I’ve been putting out a free scan every Sunday for the past few months. Today, I wanted to dive a little bit deeper. Make sure you watched yesterday’s video (below) and read through the scan.

From Game Plan to Trade Plan

The point of today’s post is to show you how we go from creating a watch list to actually trading. You need to understand this methodology if you actually want to make the most of each scan.

Let’s start by explaining the purpose of the scan.

The scan is NOT a list of stocks you should buy. If that’s what you’re looking for, look elsewhere. But, be warned, trading is not as simple as following buy and sell alerts. If you don’t understand why this doesn’t work, just look at some of the charts below. The stocks fluctuate within a range throughout the day and timing is everything. A few minutes can make the difference between a good trade and a bad trade.

Now, let’s talk about what the scan IS.

The scan is a list of stocks that we want to pay attention to during the next trading day. These stocks are generally experiencing abnormal trading activity. They may be breaking out, breaking down, trading on higher volume, or trading in a broader range. We want to be prepared to trade them in case they provide an opportunity. My goal is to familiarize myself with these charts so I can be prepared the next day.

The next morning, I start analyzing pre-market trading activity so I can narrow the list of stocks even further. At this point, I narrow the watch list down to two or three names that I want to watch when the market opens. I stream this thought process live for members at 9AM. Here’s the pre-market broadcast from today:

By 9:30AM (market open), I have a clear trade plan. I focus on the best trades that have the highest probability for success.

The Plan in Action

Hopefully, you’ve been following the free scans every Sunday. Today, I want to show you what happens AFTER I create the watch list.

There’s a lot going on here, so make sure to pay close attention to the video and the rest of the post. If you have any questions, please ask a question in the comments! Asking questions will help you become a better trader.

Sunday Scan Review – Looking Back on the Game Plan

Today’s Trades + Chat Room Commentary

Winning Trades

CLVS trade – perfect example of looking left as we discussed on the video scan last night. It went into the exact levels we were looking for — all I did was execute what I spelled out Sunday night.

08:16:36 am stapes1: CLVS starting

08:16:37 am P_Mil: CLVS testing friday highs

08:18:27 am InvestorsLive: this area is a big one – like it to fail a few times before it sets up for the rush through

08:18:29 am InvestorsLive: re: CLVS

08:18:32 am InvestorsLive: on daily chart

08:30:01 am shaka_zulu: CLVS smack

08:30:54 am InvestorsLive: CLVS trading the plan from scan

08:42:35 am InvestorsLive: CLVS nice way to start

08:42:47 am InvestorsLive: locked few around core

08:42:59 am Argento: Nice plan Nate!

09:32:59 am InvestorsLive: CLVS good slam

09:37:10 am InvestorsLive: CLVS newsletter

09:41:33 am InvestorsLive: CLVS good to trade around core if participating in strength

09:45:29 am InvestorsLive: big slams CLVS

09:49:42 am rainman: CLVS breaking $6

09:51:54 am InvestorsLive: cov 1/2 CLVS

09:51:58 am InvestorsLive: re add if 5.80s hold

09:52:03 am InvestorsLive: big big opp perfect off scan

09:52:33 am shaka_zulu: CLVS el sicko

09:52:41 am InvestorsLive: all covered CLVS that was wild

09:53:36 am P_Mil: nice read Nate CLVS

09:59:45 am InvestorsLive: CLVS like re joining failed follow thru

09:59:48 am InvestorsLive: scale sub .50s

10:09:11 am InvestorsLive: CLVS next pull holds will move on w/ the dabble back

10:13:14 am InvestorsLive: cov 1/2 CLVS

10:14:12 am InvestorsLive: cov bit more will re size up sub 5.50s if confirms heaviness

