Everyone comes into the world of trading with some type of expectation. Some people see trading as a shortcut to riches while others cynically dismiss it as a scam. Regardless of where you fall on the spectrum, one things certain; you don’t fully know what to expect until you start your journey. There’s a lot of misinformation that leads to misguided expectations.

The truth is trading is NOT easy but it’s also NOT “rigged.” Like any worthwhile endeavor, trading has a steep learning curve followed by ongoing challenges.

Understanding the journey and the problems you will face at each stage can help you align your expectations with reality. Today, we’re going to discuss the different stages of trading and what you should expect at each level. Be honest with yourself about your progress so you can better identify with the corresponding challenges.

Why Trading is the Hardest Thing You Will Ever Do

Challenges at Every Stage of Trading

Trading success is not black and white. There are levels to the game.

Learn to appreciate your progress and respect where you are on your journey. Understanding the bigger picture promotes patience and persistence.

Your goal should always be to graduate to the next level. If you’re a newbie, you want to graduate to beginner status. If you’re a beginner, you want to graduate to intermediate status.

Skipping steps isn’t possible so don’t even try it.

Let’s look at the different stages of trading and discuss the evolution of a new trader.

Newbie Stage

As a new trader, you have no idea where to begin. You’re not even sure what to think about trading. You’ve heard people talk about how trading is a scam but you’ve also come across a few traders who are making a killing. Your interest is piqued, but the amount of information is overwhelming. You may have a basic understanding of stocks, but day trading is another beast.

Don’t stress – this is where everyone starts. You don’t need to be a math prodigy or financial guru to make it to the next stage. You just need to accept a few basic principles.

Set Realistic Expectations

The allure of trading is crystal clear. Everyone wants to make a lot of money on their own schedule – no surprise there. The ones who actually achieve this goal are the ones who respect the process.

If you’re looking for shortcuts, foolproof systems, get-rich-quick schemes, copy-and-paste strategies, and easy money, you will fail. Use your ambition as a driving force, but don’t let it overcome you.

You’re going to put in a LOT of work before you start reaping the benefits. Set realistic, short-term goals. You need to become consistently profitable before you aim to make $100/day and you need to make $100/day before you make $1000/day.

Don’t put a down payment on that Lamborghini before you’ve even started the education process.

Surrender Your Ego

The first step towards learning is admitting what you don’t know. Be honest with yourself – you know nothing about trading at this stage. It doesn’t matter if your 401k is killing it, you passed finance class with excellent grades, or you’ve had massive success in another industry. You know nothing about day trading.

Accept what you don’t know and don’t try to use your intuition to fill in the gaps. Your intuition will fail you and your ego will cost you real, hard-earned dollars.

Go into trading with a blank slate and prepare to absorb as much information as possible.

Put Education First

Once you’ve surrendered your ego, you’re ready to start your education. Learn as much as you possibly can. Watch videos, read articles, take courses, etc. If you don’t know something, look it up.

Not sure what VWAP is? Google it. Don’t know what Level 2 is? Google it. Unclear on why a stock behaved the way it did? Research it.

Protect Your Capital

Don’t be tempted to start trading right away. If trading success is in your future, you will have years to collect profits. Be patient and focus on learning. If you start trading right away, you could take yourself out of the game before you even gave yourself a fair shot.

Ignore Insignificant Information

New traders have a bad habit of fixating on trading tools. They want to know the best broker, platform, scanner, computer, etc.

None of this matters until you’ve developed a strong skillset. It’s just as easy to make/lose money in E*Trade, TD Ameritrade, Schwab, or Interactive Brokers. You can make/lose money with one computer monitor or ten.

The tools are insignificant when you’re starting out. When it comes time to be selective about these tools, you’ll know what you need.

Beginner Stage

Once you’ve gone through the newbie stage, you enter the beginner stage. At this point, you have a basic understanding of how trading works. You understand trading tools, terminology, setups, and basic market principles. Still, you feel like trading is nearly impossible.

You find it hard to apply the lessons you’ve learned. When you do apply them, you still lose money. You may place a few profitable trades, but overall, you’re losing money.

Once again, don’t stress – this is all part of the process. Here are some tips to help you graduate to the next stage.

Fill in the Gaps

Being partially educated can be more dangerous than being completely uneducated. Partial education can lead you to believe that you know more than you actually do. You may know more than when you started, but you still have blind spots.

Take a black and white example like math for comparison. If you know basic addition and multiplication, you would assume “2 + 2 x 2” equals “8.” You’d probably be willing to bet on it. It’s not until you learn about the order of operations that you realize the answer is actually “6.” A single missing link makes the difference between a right answer and a wrong answer.

The same is true for trading. A single missing piece of information can make the difference between a profitable trade and a losing trade.

Beginners have blind spots that can be costly when untreated. During this stage of your trading, it’s important to fill in the gaps. Look for holes in your strategy or areas where you may be misunderstanding certain concepts. Once again, it’s important to surrender your ego and recognize your own limitations.

Get in the habit of asking, “why?” Why did this stock behave this way? Why didn’t this trade work out? etc.

