One of the most popular questions I get where I have to repeat myself over and over again is, “What is a “stuff” move?”

It’s not something that’s learned with one example and it’s not something that can be learned in one day. The concept is understood over time, much like level 2.

I had a strong feeling that OMER was about to really cave in. I had been actively monitoring this name all morning and watched how it reacted on each push and each dip. I thought that, although it was hanging on, it seemed to be really heavy (term I discuss in my educational products quite a bit) and was pretty much convinced that this was not going to have the staying power it needed (like AQXP did.)

Everyone wants to be part of the next big mover but the difference is in the chart. Could I have been wrong? ABSOLUTELY.

Trading into a parabolic move works 99 times out of 100, but the one time it doesn’t (like AQXP), not only do you blow all your gains from the prior 99 parabolic trades that worked, you end up in a ridiculously bad spot because you kept thing, “how the HECK could it go that far?”

So, as I say time and time again the parabolic move is NOT to be messed with, especially if you’re a new trader, and even if you’ve been around the block once or twice. Whether you want to believe it or not, there will be a time that you make a bad trade, blow through all rules you set forth and have to rely on that ‘oh shit handle’ number we always talk about. Have that MAX number you’ll take a loss at NO MATTER WHAT! Keep yourself in the game. Most don’t have this number and that’s why many traders have a tough time.

Moving forward:

Waiting for that exhaustion candle is important, many times into a whole or half dollar. I have no interest in having the best entry and best average on any given name. Although it may be a sweet entry, was it an ideal entry? Was it high risk? Was there something you could risk off? A lot of people get confused that just because stocks are up, they are shorts! In this market, that’s a BAD idea. It’s import to join trend and not try to predict it.

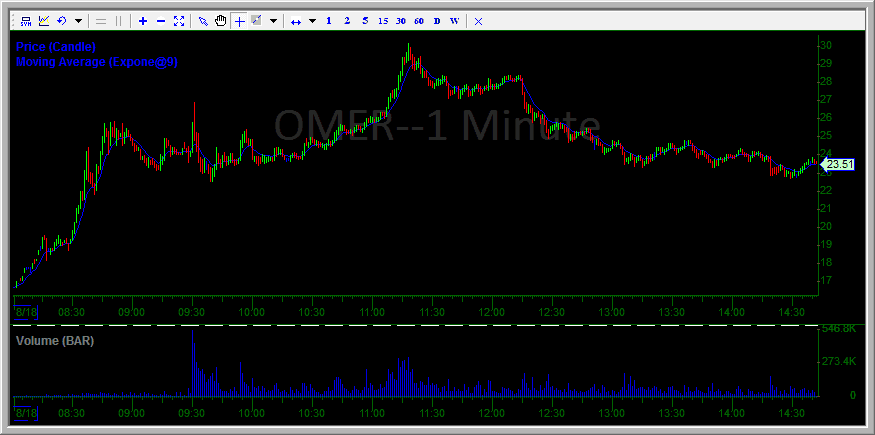

Check OMER here as it surges on the front side towards $30 magnet – note the volume coming into that move. This is one thing I look for – higher than average volume into a break out. If it’s BIG volume on the move, it’s likely that it’s going to eventually pull back IF the next re-test of a breakout fails.

