I really wasn’t sure where to start with this post so I’ll start with this: I think it would have been easier to cover at $11 on KBIO than it would be at $4, $5 or 7 to $8 range. That makes no sense right? Well, keep reading and you’ll get it by the end of this article.

KBIO is another reminder of why new traders should stay away from shorts if they are not familiar with the risk of holding overnight. Although this rarely happens, it truly drives home the point that short side losses can be unlimited, compared to a long where you can only lose 100% of your investment.

There’s five points I want to make in this article:

1. A Brief Intro and What I think Happened

2. How would you have reacted?

3. The Twitter response

4. What can we learn from it? (holding low floats overnight, not using margin, etc)

5. Where does it go from here?

What Is a Short Squeeze?

First things first, it is important to understand the concept of a short squeeze. A short squeeze occurs when shorts are forced out of their positions due to a stock that keeps increasing in price. When short sellers liquidate their positions, they are forced to buy back the shares that they initially borrowed to short sell. These market buy orders continue to push the stock up in price, causing even more short sellers to liquidate their positions. The causes of a short squeeze can vary, but may include margin calls, a dramatic and unexpected rise in the stocks price, or a high short interest in a stock.

Brief Intro on KBIO and what I think Happened

There is SO much to learn from KBIO. The talk of the entire twittersphere this week was this tiny near bankrupt company that literally black swan’d itself from zero to hero over night.

To sit here and think that Martin was a mastermind behind a monster short squeeze that he orchestrated at the expense of short sellers is not even close to plausible on his first buys Monday morning. His goal was to take over the company. There was no squeeze at that point just a crappy company going out of business gapping down. Martin came to the market with a plan after reading Friday’s news on KBIO. He was the primary buyer from 8AM to 9AM based off his initial buy range. However mid to late day Tuesday is when things got a little juicy and he got his “investing group” in as the opportunity unfolded. The second day was just committing through what he’d already started and that’s when I think things clicked.

When Martin’s buddy Marek Biestek bought things had changed and they knew it! The fact they knew a short squeeze was imminent was highlighted by his actions BEFORE filing the From 4 later that night. He pulled a dirty move by retweeting Gregg’s comments knowing FULL WELL what they are onto, and then he took his twitter handle private after he realize that was a pretty dumb move.

At that point forward they knew they were onto a major squeeze.

Photo credit HERE.

Let’s dissect it a bit.

A small known reverse split diluted turd of a company had announced on Friday that they were likely closing their doors. KBIO had a nice gap down pre-market Monday morning. which is very typical of a near bankrupt company. Lots of times we see these names get accumulated for a bounce play and they ramp up consolidate a bit before ultimately fading off. This time, it was different.

Martin had a plan, as you’ve seen if you paid any attention to his live stream the past few weeks, he’s a pretty frigging smart dude. He works faster than my mind can even comprehend and moves like the ones he made on Monday and Tuesday are all about timing and opportunity, oth of which he nailed to perfection.

This is something that may happen .01% of the time at best. Black Swan. As urban dictionary states “An event or occurrence that deviates beyond what is normally expected of a situation and that would be extremely difficult to predict.” And that’s exactly what happened here. I saw three or more research reports and/or views that valued this thing between a half dollar and dollar. You know what? They were likely 100% spot on (like usual mind you) but this time something wild happened. An investment group led by Martin absorbed nearly seventy percent of the entire outstanding shares (or eighty percent of the float) accumulating them right off the open market..

What’s wild is they were able to take control of this company through (in my opinion) acquiring stock which more than likely wasn’t even the regular share holders selling. In other words, I believe shorts handed this company over to Martin for pennies on the dollar. This may confuse you but don’t worry, I’ll get into it.

I made this image as a joke but it’s literally what happened.

https://twitter.com/InvestorsLive/status/667431984550027267

Since the run back in September on KBIO, it’s been on a steady decline. Shareholders were down well over fifty percent and on Monday morning woke up nearly down eighty percent down on their “investment.” KBIO was nothing more than another name about to do another reverse split, spin some other shit or rebirth story into it, and repeat once again (just like NEWL, FREE, AXPW and many other repeat offenders).

