Check out my audio-blog series, where I narrate all my favorite blog posts for you guys. You can find that here.

Will be offering some more swing ideas than usual for the next couple weeks, as I’m handling some things outside of the mkt in my life and I’m not able to be at screens all day every day right now.

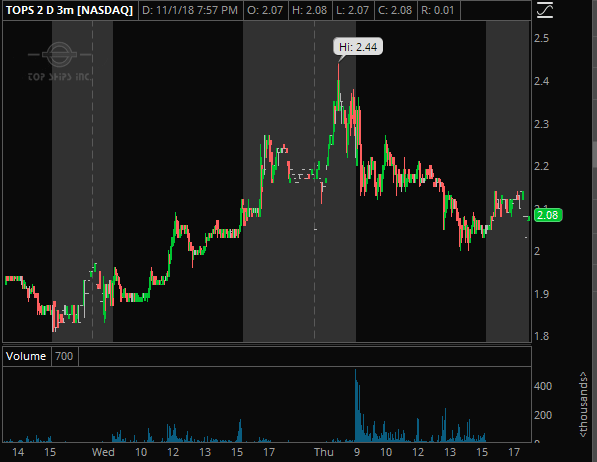

TOPS: This name needs no introduction. A gift that it ever got traction again. It’s not the best intraday trade unless you can use some size and get good entries, but I’d treat it more like a swing ss idea, any more pops into the 2.50+ zone are high probability entries with a ~ 3 stop I’d use. Not sure we ever get back there though.

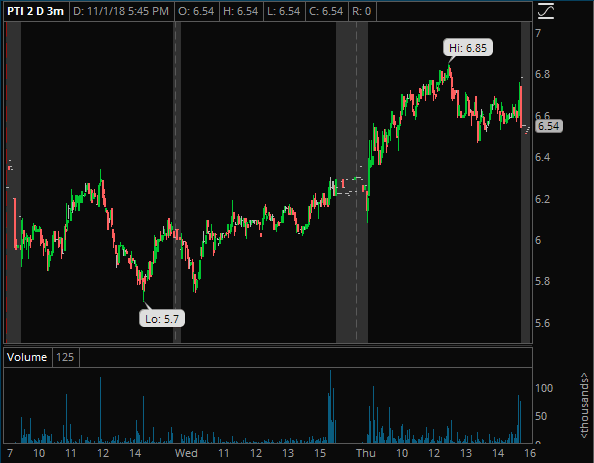

PTI: Continues to stay on radar. Gave us some nice levels to go off of tomorrow, any morning fails into 6.80-90s area it’s probably worth a short try with a 7 stop. Won’t be an exciting trade but it will be a high probability one. This company is atrocious.

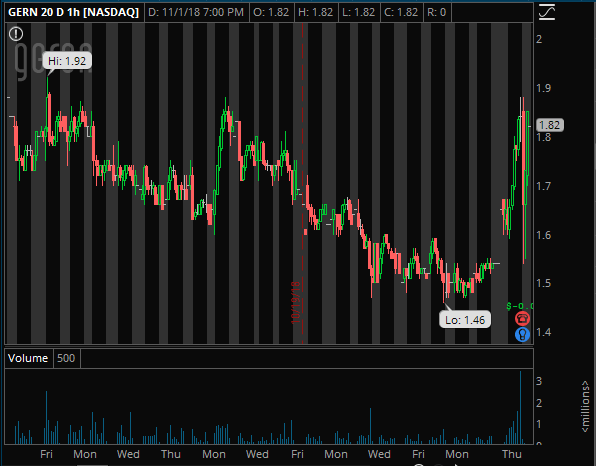

GERN: In the running for perennial shitbag of the year award. It’s absolutely hilarious someone bought this a/h after the smack, I can only imagine they are trying to use a/h and pre to jam this higher when liquidity is low so they can sell more at better prices during market hours. This is a total pig, higher the better, and it’s a short for me. Low 2s again would be a dream.

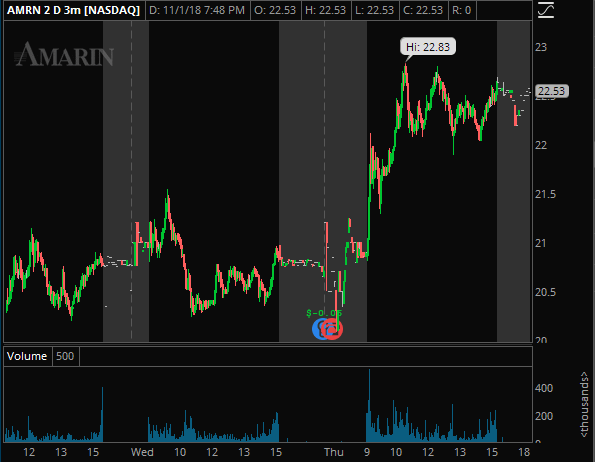

AMRN: Have been long this name for a few weeks now, continue to like the story as, at the very least, pumpable. I don’t really care about the fish oil at the end of the day, I just care that the Baker Bros are there and dips have been getting absorbed and the news the other day that drove it down sub 20 was really silly, almost an excuse for someone to jump in and buy more at a discount, you could argue. I’m just speculating with all that, but I continue to believe they have bigger plans for this re: higher, and when the mkt stabilizes, which it appears to be doing now, I expect this to continue to march higher.

Shoot me a message anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss your trade ideas with you. If you’re not an IU member and would like to become one, you can join us here.

See you out there!

– D

Love your analyses! Thanks.