Are you a reckless trader? Are some of the ‘more questionable’ decisions you’re making (and sometimes rewarded for) hiding something? By no means is this an “I told you so” post, despite having done exactly that – this is an OPEN your eyes to the risk at hand and review your trades on APDN post! Were you LUCKY on Tuesday? Were you rewarded for being reckless?

I’ll show you why I think you were, no matter the gain you made. If you want to be a career trader start reading now. If you want to gamble – you’ve read enough.

You’ll see me occasionally post #KnowWhatYouOwn on Twitter. It’s when I’ve done the work myself and feel the need to let longs know what they’re up against. It doesn’t mean it can’t go higher – that’s not my goal with the tweet. It’s just a good time to re-check that dial (something I learned at Traders4ACause) and make sure that your risk is in check with the reward.

$PSTV latest edition of #KnowWhatYouOwn pic.twitter.com/YRm0JG5EHW

— Nathan Michaud (@InvestorsLive) September 23, 2019

As I noted in one of my speeches and many YouTube videos – if you’re curious as to the WHY I was warning so much the last few days, the easiest thing to do is reverse engineer the two trades and look for similarities.

Watch the video as it unfolded live (and scroll down for the trade below)

Seconds are everything in trading.

09:13:27 am InvestorsLive: S1 S-1MEF – APPLIED DNA SCIENCES INC

Below is part of the pre market call we do every day in the room:

There are so many times we are rewarded for reckless decisions. Reckless trades, reckless choices, not always reckless results though, that’s the problem! Sometimes our biggest flaws are hidden by profits that were acquired by reckless decisions.

Not to mention the known risk …

Amend amend amend ….

Writing on wall.

Doesn't mean it's a fade (yet) but definitely something I won't long when it could surprise you midday.

This is your warning.#KnowWhatYouOwn

Reckless or not. https://t.co/BDYkH7eaGe

— Nathan Michaud (@InvestorsLive) November 12, 2019

It’s very rare you see me be a broken record. No, I don’t try to be a hero and call the top on these things – been there, done that – it’s not always rainbows let me tell you. I’d rather be on the back side of the move. Remember the further they squeeze the more downside there is and many times the REAL downside comes AFTER the crack (even though we’re always so eager to cover on that first slam).

I don’t warn online to bash things with a goal of getting them lower. Rarely do I put a bias on these things because at the end of the day there’s algo’s watching everything that’s done. Why show your entire hand? But, what I will do is yell, when there is a boat load of new traders chasing momentum who are hours away from getting their accounts blown to pieces.

I just tweet what I learned the hard way over many many stubborn losses.

Some don't carry the same risk.

Some do.

The one's that do I mention.

Nothing worse than getting stuck.

Rather wish I was in vs. wish I wasn't in.