Here’s what I think happened. Knowing that shareholders were down so much, most unsuccessful traders will just hold onto their losers and start to rationalize why they are long and fight with everyone else about why THEY are wrong. These traders assume their investment is RIGHT no matter how low it goes. Just as we warned on AVXL you’re seeing this first hand where everyone was in 100% denial and “just wait for the data” only to see it drop 70-80% over the next four or five days.

My point here is it’s HIGHLY unlikely that the shares that Martin and Co. acquired were from the bagholders. More than likely it was a failure of the system. When stocks are easy to borrow and even hard to borrow for that matter most of the inventory is calculated on some mathematical equation that gives a certain number that should be available based on a bunch of stuff that I don’t even understand. As stocks like KBIO trade .30 to .60 to $1 to $1.50 etc they attract a lot of attention. If they had hardly any volume, it’s likely no one would care. When they are trading millions upon millions most traders that I know position themselves accordingly based off what’s going on. For example, are you going to short 20,000 shares of a stock with 250,000 volume? The answer is no. Are you going to short 20,000 shares of something trading five million or more shares? More than likely, seems more reasonable.

Well, when the shares rotate over and over and early shorts get out, covering into new shorts and so on and so forth, which creates more and more liquidity. The traders who did some brief due diligence figuring out that hey .60 or $1 is likely fair value failed to take into account the momentum. So their short at $1.20 which is now nearing $1.70 starts to take a stab at their emotional strings, forcing them to cover into the rush for fear of a $2 break. Who do they cover to? Next round of shorts who is taking advantage of them. See the pattern? Yep, a lot of volume but the SAME volume over and over creating an appearance of a MAJORLY liquid market that’s really not that liquid at all.

Flash back to what most “traders” aka stuck holders do on names like AVXL, SPHS and KBIO – just hold and hope right? Even if it keeps going down, they stay positive for the rebound. Well, you think they’re selling at $1.50 or $2? I don’t. My point is, I believe the reason Martin got control was not buying 80% off the holders from $4, $3, $2 etc, but the opportunity presented due to the liquidity and number of shorts. There was likely another two million shares minimum out there NOT in the regular float I would estimate (I have no calculation here to get to that number, just an assumption based on how it was trading and how many shares Martin and Co. bought). The numbers don’t lie. First off, who is around at 4PM to sell 100% of the the remaining float to shorts looking to cover? They aren’t. Investors that got in at $2-4 range finally had the opportunity to get out but now there’s two million or more emotional shorts pulling the oh shit handle looking to get out at any expense as long as there is size to cover on the offer. At this point it’s easy to take out the remaining ~500-700k float that’s left after Martin and Co. was done buying every share under $2. I think the liquidity created an appearance that made traders forget just how thin the float was and they made decisions based off what they saw and not reality. Many will remember NDRM from years back which was a very similar situation. Typically, it’d trade 50,000-100,000 shares and then it traded 41 million in one day. Trade size relative to the volume but when the tide change, yes it’s just as thin as any other day when it trades 100,000 shares.

Confused? Don’t be – read it again and keep reading.

So my thought is, shorts are what gave Martin and Co. the ability to acquire so many shares so cheap. Maybe the first 500k he bought not so much because he was a buyer first thing at 8AM on Monday morning pre market based off the filings. As a sidenote to all the ridiculous theories out there, I doubt Martin “saw” everyone short biased and decided this was something he was going to do (at first). He researched (just as he shows on his stream) and bought out every shareholder that wanted to sell to him under $1 that morning. After that, traders stepped in shorting pops, buying dips, momentum started up and the liquidity was born. With the liquidity came increased interest on the short side, which created more inventory available for them to buy up controlling interest.

