Last November, I tweeted this regarding a conversation I had with a trader I respect and admire. He left Twitter about a year ago, but is still trading successfully.

Was thinking today something a friend of mine said (one who most knew before leaving Twitter) when talking to an aspiring trader.

"What is your process?" -NS

Can you answer that?

If not, consider answering it before your next trade.

— Nathan Michaud (@InvestorsLive) November 30, 2017

It’s not because he’s been in the game for decades and been through it all and seen it all. It’s because of how unique the situation is – that at such a young age, he has figured out his process.

Now, I take full credit since I’ve personally inspired him to come to, not one, but two Super Bowls with me and introduced him to my pal who some of you may know … Tom Brady.

I’m kidding, of course – but we had a great conversation on the flight over about traders and realized one simple thing that most traders are missing. They lack a formal process.

A New Trader’s Worst Enemy

Most new traders come for the fast money, fast action, and adrenaline that a big score brings. They’re attracted to the lifestyle, the profits, and the potential. Yes, all of these perks are great, but is it achievable without a formal process you follow every day?

This particular trader I was talking with made it at a young age. He could now reap the benefits of the “lifestyle” that everyone is attracted to (he just couldn’t legally drink). With all of this success, there was one hidden flaw. He lacked a formal process and in one day, it was gone.

One bad trade wiped out hundreds of successful trades. Sad story right? Don’t worry, there’s a happy ending.

(Spoiler alert: he’s trading better than ever).

What’s Your Mission Statement?

So, on the flight over to the Super Bowl, we were talking about new young traders (Yes, he’s young but processes information like a 50 year veteran in this space). We started talking about someone who he was mentoring. His first question to him was, “What is your process?”

I stopped right there, so simple. So. Damn. Simple.

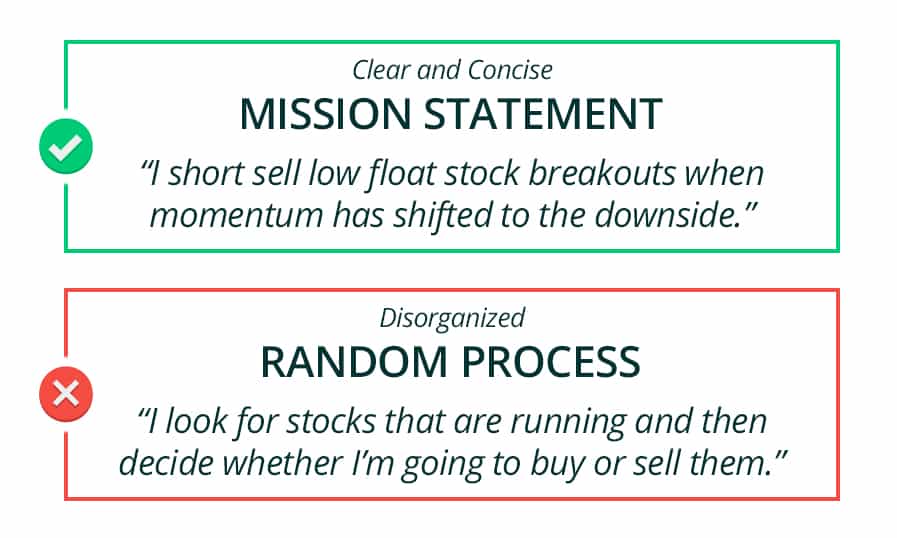

Most companies have mission statements – something that can describe what you do in 2 minutes or less (often summarized in a few sentences). A mission statement is clear cut, defined and profound. Think of this like an elevator pitch – if you had 30 seconds to explain you mission, you would choose your words wisely. When you get off the elevator, it leaves the person wanting to know more.

I thought about what I’d say if someone asked me that.

“Uh, I trade stocks …”

“I look for stocks that have the biggest range and NAIL them”

I’d been trading for over a decade but couldn’t summarize my strategy in a simple, concise statement.

