Check out my audio-blog series, where I narrate all my favorite blog posts for you guys. You can find that here.

Curious what it’s like to be a member at Investors Underground? Here’s a tour around the community.

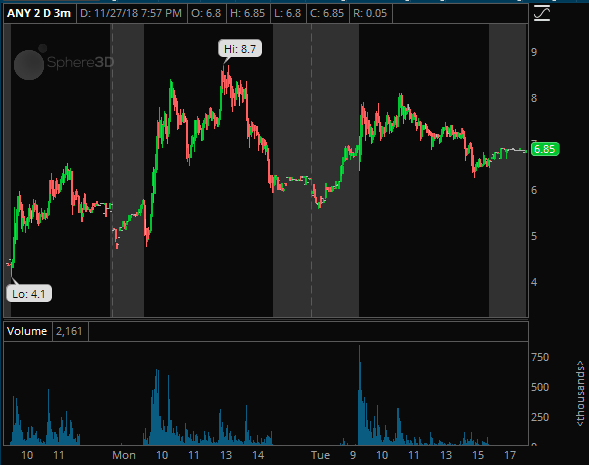

ANY: Massive pile of debt ridden trash, they’ll probably never fix that. I assume their story ends in default somewhere down the line. For now, I like the short swing. This is very likely in backside mode, as there was a fundamental reason to drive this up into 7-8s, and that was probably it. Watching all pops from here into the 8 area ideally to start in short against a 9 risk on the trade, target around 4-5 if you’ve got the patience, I don’t think that’s unreasonable at all within a week or two. That should have been the plan today, but I wasn’t around.

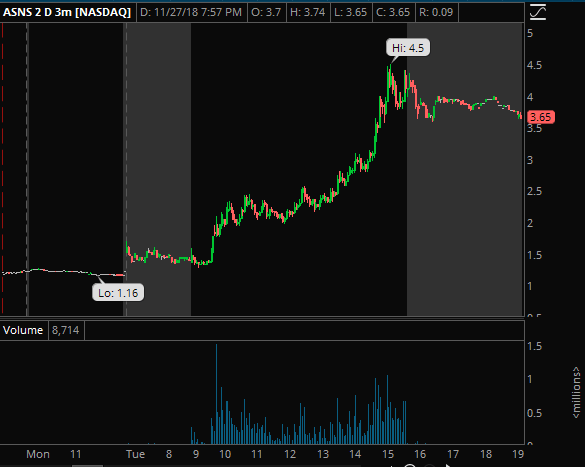

ASNS: My favorite way to play the “day after” on the crazy new runner of the day: fade the pre-market look. If they keep it down, it’s going to open on SSR and will be a complete avoid for me on the short side. But if they walk it up pre and try to jam it 5s into open, I’ll be watching very closely for a seller to step in and look to short pops up there high 4s against a HOD risk once it’s been put in and tested/confirmed.

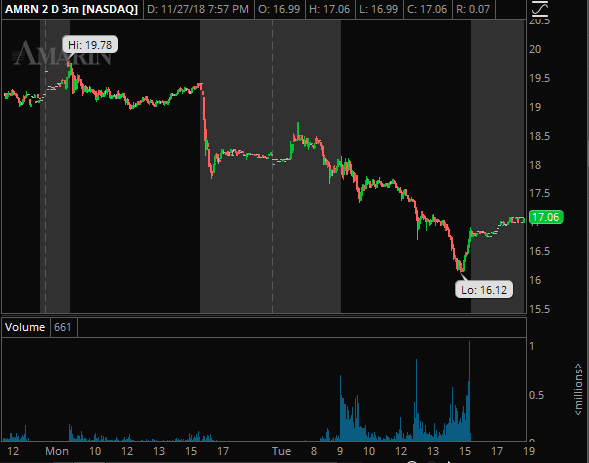

AMRN: This story went foul pretty quickly over the last week or two, Cantor is humping the hell out of it, slimy bastards on the midday ++ note yesterday, just comical. There’s just a lot of red flags now. Something tells me the selling continues, whoever stepped in to save it in the 13-14 area probably wants to get rid of those now that the offering is done – so the action today makes complete sense to me. Offering done, prop job done, now time for analysts to hump it while smart money liquidates into dumb. I could be wrong but that’s certainly how it smells between that scenario and the relative weakness today into an up market. So watching for any morning strength to get denied tomorrow morning, into 18 would be nice, and then looking for those sellers from today to return and to get short for another fade day tomorrow.

Shoot me a message anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss your trade ideas with you. If you’re not an IU member and would like to become one, you can join us here.

See you out there!

– D

0 Comments