What amazing runs on cannabis stocks !!

$CGC $TLRY $CRON important to remember these are in squeeze mode — these can hold longer than you think off dips.

— Nathan Michaud (@InvestorsLive) August 21, 2018

I had a feeling as soon as we had this first CGC move and knew not to underestimate it RIGHT away. I guess that’s always half the battle right? Knowing what NOT to short — but if you know NOT to short it — why is it so hard to get long??

Not this time !!

For those that have been following me on Twitter, you know that CRON has been a monster swing – from the $6 to $8s then the $8.50s to $11.60s this AM. Yes, I sold a bit too soon what can you do 🙂 As I said Friday, had I been glued to the desk all day, I probably would have sold more but I was away at a golf tournament and let it go into cruise control without watching every tick..

Golf tournaments are always better when you have a nice $CRON swing on 😁 nice work to those who are involved with the game plan / idea over last few days !

— Nathan Michaud (@InvestorsLive) August 24, 2018

I didn’t sell any after hours on Friday despite being up nearly $2 on the day as I figured we were going to get a big squeeze across the sector this week. I’ve had a pretty solid read on CGC TLRY lately, and IGC was the one I typically would go to right away but for some reason I just had a hard time getting there until mid .90s. That’s OK – half the battle is getting there!

I made a video today about something that I can only HOPE for every day I wake up. REAL LIQUIDITY. You see me get VERY frustrated about manufactured liquidity many times when I am quietly swinging names/big picture ideas, whether it be by definition a swing (over multiple days) or just bigger picture INTRADAY idea. The KEY of the trade is buying when no one wants it and quietly letting the trend do the work. Typically any liquidity event only causes a hiccup in the plan and can really destroy a slow squeeze ie: IDRA TIS etc.

One of the most recent trades that I got really upset with was IDRA which I had a sized swing from $5.80-6s. A particular newsletter got long, shot it up .40-.50 cents in a few moments which is fine (who doesn’t like $$ that fast?) but my game plan was big picture. I was looking for the $2-3+ move or more and put in the work of getting a proper entry with proper risk and sizing in accordingly. That goes to waste when the masses all come running into the offers and it hits a wall — because they have one place to go when it stuffs — THE BID!

I almost lost it again today on TIS with a similar situation. The stock was alerted by a newsletter which brings in the “manufactured volume.” I did sell some into each of their buys (it’s a rule I have) but as you saw it floated up quietly .50-.70 off people’s radars and the only time it dipped was after a newsletter decided to tell the masses it was time, and about 1 minute later they all exited. Usually one in and out isn’t a disaster but two usually is – that’s what happened last time so I got nervous today.

So — why does all this matter?

The difference is REAL LIQUIDITY vs. MANUFACTURED LIQUIDITY.

When you compare the pot sector to OSTK RIOT SSC NETE DPW MARA etc these were all multi day moves, multi hour moves, natural movement in the sense that ONE CROWD could not make or break the name. It wasn’t just about 1,000 people all buying a low float stock and then dumping it one to three minutes later — it was an actual legitimate market.

$TLRY $CGC $CRON is the hottest sector ramps I’ve seen since blockchain names $RIOT $DPW etc

— Nathan Michaud (@InvestorsLive) August 20, 2018

And, that’s what brings us to these moves today:

CGC started it all with a MAJOR move. Itgapped up and ran over $10 pre market and then faded all day (both profit taking and shorts positioning). On the 2nd day of consolidation I said I believe the move starts tomorrow and the only place to SIZE is $33 + as you can see it peaked out twice. Once this confirmed that the sector was taking a second leg I immediately looked for what names were sympathy. (That’s where the TLRY original idea came from $26-27 range off dips).

Then CRON was the laggard name but I could tell there was someone in there QUIETLY SOAKING size.

$CRON nice lil sympathy move starting off $TRLY $CGC

— Nathan Michaud (@InvestorsLive) August 15, 2018

REAL $$ was stepping up to the plate and each time it should have been hammered it held trend. Each time it washed out and held it bumped back up quickly on lower volume — which is what I need to see after an absorb happens. If it rebounds and is met with an offer that doesn’t uptick — it’s likely going lower. I think if you compare the discussion of CRON with today’s IGC you’ll see many similarities and it’s by no mistake.

THE EARLIER YOU CAN SPOT THE SOAK THE BETTER EDGE YOU’LL HAVE

Understanding where the money is flowing is VERY important. It’s a breath of fresh air when you can trade legitimate momentum vs. having one or two parties being able to control the entire float of a name and literally turning what was a great trade into a disaster in one candle since there isn’t an underlying market.

