Check out my audio-blog series, where I narrate all my favorite blog posts for you guys. You can find that here.

Curious what it’s like to be a member at Investors Underground? Here’s a tour around the community.

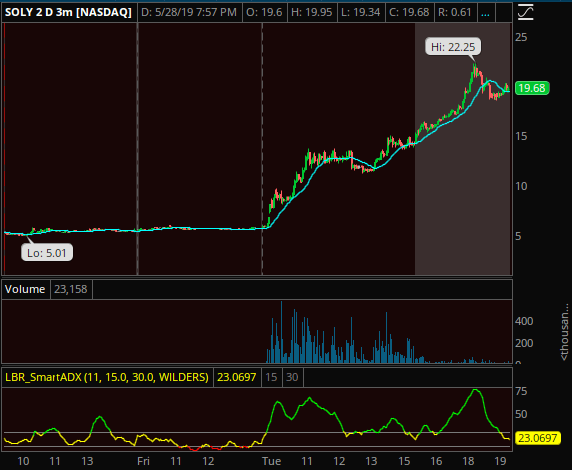

SOLY: This should be a complete avoid if you are very new. For those who are trading it, I’d treat it the same way I treat all of these pure momo plays – look to fade however it looks into the open. They really have shorts in a bind here, so weaker the better with the premarket look, hopefully shorts pile in right at 9:30 and try to force it down, and you’ll know shortly after that if it’s going to be saved, which I imagine it will, and then it could be off to the races again and into the 30s+ potentially. If it gaps up in pre and opens strong and a lot of chat rats are on it, I’d stay away from buying any of those breakouts, and look for a short scalp (high risk), and nothing I’d overstay on there as long as the volume is high. Just an quick scalp idea of fading the open look.

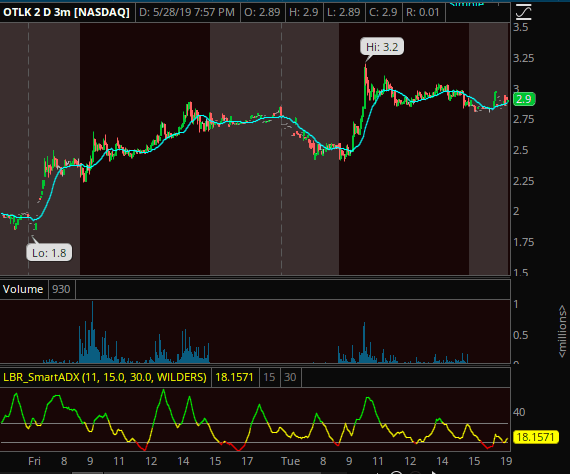

OTLK: The volume is starting to fade a bit here. Tomorrow I’d hope for a good shove through today’s highs into 3.50 perfect world and entertain the short idea up there once it puts in a top and a lower high to risk off of.

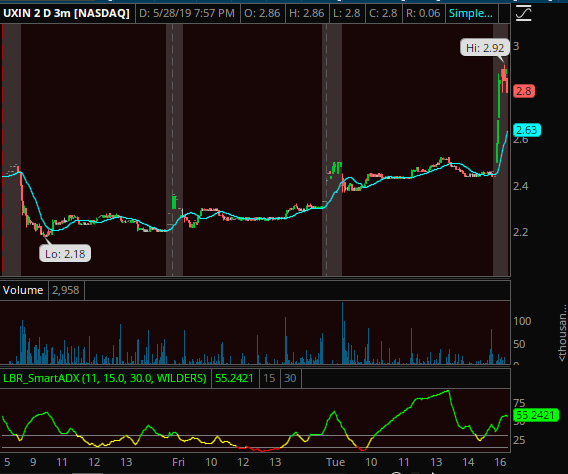

UXIN: Perennial shitbag of the day award. Up on silly news, higher the better tomorrow, into 4 would be nice and look short around there, not sure we get there though. Note: It’s nothing I’d try to jump in front of and do the “add add add” thing on short side, this is a known turd and they’ve shown in the past they can bring serious volume if they want, so be aware of that. Would only go after this if open strength, and after a top & higher low were put in to risk off of.

Shoot me a message anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss your trade ideas with you. If you’re not an IU member and would like to become one, you can join us here.

See you out there!

– D

0 Comments