By constantly seeking answers, you will gradually become more knowledge about trading.

Simplify Your Strategy

During the “newbie” stage of trading, you’re hit with a wave of information. As you begin to research trading, you’ll learn about tons of different trading styles and strategies. The amount of information is overwhelming.

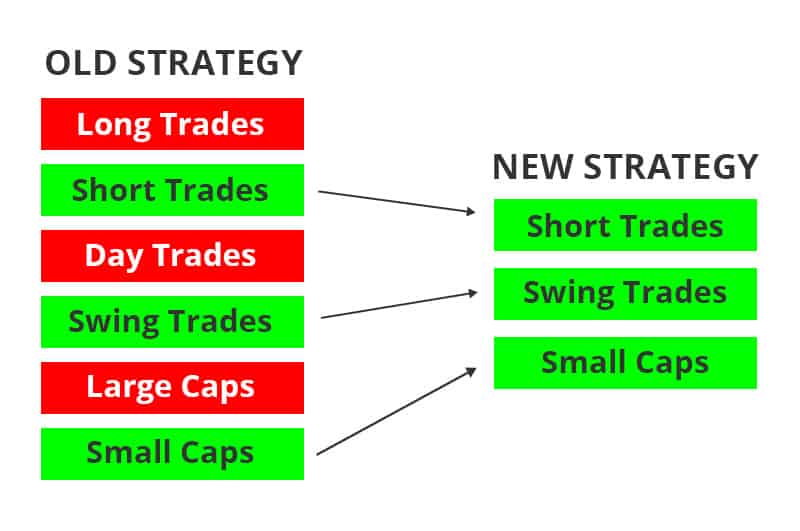

When you enter the “Beginner” stage, it’s time to start narrowing your focus. Aim to become a specialist in a smaller niche. Focus on your best setups and most favorable trading conditions.

You don’t need to be a jack of all trades to succeed as a trader. Specialization is generally more profitable than diversification.

Double Down on What’s Working

If you’ve had the fortune of placing a few profitable trades, study them. Focus on what you did right and use those insights to tailor your strategy.

Let’s use a hypothetical to illustrate this concept. Assume a beginner trader has 20 losing trades and 5 winning trades. There’s information to be garnered from this data set. What was different about the 5 winning trades?

You may find that all of your winning trades are short-biased whereas the majority of your losing trades are long-biased. You may find that you do better trading in the afternoon than you do in the morning.

Insights will vary by trader but the process remains the same. Figure out what’s working so you can narrow your focus.

Intermediate Stage

Once you enter the intermediate stage, you’ve made it farther than most traders. You still haven’t achieved your ultimate goals but you’re seeing more consistent results. You feel confident that you have a future in trading, but new obstacles continue to present themselves. You may wipe out winning streaks with a single trade. Every time you think trading has clicked, a new challenge presents itself.

First off, congratulations on making it this far. Becoming an intermediate trader takes patience, hard work, and persistence. Take a moment to appreciate your progress.

At this point, optimization is the main objective.

Stay Humble

Appreciate your progress but stay humble. Whenever trading seems too easy, disaster is usually around the corner. Ego never pays, even when you’re a seasoned trading veteran.

Once you have a track record of success, it’s easy to get stubborn. You may start to overstay positions, fight the market, or increase your risk exposure.

You’re at the point where your showing a lot of potential to become a great trader – don’t ruin it. Respect your stops, keep your position sizes appropriate, and don’t overtrade.

Be humble and remember that a little bit of fear is good; it keeps you on your toes.

Control Risk

Risk management is essential for traders of all skill levels. That said, traders have a different relationship with risk at every stage in their journey.

Newbies and beginners are often blind to their risk, whereas intermediate traders can become callous to it. A track record of success, however short it may be, can lead to stubbornness. Traders who would have cut losses during their newbie and beginner phases may now hold onto these positions because they believe they are right and the market is wrong. These traders may have even been rewarded for poor decisions like going in too big or holding onto a losing position until it went green.

Don’t let ego creep in after you’ve worked so hard to make it to this stage.

Poor risk management strategies represent a crack in your trading foundation – seemingly harmless until it isn’t.

Be Patient

Impatience is one of the leading causes of failure amongst intermediate traders. Successful trades often serve as the fuel that ignites a streak of reckless behavior.

It was easy to be patient when you were getting started, but now that you’ve had a taste of success, you can’t go back. You want to keep collecting profits so you may overtrade or try to force yourself to the next level.

Take a step back, breathe, and respect the natural progression of your trading career.

Advanced Stage

Once you progress to the advanced stage, you’ve entered the territory most traders can only dream of. You are in the top 1% of traders who can actually make a career out of trading. You have a track record of success and you may have already reached financial milestones you never thought possible.

Of course, there’s always another level to reach. Even if you’re making $1 million per year, you could always be making $10 million or $100 million, right?

Advanced traders still face issues with their trading. Trading never becomes effortless. There’s always another level to reach and risk is constantly lurking around the corner.