Just like a mission statement guides a company’s daily operations, a trader’s defined process should guide his/her daily trading activities. The faster you can define what it is you do, the faster you’ll find success in my opinion.

Do you “do nightly research to take on an CALCULATED risk on the highest probability names that over time have proven to fail ninety percent of the time?” Think about it …

How do you define what you do?

Once you define it, you can then focus on your process to make you better at your underlying mission. You will know which activities to avoid and which activities you should double down on.

Tom vs. Time

How many of you have seen Tom vs. Time? If you haven’t it’s a must.

Take a look at how Brady discusses his strengths and weaknesses. To an outsider, Brady just seems like a great football player, but his approach is far more granular. He dissects every aspect of of his game and pays attention to all of the minute details.

He’s rewiring his nervous system to talk to his muscles and extend the level of skill that he’s achieved. It’s in the hard wiring.

There is so much to learn here from Brady. Brady understands his process so he’s able to he’s able to put each component under the microscope. He can identify areas of strength and weakness and refine them accordingly.

It’s not about big changes. Making small changes over continually fine tunes the process.

“I want us to put the work in because I want it to pay off” – Tom Brady

“Every play I want to be so decisive” says Tom. Every trade should be too!

Do You Have a Formal Process?

Do you treat trading like Tom Brady treats football? Do you have a process?

Do you wake up the same time each day?

Do you check our early moves and start to make a macro plan for the day?

Did you do the work?

Are you prepared?

Much like football, there will be hits in trading. How many times can you get sacked and get back up? What can you do about it so each time you do get sacked, it’s less of a blow?

If you want to perform at the highest level then you need to prepare at the highest level mentally.

“The game now is very CALCULATED” says Tom. Your approach to trading should be as well – after all, your money is on the line every day.

Creating Your Playbook

Tom talks about the importance of reading body language and movements. “How do you know when a guy is going to blitz?”

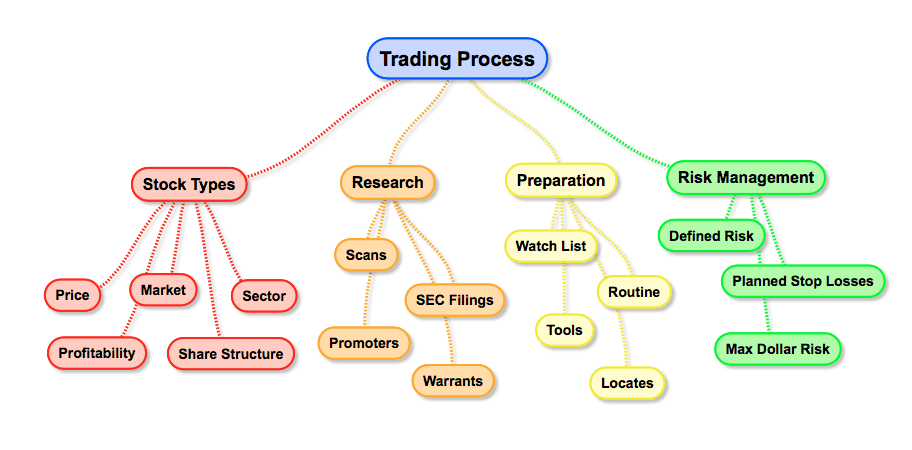

We do the same thing in trading. We analyze situations and try to predict what happens next. We build our trading playbook as a tool to help us thrive in these situations.

Blitz or bluff?

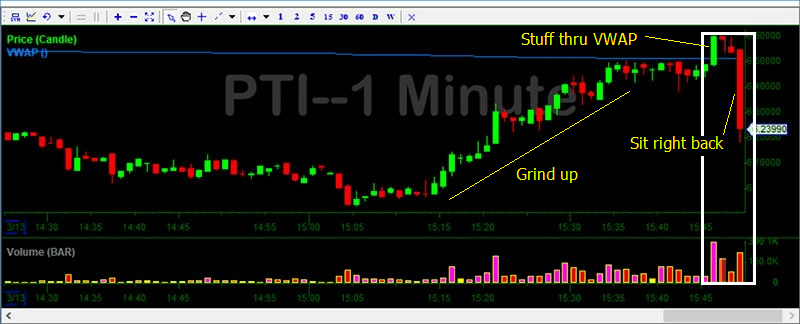

I’d compare this to a theory I came up with called a “stuff move.”