Don’t forget the first few moves on KBIO. When it started to run, it ran .30, .50 at a time – jumped up and bounced all over the place on low volume. My point? Nothing really changed to the share structure from that day so how did it become so thick? I think I explained that above.

https://twitter.com/Traders4ACause/status/647840239008923649/photo/1

It was a perfect storm. As Peter Brandt said at Traders4ACause, KBIO was the CHAMELEON. What do I mean? KBIO was the same damn thin name, just presented in a different disguise. The disguise was volume and price action.

So, flash forward to the 18th when the Form 4’s hit. Holy shit, oh that’s right this is a THIN name. All of the traders that traded based off the volume forgot just how thin this name actually was, and it just got a whole lot thinner. Panic. Emotion. What to do? It doesn’t take much to get a low float name going and when there is a million or two on the wrong side of the trade, this is what happens.

I have to say, I am SO happy that it was insanely hard to borrow at most of the firms where the “littler guys” (and I mean no offense by that, we all start somewhere) trade, because who knows – if it was easy to borrow, I’m sure there would be a ton of causalities.

How I would have reacted?

Give this section a serious thought. I did.

The night this happened I took a solid hour looking at the chart and wondering just what I would have done if I was short and if I would have reacted any better or worse than anyone else. Truth is, Phil, Eric and Loui’s covers are so commendable. It’s hard to explain but it truly would have in my opinion been MUCH easier to cover at $11 than it would be at $4, $5 or 7 to $8 range. Seriously.

This type of move is SO rare that it’s likely it will not happen for a very long time. Although I say that, I said the same thing about AQXP and we almost did and still may see it on KBIO which is only a few months later. The chances of it happening are so slim but as we went over above – Peter Brandt’s quote makes so much sense because no matter who you are as a trader you’re going to face speed bumps along the way. If you think you’ll be immune to set backs, then quit now! Things may come back a month or two later in a different form only to test your ability to do the right thing, once again.

To be quite frank, I’m not sure I would have done the right thing on KBIO. Seriously, I’ve thought about it a lot. I’d likely have froze and waited for a small pull back even .50 or $1.00. Then if it popped again I’d probably debate adding a bit to capture any quick dip and then just all out panic cover at $11.

You never really know how you’d react until you’re faced with the situation at hand. No matter how “PERFECT” you think your trading rules are, if you’ve never really been tested and I mean tested, you never know if you’ll break them. The tweet below is literally the best way I’ve found to explain the exact point I’m trying to make, Thanks Jesse (who is a great mod in Michele’s room by the way) for sharing his conversation with @Canny4 as he figured out a way to make it make sense.

https://twitter.com/PsychoOnWallSt/status/667925314798878720/photo/1

I’ve compared what I’ve done in the past when I’m faced with a situation at hand where I may be in a bit too large, a bit too early and rules are tested. Sometimes no matter how good you’ve been in the past there’s always that small possibility that maybe it could dip? A little bit? And sometimes that’s the difference between in this case a few hundred thousand dollars, no joke.

I’m going to use Eric as an example here (but you can apply this same section to Phil as well – as he shared. He’s had his best year ever and absolutely impressed me with how well he’s done. Not necessarily with how much he’s made but flash back a year it’d take him $15,000-$20,000 draw down in a position to get pissed off that he didn’t respect his plan. Today, I talk with him and he’s like “MAN I did it again, I knew it, I didn’t cover and shit is going against me.” Oh yea? I’ll ask him how much he’s down and often replies $1900 bucks man, dammit I should have taken it off. Impressive and that’s what it’s all about, keeping losses minimized and really flexing and adding into winners. True story.

Anyway, back to what would you have done? Again I use Eric as an example just like he shares his wins he shared his loss. He called me as it was happening because that’s what we do; we are there for each other when times are good, and the rock we all need when times aren’t good. Ready for it? Eric ate a $375,000 dollar loss a $7 to $9 bucks. Wow right? Well, forget the $375,000 because that was a good loss.