10:14:14 am InvestorsLive: re: CLVS

10:15:51 am InvestorsLive: done CLVS

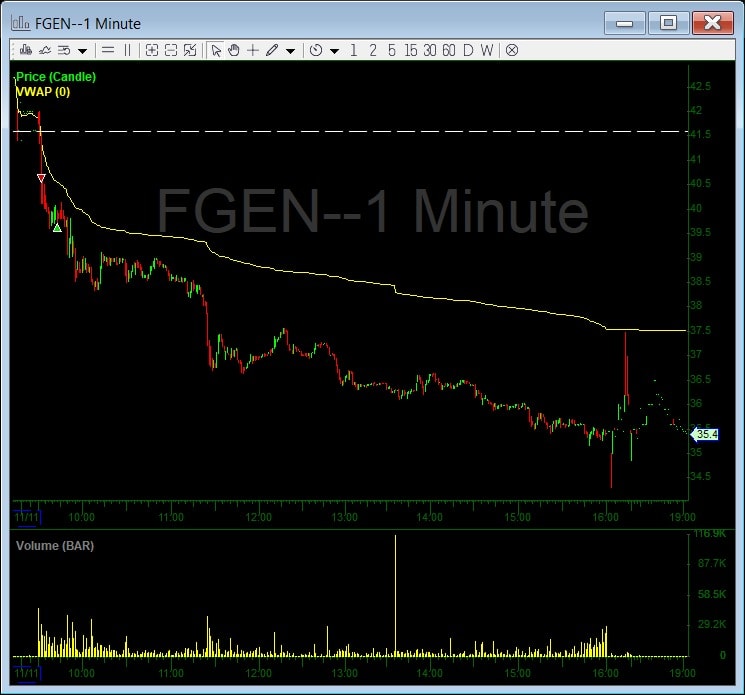

FGEN unfortunately screwed this one up – goal on scan was thinking it was going to pick a trend and last all day. We needed to confirm failed follow through my goal was $43s + for a fade sub $40s but they just didn’t show up today.

Friday tape sorta told us this story. It felt like the data was priced in based on how heavy it was trading after the open. I joined today but my goal was to cover that fast $1/share and re add but — sadly never got back in there.

The good news is we had ASMB which was a carbon copy of the idea. Retail crowded name, ran into the data and sold off all day every chance it had.

Two two plays are below:

09:32:53 am InvestorsLive: FGEN like pops vs r/g

09:36:46 am InvestorsLive: 40 test FGEN

09:45:09 am InvestorsLive: FGEN done w/ never got sized up tho – we may have another $1-2 later of downside to watch tho

09:50:35 am InvestorsLive: FGEN fresh low

08:05:16 am InvestorsLive: ASMB check daily

08:35:13 am InvestorsLive: ASMB still going

09:30:24 am InvestorsLive: ASMB failed follow thru – watching for pops for red

09:40:45 am Renzo: ASMB smack

09:40:56 am InvestorsLive: ASMB nice game plan

09:49:41 am InvestorsLive: ASMB good

09:57:56 am InvestorsLive: still like adds on ASMB

10:16:02 am InvestorsLive: done ASMB

10:30:15 am InvestorsLive: ASMB staying heavy

10:30:22 am InvestorsLive: like re lean vs 17-1720s scale 1650s

11:47:07 am InvestorsLive: still like ASMB scale all fails

11:47:13 am InvestorsLive: can get another buck or two

11:57:53 am InvestorsLive: ASMB near 16

12:28:04 pm Phoenixbird: ASMB printing 16

12:33:26 pm InvestorsLive: ASMB minimal left had sized back in but sized out near 1620s just about 1/3-1/4 left over all

01:51:32 pm Phoenixbird: ASMB 15 test

03:06:31 pm Phoenixbird: ASMB nlod

03:40:40 pm InvestorsLive: ASMB fresh lows

BE was a carbon copy trade thesis as CLVS

09:34:23 am InvestorsLive: BE from scan

09:34:59 am InvestorsLive: BE reactive vs $5.50 over/under goal for me

09:35:09 am InvestorsLive: if firms up – would move on

09:37:56 am InvestorsLive: BE good

09:38:00 am InvestorsLive: BE slam

09:38:42 am InvestorsLive: BE good to cover around core imo and re size if it fails/confirms

09:53:51 am InvestorsLive: BE doing CLVS mimic

09:54:01 am InvestorsLive: cov some from 5.50s

09:54:11 am InvestorsLive: $4.80s ideally on rest or lower

10:12:30 am InvestorsLive: BE staying heavy

10:12:41 am InvestorsLive: new scale around winner = 5.20-5.30s mental risk

10:19:43 am InvestorsLive: sub 5 BE

10:22:45 am InvestorsLive: cov some BE gonna try to be patient on rest

11:04:17 am InvestorsLive: BE failed follow through

TRNX was one of my best trades in a while as far as execution to headache ratio. Zero head aches, perfect entries perfect covers and it did what the tape told us was going to happen.

09:28:10 am JowydS: TRNX swipe

09:29:44 am TexMex: TRNX huge imbalance for open is why 1.90 to 2.15

09:48:51 am InvestorsLive: TRNX came back

09:48:58 am TexMex: TRNX total short trap

09:53:38 am InvestorsLive: TRNX if it pulls flushes 207-208 then reclaims 210 + I’m interested quetly vs. 2

09:55:55 am InvestorsLive: Nice call TRNX tex

09:55:59 am InvestorsLive: def shorties in a pickle

09:58:27 am InvestorsLive: TRNX beauty never enough when it works that well

09:59:16 am InvestorsLive: all done TRNX

09:59:19 am InvestorsLive: newsletter came in at top

10:08:02 am TexMex: TRNX healthy dip to vwap here 2.23-2.24

10:09:41 am InvestorsLive: TRNX sick exits – free look by newsletter

10:33:29 am TexMex: TRNX nastyyyy, new highs

10:48:24 am akaMePs: TRNX highs

10:49:54 am InvestorsLive: TRNX shorts punked

11:17:07 am InvestorsLive: TRNX fail

12:07:17 pm InvestorsLive: TRNX failed follow thru

12:13:13 pm InvestorsLive: TRNX more fail

12:32:57 pm InvestorsLive: TRNX going to be watching 2-3PM + traded it a few times but need better edge now (later on)

