First and foremost this halt was NOT predictable … was the company a sham ?? who knows I’m sure we’ll find out one day.

This article is not to say the marijuana run is over AT ALL. The point of this article is to open your eyes to the reality of OTC stocks!

Keep this in mind when reading it:

1. OTC stocks are not investments

2. Anytime there is a cult like following stay FAR away

3. It’s OK to take profits when you’re up huge

4. Don’t average down without a game plan

5. Never underestimate how easy it is to convert stock to sell in the open market

6. The best of companies rarely put out PRs they just stick facts in filings

Always remember this:

It’s never good when people lose $$ in stocks or halts like $PHOT etc … never make fun of people getting smoked – karma will get you

— Nathan Michaud (@InvestorsLive) April 10, 2014

I was long Hemp, Inc. (HEMP) over night partial size due to a great bounce the prior day where we had bought low .08s anticipating the .10 break, given the strong close I held it looking for a bit more out of the morning gap up – and we got just that BUT this VERY easily could have been me stuck in a halt. I NEVER would have expected Growlife, Inc. (PHOT) out of all the pot stocks to halt!

In fact, if I were to “trust” any pot stocks and I use the term “trust” lightly, I always thought it was “safe” to stick with the original pot sector leaders:

Cannabis Science, Inc. (CBIS)

Hemp, Inc. (HEMP)

Growlife, Inc. (PHOT)

I had suggested to 100% stay away from all these next day reverse mergers and joint ventures that were done specifically to take advantage of a HOT sector and not because the companies are GREAT.

Fact is this: Things are always changing and it’s clear the SEC can halt ANY stock for ANY reason even if the reason is NO REASON. Stay away from over nights on over hyped PR happy stocks in OTC land.

Did PHOT halt because an insider just registered 7,500,000 shares to dump? We don’t know and we won’t know until later — but if you check out OTCMarkets they’ve been dumping for weeks (Form 4s are insider sells when red)

I predicted the PTOG halt and warned against holding over night any of these ‘next day’ pot stocks.

Like I was tweeting other day – by no means do I want any halts cuz it’s not good for OTC land – but this fake PR crap will cause them $PTOG

— Nathan Michaud (@InvestorsLive) February 19, 2014

$PTOG scam thanks you for buying up all the shares on their bogus PR – you just made someone millionz

— Nathan Michaud (@InvestorsLive) February 19, 2014

$PTOG I got hate about saying this would halt eventually … I think it’s the first of many fake OTC Pot stocks to be halted

— Nathan Michaud (@InvestorsLive) March 14, 2014

What do I mean?

All these drilling for oil one day and next day pot company reverse mergers are taken public because the insiders (not necessarily the company insiders) but rather debt holders and promoters who are able to convert stock at pennies on the dollar and liquidate at any cost, and when you don’t have to PAY anyone to bring in volume (ie: newsletters promoting it, mailers etc) it’s all FREE because of the sector strength …. FREE MONEY!

When I first started trading in 2003 the market was a lot like it’s been in the past six to twelve months where “investing” in OTCs …. WORKED! For a a few months anyway ..

I’ll be the first to admit I severely underestimated where these stocks could go … HEMP sub penny to .30 cents? Are you kidding? Sure it could happen on light volume … but $50-70 million trading every day? That was AMAZING and really made be reflect on how much I had missed because actually drinking kool-aid and trusting penny stock CEOs is/was working again and small message board believers are getting rich rich rich ….. for now … unrealized!

Define “RICH”

I mean ON PAPER RICH. They are unrealized up a lot of money on small accounts, up tens of thousands but the troubling fact is these folks are investors for life. All those that bought and held through the .05 to .30 move will still be investors at .02 … .01 … .001 and hold for the eventual reverse split, rinse and repeat like all OTC companies do.

The worst part? They start to believe in the company so much they start to put MORE money in their brokerage accounts to buy MORE shares on the way down and end up losing WAY more than they ever thought.

I blew through at least three or four $5,000 accounts when I first started with this SAME exact “strategy.”

Besides the obvious marijuana in the news lighting up the sector I believe this sector got a ton of $$ flow because of the CNBC publicity and many articles which tagged all these pot stocks as solid investments attracted Mom, Pops and Grandma’s all over the world.

The OTC market was no longer uninformed small traders looking to get rich but your Grandma buying in her 401K to be part of the next big boom.

Let’s define the goal of the OTC market in a few sentences:

The GOAL is to get a FEW shareholders with a TON of stock into a TON of share holders with as little as stock as possible (the thinner it gets spread out the last people panic on pull backs since their swings are not as large)

In other words spread it out as far as you can in the end – it’s a game of numbers, THAT’S ALL IT IS. If you have 20,000 share holders and they all own 1,000 shares you can take a float of 20,000,000 million shares out like butter.

