Attempting to master a new skill is never an easy process. Whether you’re learning to cook, code, or trade stocks, the process is always the same. First, you need to absorb tons of information and then you need to start applying that information. Once you start applying the information, you realize that there’s even more you need to learn.

The process can be overwhelming and leave you feeling lost.

So, how do we combat this?

First things first, you need to understand the process and where you currently stand. Mastering any skill takes time and trading is no different. You need to accept that and decide whether or not you want to commit to the process. If you’re looking for shortcuts, you’re going to get lost.

Don’t expect to become an overnight success. Learn to appreciate the journey.

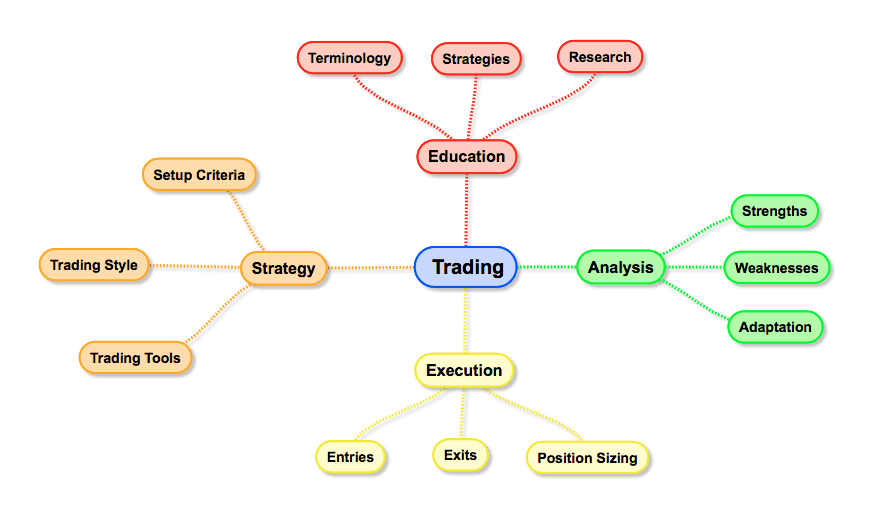

Once you’ve committed, you need a game plan.

This is where even the most dedicated traders can hit a wall. You set a goal, create a game plan, and put in the work, but nothing is clicking yet.

You know where you are and where you want to go. All of the pieces are there but there’s no roadmap. It’s easy to become overwhelmed by information overload.

Chances are, you’re lost in your own head. You’re putting in the hours, but your efforts aren’t organized.

The best way to fix this is to break the process into smaller parts.

Breaking Down Your Goals

Take a real-world example to convey the point. You want to start living a “healthy lifestyle” but you don’t know where to start. The task is broad and potentially daunting. It’s easy to freeze up if you don’t know where to start. If you break it down into smaller tasks, it becomes a lot easier.

- Sign up for a gym membership

- Choose 3 convenient times to go to the gym

- Choose 5 exercises you will focus on

- Remove junk food from the house

- Sign up for a healthy meal plan

Everything on this list takes about 5-10 minutes and there’s nothing stopping you from doing it.

We discussed a similar concept in a recent post when we showed how Tom Brady breaks down every small aspect of his game. By focusing on smaller parts of his game, he’s able to improve his overall skill.

We’re going to apply the same approach to trading.

Let’s assume you already have a reasonable goal – you want to make $100/day in the next 6 months. You’re committed to the goal but you don’t know where to start. Maybe you’ve already started but you keep hitting a wall.

