Webinar Replay w/ Alex: If you haven’t checked it out yet, please watch the webinar I did with Alex, a lot of good info in there for traders of all levels, and some background about my story and who I am. Watch here.

Webinar #2 here.

Webinar #3: Here

There’s also a special sale going on for those interested in getting involved with IU, which you can find here.

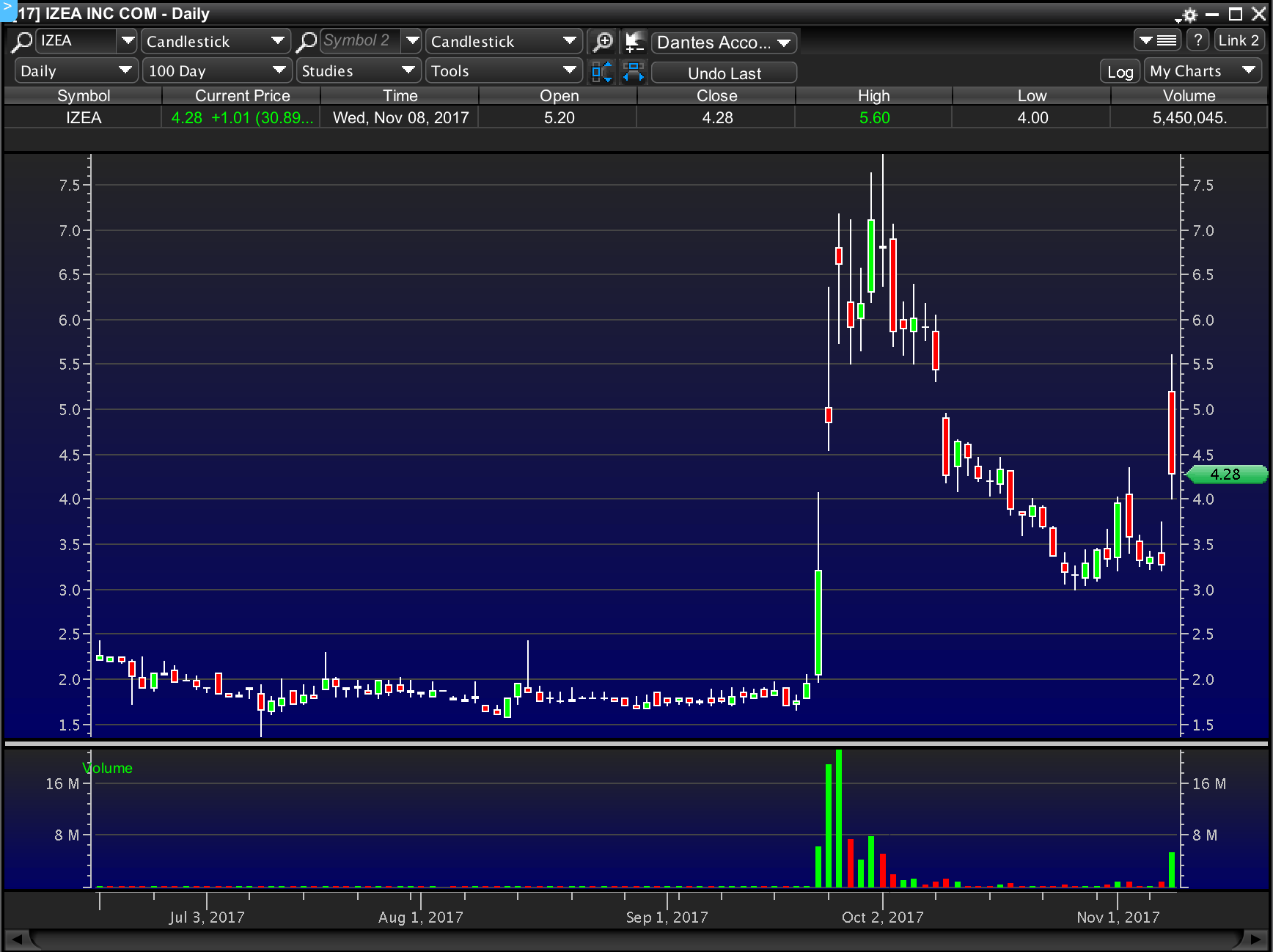

IZEA: Lot of longs bagged here today plus some newsletters on it to add even more baggage. Watching all pops into the 4.50-5 area for a re-short opportunity.

