Rounding out another solid week in the IU community. Every week has provided so many opportunities that it is essential to focus on your A+ setups and don’t get tied up with everything else going on. Narrowing down your watch lists and having your scanners dialed in has been key to taking advantage.

We have new members coming in everyday and I try to stress to them to take things slow and learn the right way. I really can’t think of a better time to be learning to trade because of all of the different setups and volatility there is right now. Don’t try to master every style of trading. Become a master of one or two and focus on them. If you look at any of the really successful traders, they really only trade 1-3 different strategies. Just like being a doctor or a lawyer. Some specialize in brain surgery and others on orthopedics.

No matter your experience level, reach out to me and I would be happy to help. [email protected]

KOD Hidden Seller

Monday brought us KOD. @Investorslive was able to catch on to the games being played as the stock ramped up. These are the kind of things that new traders can learn in real-time from other members that have seen it over and over. Nate started into his short position and gave a great play by play to show everyone how to trade these in the future.

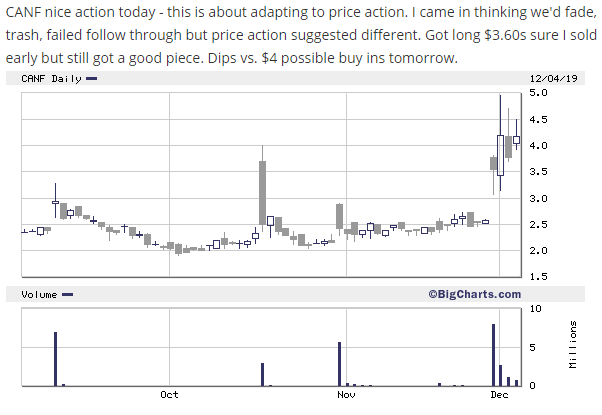

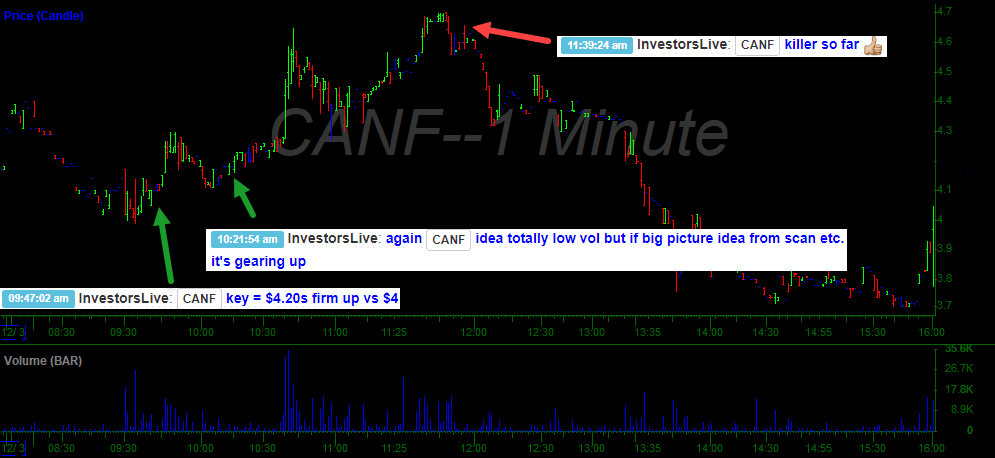

CANF Scan and Trade

Not a ton to say about this trade as the game plan was laid out the night before via the scan and then Nate went over the final game plan in his pre-market broadcast. Here is the scan from Monday night.

And the chart from Tuesday.