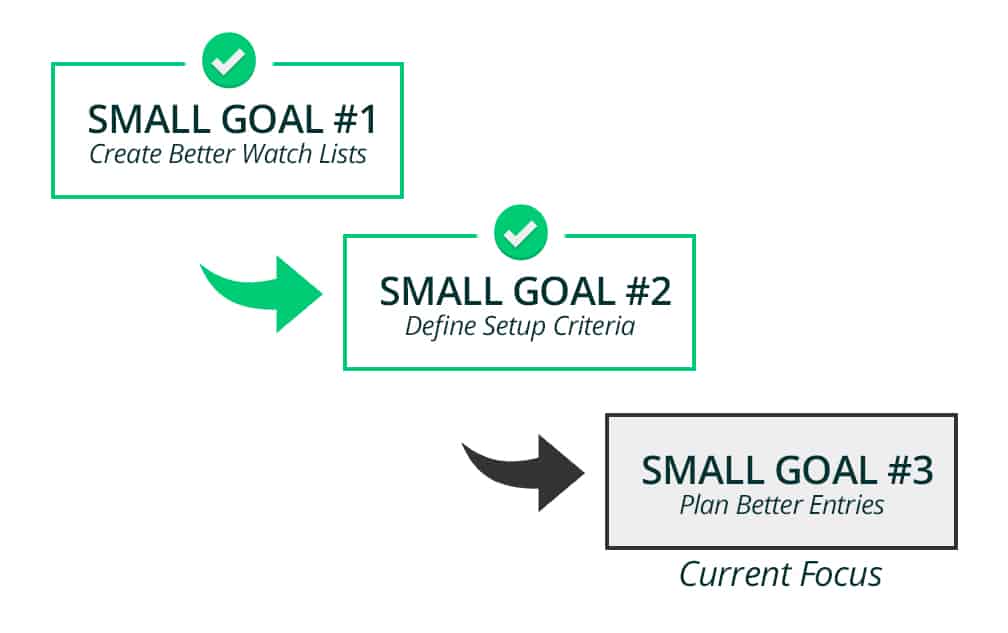

It’s time to turn that goal into “micro tasks.” Micro tasks are a lot easier to take action on and much less overwhelming. You are taking your bigger goal and turning it into a bunch of smaller goals. You will focus on one smaller goal at a time before moving on to the next.

For example, if you’ve decided you really need to learn how to use the VWAP indicator, you will shift all of your attention to this goal until it is completed.

How to Set Smaller Goals

“Smaller goals” will vary by trader. These goals should be broken down into clear, actionable steps that you can start working on immediately.

The first step is analyzing your current trading process. Jot down a list of things you do every day. It may look something like:

- Scan for stocks

- Build watch lists

- Analyze charts

- Etc

You can break those down even further if needed. For example, you may find that scanning for stocks includes the following activities:

- Scanning on Finviz

- Checking Top Movers Lists

- Analyzing Charts

- Filtering Stocks

Of course, you don’t want to rely on simply analyzing your own behaviors because you may be missing an important part of the process. Once you’ve analyzed your own behaviors, find examples of traders who are in the position you want to be in. Start analyzing what they do (to the best of your ability). You may come up with a list like:

- Secure borrows every morning

- Keep track of trades in an excel file

- Wake up an hour early to analyze pre-market trading

Once you’ve done this exercise, you should have a list the skills you need to achieve your goal (i.e. your list of “smaller goals”). Make sure the list is well-defined and unintimidating. For example, if one of your smaller goals is learn more about the VWAP indicator, you could create a few micro tasks:

- Watch 5 video resources on the VWAP indicator

- Study 10 charts to see how stocks react to the VWAP indicator

- Place 5 paper trades using the VWAP indicator

Everything on the list is clear and actionable.

The next step is taking action.

Taking Action On Your Smaller Goals

Start by choosing a goal and shifting all of your attention to this single goal. Avoid any distractions, as tempting as they may be. Decide what micro tasks are needed to achieve this smaller goal and get to work.

If your goal is to “create better watch lists,” don’t move onto the next goal until you’re confident in your ability to create effective watch lists.

We’ll discuss some examples below, but the lists will vary by trader. Your goal is to develop skills you may be missing or sharpen skills that may be lacking.

Measuring Success

It’s important to be objective when measuring the success of your smaller goals. Obviously, your ultimate goal is to become a profitable trader, but each smaller goal will be measured with different metrics.

For example, if you’ve decided to focus on creating better watch lists, you will NOT measure your success based on your profitability. Here are some more appropriate considerations:

- Did I have a game plan when the market opened?

- Was my watch list an appropriate size that allowed me to stay focused?

- Did I neglect any stocks that should have been on my list?

- Did I actually use my watch list to narrow my focus (vs. making it for the sake of making it)?

Once you feel you’ve achieved this smaller goal, you can move onto the next goal.

Examples of Smaller Goals and Micro-Tasks

You’ll find some examples of goals and their related micro-tasks below. These are just examples and your list should be personalized to your own needs.

Let’s get to it.

Creating Watch Lists

Work on mastering your watch list creation. Your only goal is to make sure you come to the market focused on the right stocks. We’ll deal with trading them later.

Here are a few things to consider:

- What tools are you using to scan for stocks?

- What is your stock selection process?

- Do you have a game plan for the stock or are you just watching it?

- How many stocks are on an ideal watch list?

- What time do you compile your watch list?

- Do you end up trading the stocks on your watch list or ignoring it?

- Do you refine your watch list before market open?

