What an insane week. The oil sector gave great plays all week on the long and short side. Having a basket of names for each sector was a huge help and will continue to be for the near future. Once one name started to get attention it would fuel the next and the same thing on the downside.

If you aren’t familiar with how things work at IU, here is walk through. https://investorsunderground.com/s/PXvWe

BBBY Key Level

Knowing where the major exchanges have happened in the past is key right now. If it can’t hold those levels then it is probably headed south.

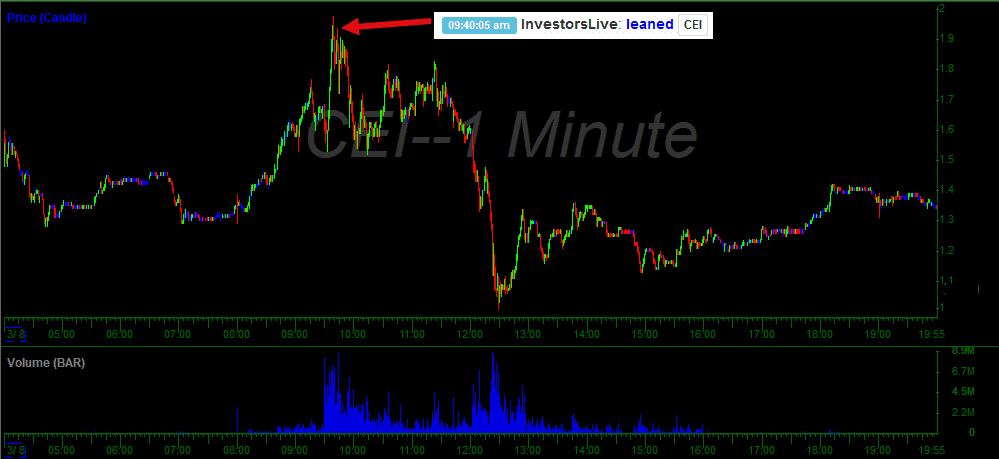

CEI Fade

This trade ended up working well if you covered half on the initial fade and then added the covers back on the pops.

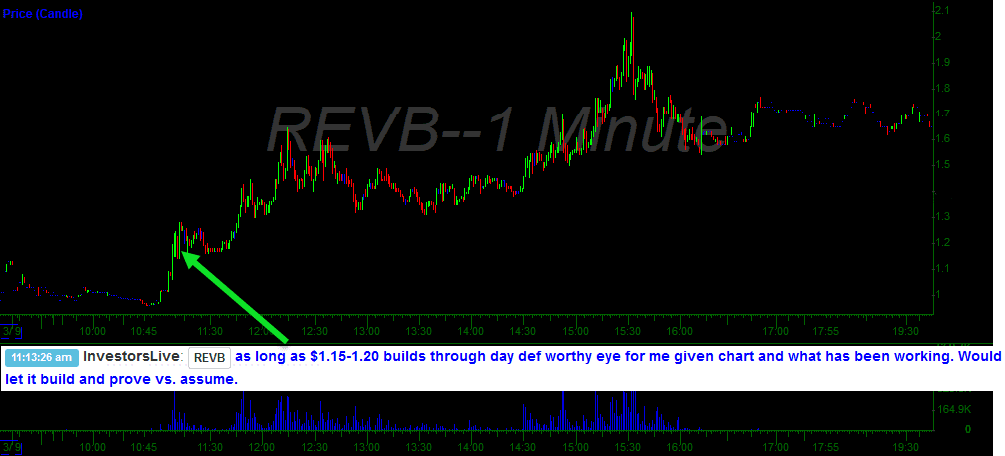

REVB Momentum

Once it has shown you it will hold a key level then you can use just below that as your risk level.

Sector Trades

I just wanted to share Nate’s initial game plan in the morning and then a couple of charts to show how it worked out.

HYMC Both Ways

Nate had held this trade for several days on the long side and ended up flipping short once it fell below the key level.

Have a great weekend.

0 Comments