There are plenty of day traders and swing traders out there, many of them engaging in the stock market at different levels. Some people utilize day trading for a living, while others just trade for a few hours a day to bring in some extra income. One of the questions I get asked a lot is, “when is the right time to make the leap to full-time day trading?”

Of course, there is no universal answer to this question, however there are a few considerations that come into play. It should be noted that day trading is not as glamorous as it is often portrayed to be. Trading stocks is not about “making bank” or living an exotic lifestyle. For full-time day-traders, trading stocks is a career. This means it requires work – work that entails sitting by the computer for hours a day staring at screens. You are not guaranteed to make millions of dollars. Heck, you’re not even guaranteed to get paid. Day trading is one of the few career choices where you are not guaranteed a paycheck, and you may even lose money after investing hours of your time.

Discouraged yet? Don’t be. This is not intended to critique day trading as a career. I trade every day and I love it. This post is intended to be a reality check that allows you to set realistic expectations that will help you take the necessary steps to achieve your goals. It’s also important to note that this post is targeted towards people who want to know how to start day trading full-time (meaning you are leaving your other job to pursue day trading full-time). Some of these points will not be relevant to those who trade as an extracurricular activity.

So, let’s get to answering the questions.

Day Trading for a Living – A Few Necessary Pre-Requisites

Training – Before you even consider taking the leap towards becoming a full-time stock trader, you should make sure you are properly equipped. You wouldn’t quit your job to become an engineer without any proper training, right? What are your of chances of succeeding? The same logic applies to trading. Start developing the proper expertise before even considering a career in day trading. We have a variety of free and paid resources to get you started on your journey.

Experience – You can read 1000 books on trading theory and still get crushed by the markets. Theory and practice are two different skill sets. Most traders need to spend some time actually trading before they can get a real feel for the markets.