Here are some tips as you continue your journey to the top.

Scale Intelligently

During the early stages of your trading career, you probably have some misconception about the scaling process. You may assume that scaling up is as simple as taking larger positions. If you go from 1,000 shares to 10,000 shares, you can 10x your profits, right?

Unfortunately, scaling isn’t that simple. New issues arise as you begin to take larger positions. We recently did an interview with Alex from the chat room who explained some of the struggles he faced as he was scaling up.

First, there’s the psychological aspect. Managing a 1,000 share position is a lot different than managing a 10,000 share position. The stakes are raised and you need to be mentally prepared to handle the situation.

Second, you will face technical issues, such as liquidity. Whereas it may be easy to buy 1,000 shares of a low float stock, you may have a much harder time taking a 10,000 share position. On the short side, you may struggle to find the locates you need.

So, what’s the solution?

Scale intelligently. Be realistic about how you can scale. Don’t expect to 10x your returns overnight. Create a gradual plan and learn to deal with the nuances of each new level.

Expand Your Trading Network

Your trading network becomes even more important as you reach new levels in your career. At the early stages of your journey, you can find answers and support from a handful of sources. You can consult your mentors or do research online.

When you progress to the advanced trading stage, resources become thin. Very few people have reached the level you’re at, making it more difficult to get good advice.

The best solution is to network with other traders who have been where you’ve been. You’ll be pleasantly surprised to see how willing other traders are to help.

Traders love trading and they love talking about trading. It’s hard to talk about trading with your “non-trading” group of friends. Make an effort to build your network so you can learn from others who are at your level.

Don’t Compare Yourself to Others

We just discussed the importance of trading network – by connecting with others, you can build great relationships and garner invaluable information. That said, you shouldn’t compare yourself to others.

Comparing yourself to others is an endless trap. You will never be happy. If you’re making $1 million per year, it’s not good enough because someone else is making $10 million.

While this advice applies to all traders, people tend to get even more competitive when they excel in a field. Whereas a part-time trader making $50,000 per year may be appreciative of the extra income, a trader making $1 million per year is in a race to the top.

I can’t say it enough – don’t fall for this trap! Step back and appreciate your own progress. You’ve already made it to a level most traders can only dream of. Be patient and continue to scale up intelligently.

Remember You’re Not Superman

Trading is one of the few careers where you can actually lose money – a lot of money. You may work hard to double your account in a few months only to lose all of those gains in a single day. You may also go through periods where you just can’t seem to make any money.

When you’re stuck in a rut, it’s easy to start questioning everything. Did I lose my mojo? Should I stop trading?

Ruts are a part of trading for EVERYONE. You can get stuck in a rut even if you’ve been crushing it for a year. This is just the cost of doing business as a trader. Accept it and remember that it’s temporary. If you persist, you’ll get back on track with time.

What Stage Are You At?

Where are you at in your trading career and what are the main challenges you are facing? Leave a comment below!

Great video! Been waiting a long time for the intermediate series.

I’m going to keep studying and hope to join you guys soon.

Thanks!

I’m at the 1%…..!!!!!!! reading this pumps becouse it shows me how much I’ve grown 🙏🥲

I’m in the beginner stage and losing money but hoping to fill in the gaps in my knowledge.

Thank you.. I am happy learning day by day. Thanks God because I got this wonderful company.

Alot speaks to me in this article, it’s like you’ve worked with a lot of traders lol

Ego has killed me, I’ve had consistent runs just to get wiped out and more in 2-3 days trying to trade everything and make it all back fast.Then back to the slow grind.

Frustrating for sure and having had success in another business heightens my need to hit certain targets. Which then leads to forcing trades and the definition of “insanity” keeps playing in my head.

I have lots of data now on what works for me, just building on that and regaining confidence on a small niche.

I’ve had 8 days green after a 3 day compounding losing streak which cost me around 15k. I’m in IU chat but need to reach out more. Thanks for this man

Where am I?

I am a beginner at a pivotal point into the intermediate side of the spectrum.

My main challenge is creating consistent profits, and narrowing into my favorite trading setups. My setups haven’t worked frequently enough for me to say, these are my favs.

Added this to my weekly ‘read’ list. Nice and quick and a great reminder how to stay on the runway before takeoff! Thanks!

I am definitely interested in trading. Love the info and the hard truths. Really shows you guys care about what you do. Need to bank roll come money get capitalized.

Am in newbie stage interested in this but u don’t know how to start

What’s the ceiling as a day trader? $100m per year?

Nice video. I have some experience trading, but I will put myself in the middle of Newbie – Beginner. I have studied a lot, but still, there is much I need to learn. I traded 2008-2009 and was smacked trying to short S&P ahead of the big washout. So, I took a long pause (12+ years), and now I am taking it more seriously. I have hopes I got to the right place to do it!

Respect and follow the created trading system should be prioritized.. When emotion kicks in we can lose a lot of money, just by trading in random..

I’m more like at intermediate stage but still with such mental and psychological issues like overtrading and revenge trading. Nice article, will learn from it.