At Investors Underground know, our main chat room is focused primarily on momentum trading. We have 2 other chat rooms for swing trading and OTC trading, but the main room is focused solely on momentum. Understanding what momentum trading is will give you a better idea of our approach to day trading.

Momentum traders take advantage of short-term price action in a stock. Whereas a swing trader may hold a stock for days or weeks, a momentum day trader will generally buy and sell a stock within the same day.

Finding ideal trading candidates is of paramount importance. Not all stocks provide momentum trading set ups, and focusing on the wrong stocks will waste your time and cost you money. Here are a few things to look for

Stock Volume

A stock’s volume is simply the number of shares that are traded. As mentioned above, the goal of momentum trading is to get in and out of a position in the same day. In order to do this, you need to make sure that there are enough buyers and sellers. Therefore, it’s important to focus primarily on stocks that have high volume. This allows us to get in and out of trades with ease. High volume stocks have higher liquidity, meaning it can be bought and sold quickly.

Volatility and Range

As a momentum trader, there is nothing exciting about a non-volatile, range-bound stock. We are looking to take advantage of intraday price action (keyword: “action.”) We’re not trying to scalp stocks for a few cents; we want to play significant moves in the market. If a stock is stuck in a $0.30 range for the day, there are very little trading opportunities. Contrarily, if the stock is trading in a $5 range, there may be profitable trade setups.

Time Frame

Momentum trading is focused on short term moves in the stock market. We don’t care what a stock is going to do a month from now. We’re focused solely on what is going to happen during the day. This is part of the rationale for why we don’t care about the condition of the underlying company. A terrible company can experience exponential price increases, and a great company can be undervalued for ages.

Of course, it’s still important to pay attention to the longer timeframe charts so you can understand significant price levels, but you’re trade plan should be focused on short term price action.

Technical Analysis

Whereas investors care a lot about the underlying company, momentum traders only care about the stock itself. You’ll hear me say time and time again, “Trade the ticker, not the company.” As momentum traders, all we care about is price action. We save the balance sheets and income statements for the investors. In the world of momentum trading, the stock IS the product.

Every chart tells a story. A stock chart tells us how much money people are willing to pay for a stock at a given period. Reading and understanding these charts is known as “Technical Analysis.” We analyze chart patterns to make predictions about the market. If you find yourself justifying a position because of a characteristic of the underlying company, you are in the trade for the wrong reason.

Catalysts

As mentioned above, momentum traders are focused on trading volatile stocks in a short time-frame. We are interested in new catalysts that can cause a stock to break out or break down. Keep in mind, we do not care about the actual implications of the catalyst, but the reaction of the market. For example, when there was an Ebola scare in America, the stock prices of many companies in loosely related sectors skyrocketed. Was this price movement rational? No, but it created many trading opportunities. Understanding the catalyst of a move can help you gauge the magnitude.

High Risk/Reward

Many people compare day trading to gambling, and, if done improperly, the two can be similar. What separates a day trader from a gambler is research and risk/reward analysis. This is similar to any business.

It’s estimated that 80% of entrepreneurial ventures fail within 18 months. Does this mean starting a business is gambling? Yes and no. There is an inherent risk to most things we do. That said, there are ways to mitigate this risk. In day trading, we do this by finding stocks with favorable risk/reward ratios. For example, if you enter a stock blindly, you basically have a 50/50 chance of making a profit; this is gambling. If you analyze patterns, study technical analysis, and find favorable risk/reward setups, you can lower your risk. In general, you should never risk more than $1 for every $3 you expect to make.

Sector Strength

Certain sectors start running at different times. For example, marijuana stocks ran when new laws were passed and non-lethal weapon stocks ran when police brutality was in the headlines. Understanding sector trends can help you better understand why certain stocks are moving. It can also help you find more stocks to trade within the sector.

Market Strength

Paying attention to the strength/weakness of the broader markets can help you understand “momentum” at a larger scale. This can be done by looking at the indices such as the S&P, DOW, and NASDAQ. The broader market strength speaks to the overall sentiment of the market. For example, if the S&P is up 3% on the day, the market would be considered bullish, therefore, the probability of bullish setups working out in your favor is increased.

