First and foremost YES CYNK is a piece of shit.

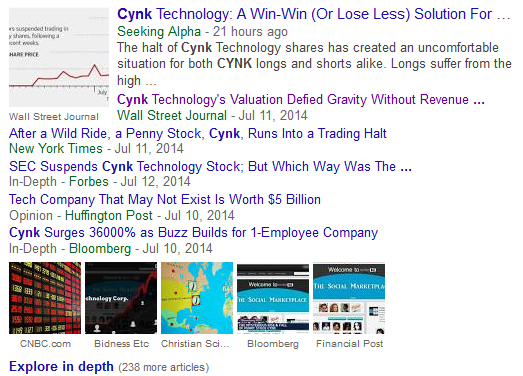

As much as the media would love to proclaim the next “Wolf of Wall Street” style pump and dump, they got this one WRONG. In my opinion, CYNK was just one BIG MISTAKE. A MISTAKE by early shorts who got trapped and squeezed to ridiculous levels on an insanely thinly traded stock.

It’s been suggested that it was a “manipulative scheme” to enrich the “insiders” by researchers and journalists who have ZERO trading experience. Even national television called it a pump and dumb scheme and promotion which is 100% baseless, as I have yet to see ANY promotion material or paid touts.

Would this have eventually been a paid tout? A manipulation scheme? Based on how the share structure was set up I would say more than likely! So yes, what FINRA & SEC did probably saved what could have been an eventual piggy bank for years for those holding the majority of the freely tradable shares.

Another article, while very good suggested that ‘insiders’ can pick when their shares are borrowed and then pull them back. That is NOT the way it works with Interactive Brokers — I’ve tried to loan out my holdings before.

It’s interesting to me that so many outlets are covering CYNK, trying to dissect what happened, when really, they’re the ones to blame (and they haven’t a clue as to why).

The media has tried to established:

1.) If it was a paid promotion

2.) Who was behind it

If it was such a manipulative scheme to enrich shareholders, we have to ask why it went to $22? Why wouldn’t they have sold millions upon millions of shares at $1 to $2 or even $3 bucks? Why let it go up so high on virtually zero liquidity? If this is a paid tout, they would have been prepared, turning those worthless shares into real money and wiring out proceeds as fast as they could — remember it’s based in Belize?!

It’s quite simple: it was a shell with a thinly traded float that ended up becoming a MAJOR short squeeze.

The reality is that there isn’t much to talk about when the market goes up every day, so the media explores other angles to interest people, attract hits to their website and bump up their advertising revenue. In this case, it’s was a multi billion dollar penny stock soaring for unknown reasons. Little did they know being touted nationally before millions of viewers on CNBC, WSJ, Bloomberg and other news outlets only helped the move.

As the old adage goes, “There’s no such thing as bad publicity!”

So what happened?

First off, it’s thinly traded. There have been plenty of billion dollar market caps with hardly any volume traded. It all comes down to the share structure — if there are no sellers, it’s very easy to just print the tape higher and higher.

Many journalists decided to jump on the bandwagon and write articles about CYNK because the competition was writing about it and they didn’t want to be left behind. They wanted to cover the “hot” stock that everyone was talking about but no one really understood.

Everyone gets so fixated on the lofty valuation and assume,“Wow this CEO is sitting on $3.5 billion worth of stock” but they have little to no understanding of what that even means — they think, “Oh he can just sell and be a billionaire if he wants!”

1. ) Most journalists have little to zero understanding that it takes REAL liquidity and/or buyers to actually PURCHASE that amount of shares. “Billion dollar fortune” is fictitious and an unrealistic “on paper” value.

2.) Don’t even trade or know what they are writing about!

CEOs can’t just go and sell whatever they want whenever they want — in most cases if you’re a CEO and own a control block of a company, the shares are in certificate form sitting in a folder in your desk drawer. They aren’t sitting in your brokerage account — in the case of CYNK CEO — with 210,000,000 shares in your portfolio ready to click “sell.”

Not to mention, this particular CEO’s shares were restricted anyway – as the true float was a bit over 81 million shares.