By the time you move on from this goal, you should be confident in your ability to build a solid watch list.

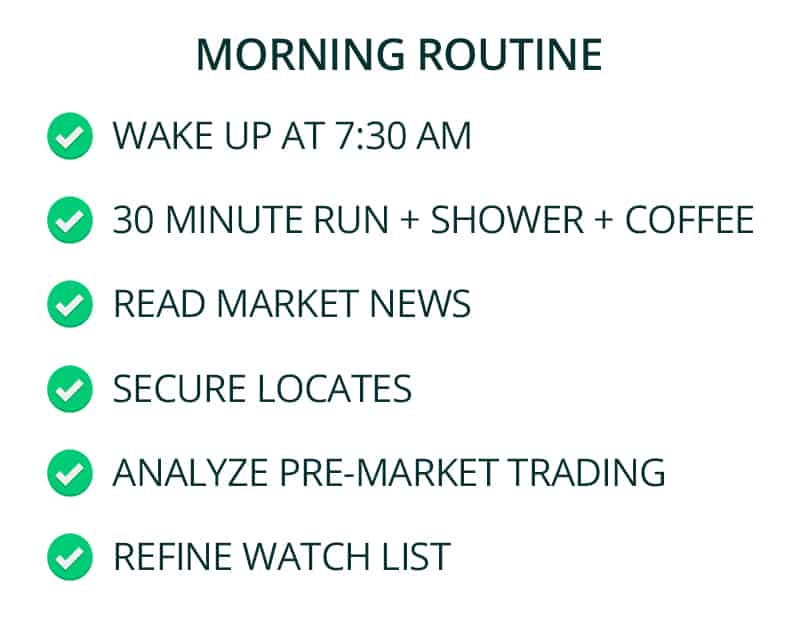

Morning Routine

Work on mastering your market preparation. Make sure you are doing all of the things necessary to come to the market feeling good and prepared.

- How early do you wake up?

- What is your optimal morning routine? (i.e. shower, run, breakfast, etc.)

- Do you analyze market news?

- How do you filter your watch lists?

- Do you focus on pre-market activity?

- How do you feel at market open?

Before moving on, make sure you are confident in your ability to come to the market prepared.

Entry Plan

Work on mastering your entries. Your goal is to have a solid process for entering a trade.

- What makes you pull the trigger on an entry?

- What factors do you analyze before entering a trade?

- How do you choose your entry price?

- If a stock gets away from your ideal entry price, what do you do?

- Is your entry planned in advance?

- Do you add liquidity or remove liquidity?

Before moving on, make sure you are confident in your entry strategy. Avoid the outcome bias – this is when you judge the quality of a decision based on the outcome. A good entry can still lead to a losing trade. Be objective.

Exit Plan

Work on mastering your exit strategy.

- Do you plan your entries in advance?

- What makes you pull the trigger on an exit?

- Do you have a set price point for your exit?

- Do you rely on the price action to dictate your exit?

- Do you get greedy?

- Do you trade scared?

- How do you react to unexpected price fluctuations?

- Do you turn winning trades into losing trades?

Before moving on, make sure you’re confident in your exit strategy. Similar to entries, a good exit doesn’t always equate to a profitable trade. For example, cutting losses early would be considered a good exit. Getting rewarded for overstaying would still be defined as a bad exit.