We were on the phone he’s like “DAMMIT I covered the rest at $9 dude, it’s $8.60 now, ugh I should have waited.” I responded and said “Eric, seriously think for a minute, what’s the difference?” He said “You’re right.”

So how the hell is a $375,000 dollar loss good? He did everything RIGHT. Heck the guy just made $200k in recent weeks on AVXL and others so sure it’s a dent but it’s not a blow up but let’s take a look at what happened to KBIO fourteen minutes later? $9 bucks was history, $10, $12, $14 and all the way to $18+ after hours. Wait around and “see what happens” and experience a seven figure loss. It is by far most commendable that he ate the loss at those levels. Like what I assume I would have done he froze at $4, $5 in disbelief thinking possible pull back then $6 happened $7 at that point a small speed bump was turning into a thorn in his side.

I challenge people to think what they’d do in this situation. The answer is not “Oh I’d just cover at $3, or $4” because sometimes you’re not that fortunate. Sometimes there’s no inventory on the offers and it skips fifty cents to a dollar plus in a split second. The point here is you never really know how you’ll react until you’re faced with that situation.

Granted this situation was on steroids since there was some size involved but even on a smaller scale it’s all relative to the trader.

As most know, I preach about crowded trades. When everyone feels the same way about something I tend to ignore it. I literally take it off my charts and focus on other names. There were many negative traders and newsletters on KBIO and it was just not breaking down. Now, let me set something straight here – this by no means is me saying “oh it was easily avoidable” and “obviously it wasn’t a short” or “I told you so.” This is just a trade that I won’t touch – hence why I warned given the crowded nature against shorting it. ON THAT NOTE, I’ve missed out on COUNTLESS profits by NOT swinging names like this such as AVXL and SPHS where everyone just absolutely banked earlier this month. So, although I’d never swing a low float pharma crowded style trade short, there are many who do and typically bank 99.9% of the time.

That’s the reality, if you disagree – so be it.

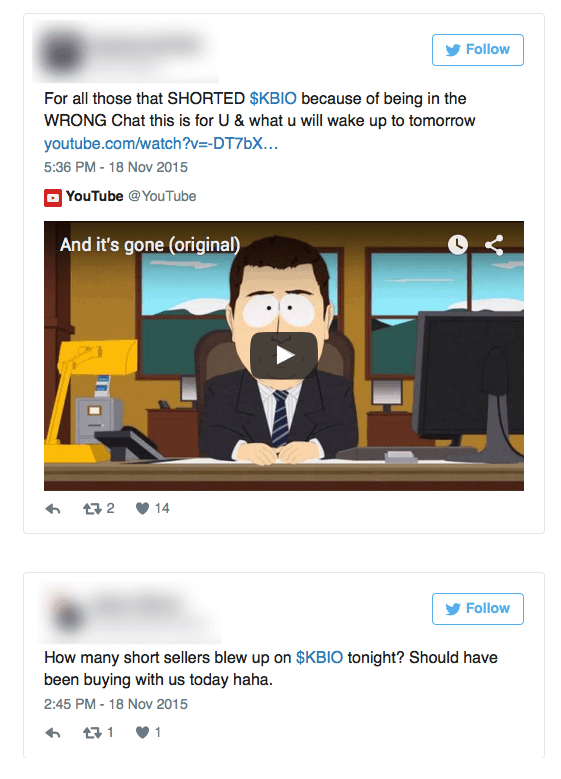

The Twitter Response

Holy shit, just when you think immaturity had reached a peek on twitter – you were wrong! Incredible how immature people can be. I get it, most are failed traders so it comes with the territory. You make money, they lose – so it’s only second nature to kick someone when they are down if they made a bad call or lost huge.

Some examples of idiots trying to promote their chat rooms at the expense of people who shorted. No shame right? Disturbing to say the least. Craziest part is people promoting it as if they made a good pick when this was a black swan event. News flash, relying on black swan events will not make you a good trader 😉 At any rate not sure what chat they’re referring to but if it gets more subs hey why not right? Shameless.

