You can find a compilation of all Alex and I’s webinars here.

If you’d like to get involved in the community, there’s a sale still going on here.

Also if you haven’t seen yet – I’ve started an Audio-Blog series. I narrate all my favorite blog posts for you guys. You can find that here.

AMPE: This company… lol. Been following them for a while, have listened to multiple conference & earnings calls, it’s a complete clown show. It’s baggie heaven waiting to happen. I’m actually really surprised it’s back again. It will end the same way it did the last 3 times it tried to go – so this is a bit of a patience play, where I’m not quite interested in the ss just yet, but as it creeps up on that 3.50-4 level, it looks better and better. This company will have to face the music eventually, this should be their last hurrah I’d imagine. Higher the better.

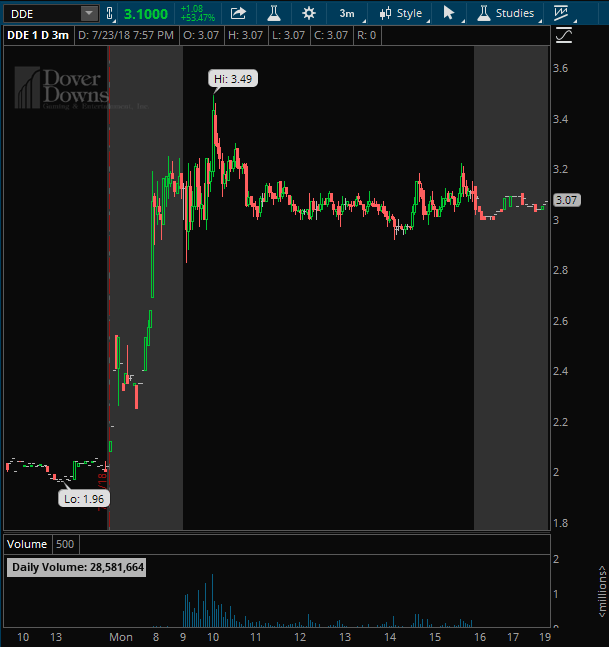

DDE: Held a bid and was supported all through the afternoon, could potentially be pretty jammed up with shorts who held o/n, no real reason to cover or bail. 28M shares traded, have to respect that – I’m hoping they are setting this up for another jam day tomorrow and then would be interested in the short on any capitulation move through 3.50. Otherwise pretty clear line there – if it doesn’t breakout, the secondary short play is on pops once 2.80s peak out.

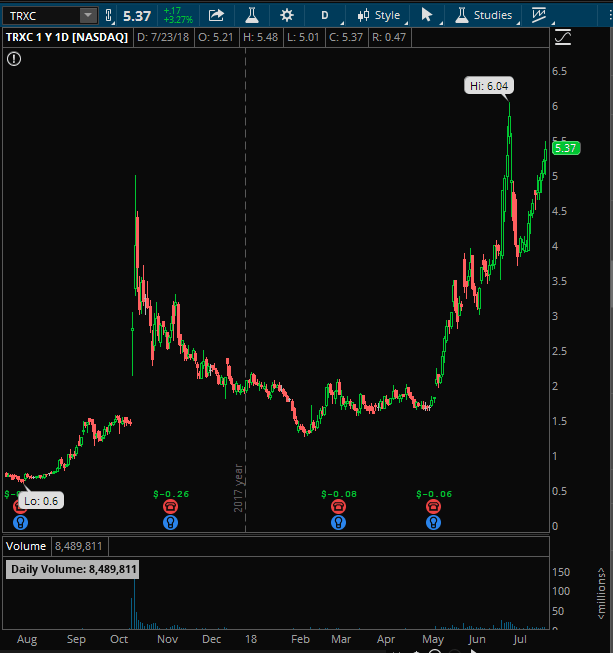

TRXC: This company seems to have a lot of believers, I’m not one of them. I think they are largely garbage, and will be very interested in the short back up around 6. Ideally they try and shove it through there for a squeeze event, but if it tries to go again tomorrow, i’ll be eyeing it for failed follow through and to start in on the short trade mid-high 5s.

If you’re not an IU member and would like to become one, there’s still a sale going on here. Shoot me a PM anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss trade ideas with you.

See you out there!

– D

0 Comments