01:14:34 pm InvestorsLive: TRNX swipes

01:14:36 pm InvestorsLive: nice trappy move

01:40:00 pm InvestorsLive: TRNX swipe but not 100% natural just fwiw

02:29:53 pm InvestorsLive: TRNX feels pretty stuffy on that move

02:37:05 pm InvestorsLive: if they pull plug TRNX will be a deep fail

02:37:21 pm InvestorsLive: perfect off the stuff move

02:37:33 pm InvestorsLive: best to lock around core front side until confirms

02:38:09 pm InvestorsLive: $2.50 the point of no return imo so until then cautiously trading that stuff move

03:00:20 pm InvestorsLive: hehe TRNX

03:00:22 pm TexMex: TRNX smash

03:00:38 pm Ryan_P: nice

03:00:40 pm jfacada: under 2.40 is backside

03:00:42 pm jfacada: TRNX

03:00:47 pm InvestorsLive: wish orders filled on partial nice off the stuff

03:20:47 pm InvestorsLive: TRNX another fail

03:38:36 pm InvestorsLive: TRNX how sweet it is

03:41:17 pm InvestorsLive: all done TRNX from thoughts written

Secondary Trades

We had some good trades, but a couple didn’t work – that’s part of trading.

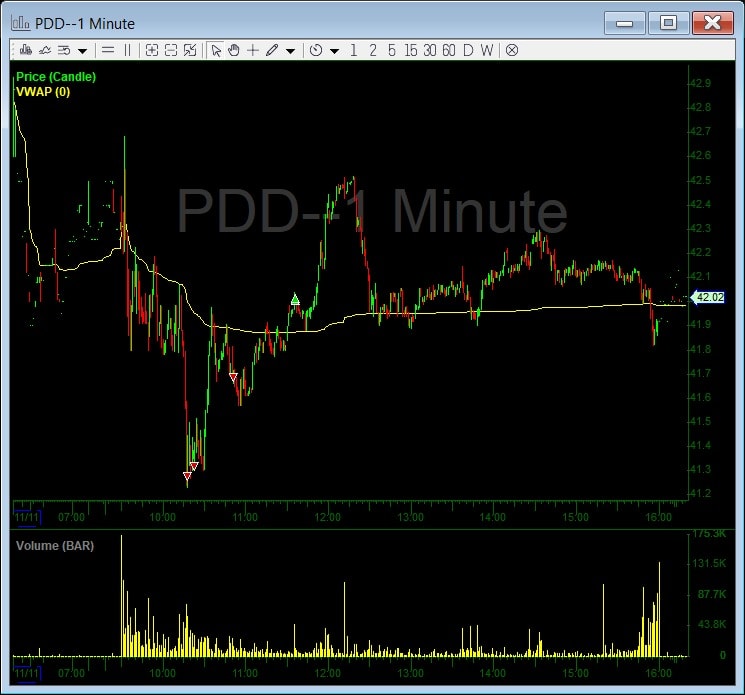

PDD one of those China names that is just tough to trade – it always does enough to get my interest only to take my money 🙂 But, not bad – no reason to scale on this one.

10:18:04 am InvestorsLive: Emil check it — PDD slam

10:18:20 am InvestorsLive: like joining PDD vs 41.50s

10:36:53 am InvestorsLive: PDD swiped back – still have my dabble

11:36:36 am InvestorsLive: ditched PDD never came back in much almost was flat on the dabble but – ABCDing will re visit another time

BA doesn’t get much better than this on the news!

Fast alerts, I got there a bit early never a spot to scale so ended up pretty much scratching out over all.

11:43:15 am DanS: BA spike

11:43:40 am stapes1: *BOEING SAYS 737 MAX DELIVERIES COULD RESUME IN DECEMBER

12:05:22 pm akaMePs: BA insane call

12:43:41 pm InvestorsLive: leaned some BA

12:44:25 pm InvestorsLive: if 365 no fast crack on BA likely move on and take small break on day

12:52:53 pm InvestorsLive: BA fails again will fade to 365 and be done

12:58:56 pm InvestorsLive: 365-366 prob max it can wash until 365 confirms couple times

12:59:04 pm InvestorsLive: re: BA

01:15:27 pm InvestorsLive: BA found some profit takers

01:33:33 pm InvestorsLive: BA good – don’t expect too much more of steady fade until 365 confirms a few times but nice off failed follow thru confirm