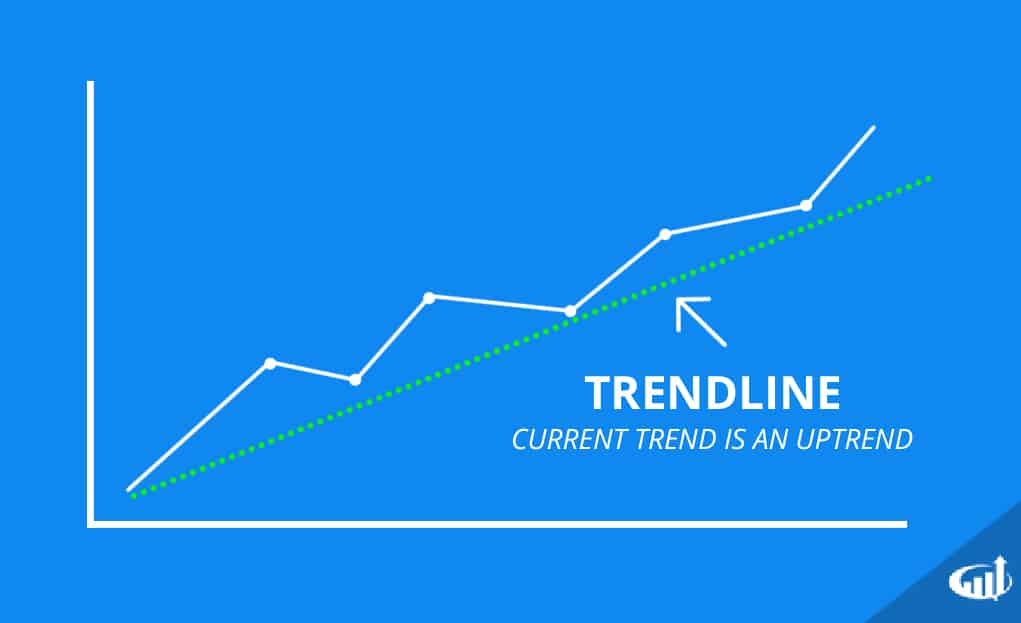

Stock Trends

This should go without say, but it’s important to focus on the trend of a specific stock. You never want to fight the trend. So, if a stock has been uptrending all day and you decide to short it, you are fighting the trend and increasing your risk.

Trading Setups

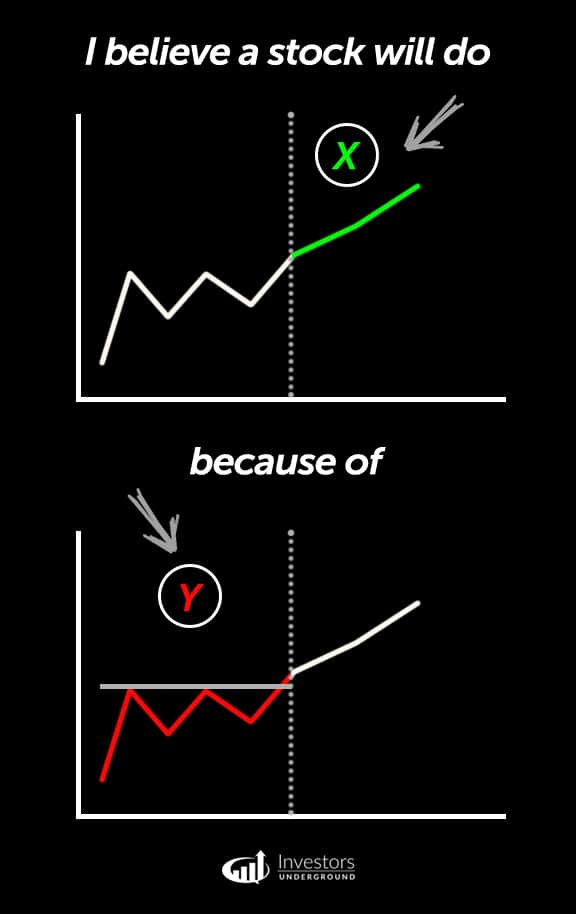

This is another one that should go without say, but some traders neglect to focus on it. If you are entering a position in a stock, there should be a reason. You should be able to answer the question, “Why did you enter the stock at that price?”

