Day trading can be both exciting and confusing for beginner traders. Many new traders are attracted to the market because they see the potential rewards of becoming a successful trader. You have unlimited earning potential, you can work from home, and you can be your own boss. The rewards are clear. The hard part is connecting the dots and figuring out what path you need to take to achieve your goal.

At Investors Underground, we are dedicated to teaching day trading for beginners and traders of all different skill levels. Whether you have been trading for years or you’re just getting started, there is always something new to learn; there is always a new level to reach. Keep in mind that many trading questions can be answered with a simple Google search. Get in the habit of doing research whenever you have a question. If you get in the habit of doing this, you will gradually increase your trading knowledge over time.

For example, you don’t need to reach out to a trading mentor if you want to know more about VWAP. You just need to read a few articles and look at a few charts. That said, certain questions are harder to answer and some require the expertise of an experienced trader.

We get a lot of similar questions about day trading so we figured it would be a good idea to share some of the answers in a blog post.

I heard all day traders lose money and trading is just gambling. Is this true?

The short answer is, “no.” Obviously all traders do not lose money, however it can be very easy to lose money in the markets if you are not careful. It’s also important to remember that not all traders are making millions of dollars, buying yachts, and traveling the world. While the glamorous side of trading can be motivating, it’s certainly not the reality for all traders. Some traders make a part-time living or supplement their incomes with trading profits. Other traders trade full-time and make modest salaries. Then, there are a select few traders that make millions of dollars.

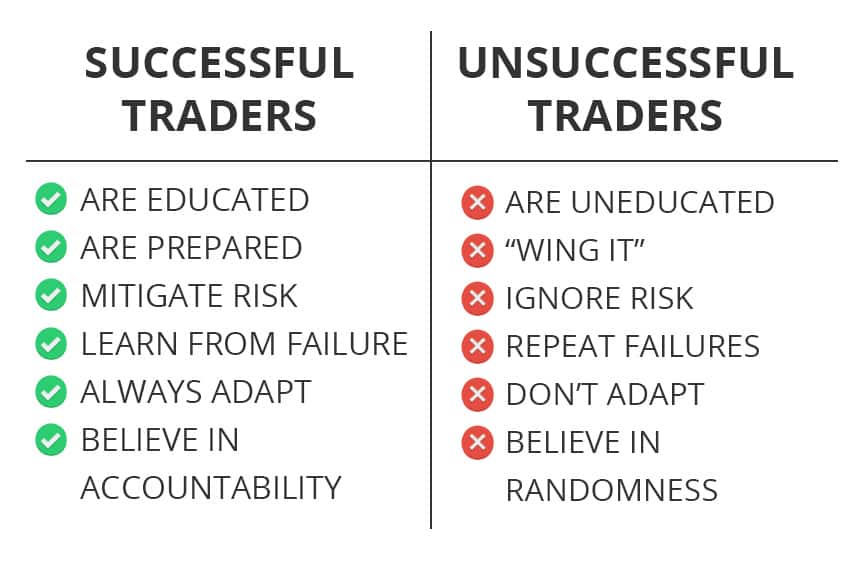

So, what separates the winners from the losers?

Let’s compare trading to starting a business. You’ve probably heard expressions like, “90% of traders fail” or “the stock market is just gambling.” You rarely hear similar viewpoints on starting a business. In fact, entrepreneurialism is generally glorified and praised in our society even though 50% of businesses will not make it past their fifth year. So, is starting a business gambling as well?

Yes and no. If Billy Blaze is struck with the epiphany that glow in the dark water bottles are the future and pours his life savings into the venture, he is gambling. If Joe Corporate researches an underserved market and develops a product and distribution strategy to reach his target market, he is not “gambling.”

Most (if not all) ventures have some form of inherent risk. Intelligent people do everything within their power to mitigate that risk. For example, if you are starting a business, you may decide to go to business school, do competitive research, start with a smaller investment, and pivot along the way. The same logic holds true with trading.

You need to educate yourself, do your research, and constantly analyze what you are doing right and wrong. There is no guarantee that you will make money, but you can do everything within your power to control the outcome.

I’m interested in trading but don’t know where to start. Any tips?

Step one towards becoming a trader is education. There’s no way around it. You need to put in hours and hours of research and analysis. How you choose to educate yourself is up to you; everyone learns differently.

We recommend starting with our free beginners trading course. We’ve compiled everything you need to know to get started. More importantly, we’ve organized the information you need all in one place.

There are plenty of ways you can learn on the internet, from blog posts to YouTube videos. The main benefit of a course is that it organizes all of the information for you. When you’re getting started, you don’t really know what to search for. You don’t know if you should be searching for “technical analysis” or “how to find undervalued companies.” A course solves that problem.

As you become familiar with the basics of trading, you may consider paid courses such as Textbook Trading or Tandem Trader. You can also look up specific questions and terms via Google, Investopedia, or our Day Trading Enyclopedia.

How much money do I need to get started?

