Twitter is an incredibly powerful tool that stock traders should be taking advantage of. There are so many influential individuals and experienced day traders sharing their ideas in real time, making Twitter a data gold mine.

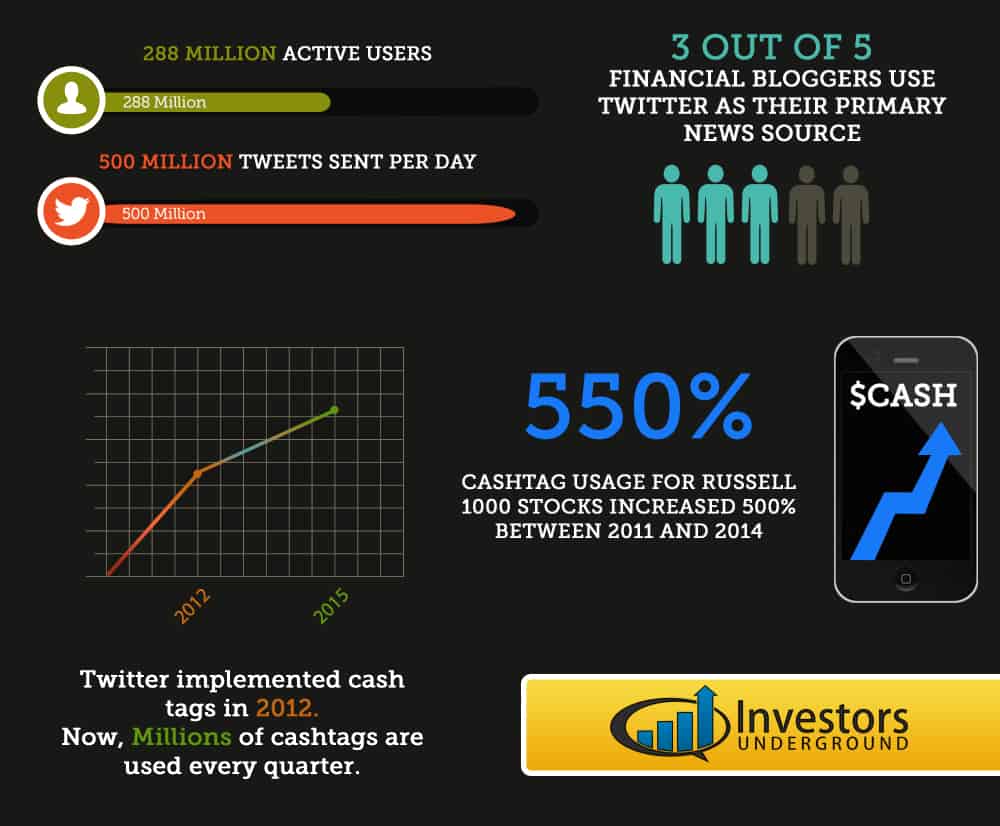

Here are some interesting facts about Twitter:

- There are 288 Million Active Users

- Over 500 Million Tweets are Sent Everyday

- 3 out of 5 financial bloggers use Twitter as their primary news source

- “Cashtags” were implemented in 2012 and allow users to organize messages for a stock ticker

- Millions of cashtags are used every quarter

- Some hedgefunds use Twitter as the basis for their trading algorithms

Clearly, Twitter can be a very powerful tool for day traders. That being said, there can also be a lot of noise, so you need to make sure you are following the right people. There are so many great traders on Twitter, so it’s difficult to narrow the list down to 10, but we have to start somewhere! Don’t worry, this is only “Part 1” and there will be more to come.

10 Traders to Follow on Twitter

1. @offshorehunters

$SOHU ripper off last nights http://t.co/bB7K4kPKAy scan pic.twitter.com/lpmfDiaYWq

— Offshorehunter (@offshorehunters) April 8, 2015

@offshorehunters runs the swing trading chat room on Investors Underground and Trade on the Fly. She is a valuable asset to our community and shares plenty of great trade ideas on Twitter. If you are a swing trader who loves charts and technical setups, @offshorehunters is a must follow!

