Hey guys. Thank you for all the submitted questions…I don’t have a ton of time to work on this, so I’ll answer as many as I can and the most relevant ones re: value add content. My apologies if I did not include yours, I will be doing these again in the future so you’ll have another opportunity to submit Q’s. Alright lets kick it off.

Currently, the best long trade to me is no long trade at all lol, I identify almost exclusively as a short seller these days. I used to go long a lot more often earlier in my trading career actually, it’s pretty rare now though. But one of my favorite long setups was the “Low Vol Hold Pattern” I called it …and I wrote a post detailing how it works, which you can read about over here.

There are days I’m still not sure man lol. This is not a safe profession. Also I don’t know why everyone is fixated with this ideology…this is one of the most common questions I get asked by far. “When did you get it? When did switch flip? etc” and that’s just not the way it works. You don’t go to sleep one night an undisciplined jerk and wake up the next day a consistently profitable stud. So if I had to describe the moment to you when it all clicked, my answer is that there isn’t one. It simply does not exist. There’s an applicable quote here from one of my favorite movies of all time, Layer Cake. My man Eddie Temple says this:

“You’re born, you take shit. You get out in the world, you take more shit. You climb a little higher, you take less shit. Until one day you’re up in the rarefied atmosphere and you’ve forgotten what shit even looks like. Welcome to the layer cake, son.”

You start out taking shit and losing money. Everyone does. Then you climb a little higher and learn how to lose less money. This is huge progress. Then you hover around break-even over/under for a while. Then if you’re lucky you start to make a little money, then a little more, so on and so forth. I know that’s obvious, but just making a point that there is no “switch flip” moment. There wasn’t for me at least. It’s just a slow gradual improvement over time. So don’t seek this out – there’s no golden piece of advice or any Holly Gale out there that’s going to get you where you want to be overnight. It’s a nasty, dirty, gritty scrap down in the trenches. Becoming a profitable trader is an ugly process, and there’s nothing pretty, uniform or orderly about it. It’s absolutely chaotic and entirely unique to each individual.

What would I have done differently…hmm. This is a tough one because you could make the argument that since it all turned out OK, perhaps I did exactly what I was supposed to have done. Initial losses could have been smaller I guess but I really don’t think I’d change anything otherwise. And I’ll tell you why I feel that way in a second.

Here’s the deal from my experience. Actual TRADING knowledge…technical analysis, patterns, setups, moving averages, all the “how to” of trading – is the easy part.

Almost everyone is able to figure this out, literally. Even guys who are not profitable yet – most of them still know how to trade for the most part. I know plenty of guys who totally understand “trading” – yet they can’t manage to make money. Why? Traders don’t lose because they’re completely clueless and don’t know how to trade; they lose because they’re undisciplined & greedy. The mental/discipline side of trading is something entirely different, and much, much harder to learn, and it’s the master key to your success. I created a Yogi-ism quote for this.

“99% of trading success is just learning how to stay out of trouble. The other half is easy.”

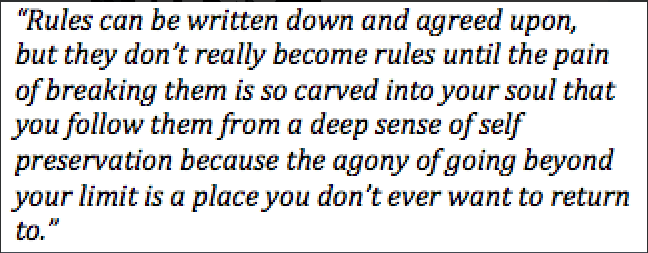

Anyway – the whole point of that side rant was to say that even though I had an extremely rocky start to my trading career, I believe those years of agony & pain shaped my discipline levels into what they are today. Pain and loss are the absolute BEST teachers this game has to offer, bar none. For example, everyone knows THE cardinal sin in trading is having a massive blowup trade. We all know not to do that. But guess what – you don’t learn how to not do that by reading about it somewhere. You learn how to not do that by doing it. By getting absolutely f#&$%ed so hard it literally hurts every facet of your being down into your soul. That is the precursor to true discipline. Here’s a quote I love that I took from Jesse.

