I wanted to recap the events that happened this week and last regarding Pingify International Inc. (PGFY) and why I suggested staying AWAY from the long and keeping short over night.

Holding $PGFY short over night again just in case it halts – just want to be there for it

— Nathan Michaud (@InvestorsLive) May 13, 2014

As more and more traders get caught up in these death spiral stocks and the summer blues start, the OTC liquidity dires up you’re going to need the tools I outline for trading NASDAQs in my streaming DVD.

First and foremost as I have always said a halt is nothing good for ANYTHING – it spooks the market, fear comes into OTC land and the volume dries up and people are afraid to hold OTCs over night AND YES, that is still my belief.

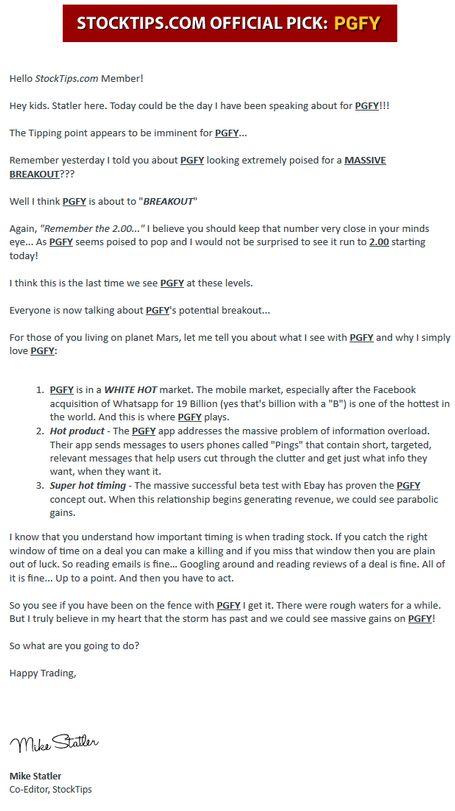

HOWEVER when a 100% FRAUD comes out, PRs are SCREAMING please investigate us, MAJOR campaign is pumping it under a fictional character named “Statler” as disclosed in the disclaimer the reality is this …. it’s a ticking time bomb, you should know, it should halt and I don’t think it ‘negatively’ impacts the OTCs because the facts are out there if you’re long and strong you 100% deserved a loss.

If you don’t believe me about fictional character – check it out:

Many times I get a lot of shit from believers just like I did on SPLI (now VPOR) and the rest I warned about before and around this PHOT article about the pot sector before nearly all pot stocks crashed about 50% in the month following ….

I don’t do this because I am short stocks. Yes, sometimes I am but it is not by any means to influence price but rather state opinions backed up by facts and market activity that I am watching on a regular basis. Each time I have reply to a bunch of new people who believe their stock is going to the move and everything I say is wrong — and really the only way they learn is either a) they lose their shirt like VPOR and average down down down and you’re WRONG no matter what even though their account value is plummeting … or b) they get stuck in a halt and lose it all

So why the broken record?

For starters:

Pingify International Inc. Comments on Recent Stock Volume and Price Increase

I don’t do it because I want to say ‘I told you so’ after and I surely don’t do it to influence anyone’s decisions but rather just post my own opinions and warnings which I think should be taken rather seriously about what’s going on in the market, what I see and what people should watch out for.

As I said in each tweet I was not shorting large but remaining short off pops on PGFY over night because it was my belief it was only a matter of time before it halts.

We never know when things will halt, sometimes they come as a surprise – much like I wrote about on PHOT where I was long HEMP that same night and VERY EASILY could have been me!

BUT as a trader, as a “penny stock investor” (I use quotes on purpose) … you should be aware as to what IS and IS NOT a LIKELY candidate for a halt. PGFY had ALL the warnings, and silly PRs and internal ego battle among executives to get the regulators interested. They aren’t dumb, PGFY is just an excuse to sell stock and they know that.

Here are the tweets warning you guys all along

I am net short 12,500 shares at a mid .7388 price point as I said I was and would be since I expected a halt ANY DAY. This morning we got that halt and you can read it HERE.

Here is this mornings email filled with lies:

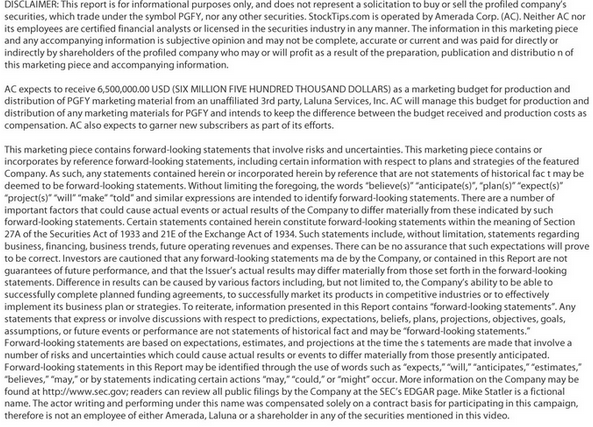

Below is the disclaimer $6,500,000.00 disclaimer and “fictional characters”

Below are the tweets leading up to the halt

$IGPK holders can believe all they want but just sticking to the facts as I did on $PGFY .. trade carefully this is NOT a buy

— Nathan Michaud (@InvestorsLive) May 7, 2014

Once again re: $PGFY like $PHOT – never make fun of traders who lose but the writing WAS on the wall & you ALL had PLENTY of time to EXIT

— Nathan Michaud (@InvestorsLive) May 7, 2014

@InvestorsLive now he can sell lol

— jake (@CAMAR024) May 7, 2014

Anyone bag holding $PGFY should use this rebound for an exit imo

— Nathan Michaud (@InvestorsLive) May 8, 2014

Once again, $PGFY I don’t care how high it goes (still down 50% from warnings) you do NOT want to own this stock

— Nathan Michaud (@InvestorsLive) May 8, 2014

I am going to remain short $PGFY over night tonight – not chasing weakness but will short pops #ticktock

— Nathan Michaud (@InvestorsLive) May 12, 2014

My plan with $PGFY is to short into any big push/cover into close (NOT into weakness) will wait for fast pop

— Nathan Michaud (@InvestorsLive) May 12, 2014

$PGFY so much for that bounce today I plan to hold short over night again — worth the risk (obviously will respect the trend if it holds)

— Nathan Michaud (@InvestorsLive) May 13, 2014

Holding $PGFY short over night again just in case it halts – just want to be there for it

— Nathan Michaud (@InvestorsLive) May 13, 2014

0 Comments