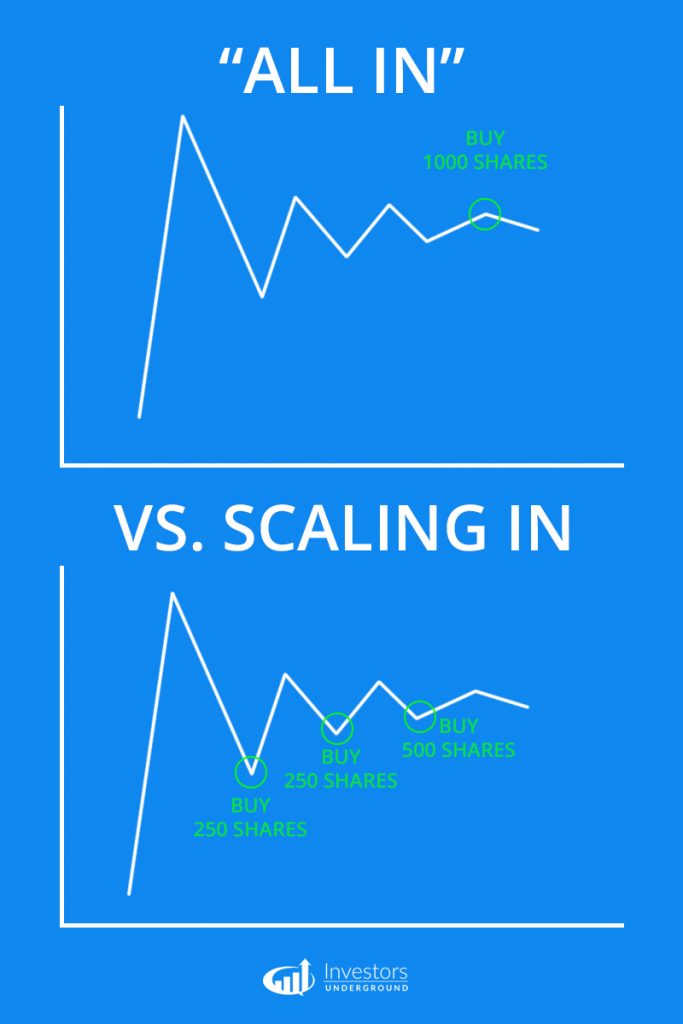

Position Sizing

Work on mastering your position sizing strategy.

- How do you choose a position size?

- Is your position an arbitrary number (i.e. 1000 shares)?

- Is your position size based on risk (i.e. risking $100)?

- Do you scale in and out of a trade?

- Are you going in too big or too small?

- Are you burning commissions for no reason?

Setup Criteria

Work on defining your ideal setup. Be as specific as possible so you can easily differentiate between stocks that fit your criteria and stocks that don’t.

- What types of stocks do you trade?

- What chart patterns do you favor?

- What factors do you analyze?

- Are you long or short biased?

- What is your ideal timeframe?

Before moving on, make sure you can clearly differentiate between a setup that fits your trading style and one that does not. This will help you filter out the noise of the markets.

Trading Rules

Work on creating a list of trading rules that help you make smarter decisions. These will be relative to your trading style as well as your own personal strengths/weaknesses.

Examples may include:

- Don’t trade the market open/close

- Avoid short selling low float stocks

- Avoid entering stocks being pumped by chat rooms

- Don’t trade ETFs

- Don’t hold short positions overnight

There is no golden set of trading rules. What works well for one trader may be disastrous for another. Focus on areas of strength and weakness and build your list accordingly.

Tools

Build your trading toolkit. Do you have all of the tools that enable you to trade at your best.

- Do you have access to real-time market data?

- Is your broker suitable for your needs?

- How is your mobile trading platform?

- Do you have a good scanning tool?

Before moving on, you should make sure you have access to all of the tools that you need to execute your trading strategy efficiently.

Post-Trade Analysis

Work on developing a post-trade analysis process. A lot of the “learning” and “adaptation” in trading comes from analyzing your own personal trades. If you just move on from a trade when it’s executed, you’re leaving a lot of important information on the table.

- What did you do right in your winning trades?

- What did you do wrong in your losing trades?

- How do your entries/exits affect the outcome of your trades?

- How does your setup criteria affect the outcome of your trades?

- How do you plan on avoiding mistakes you’ve made in the past?

- How do you plan on doubling down on areas where you excel?

Commit the time to building a post-trade analysis system that works. This is where you will get a lot of the insights that make you a better trader.

Here are 9 ways you can start analyzing your trades.

Where to Go From Here

These are just a few of the different components of trading. There are plenty of others that you can analyze. Turn this approach into a habit. Remember, this isn’t a list you want to tackle all at once. Sharpen one skill at a time before moving onto the next.

Whenever you feel overwhelmed, break your goals into smaller tasks.

What are you going to focus on first?

Love it

Most informative.

I’ve been trading for a year. I wish I had taken it more serious in the beginning. I would have come across articles like this and took advantage of them.

These are really helpful. Keep it up!

really very good informative,good work

Good information, that when followed changes how one views the trading business

Thank you Nate!!

Wow!!! This is amazing information as am just starting my journey in trading and it very overwhelming, with all the information out there.

Killer Blog Post Nate!

I copied this and will read it every morning. Great piece to check your checks and balances. I’m doing most of these things and this re confirms to me that I am doing the right things.. I love, love , love this piece. Keep it up and thanks.

Im going to focus first on creating MY OWN watchlist, rather than just looking at your scan list and watching those tickers.

Excellent Info. Thanks.

Amazing ! Thanks Nate!

Wow ! One of the best !

Really good. Need to master this

Thx Nate .. great article