01:46:40 pm InvestorsLive: BA imo edge gone until speeds up /stuffs later 3pm + avoiding for now

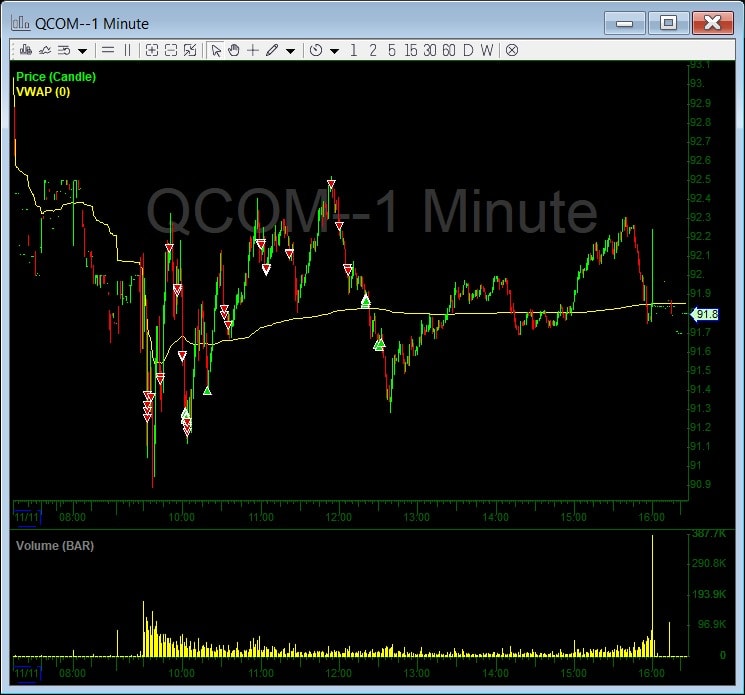

QCOM has been a good one lately – but we were faced with a downgrade and a $2 dollar gap down this morning. Heck, woulda been nice to ride that down instead!

09:38:27 am InvestorsLive: QCOM scaling per plan pre

09:46:07 am InvestorsLive: QCOM higher lows so far – won’t scale until fails sub 9120s

10:00:55 am zimmy18: QCOM VWAP

10:01:03 am InvestorsLive: scaling some QCOM vs 92

10:02:17 am InvestorsLive: 9120s key level for me QCOM if it bases I’ll size down some and re size back under

10:02:51 am InvestorsLive: sized down on QCOM adds

10:14:54 am InvestorsLive: QCOM won’t re add any covers unless big stuff sub VWAP – if just slow fade/flush out I’d prob be done w/ trade – using more eyes than worth it imo

10:20:12 am InvestorsLive: mostly cov’d QCOM re visit sub 9120s

10:27:11 am xChris: QCOM 92

10:32:33 am InvestorsLive: QCOM reject vs. 92s so far

11:04:50 am InvestorsLive: scale some QCOM again vs. high

11:17:01 am InvestorsLive: ditching QCOM if it doesn’t settle under this prior top

11:17:06 am InvestorsLive: market may help here we’ll see

11:26:24 am xChris: QCOM slap

11:45:28 am InvestorsLive: QCOM annoying trader – was 3 cents from my cover – back to same level as lean over/under spot

12:06:51 pm InvestorsLive: QCOM big levels

12:20:09 pm InvestorsLive: covered bunch QCOM .88

12:32:06 pm InvestorsLive: done QCOM

12:37:13 pm InvestorsLive: QCOM = example of exhausting myself front side vs. just waiting for the trade – worked out fine – good entries exits etc but just too many times held on finally worked me out vs. just waiting for it

02:15:38 pm InvestorsLive: QCOM failed follow thru (no pos.)

NKTR one off the scanner was a nice trade but scaled in a bit and chopped me out for flattish

10:04:57 am InvestorsLive: joining NKTR fade vs 2150s

10:25:51 am InvestorsLive: done NKTR

I really like your thought process about entering a trade, I think everything you say is all connected, because you gotta look left to predict right before entering a trade and you gotta spot the key levels in the 1 min chart to know the best price, I’ve learned a lot with that, I really like when you spot the key level and say weak opens or the higher the better, based on the VWAP (those are my ah ha! moments), because now i know what will happen if the trade goes either one way or another, and i’ve applied that not only in the stocks you show in this scan but in the ones i sacan every day, also like when you spot the patterns like the abcd set up, is hard for me to find those in the moment, i always find those set ups after it has happen, if you now more type of set ups i would really appreciate if you can teach us about them.

Overall your videos are really great and thank you

Thanks for posting Nate, I like the idea behind the post. It allows us to see how you traded the stocks in your watchlist, very cool to see such on-point execution!