If these “insiders” were suddenly rich at this multi-billion dollar valuation (not just on paper), it would have NEVER traded this high on such little volume. It would have NEVER broken passed a few bucks without some SERIOUS volume — why wouldn’t you be selling 80 million shares at $1? That’s a good pay day, no?

The point here is yes, the outstanding shares are LARGE, which is what creates the lofty valuation that everyone is SO fixated on when you multiply it out.

Let’s take a minute to understand this:

The market cap on a company is determined by the outstanding shares multiplied by the share price.

When there is virtually no liquidity in a stock (as the case with CYNK) you cannot consider the market cap to be a realistic valuation of the company, EVER.

Secondly, when a large percentage of the outstanding shares is with one holder it really depends on what the other share holders, the actions of other shareholders become very important. If the shares are in a drawer and only a few hundred thousand are available to the public (the float in DTC) the market cap may reflect a much higher valuation despite an enormous amount in the outstanding shares

I called the transfer agent to find out if I could get any more information regarding how much was actually in DTC (not typically public information but for the company’s use only) but she couldn’t tell me. All she could tell me was 81,450,000 shares were in the float.

In my opinion MOST of the shares are likely NOT in DTC (dtcc.com), which is the FORMAT that you and I could actually TRADE the shares (digitally) on the open market. It’s highly likely that just about ALL of the shares were still in certificate form on someone’s desk.

Probably the only shares that may have been available to the public were those they may have given to their market maker sponsor for piggy backing them when they filed the S-1 to get public.

As you know with CYNK it has 291,450,000 shares outstanding multiplied by the closing price of $13.90 equates to just over $4 billion as a market cap, but just how much was really trading?

Even some highly respected researches have suggested that CYNK was “wash sale trading” done by “insiders” which in my opinion are baseless comments from non-trader research writers (no offense meant at all).

UNDERSTANDING LIQUIDITY

We can compare CYNK to MGIC Investment Corp. (MTG) (below). The important thing to note below is that the average volume (and that’s just the past few days that has kicked this volume up otherwise it’d be virtually nill).

| Avg Vol (3 month)3: | 33,082 |

| Avg Vol (10 day)3: | 115,014 |

| Shares Outstanding5: | 291.45M |

| Float: | 81.45M |

Now let’s look at a real company MTG and note the normal trading volume of 6 to 9 million shares (in other words trading approximately $70,000,000 million per day and on days with news (like Friday) it traded as high as $345,922,527! Notice the difference?

| Avg Vol (3 month)3: | 6,031,060 |

| Avg Vol (10 day)3: | 9,828,790 |

| Shares Outstanding5: | 338.52M |

| Float: | 332.51M |

Journalists fail to understand what liquidity really means! If MGIC traded $70 million of shares does that mean one insider could have sold $70 million worth of stock that day? Absolutely NOT! This is the total buys and sells on any given day combined.

On CYNK’s biggest day it traded $6,244,102 of total dollar volume on 386,060 shares. Journalists like to think insiders sold “$6 million worth” etc., which again, is impossible.

Let’s kill that idea right now:

MGIC – on Friday I shorted 8,000 shares after the halt at $8.58 or $68,640 and covered at $8.40s or $67,200 which equated to nearly $150,000 of $ volume.

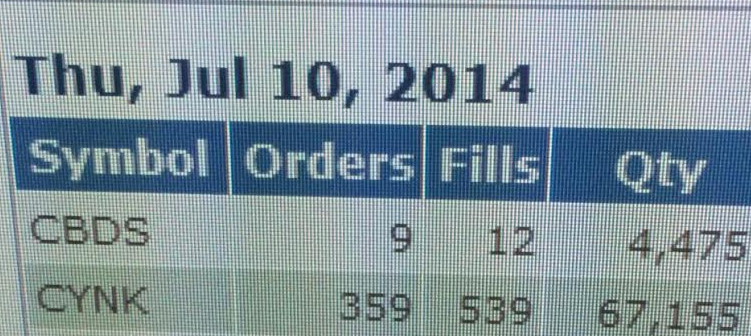

Back to CYNK — let’s say you traded it intraday (because as me and @modern_rock warned this was definitely NOT an overnight given the high chance of halt) there is a chance if you were flipping the stock on Thursday you may have bought 1000 shares on the panic drop at $11.65 before it rebounded over $12.65 + which equates to $11,650 purchased and $12,650 sold for a net profit of $1000 bucks on total $25,300 dollar volume traded. Get where I am going with this?