That simple. $APDN https://t.co/PtTzUQ71DG

— Nathan Michaud (@InvestorsLive) November 12, 2019

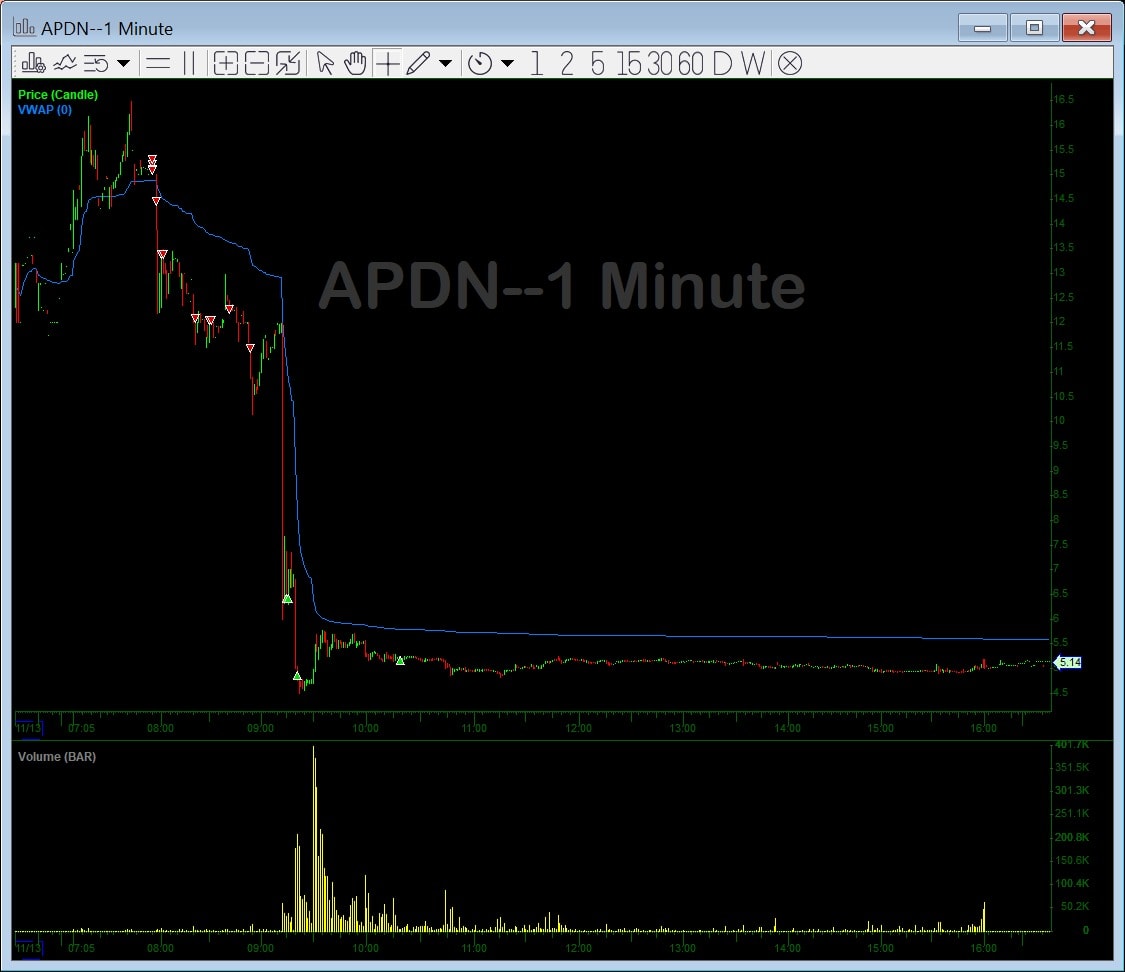

This morning I related APDN to PSTV you’ll note that this PSTV raise happened INTRADAY. The risk was KNOWN, traders knew that they could raise at any moment but yet had FOMO and wanted to be part of the next big thing. Why not? It’s sweet when you get paid out for being reckless but as noted at the start of this post — MANY times our WINS hide some VERY reckless behavior. Everyone always says to focus on your losers so you can learn what you did wrong etc. but I’d like to stress the importance of reviewing your winners and what COULD have happened had you not been so fortunate as most longs were yesterday on APDN. I don’t care HOW MUCH you made yesterday on APDN your behavior was reckless and will be the end of your trading career one day if it’s not addressed.

No matter how clean the trade was yesterday – trading is a marathon not a sprint. Don't put yourself in harms way. This chart will serve as reminder of why I don't go long ones that have the risk. pic.twitter.com/FaC3llxBt4

— Nathan Michaud (@InvestorsLive) November 13, 2019

There are just certain names I won't long. I know my biases — just look at $PSTV would hate to lose $10/share.

Yes in hindsight woulda been sweet.

But not my style.

For me it's a marathon not a sprint.

— Nathan Michaud (@InvestorsLive) November 12, 2019

This PSTV example is literally a carbon copy of what happened.

Here’s the APDN trade as it happened and just how fast the alert

Next up NSYS

Do you have someone looking out for your best interest?

Thanks for reading, hope to see you part of the community soon. Have a great day!

Great post!

Glad you enjoyed !

Thx for feedback!

I genuinely appreciate you and the wisdom your share. Thank you, Sir!

Nate have you consider to make a new or updated DVD ever ?

Think in the market lots have changed etc algos step in more in pennys

or new thing which you were learned since your last dvd’s thx

Definitely have thought about it but everything in DVDs still up to date and accurate I’ve just fine tuned it a lot.

The daily video lessons discuss a lot of the new stuff as well and Traders Lounge during day.

Nate, I finally read your post. Thanks again! I’m a beginning trader and watch and study your Sunday watch list each week. I try to follow along but sometimes get lost in your jargon, like flush, stuff, backside etc. There is a lot to learn. I hadn’t really studied shorting stocks but after listening to you for a while a get it right some times. I find myself getting in and out too soon. Good thing I’m still on a simulator!

Thanks again for sharing all of your knowledge!

That is what separated elite trader from chasers, cheers nate, thx

thanks Nate