2. @modern_rock

#ThrowbackThursday to the good old $FNMA days where I pounded MMs on a daily basis via 4 accts so they can’t track me pic.twitter.com/XTwpwdZNIu — Modern Rock (@modern_rock) April 3, 2015

@Modern_Rock has become a legend in the trading community and we are fortunate enough to have him in the Investors Underground chat room. @Modern_Rock tweets real-time alerts about his trades, as well as some great trading lifestyle commentary and trading rules. And, of course, who could forget the occasional rant?

3. @d4ytrad3

$LPI update:After nailing golden signal days ago for a 35% upside move, completed 20% retrace & sets up for 15%bounce pic.twitter.com/0mba3wYhje

— The Daytrade (@d4ytrad3) February 11, 2015

@d4ytrad3 is an active day trader and moderator in the Investors Underground chat room. He posts many trade alerts on Twitter, as well as important news releases. @d4ytad3 will trade anything from OTCs to NASDAQs, so all different kinds of traders can benefit from his tweets.

4. @lx21

http://t.co/o15BCXgvcp latest addition: short $THCZ — lx21 (@lx21) April 1, 2015

@lx21 has made millions of dollars trading stocks, and he just might be the most well known short seller in our trading community. @lx21 posts trade alerts on Twitter, as well as his personal site, 90percenttrades.com . He is a “must-follow” for anyone disciplined enough to apply his short-biased swing trading strategy.

5. @DerrickJLeon

I had to post this ha. Just shy of 100k both days included. Lost 16k trying to hit this early but man feels good. pic.twitter.com/PBUkcPFqaJ

— DerrickJL (@DerrickJLeon) January 22, 2015

@DerrickJLeon has made quite the name for himself in 2014/2015, bringing in over $800,000 in profits at the age of 23. We recently did an interview with him that you can check out here. @DerrickJLeon is known for going big and he posts his trade commentary on both Twitter and the Investors Underground chat room.

6. @TradeHawk

$ARIA – Daily Mail out with a story saying three pharmas including $LLY approached $ARIA, mentions $20 price http://t.co/uGgTJP5xy6 — TradeHawk (@TradeHawk) January 22, 2014

@TradeHawk is a “must-follow” for anyone looking to get speedy access to actionable news pieces. He is well known for being one of the first traders to tweet pertinent information that can help you catch moves before the masses.

7. @Biorunup

$MNKD – Years from now, there will be a college course called “BagHolder 101”. They will reference this SA article: http://t.co/WFELgclEnV

— BioRunUp (@BioRunUp) February 24, 2015

@Biorunup is a versatile trader focused mostly on the biotech sector. @BioRunUp releases information that can be helpful for shorting, going long, and trading options. If you’re looking for a biotech master, look no further.

8. @ozarktrades

I got you $GENE……Now time for my daughters first doc appt. I want to see 6’s today pic.twitter.com/LXVIlC1OqW — Phil Goedeker (@OzarkTrades) February 20, 2015

@OzarkTrades is an active day trader who has cleared $2.8 million in trading profits. We are fortunate to have him as a moderator in our chat room. @OzarkTrades posts his entries and exits on Twitter, making him a great trader to learn from and get trade ideas from.

9. @crawfish_poboy

First month of 2015 is in books. Finished up 32k which is good bit higher than my avg month in 2014 (23.5k) hope to keep momo rollin’

— Brandon Garretson (@crawfish_poboy) January 30, 2015

@Crawfish_poboy is a day trader and moderator in the Investors Underground chat room. He got his start trading OTC stocks and eventually made his way up to NASDAQs. Now, @crawfish_poboy continues to profit consistently and shares his trade ideas on Twitter. (You’ll also see some delicious food pictures every now and then)

10. @splendores

When trading gets too easy – take a break, when trading gets too hard – take a break. When in the zone – carry on #tradingrule — Sandro Splendore (@splendores) March 23, 2015

@Splendores is well known for taking his trading account from a few thousand dollars to over six figures in a short period of time. He moderates the Investors Underground chat room and shares many of his insights on Twitter. @Splendores shares his entries and exits, as well as his commentary on his trades.

Stay Tuned for PART 2 – Coming later this week!

Great post, you should also take a look at the first part of this blog! https://medium.com/@symbols/mayweather-vs-pacquiao-the-fight-from-twitter-and-facebook-77bc547020b9 Twitter is and will become a key tool to investors.

TripleV was here learning. Thank you, Nate!