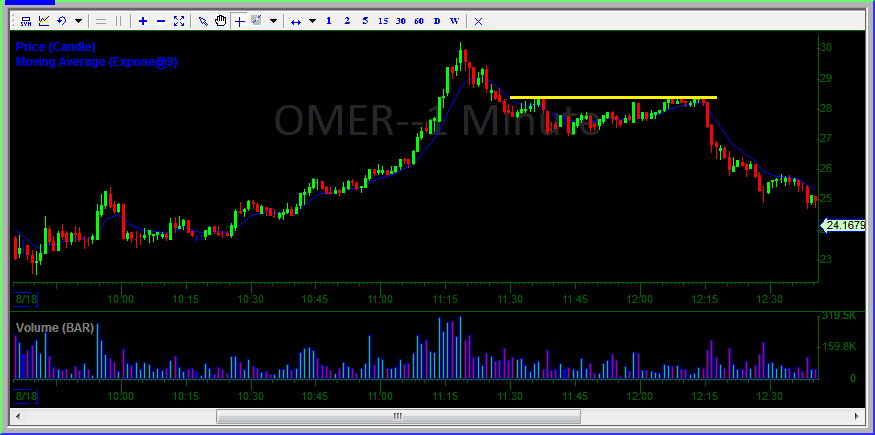

I was patiently waiting for OMER to come in. I prefer to see a few lower highs and then, once it re-tests and fails at a particular level, I start to watch that level for a trade. That level for me was $28.40s. I wanted to see $28s peak, re-peak and peak again before I was committed for any size. Yes, I’ll start in very small on the push, anticipating the move, but until I see $28.40s become a peak a few times and $28 confirms, I do not have a good set risk vs. reward to start scaling into the trade.

Trading the STUFF move is about anticipating a few things WITH an educated risk in mind.

Keep this in Mind

1. The “stuff” level at which a breakout/squeeze may occur if it breaks and holds trend.

2. The “stuff” level is many times that spot where you’ve been short and you’re on the edge of your seat about to cover and don’t. Then it happens again, re-test … and bam you cover ….. ANDDDDDDD it’s the top! (After many times of emotionally covering into the pop that ends up being the top, I’ve realized a few things).

3. The stuff level is also the level where everyone is excited and chases the break out.

So — WHAT HAPPENS when that level is tested, all these things occur, the volume SPIKES and it doesn’t go up? What next?

That’s where this trade comes in !!

So given my bias and assumption that we were about to get a nice big ‘stuff’ move I went ahead and started recording so you can once again see the raw footage AND commentary in the live chat room to go along side it.

I would encourage you to read it along side the commentary.

If you have any questions about this move, we have a webinar tonight and you can ask questions here. If you’re not a member yet, there is still time to join and catch the webinar at 8PM EST.

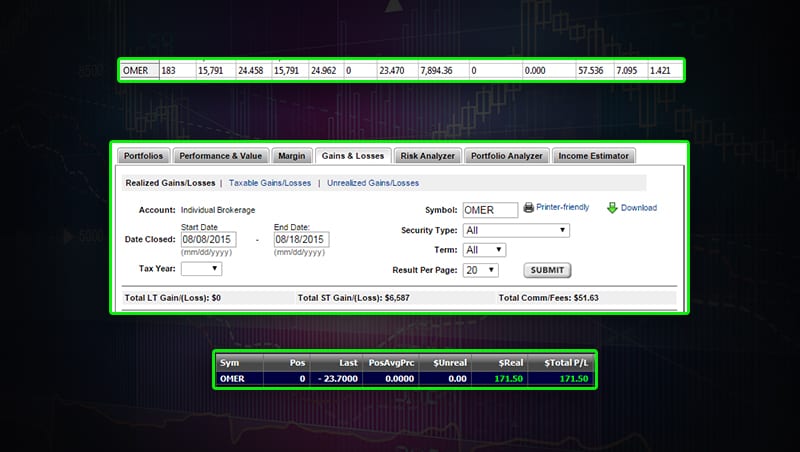

Here are my P&L’s for the trades:

Here is the Video Recap

(no sound it’s all discussed in the post and below)

Here are the Chat Logs

[Aug 18, 2015 11:43:06 AM EDT] InvestorsLive if OMER stuffs at $28 should provide some nice fade back $25-26 range — will be eyeing

[Aug 18, 2015 11:48:24 AM EDT] InvestorsLive going to s/s pops OMER

[Aug 18, 2015 11:48:29 AM EDT] InvestorsLive risk based $28s – have started

[Aug 18, 2015 11:48:44 AM EDT] InvestorsLive NOTHING TO CHASE DOWN entry is everything

[Aug 18, 2015 11:51:51 AM EDT] InvestorsLive OMER any good 28s ramp that fails if it grinds/holds no interest to fight the short – this trade is ONLY into strength and not for new traders dont like any size unless 27s get heavy — just fwiw