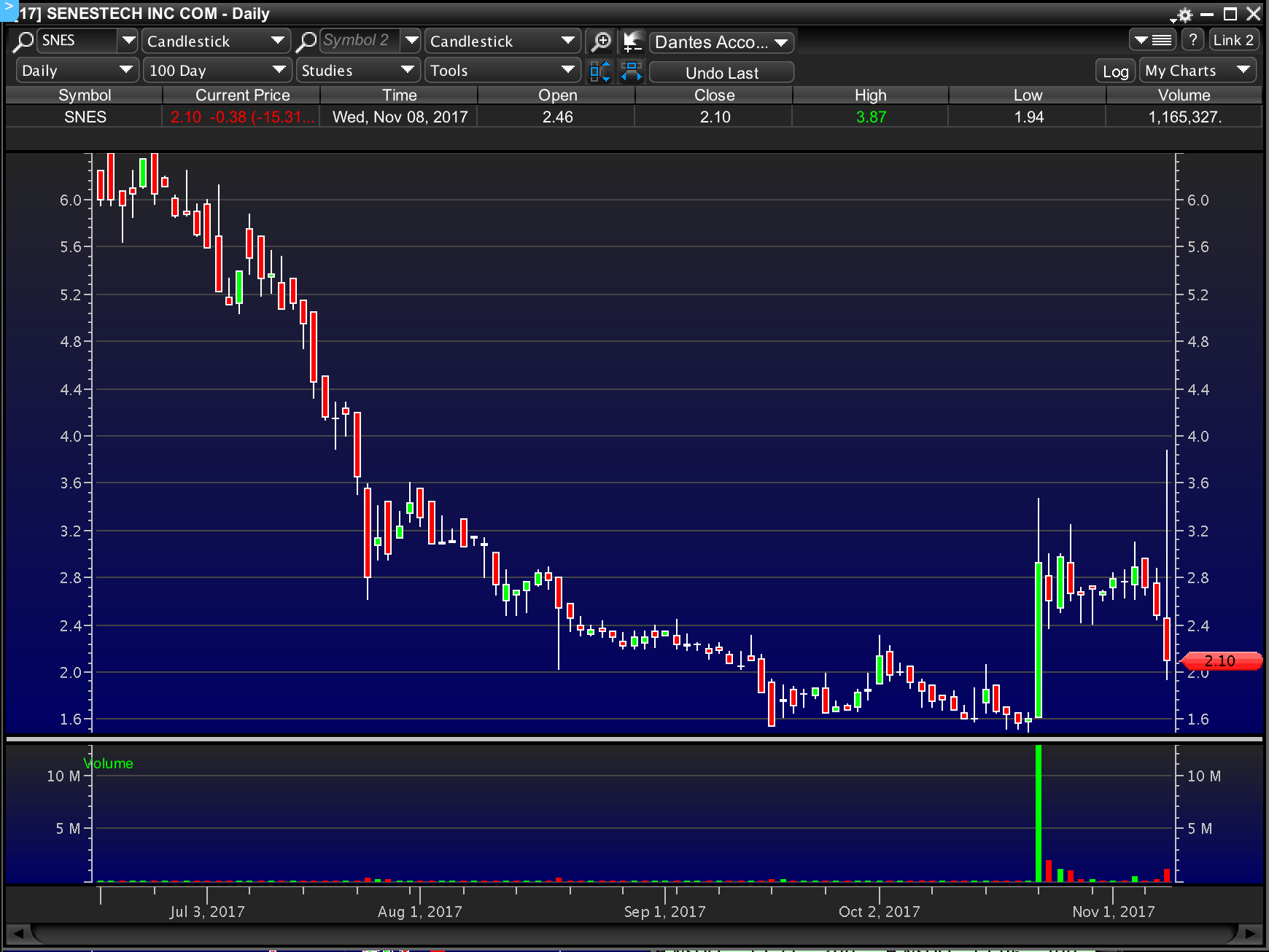

SNES: As piggie as piggie gets here lol. Dropped mind-blowing earnings numbers today of a massive 17K in revenues, I made more than that yesterday by myself. Nice work SNES. Then an offering with warrant coverage at EOD today as icing on the cake. Watching all pops back into mid 2s for a short. What an absolute joke of a company, really.

