Another wild day in the markets. I wanted to go over some of today’s best trades and discuss a few important trading concepts. Let’s get to it.

What is “Boxing” a Stock?

Whenever I mention boxing people pretend it’s beyond comprehension and doesn’t make sense to them — as if it’s the weirdest concept they’ve ever hear of before — but truly it’s not rocket science.

There are four times I believe it’s important to box:

- When you’ve located a hard to borrow name which may/may not be available the next time you go to locate it. If you are short 1,000 shares and you want to cover but don’t want to risk not being able to locate shares to short again you can go LONG 1,000 shares in the same account at Etrade. You will then be -1000 shares and +1000 shares thus FLAT. If the stock rebounds or looks like it is going lower and you’d like to short again you simply sell the long. Thus, you end up net SHORT.

- Another reason especially right now when borrows can be crazy expensive, let’s say every time you want to short 5-10k APT shares it cost you $300-500. Some brokers YES you can pay to locate and they are YOURS for the day. Others like Etrade you have to pay this EVERY SINGLE TIME you locate the stock to short. Why would you pay this every single time if you were planning to actively trade it when you can SIMPLY go LONG when you want to cover. If you’re short 5000 shares and you go long 2500 shares you’re NET SHORT 2500 shares. If you go long 5000 shares you’re FLAT. If you go long 7500 shares and short 5000 shares you’re NET LONG 2500 shares. VERY VERY simple. Do not make it more complicated than it is.

- Third reason I would box is a situation like BIOC today when I went short. Etrade does NOT allow you to short stocks UNDER $1. So, If you’re short BIOC at $1.05 + and want to be able to actively short it later on in the day or you expect it to rebound at some point off open and would ideally re short it into a pop WHAT IS THE SOLUTION? That’s right, you box. Here is an example – you expect BIOC to go to .70 off the open after fading to .50. You want to get short .70 but know you won’t have shares if you cover since it’s under $1. What do you do? You get long at .50 the same amount you’re short and sell into the .60-.70 move you expected. Thus leaving you net short on a sub dollar stock.

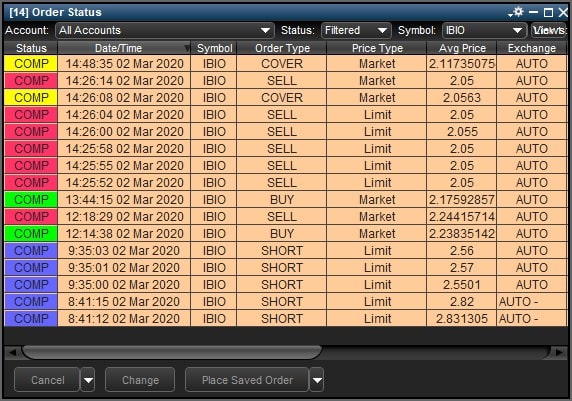

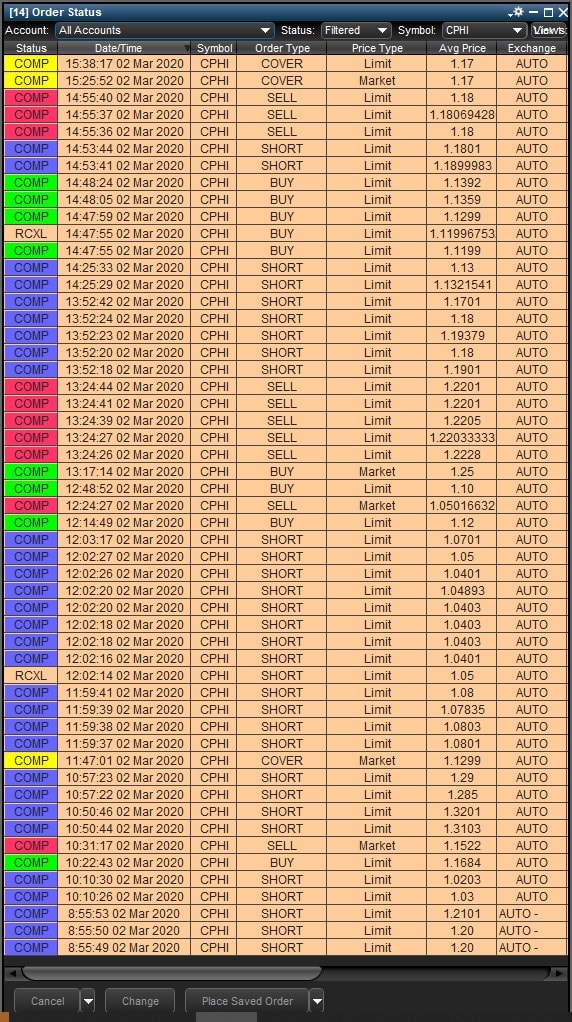

- The FOURTH and FINAL reason it’s useful to box AND why I boxed some of CPHI and IBIO today was because SSR is on. Ever try to short a stock when its starting to break down and you can’t get any fills? That’s right – you can’t hit the bid because of the uptick rule. Well, what’s the solution? Weird, once again — box the stock. When you want to short – you can hit the bid. Amazing, it’s like magic.