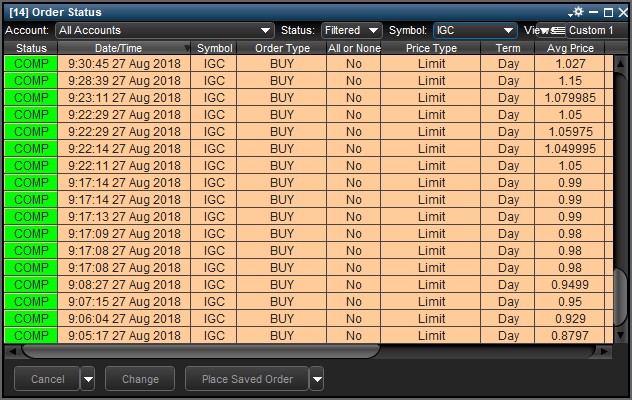

So here’s the chat logs from today. I started into IGC early despite a bit of a chase but stuck with it all day – I did not get into the size I wanted to but that’s OK it still added up and worked well.

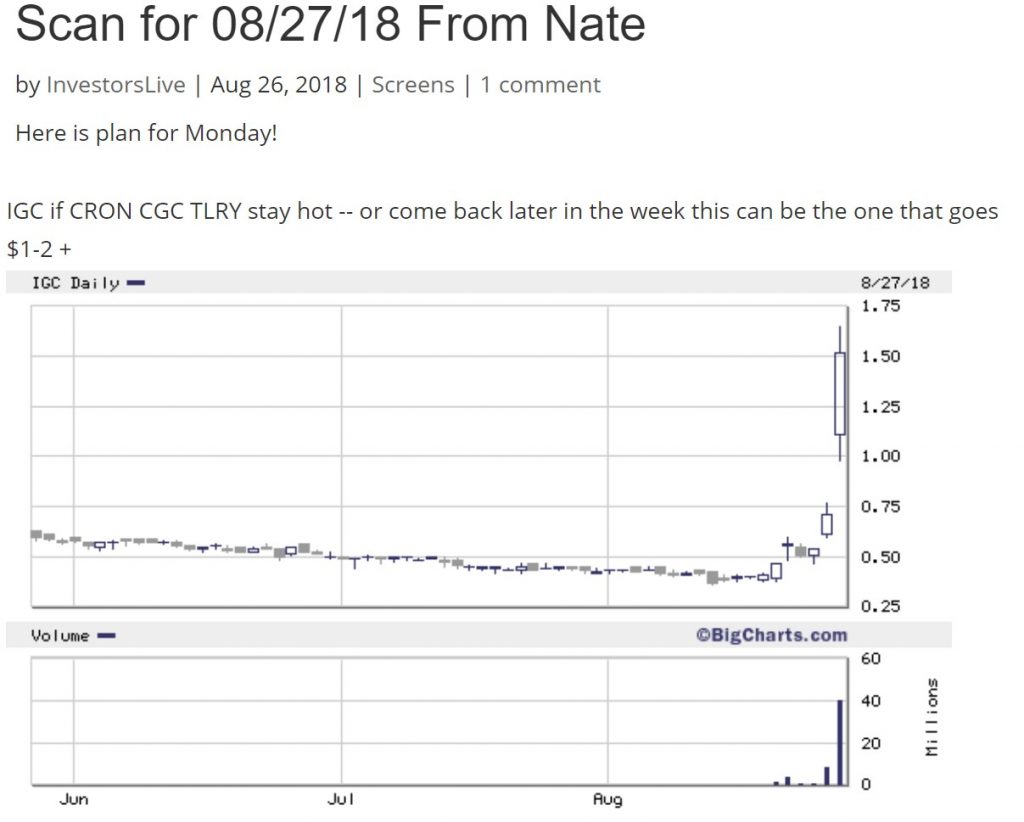

Here was last night’s plan on IGC:

Chat Logs for Monday, August 27, 2018

09:04:39 am InvestorsLive: IGC nice rip damn

09:17:18 am InvestorsLive: IGC nice

09:17:19 am InvestorsLive: nice

09:17:38 am InvestorsLive: been joining dips thru morning per scan plan but only chase size

09:17:41 am InvestorsLive: I missed the first move

09:17:52 am InvestorsLive: think same as scan tho

09:18:02 am InvestorsLive: TLRY CGC CRON all higher the better

09:21:51 am AlexP: IGC more

09:21:53 am InvestorsLive: IGC bingo

09:23:32 am InvestorsLive: in my eyes TLRY CGC = OSTK

09:23:34 am InvestorsLive: CRON = RIOT

09:23:37 am InvestorsLive: IGC = DPW MARA

09:23:59 am InvestorsLive: that’s my thought process in the pot kingdom comparing it to a run you should be familiar with when crpyto was hot