Your answer should be well-thought out and rationale. I think it will go up in price later” is not a good answer, whereas “The stock was breaking out of an ABCD pattern and the risk/reward ratio was 1:4″ provides solid rationale.

Hearing this, and being on the fence about getting tandem trader, after having text book trading,- is that – (call me a turtle), but I find IF I don’t keep a pretty grueling accurate account on a spreadsheet of pretty much every detail going into ‘why I a mouse clicking on a trade, what I am thinking, what my emotions were/are, why I acted the way i did, what I think I see, why I think I see it, and mostly why I can or can not seem to hold a position for its idea to reach the full outcome its plan.. I don’t seem to learn. Just where I am at I guess. I spend a lot time doing it, but think tis the best effort for my point in learning level. It’s like I can hold up a transparency of an ABCD up to the set ups I take positions on, and then mainly I deal with patience and what to do with myself during the day. Really self management to facilitate emotional discipline.. that is almost worth a blog topic in my eyes. I’d be happy to write something up, and submit to IU for review to see if is worth posting?

I.e:Something like… What do you do with yourself when you are exercising your trade plan and letting it work out? Afterall, it can be a few hours you are sitting there..Are you engaging in things that allow you to more fully enjoy the actual act of holding in the duration of things? How do you self manage you time? What are or aren’t you doing that is forming other habits? if you find yourself having to ask yourself these questions, because you are planning your trades and trading your plan.. what else can you be doing to live a successful life and feed yourself the types of activities that advance your other goals and values (relationships, friendships, health, contribution, purposefulness besides ‘making bank’ and tax strategy?) .. .just a thought!!! Look forward to keeping my learning going here.

Just my honest opiniong, but i think you should have one single focus during the trading day, “How to extract the maximum amount of money from the market with minimal risk” If your focused on relationships, and friendships in the hours between 9:30 and 4:00 your results will reflect your focus.

As to other things you should be doing while in trades and waiting for them to pain out, if you are laser focused on a stock watching every single tick you are bound to get shaken out of it, so i try to focus on finding new setups, while keeping an eye on key points on the charts on my other ones, but if you are watching it tick for tick its definitely going to do more harm than good IMO.

Thx. Great point Golden haired God. I listened to Brett Steenbab, a trading psychologist that has spoken at Traders for a cause, and I recall him mentioning the emphasis on how important it is to have a life outside of trading. To your good point, that the results of what I choose to focus on during a trading day will inevitably be reflected in my experience of reality. I concur in seeing ways that Learming to be a better trader (is not necessarily the same as learning to be a better person, more relatable person, or more skilled person at handling compulsions, instant gratification, or other undisciplined habits in ones personal a life, per we)..Perhaps I’m touching on the idea that this is just the age old dillema of “who am I becoming , as a person, as a result of my daily choices?” I happen to pay attention to that, over and above my account size…And i ‘ve made a good bit money too, and “it’s getting easier,, though more taxes” to keep making money as far as trading skills go. So I guess my point in my limited view, is that , if not careful, “having no WHY in ones life past the money , is a recipe for mental illness, depression, negative compulsions, etc..So I be found and it does not mean what’s self evident to me, is the same for any other person…i say that in response to your kind point that self managing during the day, as the drive for making bank, or just the act of trading pleasure for its own sake, and your suggestion to use time during the day shopping set ups, is something ‘one should’ do. I respect that. or using the time in between trades and during trades to even figuring out how to help Marines, breast cancer, is productive, via comes at sacrifice to attention, and striking that balance in the life-trading scenario I think is so key to being a balanced approach. But again Jesse Livermore took his own life “after a successful trading career”..So I happen to pay some attention to the big picture, while I get rich, and sorta keep an eye on who I Max Heter an becoming , and what impact my actions have on the lives of others and myself, as I go do ABCD, parabolics, all day long bankrolling whatever it is I choose..I am totally open to hear feedback more! Glad to have this community to engagement…