Some of the best traders I know who trade these set ups regularly were VERY biased and rightly so on this name. They had some size, dotted all the I’s and crossed the T’s and spent (as usual) a ton of time researching KBIO.

As you know the .01% chance black swan event happened, which threw that out the window and made it 100% irrelevant. Was research wrong? Absolutely not, and I bet that Martin would likely agree (and by agree I mean if had he been too busy to get involved or didn’t care to – based on the company alone I’m sure he’d be on the same page). Instead, Martin saw an opportunity swooped in and nailed it. Great job.

Keep in mind, this is the same research that has made many of these traders millions and millions of dollars each and every year. In fact, the same research made many of these traders nearly 70-80% downside on AVXL for them just weeks prior. I just can’t get over how many people made fun of real people losing real money especially when the people who lost provide invaluable insight on a regular basis. Then again, I get it. When Gregg donates more to charity despite losing, the fact remains that $50,000 is likely more profits than the guys who kicked him when he was down will ever see in their accounts, ever.

Forget those dumb Twitter people though – they are useless anyway. The part that I cannot believe is how many people promoted their services while laughing at those who lost. Seriously shame on YOU, and you all know who you are. I did find one thing funny; I had to block about twenty traders or so, which I still don’t get. Spreading rumors that I was short and that I got my whole chat short. I mean, really — just a note for those who spread false information trying to gain subscribers – trade well, profits and subscribers follow. When you overreach, it shows your weakness 😉

Heck, I’ll take ownership that at times I hound unsuspecting kool aid drinking cult longs and might go over the top sometimes, (for example AVXL) but there is a reason for it. The name is STILL down over 50% from the warnings. I don’t sit there making fun of everyone who lost. Draw the line guys. Shame on anyone who poked fun of traders who lost money. This is the reason you’re not successful yet.

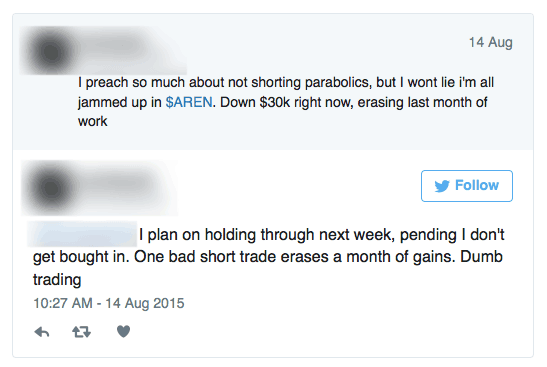

Even when you start to make money no matter how great your rules are you’ll run into issues once and a while. I’ll give you a funny example of a hypocrite to understand just that point – it can happen to anyone! I’ve had a long time troll who continually preaches about not shorting front side of the move (which I don’t do unless a brief scalp and small size). Flash forward a few months and guess who is in a bind?

My point here is that it can happen to anyone. No matter who you are it can, may and likely will happen at some point even if you believe you have the best rules. Be real, be truthful to yourself and most important stay humble. Don’t troll, be mature.

What can we learn from it?

This is not an I told you so section. As I said above, many of the big guys who lost big make MILLIONS from the same trade. This was a fluke. This is a reminder why I never hold low floats short over night. This is why it’s important if you ARE going to hold over night to ONLY be a small portion of your account. This is why I go cash 100% over night just about EVERY day.

I think the biggest takeaway is to re-read and re-think how would you have reacted?

This is by far the best advice and sums up the entire post:

Rules can be written down and agreed upon, but they don’t really become rules until the pain of breaking them is so carved into your soul that you follow them from a deep sense of self preservation because the agony of going beyond your limit is a place you don’t ever want to return to. – Tom Canfield

That my friends, is how rules get formed. REAL RULES.

Don’t believe the shit on Twitter that says “oh just have good rules and you’ll be fine.” Any trader that tells you that’s all you need to know, has never really experienced it. Every great trader I know has sensed this side ONCE. And usually that’s all you need.

Where does it go from here?