So, next question – can you do this all in the same account?

Yes the answer is Yes at Etrade.

So, hopefully this is the version of the answer that finally brings clarity to such a simple concept but yet a trying one for many 🙂 This will serve as the link I send traders to in the future when they ask “what is boxing?”

Below is a video recap from today’s trades as well as the charts from today – you’ll notice on IBIO and CPHI I boxed.

Video Recap

A few things to consider throughout the trading week:

The next A+ set up should excite you more than your PnL.

Focus on what matters and the rest takes care of itself.

PnL is a product of proper risk management, set ups, patience and entry.

Focus on PnL you'll end up shits creek.

Focus on the set up – rest falls into place.

— Nathan Michaud (@InvestorsLive) March 2, 2020

Best day of trading 2020.

What does that mean?

Nada.

Biz as usual tomorrow.

Focus. Zone In.

A high five or two is fine but faster we can re center the faster we can get back to business.

Slower you move on less focus you have on what matters.

Next.

— Nathan Michaud (@InvestorsLive) March 2, 2020

Charts and Trades

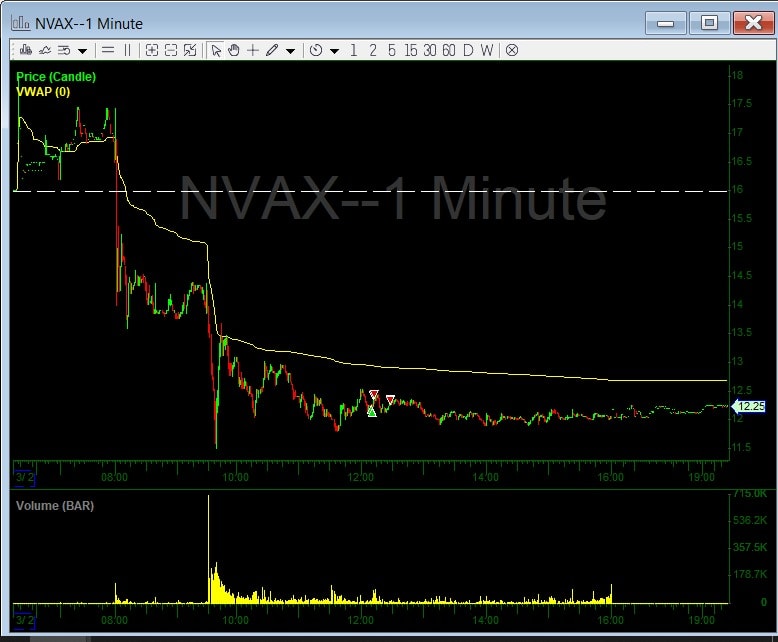

NVAX

MRNA

IFRX

IBIO (CenterPoint Trades)

IBIO (Etrade)

DXR

CPHI

CODX

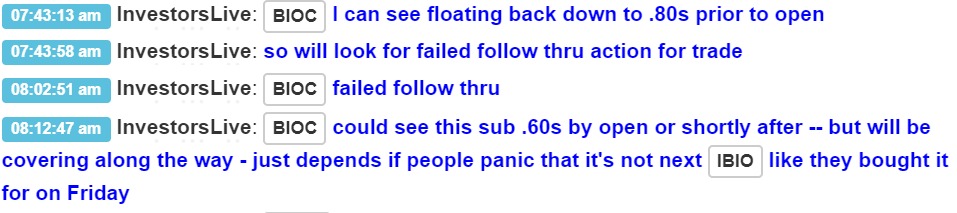

BIOC

BIOC sold over night at .89 short 1.06-1 and cover .46-.50

Trade plan from the room:

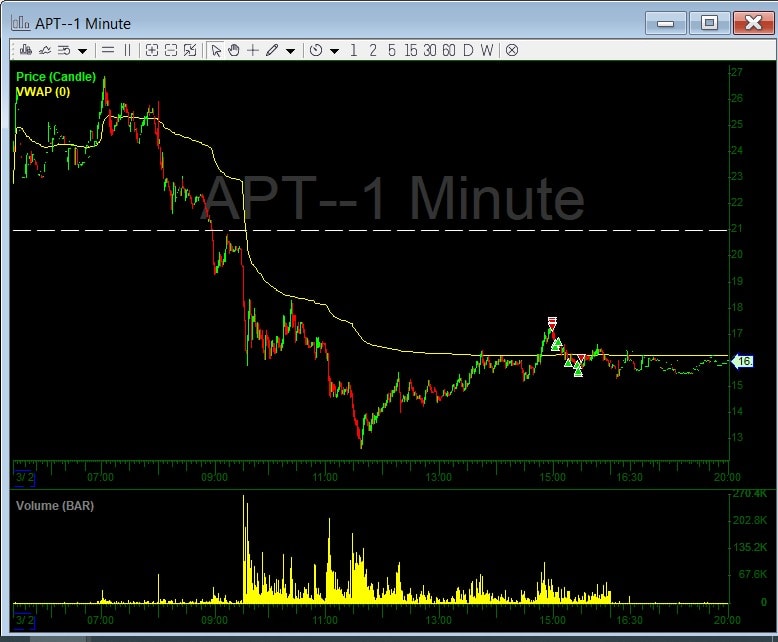

APT

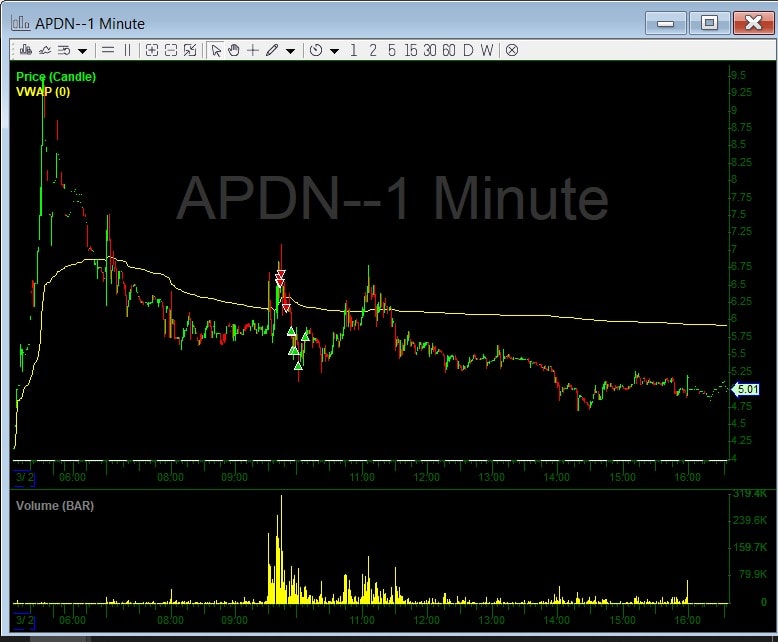

APDN

ALT

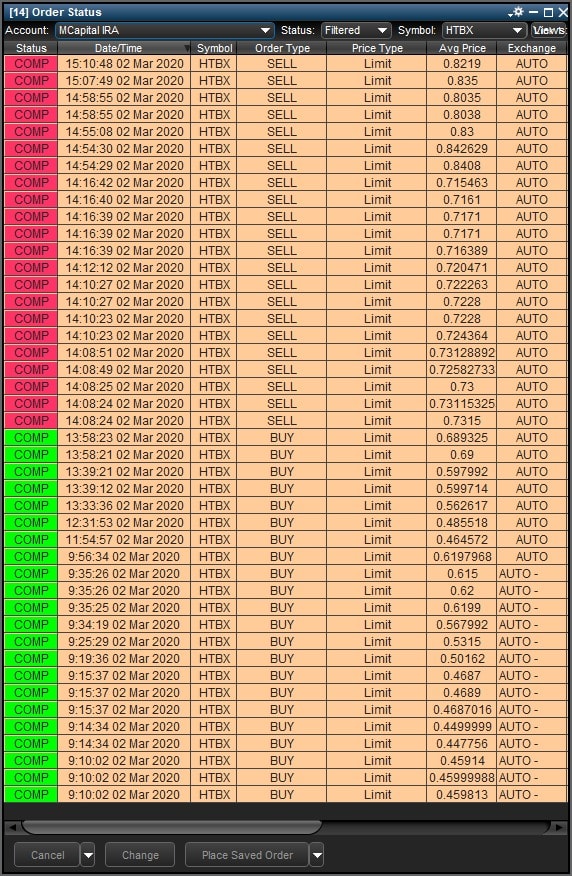

HTBX

Straight from the Free Sunday Scan.

Adds to over night position from .2x’s as stated I was swinging on scan last night:

Awesome work on explaining boxing your trades.

Thank you! the order status screenshot of IBIO helped me understand Boxing the stock. I’m more of a visual learner! So basically the sequence on Boxing HTB on Etrade for would be Short – Buy – Sell then Cover Correct?

Great way to maximize gains by understanding how the process works!! I’ll definitely look to paper trade the box before I implement it. Question. Do you use the E*TRADE scanner at all? Any tips on how you would set it up to identify pre-market & intra-day stocks?