That’s $25,000 of volume traded.

You can quickly see that between two traders with two different opinions on four trades we’ve already traded $50,000 of volume. So fixating on the amount of dollar volume traded is an inaccurate number to judge liquidity in terms of what an insider “could” have made. The same shares changed hands over and over again throughout the day; the only additional were most likely from shorts.

I would assume the true float (shares actually available for you and I to trade to be in the ballpark 50,000 to 100,000 shares) may have been closer to 100,000 to 200,000 due to a few market makers getting short early, covering their short in panic and causing the price to break out.

Another error, once again illustrating the disconnect between journalists and traders is,“That day, various stock promoters on Twitter raved about the stock, saying, “it keeps surging higher!!” and “this could be EPIC!!!”

Hate to burst your bubble, but it was epic!

We haven’t see a short squeeze like this for a LONG time. Just because someone mentions a ticker on Twitter does not make them a stock promoter.

The next step is understanding what a “thin” market looks like vs. a typical stock with heavy tradable float.

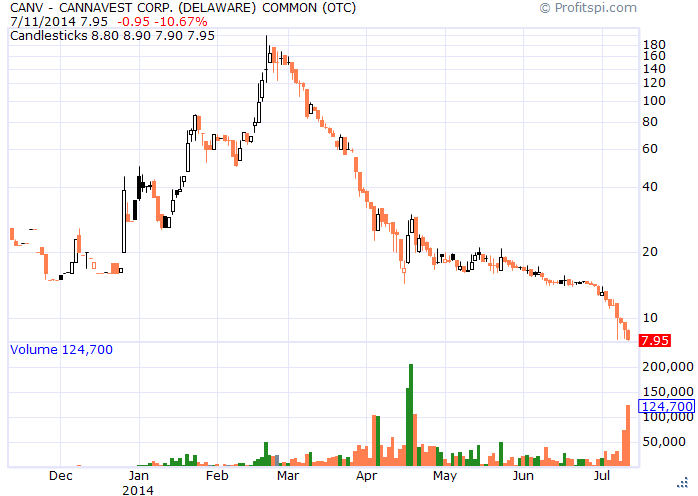

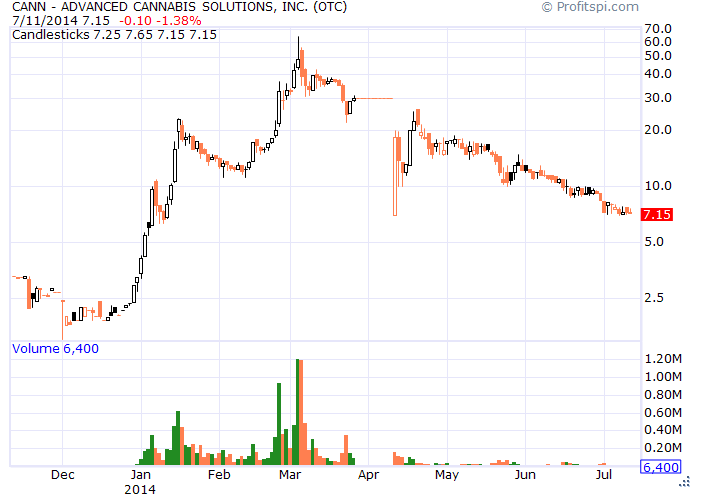

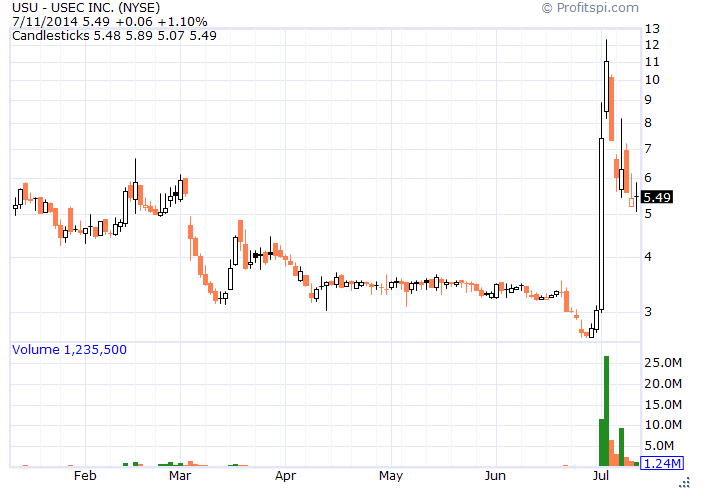

If you take a look at stocks like USU, DGLY, EVRY, DRL and other recent stocks that have had large runs, you can see that these names move a lot more than your ZNGA, MTG, SIRI or in other words floats with a largely freely tradable float.

You can see the difference in how things trade as the market valuation can shift much more quickly on little to no volume when there are a minuscule number of shares available to the public. This is what happens when the valuation is determined by a handful of traders with stock vs. hundreds of thousand if not millions of shareholders.

The big thing to understand here is this:

There was a very minimal amount of shares publicly available. As the stock started to soar, it received national attention from CNBC, WSJ and many other news outlets.

