There were a ton a catalysts this week. The Fed meeting, earnings and the Russia issues. Just like last week, you usually got a few paper cuts before getting the right entry and riding out the meat of the move. Dip your toe in before jumping all the way in.

No blog sale this week but reach out if you are looking to join. I have promos on almost everything we offer. [email protected]

RBLX Trend Join

There were a lot of false bounces this week. You can see how Nate waited for it to get above the last pop. You can also use that level as your risk if it turns back down.

PTON Starter

Here is a great example of using starter size. If he had entered with full size, that quick jump after the entry would have caused panic. With small size you can open up your risk a bit.

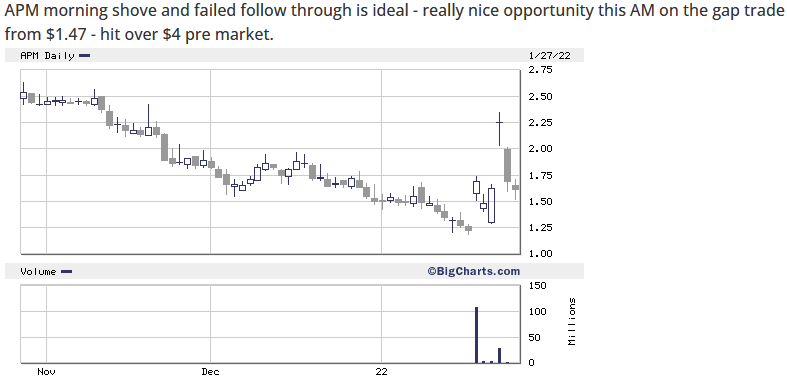

APM Scan and Trade

Nate went over this trade on his scan. Once it put in that double top it was a safe entry using that recent high as risk.

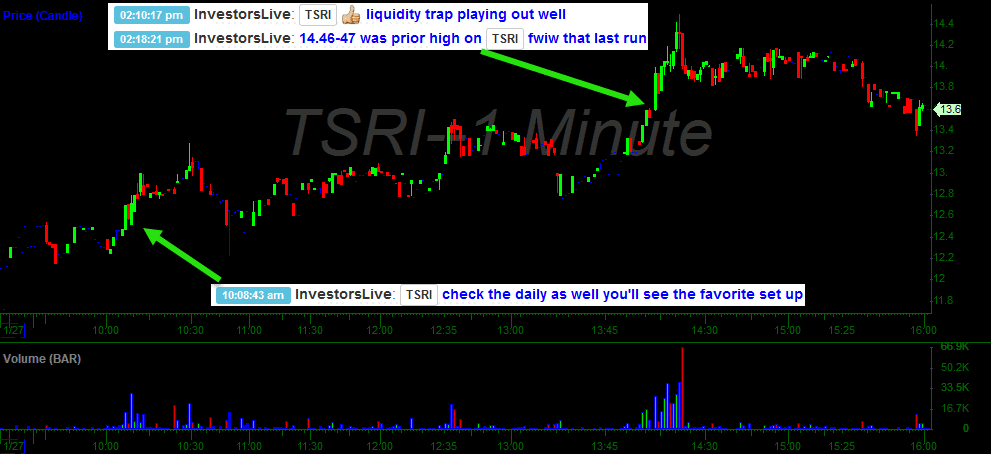

TSRI Trap

Nate has become VERY good at spotting these traps and letting the community know.

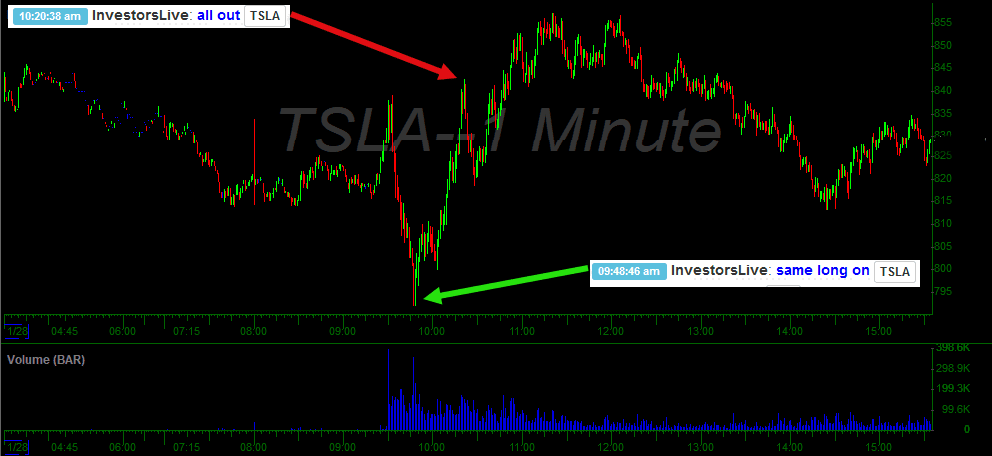

TSLA Long

Just a simple bounce play.

Have a great weekend.

0 Comments