[Aug 18, 2015 11:53:06 AM EDT] InvestorsLive for new traders draw a line at $27.20 — should NOT touch it unless that snaps

[Aug 18, 2015 11:53:09 AM EDT] InvestorsLive and peaks

[Aug 18, 2015 11:59:16 AM EDT] InvestorsLive 28s action is what I want to see stuff for the trade as I wrote — but again not for new traders I’m just speaking out loud in hopes that traders learn stuff from these levels what stuffs look like and what sorta action I am interested in

[Aug 18, 2015 11:59:24 AM EDT] InvestorsLive so if trading it — please be careful and please trade on ur own

[Aug 18, 2015 12:03:52 PM EDT] InvestorsLive 27.40-27.50 push towards 28-28.20 level reminds me of 23.60-23.70 level and 24-24.20 on OMER — stuck in channel until one end breaks its 50/50 shot – hence entry being everything

[Aug 18, 2015 12:12:27 PM EDT] InvestorsLive anotehr stuff OMER

[Aug 18, 2015 12:12:29 PM EDT] InvestorsLive top end of channel

[Aug 18, 2015 12:13:16 PM EDT] InvestorsLive do not like name unless 2780-28s start to get heavy

[Aug 18, 2015 12:15:46 PM EDT] InvestorsLive huge stuff there again OMER

[Aug 18, 2015 12:15:48 PM EDT] InvestorsLive nice action

[Aug 18, 2015 12:15:57 PM EDT] InvestorsLive caught the stuff on video too

[Aug 18, 2015 12:16:04 PM EDT] InvestorsLive since we were anticipating it – set it up to record

[Aug 18, 2015 12:16:04 PM EDT] Bertonwong great call Nate

[Aug 18, 2015 12:18:55 PM EDT] InvestorsLive make sure to lock in along the way on OMER if u traded it

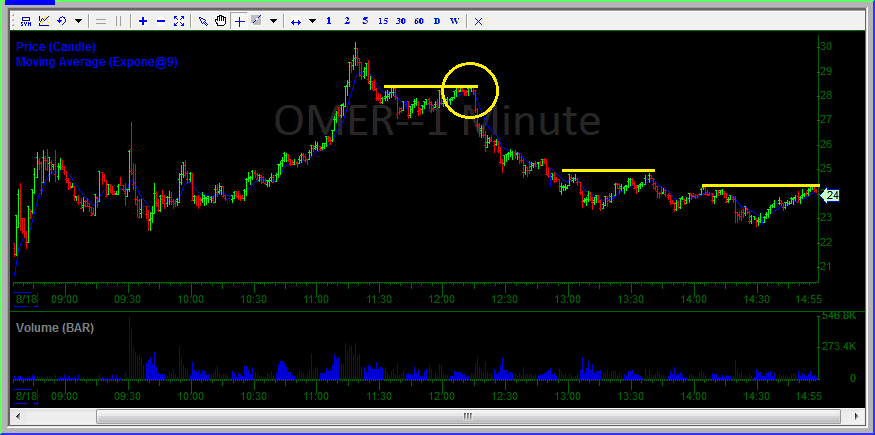

[Aug 18, 2015 12:19:25 PM EDT] InvestorsLive but my opinion is it fades further than most think

[Aug 18, 2015 12:19:34 PM EDT] InvestorsLive but that is only a bias if you lock in along way

[Aug 18, 2015 12:20:57 PM EDT] InvestorsLive BINGOOOOOOOOOOOOO

[Aug 18, 2015 12:21:30 PM EDT] InvestorsLive lock in pay youself fast $2 fader

[Aug 18, 2015 12:24:15 PM EDT] InvestorsLive next leg down OMER

[Aug 18, 2015 12:26:07 PM EDT] InvestorsLive 2650 re-test a few times over/under naturally healthy imo on OMER if it stuffs next leg should be fast I missed cover of 1/3 on 26 wash but looking to cover 1/3 into flush