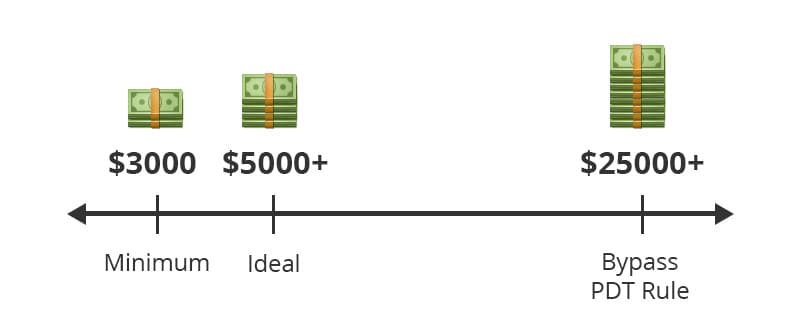

We recommend new traders have at least $3,000 in their trading account (ideally $5,000+). This gives you room to pay for commissions, take losses when learning, and take positions where you can make decent profits.

Many traders come to the market with the misconception that you need over $25,000 to make it as a trader. While you do need over $25,000 to bypass the Pattern Day Trader rule, you do not need $25,000 to trade. Traders with under $25,000 will just be limited to three round-trip trades (buying and selling in the same day) within a 5-day period. While this rule may seem restrictive, it can actually protect new traders because it forces you to choose your trades wisely. You’re less likely to settle for sub-par trading setups if you know you are limited to three day trades per week.

It’s also important to note that not every trade needs to be a “day trade.” Swing trading (buying and selling over a few days/weeks), can be a worthwhile option when you have a smaller account.

How Will I Be Able to Trade Expensive Stocks With a Small Account?

Not all stocks are expensive. Stock prices can range from fractions of a penny to $100+ per share. If you have a small account, you don’t have to trade the more expensive stocks.

That said, it’s not the price of the stock that matters – it’s the percentage gains. If your average position size is $5,000 and you make 10% on a trade, you will make $500 regardless of whether the stock you trade was $1 or $100.

Let’s illustrate that concept with an example. You buy a $10 stock with risk a stop loss at $9.70 (-3%) and a profit target of $11 (+10%). Your $5000 will buy you 500 shares at $10. If the trade goes against you, you lose $150. If the trade goes in your favor, you make $500.

Compare that to a $100 stock with a stop loss at $97 (-3%) and a profit target of $110 (+10%). Your $5000 will buy you 50 shares. If the trade goes against you, you lose $150. If the trade goes in your favor, you make $500.

Both situations have the same outcome.

Of course, these examples are theoretical, but the broader point is simple. Percentages matter more than dollar amounts. Just ask traders like Alex and Sandro who turned 4-figure accounts into 6-figure accounts by focusing on the right setups.

Can I Trade Part-Time?

Yes, you can definitely trade part-time. Most traders we work with are part-time traders. Some are looking to supplement their incomes, some are working on going full-time, and others just enjoy the challenge of trading.

If you want to trade part-time, you just need to tailor your strategy accordingly. Don’t expect to place momentum trades if you know you usually have early morning meetings.

Think about your availability and how it aligns with the market hours. You can decide to trade before work for a few hours or hold positions for a few days at a time.

How much money can I expect to make from trading?

This is one of the most frustrating questions because there is no definitive answer. We get a lot of traders who are just getting started and looking for a strategy to make $100/day. This isn’t the “make money online” niche and you shouldn’t expect to make “$1,567/day from home with only 3 hours of work.”

Theoretically, trading provides you with unlimited earning potential. That said, you shouldn’t put too much focus on the monetary aspect when you are just getting started. It’s distracting and potentially debilitating. Remember, you can also lose money.

Focus on developing a skill and set personal goals along the way.

It’s okay to set a goal of making $100/day once you’ve verified your trading skills, but if you go in expecting to make a certain amount, you will discredit your smaller milestones and hinder your own progress.

Which broker should I choose?

Discount brokers, such as ETRADE, are a good fit for most beginner traders. These brokers give you a flat per-trade commission rate and access to the trading tools you need. They also keep additional costs to a minimum.

As you begin to grow your account and develop your own unique trading style, you may consider other brokers. Brokers like Centerpoint and SpeedTrader provide more competitive rates as well as access to better short lists and stock locates.

Choosing a broker may seem like a big commitment but there’s no need to overthink it when you’re getting started. As a new trader, your broker is NOT going to make or break your success. You can always switch brokers at a later point.

If you want to learn more about brokers, watch our video guide:

Which trading platform should I use?

When you are getting started, use the platform provided by your broker. Most platforms do the same thing. They provide access to charts, scanners, level 2, etc.

ETRADE offers access to ETRADE Pro. TD Ameritrade offers access to ThinkOrSwim. SpeedTrader and Centerpoint offer access to DAS Trader.

These platforms are all relatively similar. If you have access to real-time data, candlestick charts, and level 2 screens, you have everything you need.

Choosing a platform often comes down to familiarity and personal preference. If you are unhappy with the platform provided by your broker, feel free to test other platforms and decide which you prefer.

What style of trading is best for me?

One of the great things about Investors Underground is we have a community of unique traders. Every trader’s strategy varies slightly from other traders. Some traders are short-biased while others are long-biased. Some traders are focused on momentum trades while others are focused on swing trades.