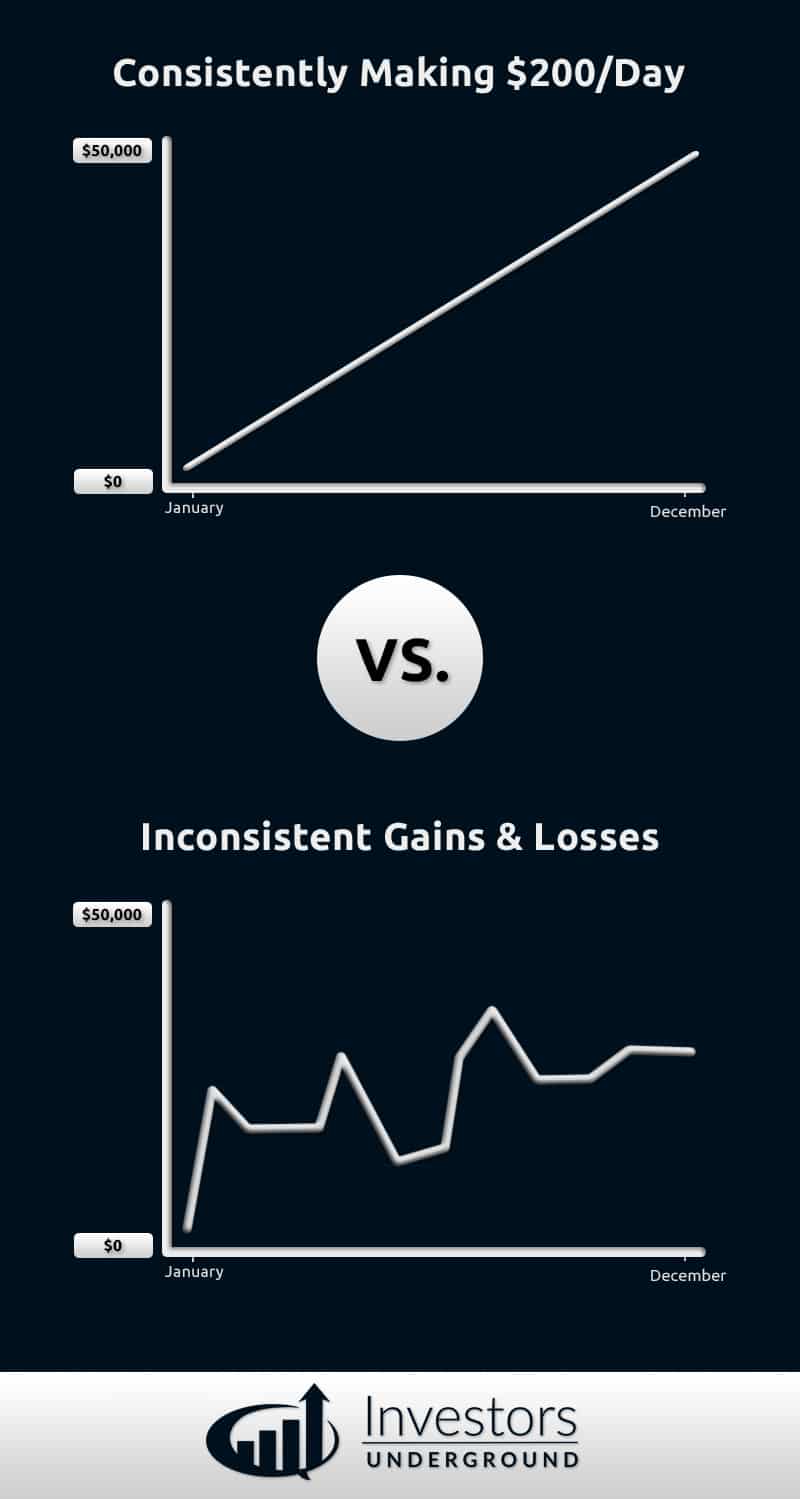

Consistency – If you are even considering becoming a full-time trader, make sure you are trading consistently. This will allow you to set realistic expectations for the future. Consistency is proof that you have actually developed an applicable skillset. For a new trader, there’s more long-term value in making $5,000/month for 12 months than making $200,000 your first month and $0 the rest of the year. Sure, one provides a higher short-term monetary value, however, it is less sustainable in the long run.

There is no “magic number” when it comes to calculating the amount of experience needed. Different traders will learn at different paces. One trader may be able to become consistent in a year, while others may take a few years. It’s important to take these next few considerations into account.

How to Become a Day Trader Full-Time

Both day trading and more conventional career paths have their benefits. A conventional job guarantees you a salary (and, sometimes, benefits), whereas day trading has higher theoretical scalability and allows you to be your own boss. For most full-time day-traders, the biggest benefit is that you get to do what you love at a job that consistently challenges you. Sound appealing? Take the following into account:

As a full-time day-trader, you will have less stability, especially as you start out. You will have good months, bad months, great months, and mentally exhausting months. While this roller coaster of emotions is part of what makes day trading exciting, it can also be stressful if approached improperly.

Financial Considerations

Account for Your Day Trader Salary and Build a Safety Net

Leaving your job means leaving your guaranteed income stream. A day trader’s salary is never guaranteed. Sure, leaving your job means you get to escape the monotony of a 9-to-5, but if you want to day trade for a living, you need to be prepared for what follows. Create a financial plan.

You should save up enough money to cover your expenses for 2 years. This will take some of the stress out of trading. If you’re not trading to pay the rent, you can make much smarter decisions. Of course, this approach relies heavily on your ability to accurately calculate this number. It’s better to overestimate than underestimate.

Make sure to account for everything, including:

- Rent

- Utilities

- Food

- Toiletries

- Cell phone bills

- Insurance

- Entertainment

- Etc

Don’t sell yourself short here. It may be easy to say, “I can live without entertainment for 2 years” until you are 2 months into staring at the screens for 12 hours a day. Be realistic, be accurate, and plan accordingly.

If your calculated budget is $3000/month, save up $72,000 and stick to your budget. If you can live off of $2000/month, save up $48,000 for expenses. This budget will vary considerably by person but the end goal is the same. You are covering your expenses for the next few years so that you can detach yourself from financial stress and have the best shot at success.

Your Stock Trading Account

We discussed the importance of saving up enough money to cover your expenses. You will also need to have the capital to fund an account. Once again, the amount of money necessary will vary by person. You will need at least $25,000 to day trade regularly (based on the Pattern Day Trader rule), however you can swing trade with less. Choose a number and setup the accounts.

Choosing a number is about giving yourself the best chance. Sizing up an account too early before learning consistency is only going to put yourself at the risk of losing more faster. Starting small limits what you can do but also limits your risk vs. starting larger.

Keep in mind, that your expense account and brokerage account are completely separate. You shouldn’t have to pull from your expense account to cover your trading costs and you shouldn’t have to pull from your trading account to cover expenses.

Other Considerations

Opportunity Cost

Up to this point, we discussed the financial planning involved in taking a leap into full-time trading. It’s also important to focus on the opportunity cost of the leap. What are you giving up by making the transition?

For example, if you are making $100,000/year + benefits at your other job, you are walking away from a solid salary and entering a career with an unpredictable salary. Will you be able to get a similar job after 2 years if trading doesn’t go as planned? Maybe yes, maybe no. Make sure to account for this before committing to the leap.

Personality Traits

When you become a full-time trader, you enter a world of 100% accountability. Nobody is making you get out of bed every morning and no one is telling you what to do all day. You are the driver of your own income and you are the only one who cares enough to generate it. Make sure you have the discipline and proper organizational skills necessary to make the most of this process. Are you someone who enjoys the autonomy of being your own boss or do you prefer being told what to do? Are you able to keep yourself in check and stick to a schedule or do you veer off and do your own thing? Do you need stability or does risk keep the markets exciting? Be prepared for the lifestyle change just as you are prepared for the financial changes.

Key Takeaways

Day trading stocks is an incredibly rewarding career path with a long list of benefits and perks. This post was designed to help people prepare for the transition. The rewards of day trading for a living can be exciting, causing some people to ignore the work involved in getting there. Let this bring you down to earth and help you take a realistic approach to the transition. Preparation is key. You can get there if you take the necessary steps.

Any questions? Leave them in the comments below.