[Aug 18, 2015 12:26:50 PM EDT] InvestorsLive coverd 1/3 OMER .85

[Aug 18, 2015 12:27:39 PM EDT] InvestorsLive BINGO x 2

[Aug 18, 2015 12:29:44 PM EDT] InvestorsLive scaled down to 1/2 OMER

[Aug 18, 2015 12:38:45 PM EDT] InvestorsLive next wash near OMER

[Aug 18, 2015 12:38:50 PM EDT] PatS boom

[Aug 18, 2015 12:40:14 PM EDT] InvestorsLive sub $25

[Aug 18, 2015 12:47:47 PM EDT] InvestorsLive have 1/4 OMER left eagerly looking for an add on any good pop

[Aug 18, 2015 12:48:00 PM EDT] InvestorsLive I am not looking to short first pop hoping there is a secondary squeeze

[Aug 18, 2015 12:50:10 PM EDT] InvestorsLive nice stuff again OMER

[Aug 18, 2015 12:51:08 PM EDT] InvestorsLive %%%%% ya

[Aug 18, 2015 12:54:03 PM EDT] InvestorsLive I plan to hold last 1/4 OMER as long as no grind/trend forms and holds over $25 — here to help via PM if anyone had trouble/questions today

[Aug 18, 2015 12:55:44 PM EDT] InvestorsLive 24 test OMER

[Aug 18, 2015 1:09:56 PM EDT] InvestorsLive all done OMER +3.50-4/ish

[Aug 18, 2015 1:10:00 PM EDT] InvestorsLive just 500 left

[Aug 18, 2015 1:10:06 PM EDT] InvestorsLive trying not to watch in case 21s

[Aug 18, 2015 1:10:10 PM EDT] elkwood66 great job

[Aug 18, 2015 1:10:26 PM EDT] Chris_Be nice call nate!

[Aug 18, 2015 1:37:22 PM EDT] InvestorsLive here to help via PM guys going to put out a thing for the webinar tonight 8PM EST

[Aug 18, 2015 1:37:25 PM EDT] InvestorsLive but here to help – great work today

[Aug 18, 2015 1:38:31 PM EDT] InvestorsLive monitoring OMER for all stuffs into 25s + think it can test a few times if it cnat hold 25 area bid likely gets back on the sell thru the rest of day

[Aug 18, 2015 1:46:37 PM EDT] InvestorsLive OMER nice — likely unwind potential back to $19-20s later on (nothing to add add add against just thinking patience)

[Aug 18, 2015 1:50:06 PM EDT] InvestorsLive OMER ::up

[Aug 18, 2015 1:50:18 PM EDT] InvestorsLive sick reads guys what a gift

[Aug 18, 2015 2:29:56 PM EDT] InvestorsLive awesome job on re shorts OMER be sure to lcok in along way patience is paying

Fyi, the video doesn’t seem to have any audio. At least not for me in chrome on OS X…

That’s correct no reason for audio I’ll discuss at webinar tonight .. the post explained it do you read it or just click video 🙂

Nate – what was your indicator not to short at 10:15am on the chart? Lower highs, double top at 26. Mirroring recent $ONTX $AVEO morning fades.

You can short any of the parabolic moves as long as you have a plan – but I think it’s pretty clear in this market you don’t want to do that especially pre market on low volume of only 400-500k shares right? AVEO ONTX are much different names much bigger float and known junkers.

Thanks for the feedback Nate. I was considering chart pattern only and hadn’t considered size of the float or past history. Appreciate the insight.

Hi, do you ever video screen record yourself making the actual trades live? Instead of posting screenshots and chat logs?

Yep that’s what Tandem Trader is!

Cool didn’t see the 3 minute example on MBLY yet! That is really cool how you scaled in and out so fast without even leaving the screen. I would like to be able to be that fast with making trades. I mean you didn’t even have to put in a price that you wanted in or out at, it just got out so fast! Saving up for the DVD! Thanks for the reply!

TripleV was here learning. Thank you, Nate!

nice stuff, great example of shorting backside