Investors Underground has been the top online trading community for over 10 years. Over the years, we’ve tested tons of different brokers, platforms, and trading services and we only recommend the services we actually use on a daily basis. The industry is always changing and we’re constantly testing new services to stay ahead of the game. We want to make sure we have access to the best tools, the best pricing, and the best short lists.

This is ONE of the most COMMON questions we get on a DAILY basis:

The Importance of Broker Choice

Your broker can be one of your most important trading tools. There are many similarities across brokers, but the subtle differences can have a big impact on your trading. Your broker will have an effect on your commission costs, the platforms you have access to, and your ability to short certain stocks.

The Importance of Clearing Firms

Clearing firms are the institutions responsible for settling your trades. Basically, clearing firms serve as the “middle men” who facilitate the sale and purchase of securities.

Traditional discount brokers may use their own clearing firms or offer a single clearing firm to their clients. To most investors, clearing firms are an afterthought with little to no impact on their trading.

Day traders, however, will be noticeably impacted by the clearing firm they choose. Many day trading brokers offer their clients a selection of clearing firms, such as ETC, Wedbush, and Vision.

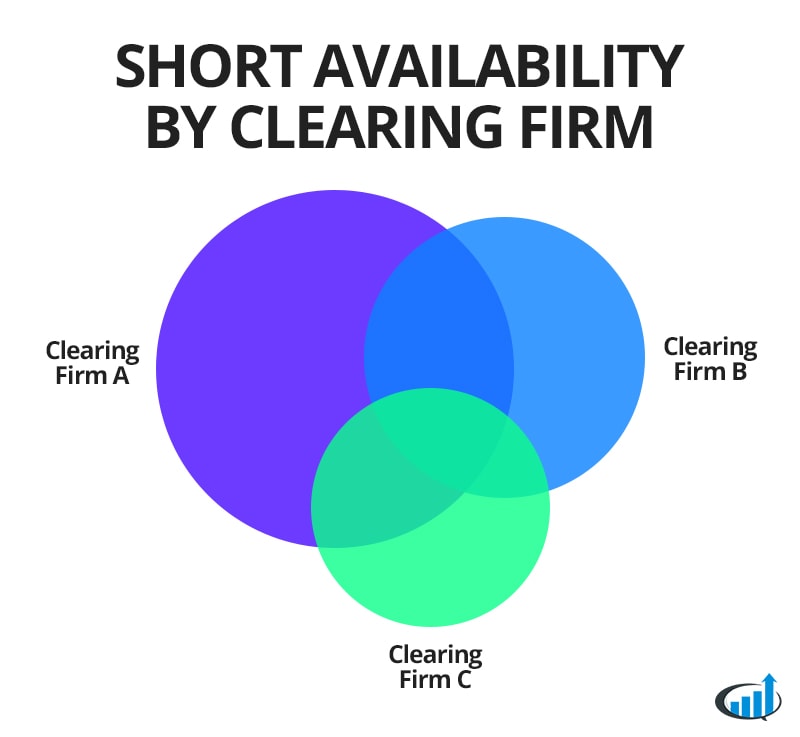

The most noticeable differences between clearing firms are short availability and fees. To put it simply, your clearing firm will dictate the stocks you can short and how much you will pay to short them.

For example, you could only short AAPL if your clearing firm had the stock available in their inventory. While most large cap stocks are shortable through any brokerage, small cap stocks can be much harder to borrow.

CenterPoint Securities

Announces New Clearing Firm

One of the brokers we recommend is CenterPoint Securities. We’ve been using CenterPoint Securities for a few years and have been impressed with their extensive short lists and great service.

CenterPoint recently announced the addition of a new clearing firm: Hilltop Securities. Hilltop Securities is a publicly traded company with a strong balance sheet and seasoned stock loan team. They have an impressive short list and a favorable cost structure. As costs for swing short sellers have been rising, Hilltop presents a possible solution to help curb these costs.

Intraday traders can also benefit from Hilltop clearing with an exclusive 25% locate discount and a supplemental easy-to-borrow list.

We’re Testing Hilltop Clearing

Investors Underground is always at the forefront of cutting edge technology and we’re excited to start testing Hilltop Clearing.

We’ve been hearing a lot of rave reviews from members in the room so we decided to start testing further.

Short sellers are always looking for ways to access better short lists and minimize the associated fees. We believe Hilltop presents an exciting opportunity for traders and Nate will be funding an account and trading there shortly. Stay tuned for an update!

Investors Underground + CenterPoint Securities

We stand behind every recommendation we make and CenterPoint Securities has proved themselves to be one of the best brokers for day traders. The tools and resources CenterPoint provides are generally only available to institutions and large account holders. Now, retail traders can take advantage of these same powerful tools without opening 6-figure portfolios.

Investors Underground members can get access to even better rates and discounted borrow fees. Reach out to [email protected] for your exclusive IU discount

The Benefits of Using Multiple Brokers & Clearing Firms

Remember, there is no ONE stop shop broker if you are a short seller. It’s about spreading the wealth across different clearing firms, all of which provide different inventories. It’s all about staying ahead of the game and that’s about having options, different places to trade. CenterPoint offers a handful of clearing options and this one has been getting rave reviews from many traders I talk to on the regular basis.

We’ve tested many brokers over the years and narrowed our recommendations down to a select few. Make sure to watch out free 30-minute guide to choosing a stock broker if you haven’t already.

Yes, Centerpoint, #1 that is no secret…. 50K to buy in. All the superstars use them and mention them on their videos.

OK. Question then. If one has 60K to play with.

What is best in your opinion…

The best broker one can get or

the most amount of brokers one can get (4 or 5)

for the same 60K.

Great article IU. You the Superstar!!!

Never located a share to short but I am interested to do so now that everything I try to short is telling me I can’t do it. Can you speak about the average price per share one has to pay for locates?