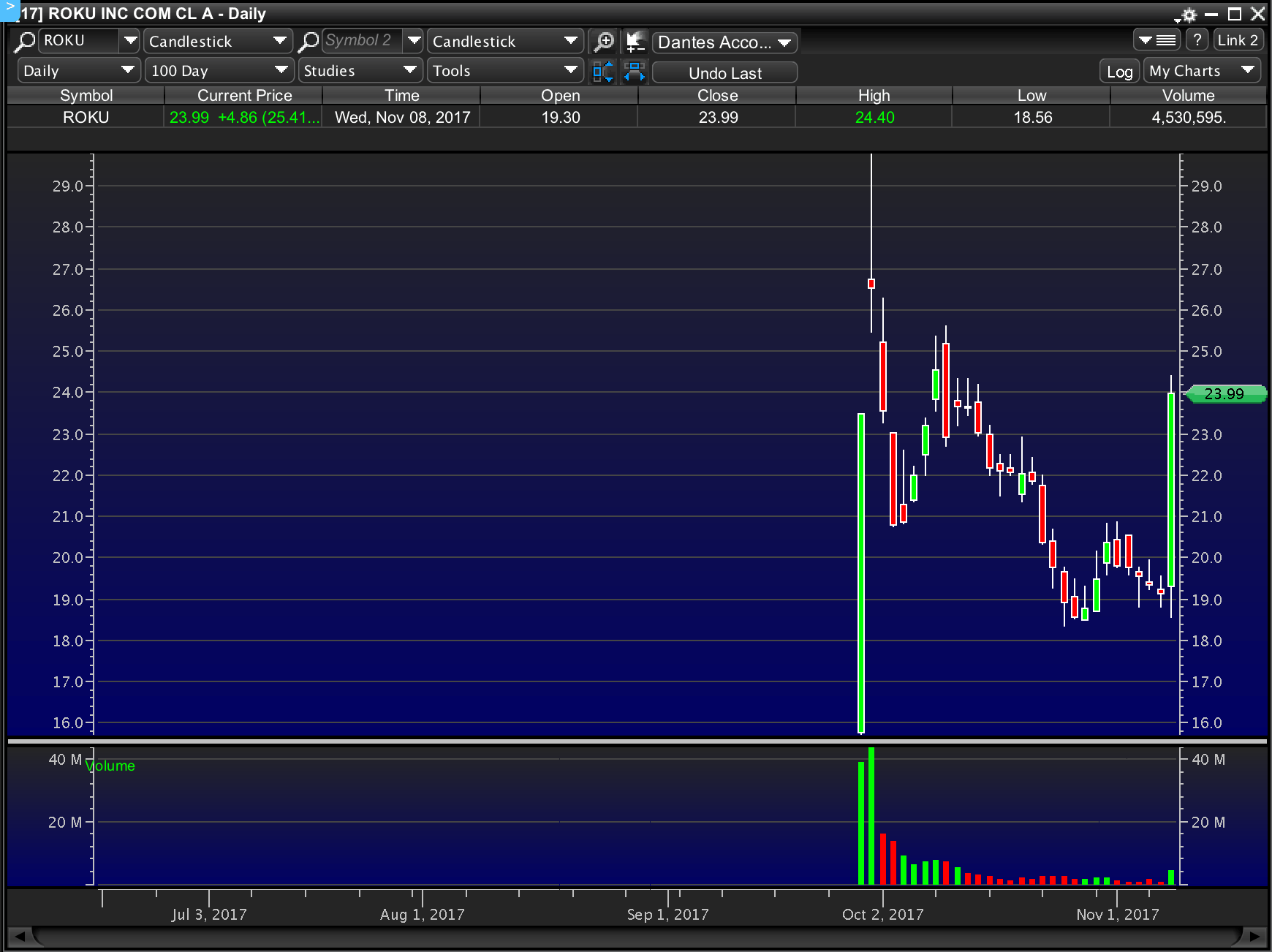

ROKU: I really like this company. Recent IPO, released very impressive earnings numbers a/h today with strong guidance to go with it. Interested in a long-term swing here, will be looking for weak opens in the low 20s in coming days to scoop dips. Don’t chase euphoria – make sure to get a good entry.