Most important is to enjoy doing it, not only for the money but also to learn something new everyday and not to feel discouraged by lack of knowledge or age. I Can’t wait to be part of the community so happy I’ve found you guys!!

with my job i can manipulate my schedule a bit but I am nervous as i dont want to study for a year on something just to lose because i cant be in trades during the market hours all the time. Ive learned to check the day gainers and watch them seeing if they hit your levels and hopefully your not busy at work when they do but i figure if i study hard enough and be patient ill find those breakouts that go crazy from 5 to 40 and i can work my day job and get out in a few days or weeks and make 100grand and after doing that a few times quit my job go full time day trading and be good. the only hedge i have for this idea is a stop loss but if all im doing is winning small and hitting stop losses all the time im worried my small starting account will run out before i hit a big one. If anyone has an tips on what im thinking please let me know

How did that go for you

This is a great opportunity, My journey has begun since february 2017.

lip servicing this is not justice to you Nate. Really, having ran into you at the pennystocking 2014 gig, and then being so grateful to gravitate my way toward your manner of trading, teaching, clean healthy giving back, and mentoring. I’ve been at this learning curve off and on 2.75 years. And having seen changes in the way chat rooms and gurus market, all I can say, is its down to earth at IU. I am glad when I can say ” I can’t trade like you Nate” but that does not mean i can not be consistent or find my own niche, or even have a legit mentor who cares. I really think so highly of this. I am still realizing so much, and as I ‘ve sought to use my subscription wisely at IU, I am making sure I have the time to really give fully to this again, and my set ups well known, and a game as best as I can get, before engaging a luscious engagement with the room again. Anywho, I’ve learned so much from text book trading , and like being in an university testing and studying environment, I hope I can bring that level of focus forward.. I’ve got my rent saved for a few years, and a cash flowing business that I have freedom of choice when I work, so that is legit responsibility.. now with this next go around, my real test will be to see if I can really pursue another level of disciplined trading.. my focus is on what I can control…. my effort, my planning, my attitude, my eye-screen skills, my set up recognition, my communication to the IU community, and reaching out, and my patience, my entry, my exit…The outcome: its not my business, per se, thats the markets…and by all mean correct me!!!

Thanks for sharing this. Very informative.

Thank for sharing, you have given great tips, I will be them in mind.

Tank you so much for sharing this information it’s an eye opener since most people don’t look at losses but highly focusing on the gains forgetting that this game is a rollercoaster ride. I am also planning to go fulltime on trading and I’m working on my consistency at the moment.

Thank you so much

thank you.

Great article.

I LO❤️E trading, very rewarding in so many ways.

Thanks for sharing! The planning for 2 years portion was extremely helpful. I never even thought of that. Maybe next you can interview ppl who make 100k a year and left their jobs to day trade/do real estate

I’m trying to start doing trade, thank you for this articles, i think I’m gonna take time to work on my discipline of consistency and hope everything is gonna be fine in the journey 💪🏻

Wow!! What a down to earth real talk. Thank you so much for your advice I been day trading for 2 months and I am up. I am learning as I trade but never thought about the two years of mortgage/rent etc. Thank you for the tip you have giving me a goal to reach so I can be self employed. GLTA.

This is totally me, passionate, disciplined, excited, love the market but rely on my full time job because do not have enough courage (cash) to make the transition, good positive information

thank you

I’ve been learning how to trade since February 2020 and am only now becoming consistently profitable. I guess thats pretty good considering, averaging around $1000/day. I’ve had my fair shares of trying other peoples styles, being a bag holder, and all of the emotions that go with trading money. Now i’m trading a style that works for me, and am able to get out quick to cut losses, and my emotions are in check. The only way to actually do this is through experience, and through actually loving the day trading game. I have that 6 figure salary with the benefits and am strongly considering giving that up to focus on my trading. All I do nowadays is read about day trading, watch day trading on youtube, and think about how im going to show up to the market the next day. I cant wait to be my own boss and justify my own paycheck!

Isn’t there a certain time the markets are available and then shut down till next day? I want to get into this but what if I’m working during the time the markets are trading?

One should not consider becoming fulltime trader till he/she has gone through at least 1-2 bear cycles.

Thanks Nate for sharing! I have followed a few trading platforms in the last year and a half and by far your way of teaching works the best for me. Newbies like myself need the details (Who, what, when, where and how) in trading and you provide this. I currently trade two or three morning sessions each week and a couple evening sessions as well. I have a couple of small trading accounts and trying to become somewhat consistent in taking profits and cutting losses QUICKLY. As soon as I become confident (Staying Humble) in being consistent I will join you guys in the chatroom. Looking Forward!!

PS: Keeping my job for now:)

Genuinely curious why traders don’t talk about tax implications and the reality of them. I’m not expecting traders to act as CPAs but not one trader mentions to meet traders to prepare for taxes and what maybe to look for. TTS status, mark to market election, etc.

Thoughts, Nate?

Thanks

Hi Nate,

I enjoyed reading the information provided here.

What important steps should i take to become more consistent over 12 months?

Can you give me your summary on what you would do if you had to do it all over again/

Thank you,

Sam Bergman