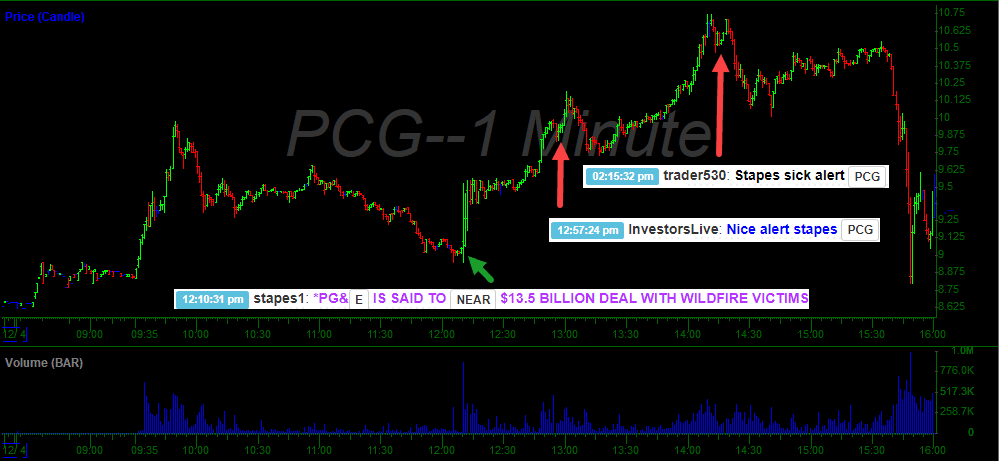

PCG News Headline

I have included PCG on several of my recaps because it is so headline driven. Between the court cases, BK and black outs it has been a great trading vehicle.

@Donaldkey got the headline into the chatroom right as it came out on Wednesday. Knowing how this moves on news made it a pretty easy long side trade.

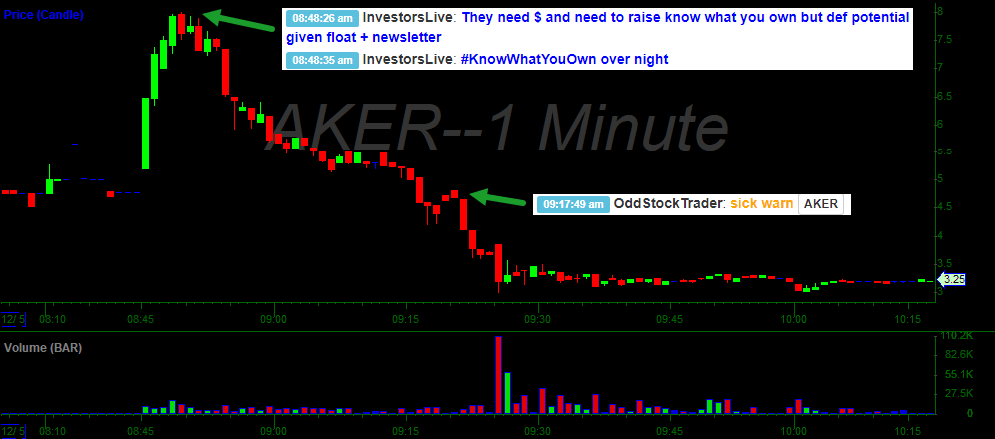

AKER Warning

This one is a bit different as it wasn’t even a trade. One of the huge advantages of surrounding yourself with experienced traders is not only helping you with positive trades but helping keep you out of negative ones. Thursday AKER looked like it was headed to the moon but Nate did his best to warn members of what was possible. They priced their offering and it crashed.

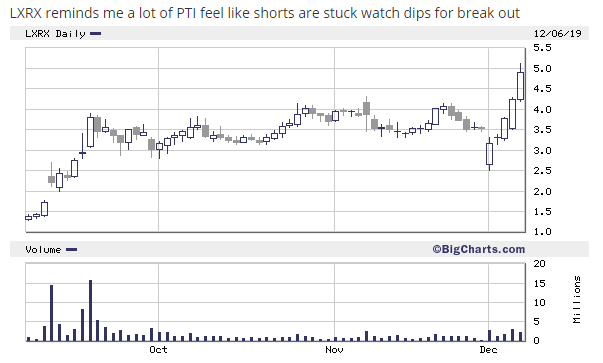

LXRX Scan and trade

Friday was another trade that played out just as expected. Look back at PTI to see what Nate was expecting LXRX to do.

Have a great weekend and I will see everyone on Monday!

0 Comments