09:29:15 am InvestorsLive: IGC will add all dips if $1.05-1.10s stay firm

09:33:55 am InvestorsLive: IGC

09:34:13 am InvestorsLive: Pay yourself along way can alwrays add dips

09:36:18 am InvestorsLive: IGC back sub $1

09:44:20 am InvestorsLive: Nice clean up job IGC

09:52:24 am InvestorsLive: IGC I think its good to keep on radar

09:52:31 am InvestorsLive: but I think I’d be cautious

09:52:33 am InvestorsLive: until firms up

10:02:36 am InvestorsLive: impressive staying power IGC so far

10:02:39 am InvestorsLive: they worked me out of any size I got – damn

10:05:42 am InvestorsLive: working back in vs. VWAP over/under guide IGC dips as long as no stuffs on $1.20

10:05:56 am InvestorsLive: lock in along way if you took the trade nice trigger at .90

10:29:11 am ChadL: IGC holding up so far

10:31:41 am InvestorsLive: so my thoughts on this IGC since its a popular one

10:31:50 am InvestorsLive: its super difficult to hold, looked really bad etc nad heavy but

10:31:57 am InvestorsLive: if you think about it — its ran a lot it should do that needs to work out the size etc

10:32:09 am Ptrader: IGC feels like $2+ if cron CGC dont die

10:32:27 am InvestorsLive: I do think this will have real momentum vs. just one and done low vol pump $ I think it’ll be really liquid so, my $1-2 thought on scan sitll stands but its all about entry- I am hopeful for dips weak open tomorrow but

10:32:29 am InvestorsLive: 100% staying on radar

10:33:55 am InvestorsLive: ideally get a chance at low .90s again IGC if these get heavy

11:01:56 am InvestorsLive: IGC still super heavy but think a good snap back in store – no interest in s/s yet but still hopeful for weak open no current pos.

11:15:43 am InvestorsLive: note the soak IGC — just remember this later in the week

11:15:59 am InvestorsLive: when I make a decision quickly to join trend — someone clearly taking in size today even tho trend going down

11:16:09 am InvestorsLive: but rather not buy too soon — but I will remember this if we are back over $1.20 later on in week

11:19:52 am InvestorsLive: if next dip holds IGC will start a swing and ideally hope for weak open along trend vs .90-.95 mental risk

11:23:21 am InvestorsLive: IGC — hopefully comments are helping

12:24:22 pm InvestorsLive: IGC churnin’

12:28:21 pm InvestorsLive: IGC gear

01:21:15 pm InvestorsLive: IGC Perk

01:44:17 pm InvestorsLive: IGC same thought process but hopeful for weak open tomorrow still any trades will be w/ that goal in mind

01:48:40 pm TexMex: IGC 1.15’s up

01:49:13 pm InvestorsLive: IGC fantastic read so far

01:49:21 pm InvestorsLive: no need for FOMO imo

01:49:32 pm InvestorsLive: don’t chase it up – think big picture pateince etc

02:01:05 pm InvestorsLive: anyhow — IGC nHODs

03:16:56 pm Crisgo: IGC near highs

03:29:19 pm InvestorsLive: IGC hell yes guys

03:29:28 pm InvestorsLive: did not size in as much as I wanted that’s for sure – nice read tho

03:45:15 pm TexMex: only IGC doesn’t pull back here, pretty strange, but feels like shorts maybe trapped there

03:54:42 pm InvestorsLive: IGC I plan to hold over just fwiw again I did not size in but as I said earlier thoughts are same as scan and ideally get a weak open for entry if not a big gapper

03:55:05 pm InvestorsLive: had a perfect read on this thing but had such high conviction I told myself to chill since I had nice CRON trade I figured I’d get too loose and make a bad decision o well

03:57:03 pm InvestorsLive: Remember the risk with IGC — of course o/n I would recommend definitely locking in along way before close and cautious w/ over night size in the event they use this to raise $$

03:57:14 pm InvestorsLive: But I think that’s why we are here — most had too much belief they’d use it

03:57:39 pm InvestorsLive: sold some IGC

04:00:42 pm InvestorsLive: NICE READ IGC today guys

04:01:15 pm RockfeiderTDR: Nate, you are awesome!!!

04:01:36 pm RockfeiderTDR: IGC was just what I needed today…haha!!

04:01:37 pm btr8er: Beauty IGC… Thanks for ATAI, Murdered FANH, Good on CRON and TLRY both ways

04:01:48 pm InvestorsLive: nice work guys

04:01:49 pm InvestorsLive: glad to see

04:04:19 pm InvestorsLive: so note the difference here guys

04:04:29 pm InvestorsLive: I said it earlier and the main reason I treat this trade differently

04:04:30 pm InvestorsLive: real $$

04:04:38 pm InvestorsLive: its not a pump name like newsletter pump style

04:04:42 pm InvestorsLive: its REAL $$ flowing right now

04:04:45 pm InvestorsLive: just like DPW MARA

04:04:47 pm InvestorsLive: vs RIOT

04:04:48 pm InvestorsLive: vs OSTK

04:04:55 pm InvestorsLive: vs. Bitcoin I guess at the end of the day

04:04:57 pm InvestorsLive: same thought process

Great thought process. The terms you coin are priceless. I must be the biggest fan. Way to go Nate…