No matter how many times someone warns you about trading blunders – the reality is that sure, you may hear them, but you won’t listen to them. You have to royally screw up yourself, and that’s when you learn. It’s like a traders rite of passage almost – we all go through it at one point or another. If you haven’t yet, you will.

So in conclusion to this question, my answer is I don’t think I’d change anything, because all of the pain and suffering shaped me into the trader I am today.

I’ve never been huge into nightly scanning, and I’ll tell you why. I know how to do it & am starting to do it again now, but my niche was always smallcap short selling, and probably 90% of the small cap stocks I end up trading, you find them the morning-of in premarket. However I am a momentum trader, so I’ll look at pretty much anything if it’s got strong volume & good range. I’m doing scans for IU now so you’ll start to get an idea of what I look for in my scanning as time progresses.

Ok so I would describe my trading style as almost entirely fundamental. In the sense that I don’t use technical analysis much, my charts are basically naked. I do have VWAP and the 20 SMA on there, but the 20 is just kind of “there”, I’m not really basing trade decisions off of it. Most of the decisions I make come from having a solid fundamental thesis in place as an anchor for the idea, and then from there I’m dissecting the tape – analyzing price and volume to determine where market participation is happening & where bias is. So as far as what indicators/collection of indicators I like to see that sounds the alarm to attack…they can come in many different forms for me since it’s fundamental based and not Technical based (Like I’m not looking for double bottoms…or Bollinger coils..or MACD crossovers…or oversold RSI or any of that stuff). But the one constant is this. Never base a trade idea off just ONE indicator signal, whatever that may be. Always make sure you can marry at least a few different things together that all support your trade idea. I wrote a post on this as well dissecting a trade I made on CLVS a while back, and I talk about where the conviction came from through marrying multiple signals. You can read that post here.

The small cap market is always changing. For starters, (like we just saw over the past two weeks before HMNY the other day) small caps were totally dead. This was mainly due to earnings season. When the big earnings names are reporting & there’s more macro stuff going on in the markets, small caps tend to slow down. This happens on and off throughout the year as earnings season cycles through. So that’s one way they change.

Another is just the type & potency of small caps that run. For example if you remember in the middle 15′ and 16′ we went through a phase where we had a small cap pharma name gapping up 100%+ almost daily. (This was when AT09 & JGram experienced their rapid rise to success trading these) So that phase was nice. These things gapped 100%, tried a morning push, & then just faded all day…it was a literal dream come true. I hope that phase comes back soon.

Then still yet in another scenario, one of my trading partners who’s been around 20+ years warned of a period where small caps died for two YEARS straight at one point. Why? Who knows. But it can happen. So I don’t think there’s much of a structure to it regarding the when or why, but different small cap phases definitely come and go often. It’s a very volatile and unpredictable environment.

Small caps also fuel off of each other in two ways. Firstly, just in general if we get an absolutely insane multi-dollar small cap runner, that will usually spark others to follow suit in the days to follow. It’s often sector related as well, the obvious example being when DRYS first started going last November, all the other turd shippers follow suit for no reason really, just because the main one is going. These are called sympathy plays. (They’re often great shorts and weaker than the main play) I know for me personally, during the original DRYS madness, most of the money I made shorting shippers wasn’t made on DRYS, it was more on SINO, DCIX, EGLT, TOPS etc. I prefer to attack the sympathies over the main play.

Taco Bell is the official taco sponsor of DGTrading101.