This is where a trending stock rips out of the trend, scaring & stopping out weaker players, only to sit right back. How do you know? How can you prepare? What can you do so that NEXT time you see the same set up – you’ve seen this before?

As traders, we have playbooks of different game plans for different situations. We analyze the charts to decide how a stock is likely to behave. How do we know? We’ve studied these moves in the past. We read the situations and allow our process to guide us.

How to Win the Race

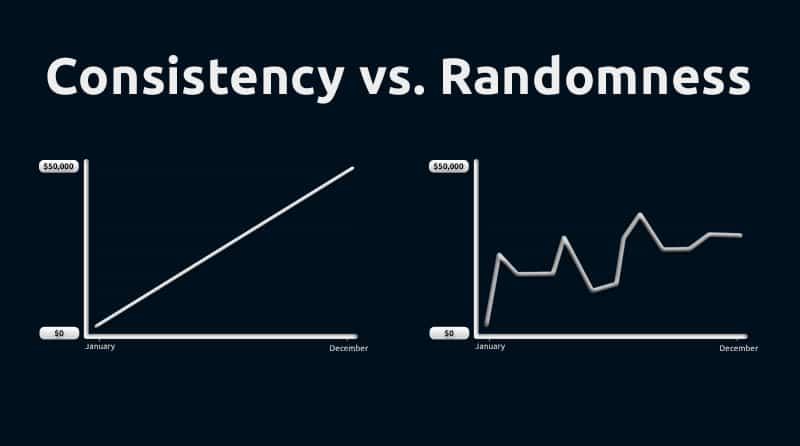

In Textbook Trading and Tandem Trader, I compared trading to sports a few time. The first popular analogy is, “it’s a marathon, not a sprint.” The second analogy is similar. In a baseball game, if you go for a home run every time you’re at the plate, you may crush a few but there is a MUCH higher chance you lead the league with strikeouts.

Lastly, in the NFL there are two talking points here:

- If you’re looking to lead the league in touchdowns, there’s a good chance you’re going to lead the league in interceptions.

- If you’re focused on the process, the work, your strengths and weaknesses, and fine tuning, you can expect results.

The main takeaway? Don’t try to be a “hero” in your race to trading success. You’ll end up gassing out. Let the small wins add up over time and you’ll get where you want to go.

Work on refining your process and building a system that actually works. Identify areas of strength and weakness. Know your limits.

What can you do NOW that gives you the BEST chance to get to the endzone in the Super Bowl?

So I’ll end with the same question I tweeted out many months ago: What is your process?

Good write-up, Thanks Nate

That motivated me big time

I very real approach.

Thank you for sharing these thoughts with us.

Awesome way to look at trading. Find what works, find tune it until you see success.

Great blog post here, loved the Brady analogies and video of him. Going to use this with my trading for sure.

Very good job Nate, Thank you!!

Refine, refine, and keep refining till you realize that it’s actually working….

Great words especially for me new day trader looking for direction. Those apologies can allow me to begin a direction.

Great stuff, Nate! Thanks for taking the time to put it in black and white.

great article … thanks

Awesome post Nate!

Process, process & more process. In the sports domain we define this as routine. Trader should have daily routine too.

The Race Is Not For The Swift But To Those Who Endure To The End

Thanks Nate

Thank you Nate for one of the simplest, most concise lessons I’ve seen! Very well thought out and written. You’ve given me much to consider in this article.

I’m going to chisel down my mission statement and build my process around that. Thank you for Taking the time to write this for us!

Great stuff, thanks Nate

Love this. Made that flow chart a wallpaper

Amazing post, thanks Nate.

great post Nate…as usual!