There is no perfect style of trading.

Focus on finding a niche that works well for you. Here are some things to consider:

What is your availability (schedule-wise)? If you have to go to work from 9-to-5 everyday, you may want to focus on longer term trades.

What size account are you trading with? If you have a smaller account, you may want to focus on small cap stocks where you can take bigger positions.

Are you better with numbers or research? If you’re better with numbers, you may prefer technical trades. If you’re better with research, you may prefer a trading style that incorporates some fundamental analysis.

Don’t expect to define your trading style after your first day of trading. You will learn more about your strengths and weaknesses as you begin to trade. Your goal is to set some basic criteria that you can continue to narrow over time. For example, you may know that $100 stocks and intraday trades are off the table from the start, but it may take you longer to realize that your best at trading small cap stock breakouts for companies with upcoming catalysts.

I keep losing money but I don’t know what I’m doing wrong. How can I figure it out?

First things first, remember that losses are a part of trading. Don’t expect to be profitable from the start.

It’s your job to take a lesson away from every trading loss. Losses are unfortunate BUT they give you the data you need to improve your strategy.

Focus on the “why” behind every loss and look for patterns.

Here are some questions you can ask yourself after a loss:

- Did I go in too big on the trade?

- Did I enter/exit the trade too early?

- Was I trading a setup I was unfamiliar with?

- Did I wait too long to cut my losses?

- Did I trade at a time when I couldn’t give the trade the focus it needed?

- Was my stop loss at a realistic level (either too high or too low)?

- Did I forget to account for something, such as earnings or broader market trends?

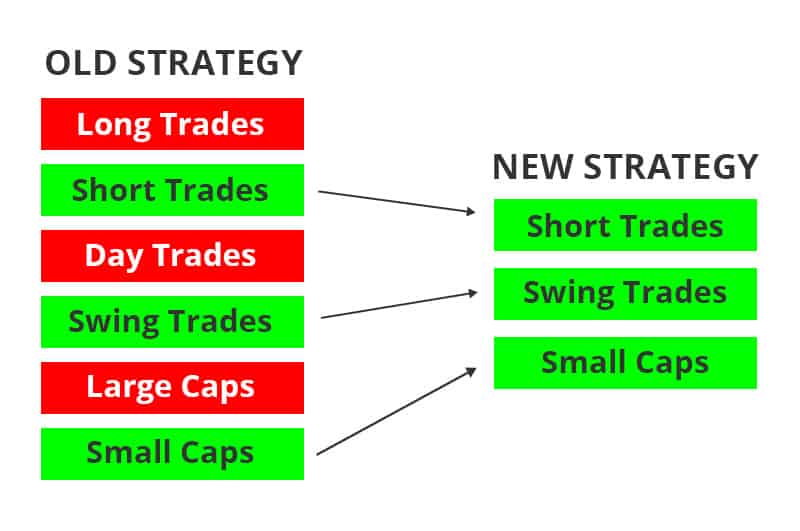

You should also focus on patterns as you place more trades. Focus on where you make/lose the most money and alter your strategy accordingly.

Here are some things you can focus on:

- Long vs. Short Trades

- Momentum Trades vs. Swing Trades

- Fundamental Trades vs. Technical Trades

- Small Cap Stocks vs. Large Cap Stocks

- Chart Pattern A vs. Chart Pattern B

- Morning Trading vs. Afternoon Trading

- Low Volume Stocks vs. High Volume Stocks

- Stocks With Catalysts (i.e. News, Earnings, etc.) vs. Stocks Without Catalysts

You may find that you lose 80% of the time when you focus on short-biased momentum trades on large cap stocks, but you profit 70% of the time when you focus on long-biased swing trades on small cap stocks.

These insights give you the information you need to start improving your strategy. Do more of what IS working and less of what ISN’t working.

Very good and helpful post, definitively you guys post better (free) stuff than Tim Sykes haha.

PD. You are wrong on this:

“If your average position size is $5,000 and you make 10% on a trade, you

will make $300 regardless of whether the stock you trade was $1 or

$100”

Is not $300, is $500 (10% of $5k)

Regards!

Great post thank you for the helpful tips and points on what folks ask.

Pretty disingenuous stuff. Ask the wife or more likely ex wife of those part time traders and see their take on the supplemental income. Making bits of money for a while and trader feels good, taking the wife out to dinner. Then starts losing and dipping into savings accounts and feeling down prob not concentrating on the marriage or job. End of the year fees put the effort into a negative.you know guys like these, the last 15 years or so struggling with trading, do you want to encourage more of that reality. There’s way less career traders than you let on. End of day guys don’t be contributing to time waste, everyone’s worth a lot so don’t have more of them stuck in a quagmire.

Thanks for the info I{m just starting investing and need all the help I can get.

Irvin

So now you have been doing it a while, do you feel you have a grasp of it? Did you learn more from one specific Article or source of the How to’s? Are you still doing it? Would you recommend anyone to do this Investing?

Thank you for your understanding…..

Hi,if ever I wanted to look for the broker like Etrade do they have a site to look up to or you guys will send the link?

Thanks I’m new, and it’s big help.