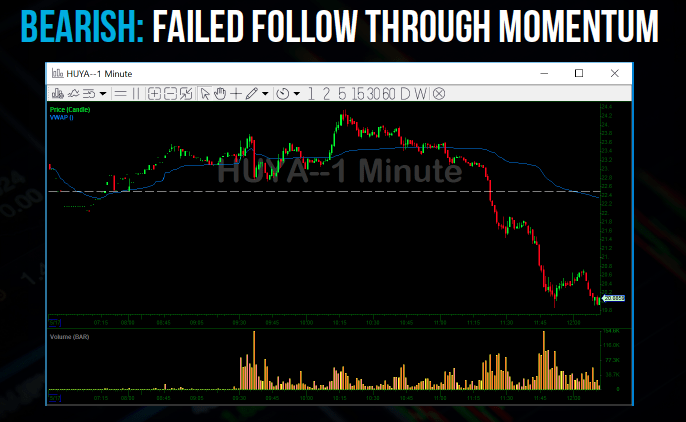

Failed Follow Through Momentum

Analyzing intraday charts for “failed follow through momentum” can help you differentiate between a breakout and a good short setup. Stocks come to a point during the day where they can either continue their breakout or reverse to the downside. Look for the point at which momentum fails, as this may indicate a forthcoming reversal.

VWAP Indicator

The VWAP indicator is one of the most effective indicators for intraday trading. It helps you understand the average price where most traders started a position. This may be an area where traders are looking to buy, sell, short, or cover, so VWAP can act as support and resistance.

High Volume Stocks

Always focus on stocks with high volume. Illiquid stocks are not good day trading candidates. Volume gives you the ability to get in and out of positions with ease. It also represents public interest in a particular stock.

FOCUS ON VOLUME & HIGHLY LIQUID NAMES = REAL TRADING

Yes, low volume low float present amazing opportunity but know when to leave the trade.

How to Apply All of This

If you’ve gone through the webinar, you should have a list of actionable trading setups and tons of examples for reference. See what works best for you and put this newfound knowledge to the test! If you have any questions, leave a comment below.

Hey Nate how you doing I have a quick question An what do you recommend.I full time in the morning pacific time but I really want too trade I could change my schedule to second shift butt I’m not going to have a life.In your shows what will you do in my situation,thank you for your time😎

This is great thanks!