Let’s face it, Grandma’s got cash she wants to diversify with 1,000 shares of each pot stock company which are never coming back out to the market – she’s an investor for life! Between Grandma and the true believers in these OTC companies …. all that’s left is the traders, dip buyers, shorts, technical breakout players which all create the daily volume around this core group of holders …. and it works … works great UNTIL the music stops or someone finally decides to start taking more profits than the demand can handle.

Once the supply > demand like I warned on AvWorks Aviation Corp. (SPLI) things come crashing down.

This warning was NEVER to offend anyone but just to really touch upon reality and what was about to happen – shit can only float for so long it’s a fact.

Once a few strong holders start to take profits it’s sorta like domino’s .. each dip gets heavier and heavier (ie: more inventory for sale, more traders ready to take profits)

The key and turning points in many traders careers is being about to KNOW when the following:

Today is the day that differentiates bagholders on $SPLI & smart $$ I will cover far too soon but save you 50-70% just like $CBGI warning

— Nathan Michaud (@InvestorsLive) March 27, 2014

This is the difference between successful traders and those that unfortunately have to go through the same learning curve that I did before I finally GOT IT.

90% will never get it, 10% like me … will eventually get it move on and realize that hey Nate wasn’t being a dickhead with his tweets he was just warning those who are uninformed.

Point of this article? Just like I underestimated where they COULD GO ….

Don’t underestimate how far they can fall!

The cult stocks are the worst, no matter how RIGHT I am I will always be WRONG in their eyes they will fight me until it goes to sub penny land and beyond.

This tweet someone posted Friday made me scratch my head and it shows just how much these cult members DON’T GET IT – this was posted AFTER the stock broke support at .17 and .14 but yet it’s VERY BULLISH? Are you KIDDING?

Stay away from stocks with cult like followings unless you are JUST trading them intraday based on momentum.

I was there once too!

I was invested in CMKX Diamonds at .0001 before it ran to .005-.01 and all the way back to ZERO bid. I also was an investor in TFCT which was Prizewise the “next eBay” and lastly GZFX GameZnFlix which was the “next Netflix” all for only a few cents per share! Anyone who said these stocks were trash I defended to my death THEY WERE WRONG!

When I FINALLY wasn’t “too proud” to admit defeat – that’s when I started to make money trading!

I would have considered myself as much of a cult member as there AvWorks Aviation Corp. (SPLI) and other pot stock posters on twitter and InvestorsHub.

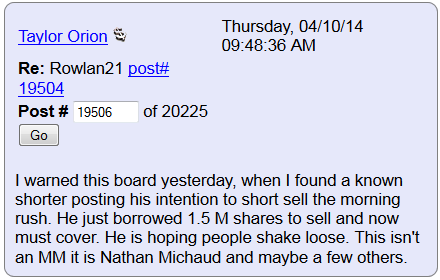

In fact check out this dude lying to try to once again “save” his baghold:

Any QUALITY or REALITY CHECK on SPLI on twitter is QUICKLY taken as bashing and person must be short! I have ZERO position. At .36 cents I warned and I said it’s probably going to fall under a dime (so far I’m wrong it only hit .12) but at .18 cents I also warned at I felt that was it for it since it was just a “dead cat bounce” off the lows sure enough in the following days it’s now 35-40% lower.

$SPLI will look for short any rush tomorrow outta the gate but beginning of end on this sucker ..

— Nathan Michaud (@InvestorsLive) April 9, 2014

THIS DOESN’T MEAN MONEY CAN’T BE MADE ON THE WAY DOWN

It can, and it will – each dead cat bounce while there is still solid volume and believers but over time each and every dip will get sold into and this will be back to a penny or less.

The reason that this stock tanked is NOT related to shorts, it’s not related to any bashing– The reason is this: REALITY.

You’re buying worthless paper in a pump, period.

It reminds me of Monk’s Den where shareholders just absorbed the float while promoters dumped and dumped.

The end this post I will leave you with two things:

TRADE TICKERS, NOT COMPANIES

OTC STOCKS ARE TRADING VEHICLES ONLY

One thing you’ll notice in these cult stocks is everyone is always buying but never selling.

You’ll notice it’s always someones fault … not theirs, not the companies but ANYONE who speaks negatively about an over valued stock – YES! YOUR FAULT!

Typically I use this as a contrary indicator when everyone is long and the stock keeps going down … I don’t want to be long that stock I’ll wait for the day of panic selling to play the bounce.

Likewise with shorting – if everyone is short a stock and it keeps grinding higher and making new highs is this something you want to be short?

There is without a doubt in my mind this will spook the OTC market again and unfortunately create less trading opportunities, although we still have PLENTY!

Summer is coming, stay safe, watch your trade size and stay out of illiquid stocks. If you want to make money TRADE THESE COMPANIES do not INVEST in them! Yes, many traders made a ton of money and are paper rich – but for how long?

Trading is about keeping your money – as @modern_rock has said many times “YOU ONLY NEED TO GET RICH ONCE”

Make sure to check out this great post by Tim G. regarding cult stocks as well

Green Trading Everyone!

0 Comments