This one kind of ties into the answer from above re: the “A” quality setups question. I don’t use many technical indicators at all, just VWAP really, and I have the 20sma (20 period simple moving average) on there as well. For time frames, I watch 2m and 5m charts primarily. For VWAP, the timeframe doesn’t change anything between the 2m and 5m, I treat it all the same basically. However if I’m using the 20sma as a guide, I’ll primarily be looking at that on the 5m chart. The 20sma is a way for me to judge the health of a trend. Say I’m short and the trade is working, that should mean that price action is taking place below the 20sma, and I”ll remain in that short position as long as that holds true. It’s healthy for a stock in trend to test the upper & lower boundaries of the trend. So back to the short trade that’s working – I want to see retests of the 20sma from below and repeatedly fail into it, that tells me the trend is in tact, the name remains heavy, and I have no reason to cover yet.

I kind of do this in two different ways, depending if it’s a conviction play scenario, or just a scalp.

If it’s a scalp play, I try to absolutely never add to a loser. Cardinal sin there. I can’t tell you how many times I’ve done this early in my trading career, and how many times I’ve seen others do it too – you get in an innocent little scalp trade just looking for a small move. Then all the sudden it goes against you some, you get pissed, start adding. All the sudden what was supposed to be a quick little scalp turns into a giant nightmare that either ruins or significantly minimizes your day. So that’s rule #1, never add to loser on a scalp idea. Also if I’m scalping, my initial entries will be larger & my risk parameters tighter. I’m looking for a smaller move, so I need a bigger initial position size to make the trade worthwhile. I’m also able to use bigger initial entries here because of that rule I have in place we just talked about – never add to a loser on a scalp so risk is controlled. So if it’s not working, I cut it fairly quick and just eat the small loss.

Now on a conviction play, I’ll approach it slightly different. I’ll start in smaller, because I want to leave room to add higher/lower if need be & properly build into this position. If a scalp trade is working, I won’t add, I’ll just let it go as is and cover sooner rather than later) But if a conviction trade starts working, I have no problem piling the f^$k in to a winner, and I’ll typically use either flat or small red as a stop point there once I’m playing with house money on the trade. My risk is also larger on these. If I’m willing to call something a conviction play, I’ve obviously got reasons for that, and I do not want to get shaken out of this trade because of the high probability I believe it has to work. So I’m willing to deal with a little more pain than usual here, in an effort to give this trade every opportunity to play out the way I think it could, and should.

–> An Open Letter to Aspiring Traders: What You’re Actually Getting Into & How to Prevail <—

Roughly 6 years.

Give Cody (OddStockTrader) a shout for this stuff…not my area of expertise at all. I couldn’t tell you the first thing about cryptos, have never traded them, will never trade them, don’t even know how to buy some even if I wanted to. It’s a largely unregulated market and you can’t really apply fundamentals to it, which is the part I don’t like. It just feels like 50/50 gambling to me, where the thesis is kind of just buy and hope the craze continues higher. Take this with a grain of salt, thats probably oversimplified on my part, I’m sure there’s a strategy to it and Cody would be a better guy to ask than myself, he does well with that stuff. I stick to Nasdaqs.

I do not keep spreadsheets of anything, and I never have. Well, I guess that’s not entirely true, I did used to use TraderVue a while back, which I have a whole article on here. I don’t really recap my trades at the end of the day anymore either unless something went terribly wrong. But if you are still in an early learning phase, I would suggest reviewing your trades right after market close when everything is fresh in your head – jot down notes on everything you did right and wrong. And then let everything marinate for a few hours, get away from PC and take your mind off trading for a few hours, and then go back and review your trade notes one more time before bed to make sure everything is understood.

Scroll down to #2 Intensive Indifference in this post for an answer to that. Also I helped collaborate an article on this with my buddy TM @TraderMentality on this topic a while back – you can read that here as well. Both of those links should sufficiently answer your Q.

Alright – this was great, kept me busy the entire flight almost. I’ll edit it and get it posted soon. Thanks again for the questions.

If you’re not an IU member and would like to become one, there’s still a sale going on here. Or if you’d prefer a shorter time commitment to see if you like it, you can go monthly as well here. Shoot me a PM anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss trade ideas with you.

See you out there!

– D

All I can say is wow DC. This is some powerful,helpful and inspiring sh@t. Thank you