I think we have two great trades setting up. The reality is this sucker will likely end up going back to where it came from. It will not happen on yours or my time table though. So that’s not the trade I am looking for.

I’d likely trade a weak morning washout on emotion out of the gate Monday morning. After that it’s a holiday week and I expect volume to really start to fade off. When volume fades off this is the worst thing that can happen to shorts. Spreads will get wider, action will get more wild. If trend holds, it’s going to get real nasty for shorts. The short these is Martin and Co. will raise that $3 million at a cheap price and all will bailed out. On the contrary, here’s where Martin can play his perfectly dealt hand correct; WAIT. Just wait for putting a price on that $3 million and let Thanksgiving week do it’s thing. This could be an epic move.

Right now, the volume is so large that until it fades off the name can keep trending. Once shorts are full exhausted and longs have filtered out and KBIO becomes “top heavy” that’s when it will start to cave in. Don’t try to anticipate it, you could just be part of the next trap. Be careful out there and trade well.

I traded it Thursday and Friday and ended up flat. I was up nicely into close on Thursday sizing into the position but failing to sell out in time – I ruined a great average adding into the winner and rather than hitting the bid at $12.50 I stuck around thinking they’d squeeze it into close – I ended up bailing at $10. OH WELL. On the flip side, Friday provided to be a banner day for me given the text book opportunity it provided to us out of the gate.

I plan to trade it this week, I can’t wait for it we should have some unbelievable opportunities.

Stay safe out there and please re-read this post, there’s so much to learn here.

If you have questions reach out, leave a comment.

Nice post. KBIO reminds me of Crumbs Bake Shop from last year ($CRMBQ), announced bankruptcy, then investor comes in to save the day, epic squeeze

I remember that off .03 right? Was nuts!

Nate, I like your post but the facts and price action don’t entirely support your thesis. The short interest was 8% as of 10/30. High, but not out of this world. On the 11/6 when it gapped down from $1.90 to around $1 (low was $0.80) there was circa 650k shares traded, mostly buying. Then was practically no volume until the 11/16 when it gapped down from $0.90 to $0.45 (very little pre-market volume) and then was bought all day closing at $1.50+. The next couple days were high volume days, a lot of churn, some buying/selling, and short selling.

Also consider fact that borrows were not available at most of the brokers the little guys use (as you put it), and the smart /big money doesn’t touch shitty $0.50-2.00 stocks. Also consider empirical evidence on social media that it didn’t seem like a lot of people where in fact short KBIO at the time before the run.

No doubt this was a short squeeze, but I think you downplay the “buying on Martin’s name” effect (just like people short on Citron’s name etc).

But my biggest problem with your blog is your opinion that Martin saw the company’s PR late Friday, quickly gathered his band of merry men and did comprehensive research on KBIO’s drug in a couple days (after all, Martin claims that he “believes in” their drug as the reason for buying – while NOBODY else on The Street believed in it) before they started buying.

And just a reminder, Martin is a finance guy.

I would be very surprised if there wasn’t an ulterior motive, or worse, something more sinister in play.

I hope that the share price today helps to answer/drive home the point about how inaccurate the short interest you used was. This move doesn’t happen on 8% short interest.

I wish you nothing but the best in the future and trading. I’ve removed the rest of your comments given the tone and inability to want to learn.

Happy Thanksgiving and best of trading to you.

What a powerful article nate. Thanks for the priceless insights broken down to delicious pieces of nurturing wisdom…now I get it. Its the extremes that broaden our horizon for the good or worse, the trick is to survive them 😉

Really liked reading this, and was glued to the article every second to the end. You have a talent for writing Nathan! Keep up the good work!

Good Article! Well explained!

Thanks Nate

The next short squeeze will be Sears Holdings, 90% of the stock is owned by three entities and its not going bankrupt, contrary to popular belief, the short interest is HUGE. Check out this article

http://seekingalpha.com/article/3836596-sears-holdings-lifetime-investment-opportunity

Great Article!