Check out my audio-blog series, where I narrate all my favorite blog posts for you guys. You can find that here.

Curious what it’s like to be a member at Investors Underground? Here’s a tour around the community.

I wasn’t here today, what a freaking day to miss, my god. Checked in on a few buddies though and happy to see they were not only safe, but nailed it.

Here is an overall thought on the market right now: Today was “the day” to catch “the trade.” Also if you weren’t already aware, the biggest green days occur in bear markets not bull markets, so I don’t necessarily see today’s action as a positive at all, I think we’re far from out of the woods, and don’t get all bulled up. The market needs to CALM down before the real bulls will be back. As long as there is crazy volatility, the thought of any structured/stabilizing participants coming in and moving us higher just doesn’t seem plausible. That thought segues nicely into the next comment: It likely gets a lot harder from here. I wouldn’t become obsessed with trading ETFs or the market every day if that’s not already your primary focus, look to get back to your comfort zone. I’d think the action gets a lot choppier and harder from here on out.

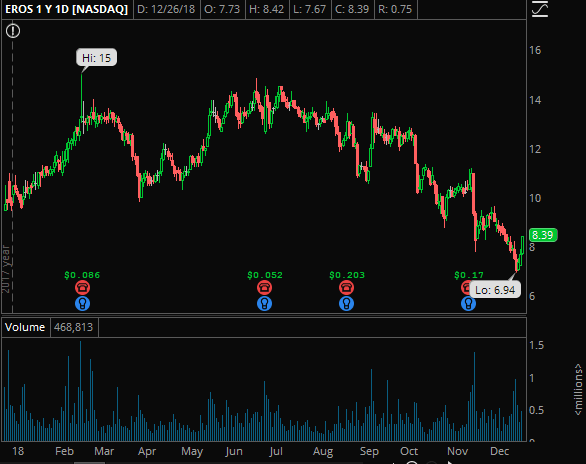

EROS: For starters…don’t go to Eros.com LOL. Great bounce today with every other name on the planet, not buying this one though. I can say with near certainty whoever is bidding this up does not have good intentions, this is a real shady company with a sketchy past. Pretty orderly walk up thus far, so I’m not chomping at the bit to short this yet, but into mid 9s I like it a lot more and will be watching for an ss entry around there.

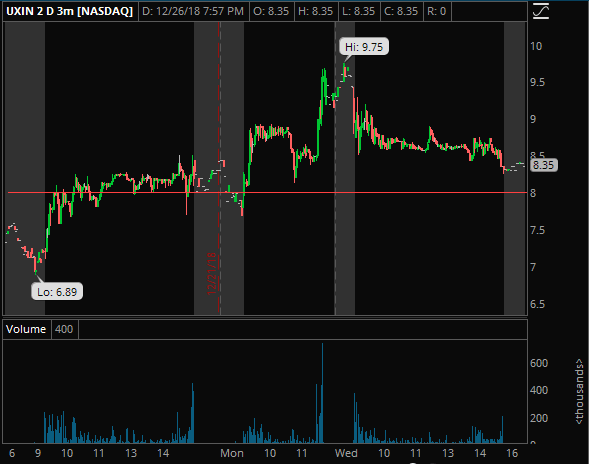

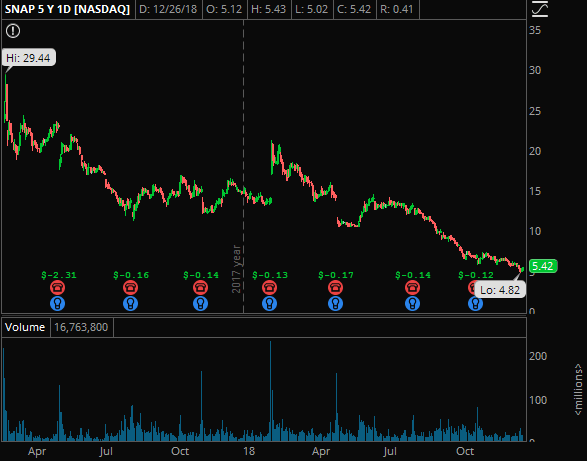

UXIN: Not what I expected the last two days to say the least. Into the blood on Monday, it closes up a buck, and then today into the market rally of all rallies, it closes down a buck. *hands up emoji* So my approach moving forward is this. We didn’t get the huge sell off post-lock up, and if it hangs around here over 8 for another day or two, I think that’s very bad news and we’re headed much higher. This type of trap is not uncommon at all, we see them pretty often, most notably off the top of my head right now was SNAP into lockup. Everyone expecting the guys who can unload to do so, and then they don’t, then you get mad, then you short pops, then it grinds, then it grinds some more, then “oh shit” and it doesn’t see lower for a long time. Not saying that will happen here, just be aware of that possibility, as they’ve been “working” this thing for weeks now, so a nice orderly selloff not happening should not be the most shocking outcome, should it unfold that way. If 8 holds tomorrow, look to get long on dips with that level as a risk. If it washes sub 8, make sure it holds below there on a retest, then short pops with an 8 o/u guide. If it reclaims 8, I’d cover.

Sidenote, speaking of SNAP: It’s finally going where it belongs – to tech Hell. The curse of most “hot” tech – it becomes outdated and obsolete very quickly. Instagram is squashing it, and will likely put out the lights for good there in the not too distant future. Do NOT invest in SNAP. It’s a little too boring to short right now, but do not buy it, it’s a dead man walking. Probably starting it’s final move lower a la APRN, SHLDQ style price action.

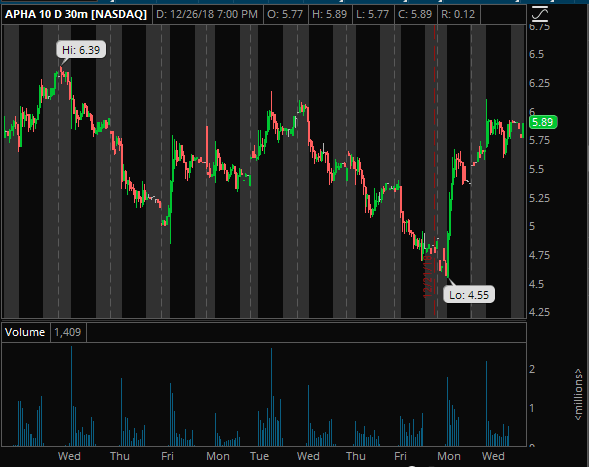

APHA: Pretty obvious level here into low 6s, that’s the spot. We’ll see how it reacts tomorrow am, looking to short pops on any 6 failed follow thru with a 6.50 risk, otherwise will probably leave it alone. And this would be a swing idea.

Shoot me a message anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss your trade ideas with you. If you’re not an IU member and would like to become one, you can join us here.

See you out there!

– D

Thanks !