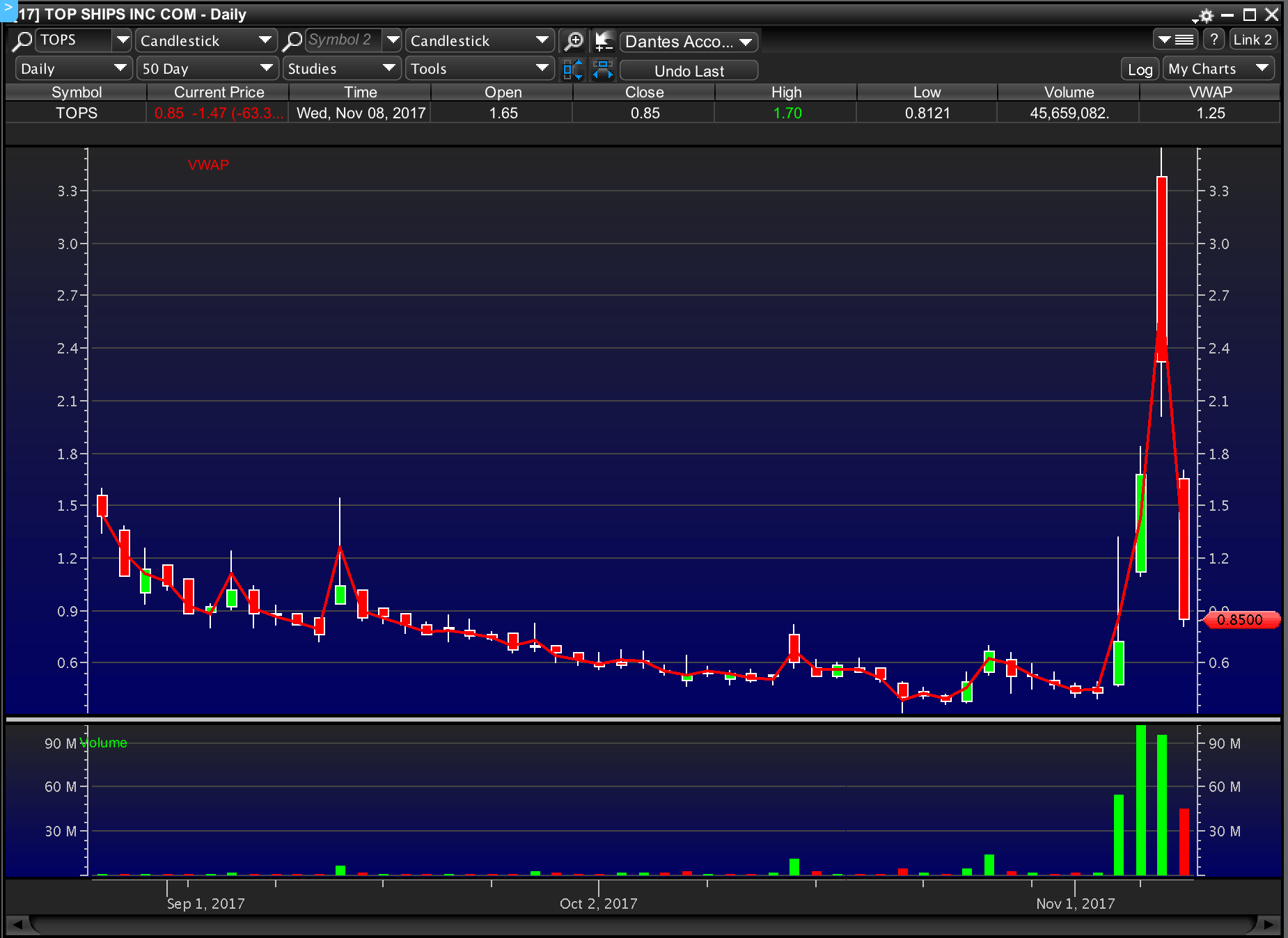

TOPS: Well well well….Kalani is back! With a different company name, but that is 100% him with this TOPS deal, we all know it. May the toxic financing and reverse split frenzy begin! My guess is first r/s will be coming by next week. We likely have a DRYS 2.0 on our hands here – so buckle up and have fun. Shorting ALL significant moves higher with reckless abandon.

If you’re not an IU member and would like to become one, there’s still a sale going on here, along with the webinar sale posted at the top. I highly recommend getting the DVDs – they truly are where I learned most of what I know, and the most significant piece of education I was able to draw from early on in my trading career. If you’ve read my blog or know anything about me, you know I’m not a bullshitter – so I really mean that about Nate’s DVDs. They helped me tremendously. Also If you’d prefer a shorter time commitment to see if you like IU, you can go monthly as well here.Shoot me a PM anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss trade ideas with you.

See you out there!

– D

0 Comments