Today was an incredible day in the Investors Underground community. This is 100% WHY we stay familiar with charts, flip through them nightly and keep recent movers fresh in our minds. We’ve just come off an intense three or four month stretch of IPO after IPO literally opening up double vs. pricing and then doubling again. We’ve seen TIGR gain momentum and squeeze shorts, we’ve seen PINS come out swinging and BYND still pressing near highs. Then, there was SOLY which was one of the thinnest of the bunch, traded exceptionally well and then the day after they presented some data over the weekend bids were gone, sellers arrived and a negative article came out setting the trap in a major way.

The Thought Process on the Trade

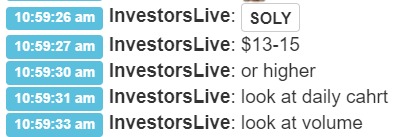

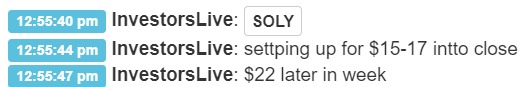

Here were early thoughts on chart potential (hit $22.25)

$SOLY ❤ had a feeling and went with it … sensing that trap and bent short. Focus as usual? The 🥩 meat of the move 👍 props to those in the chat room who nailed as well. Incredible start to week. Head down and on to… https://t.co/UkKBxDXffu

— Nathan Michaud (@InvestorsLive) May 28, 2019

Why do I care?

Trading is all about the audience right? Sometimes if the audience is too big on one side, it can set up for a disaster. In this case, shorts were totally trapped. Pleaded their case all day while this didn’t matter meanwhile they just got ran over. Sometimes people forget just how thin names are. People forget that a name with 10 million volume rather quickly is not something to fight or think that news or more importantly reality even matters. This is where the “Trader the Ticker not the company” came from. It doesn’t mean fundamentals don’t matter, it doesn’t mean you shouldn’t know what you’re trading, what it means is — all those folks who spent all day bashing on Twitter that the 510(k) was BS, nonsense and didn’t matter ignored the price action, ignored what the name was telling us and thus got ran over betting against the name. Yes, eventually truth and reality will matter but on the front side, trade the ticker ie: the price action and most important respect the volume!!

Here’s the early thoughts as soon as it checked all the boxes for this sort of trade (remember the video we talked about categorizing trades on YouTube?)

Highest volume day since IPO

Could have been trap of century

Straight down since hit piece – up on air attracts more shorts today.

Gonna be an interesting afternoon.

— Nathan Michaud (@InvestorsLive) May 28, 2019

Reminds me back when $LFIN was wild

Volume tells the story.

Tracking for 10 x float

— Nathan Michaud (@InvestorsLive) May 28, 2019

Someone still has an issue, they're trying to crack it here midday but failing so far.

Ideally comes in and traps $11.60-11.80s would be amazing but if not, hopefully sets up for monster close.

This won't be a one day situation IMO.

— Nathan Michaud (@InvestorsLive) May 28, 2019

When they can't crack it, you need to take note.

VWAP never failed.

They let it get long crowded and flushed them out hard.

When they got too aggressive they yanked the bids creating appearance that it may be a good time to short.

Nope, trap.

Beauty from 11.60-80s goal

— Nathan Michaud (@InvestorsLive) May 28, 2019

So, here are my trades on it:

SOLY Trade Recap Video

Here’s a video recap comparing it to recent discussions we’ve had and most importantly why I am happy with my exits where I did, because we can’t always see the right side of the chart right? We have to use the left to predict the right, and once the RIGHT side proves we can then make additional decisions.

Really nice alert here $SOLY

Straight into a circuit halt has been very beat.

Nice job. https://t.co/ddK2TB9viP

— Nathan Michaud (@InvestorsLive) May 28, 2019

SOLY Alerts and Commentary from the Chat Room

09:45:09 am @TradeHawk – $SOLY Soliton gets FDA 510(k) approval for its Acoustic Wave Device for Dermal Tattoo Clearing https://t.co/no9KDMGy9h

09:46:03 am InvestorsLive: SOLY off TradeHawk

09:46:09 am InvestorsLive: FDA 510K approval

09:46:14 am InvestorsLive: been super beat

09:46:29 am InvestorsLive: SOLY perfect

09:46:35 am InvestorsLive: SOLY into circuit

09:52:45 am InvestorsLive: SOLY indication pretty nice so far may be a nice gap up