In recent days, there were over 200 DIFFERENT articles talking about this stock!

While the media sought to explain the stock they neglected the effect of putting they quickly forget that when you put a ticker in front of a nationwide audience. Heck, when I was up on the podium the guy looked at me and told me there was only 100 million viewers watching us right now!

THE IMPACT OF THINLY TRADED STOCKS ON NATIONAL TELEVISION

There’s no such thing as bad publicity.

A short squeeze is a GAME OF NUMBERS, just like cold calling: the more people you’re in front of, the better chance you’re going to make the sale.

Let’s think for a second here:

People like to chase stocks moving up — my uncle does it all the time and makes good money. When I’m trying to find the top to short, he just rides it higher and higher.

Most “active” investors are afraid to miss out on the next big thing! If only .00005% of the viewers (assuming 100 million) say, “Screw it I’m going to buy some CYNK,” that’s 5,000 buyers. And if they buy ONLY 100 shares, that’s 500,000 purchased shares — keep in mind the stock only traded 386,060 on the highest day.

Couple that with the negative attention it received from media, who probably short based on the valuation without really understanding the “thin” market structure as I explained earlier in this article — and now that the BUYERS > SELLERS they’re scratching their heads unsure what to do as the stock doubles and they begin to panic.

This isn’t the first time an overvalued stock gets put in front of CNBC’s retail audience and squeezes to the heavens.

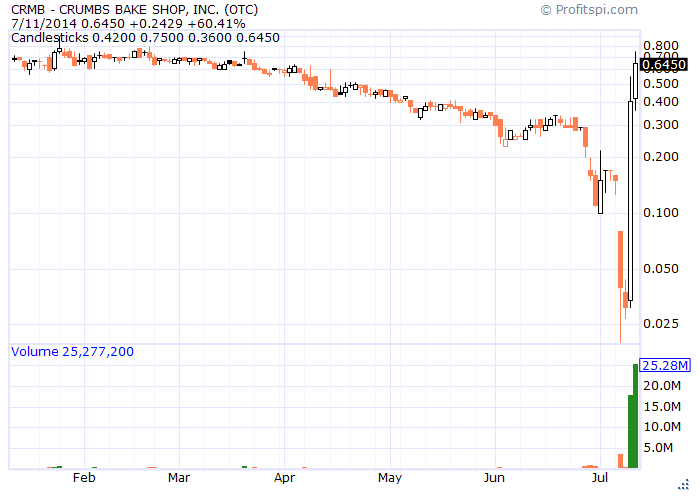

Just last week CNBC highlighted thinly traded stock Crumbs Bake Shop, Inc. (CRMB). This brings in RETAIL traders (regular buyers like Mom and Pop’s) buying into the hype and chance to make big money on the recovery story without really understanding what’s going on. Now, July 14th CRMB is down 55% pre market on these unsuspecting buyers that the media has brought into the stock.

In March, CNBC flashed the CANN when talking about CANV, a VERY THINLY traded name when the pot sector was really hot, and once again created an EPIC short squeeze AS SOON AS IT hit the screen!

Let’s take Michael Goode who was an early short and did the right thing and cut losses early on. Had he not he’d be looking at a $300,000 dollar loss when it hit $21.95. This answers the question “who the hell would buy at these lofty levels” as the stock was running from .10 to $2.50 on virtually no volume — SHORTS!This action happened over and over, shorts thinking it was at the top and then quickly realizing they needed to run for cover.

As CNBC bashed the name it brought in short term downside (10-30 minutes) before exhausting all sellers (or new shorts) and the trend carried on. This is done by the demand of covers (buyers) outweighing the sellers (shorts) and as the price continues to increased the only scared traders were those short.

A good friend @modern_rock traded CYNK each and every day buying and selling throughout the day. He told me the fills were horrendous! Absolutely no liquidity. Early on in the move, @modern_rock was shorting and it quickly turned, when he tried to cover as little as 500 shares the price moved over $1-1.50 + before giving a fill. IMAGINE being short 5,000-10,000 shares?

The only way you had a chance was much like how I teach how to trade OTCs — you really need to be one step ahead which involves incredible risk. You have to buy into panic when no one wants it before any sign of rebound and sell into the breakout when EVERYONE wants it – if you wait for the turn, there’s a good chance you miss it and won’t fill for a few bucks in the opposite direction.

@modern_rock traded over 60,000 shares on Thursday (buying and selling at different times) which goes to prove just how illiquid it was. As most of you know @modern_rock trades FNMA hundreds of times per day taking small profits hundreds of times (likewise with AAMRQ back in the day). He was down on the short side $80,000 at one point and likely will be saved by the halt as he is still short. He also traded it on the long side to protect against his early short.

All it takes is a few traders trading the trend and voila it’s not so liquid now is it?

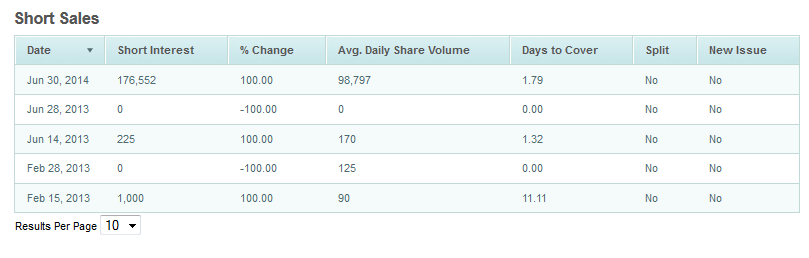

According to OTC markets — which is often an inaccurate number — stands out to me this time. It’s double the average daily share volume and more than one half Thursday’s volume alone! When the short interest is nearly DOUBLE the average daily volume it’s IMPOSSIBLE to cover without driving the price up (unless there was someone selling paper which again proves the opinion that there wasn’t a planned promotion here).

In conclusion, by no means am I defending or saying that CYNK isn’t a fraud or set up to create insiders millions and millions of dollars – more than likely, it was — EVENTUALLY but not now.

This blog is meant to share with you what happens when a thinly traded name ends up having a random short squeeze from uninformed shorts and is then put before a national audience.

I wanted to explain what really occurred on a thinly traded name put in front of millions of retail buyers. I watched CYNK trade each and EVERY DAY.

UPDATE 7/14/2014 my article theory confirmed as this market maker lost his job in the short squeeze!

This article blew my mind. Thanks for such detail