09:56:23 am InvestorsLive: SOLY 7.40 indication sick alert so far

09:56:35 am InvestorsLive: cautious if not in from the alert but – super nice opp

10:01:02 am InvestorsLive: 8.84 indication so far SOLY

10:02:23 am InvestorsLive: done SOLY b/c newsletter there

10:19:56 am InvestorsLive: SOLY PR out

10:26:47 am InvestorsLive: Newsletter almost sent this SOLY into circuit down on exit

10:55:24 am InvestorsLive: SOLY couple things to consider – came down from $13 on no vol + hit piece and this is highest volume day ever

10:55:28 am InvestorsLive: this could be nuts later

10:56:17 am InvestorsLive: will be trading accordingly

10:58:10 am InvestorsLive: SOLY 🙂

11:02:42 am InvestorsLive: 99% focus right now on SOLY

11:04:29 am Swifttrader01: Nice call / analysis nate on SOLY

11:05:09 am InvestorsLive: :up

11:05:11 am InvestorsLive: huge

11:05:13 am InvestorsLive: locking along way

11:25:01 am InvestorsLive: F*ck newsletter is talking about scalping this SOLY

11:25:09 am InvestorsLive: get off my trade bro

11:25:31 am InvestorsLive: SOLY into circuit attempt

11:47:41 am InvestorsLive: $13 SOLY llol

11:56:50 am InvestorsLive: SOLY re visiting later still super early

11:57:15 am InvestorsLive: opinion hasn’t really changed but I know my weakness

11:57:22 am InvestorsLive: and that = over stay when I am sized

11:59:00 am InvestorsLive: someone seriously bent SOLY but just feels like they need to re trap – its surprising b/c its actually relatively hard to borrow

11:59:15 am InvestorsLive: ideally 1-2 hour consolidation and dip a bit trap a bit then have an opportunity later, congrats to those who took trade. very clean.

12:03:51 pm InvestorsLive: SOLY not coming off radar – focus for later 100%

12:03:55 pm InvestorsLive: same game plan as spelled out

12:04:00 pm InvestorsLive: here to help in lounge

12:11:53 pm InvestorsLive: SOLY some covers prob

12:12:20 pm InvestorsLive: trading it as well just scalps tho was trying to be patient with the $9s avg but that didn’t last too long ha

12:13:34 pm InvestorsLive: 11.60-11.80 goal sub lull for me

12:32:23 pm InvestorsLive: Shorts are so trapped SOLY

12:48:46 pm InvestorsLive: SOLY filtering a lot of folks out here but not dying

12:48:57 pm InvestorsLive: this is the area where you learn what it wants for later

12:51:55 pm InvestorsLive: SOLY they couldn’t crack it

01:10:43 pm InvestorsLive: SOLY good reads

01:21:30 pm InvestorsLive: my thought process is everyone plays for squeeze into close SOLY and they’ll be early and I think they dunk the chasers controlled into close – not a full dunk just controlled yank. Then in coming days when most lose off radar I think we’ll have the real action. Just my two cents still trading it off wash outs and selling rips but just thinking out loud.

01:22:21 pm InvestorsLive: was there 1230-1260s and offering out 1320-1350s etc around core until picks a trend

01:22:51 pm InvestorsLive: mmhmmm

01:22:57 pm InvestorsLive: they listenin’

01:23:51 pm InvestorsLive: hope commentary helped

02:20:51 pm InvestorsLive: SOLY some swipes

02:21:34 pm InvestorsLive: imo past hour has all been trapping SOLY my thought process remains same tho

02:26:56 pm InvestorsLive: 12:13:34 pm InvestorsLive: 11.60-11.80 goal sub lull for me

02:27:04 pm InvestorsLive: re: SOLY and fast swipe back so nearly buck padding

02:51:59 pm Amp: SOLY shew

02:52:06 pm InvestorsLive: Just food for thought (LFIN chart)

02:52:15 pm TWB52: SOLY moly!

03:06:49 pm InvestorsLive: again if you think back even OTLK most recent – but BPTH etc the stuff that really went was kinda weak and let shorts “win” into close and by win I mean didn’t squeeze out into close but just sorta flattish slow fade but stayed in trend

04:05:10 pm Mcawiley: SOLY through 15

04:05:31 pm t3p0: Thanks Nate, great calls all day

04:05:39 pm InvestorsLive: SOLY nothing to see here

Last two review videos, especially, have been just superb – thank you!

Awesome stuff Nate thx

Thanks Nate

Thank you. This blog is amazing.

Awesome stuff. Thanks