Check out my audio-blog series, where I narrate all my favorite blog posts for you guys. You can find that here.

Short list today. I’m away from screens most of day still, so just monitoring a couple names for some swing entries right now.

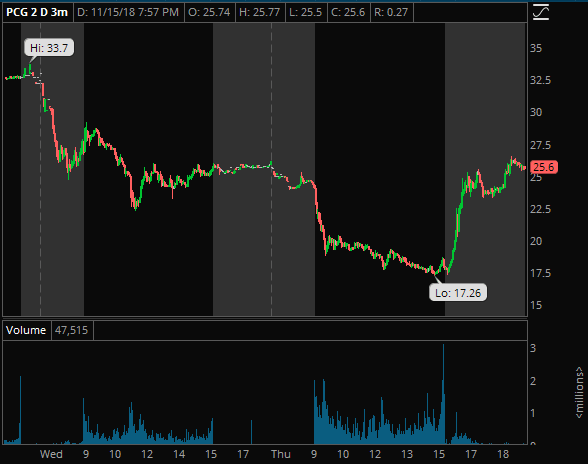

PCG: Awesome trader and amazing range, lot of emotion too it seems, I’ve changed views a couple times, but I think I see it clearly now. The news this afternoon of them not going bankrupt was probably known already, I don’t think that was really the issue to begin with. The reality is that this situation is going to put a big smear on their reputation and present an issue for them for a long time, and it’s not just going to disappear. The heavy volume selling you saw all day today is people who understand that imo. My view is this a/h spike was an excuse to get this back higher just so they can resume selling soon. So looking for some pre continuation higher ideally and maybe even low 30s again at open, and then watching very closely for those sellers to return. People are running for the hills here and it’s no secret, this should end pretty bad.

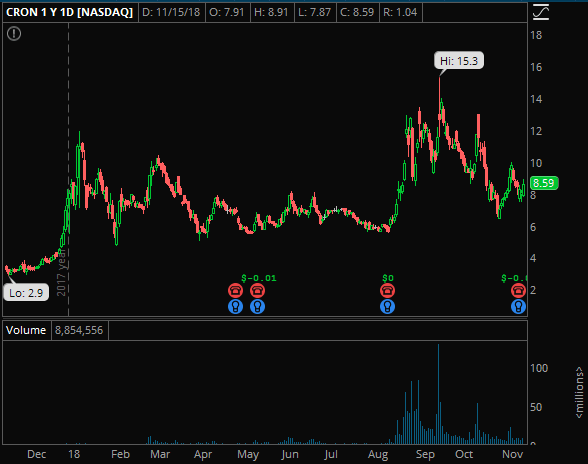

CRON: Hoping for one more good move back into the mid 9s where I got my initial entries last week and use that 10-10.30 area as risk on the swing short.

Shoot me a message anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss your trade ideas with you. If you’re not an IU member and would like to become one, you can join us here.

See you out there!

– D

PCG: “this situation is going to put a big smear on their reputation”

What about the Hexavalent Chromium in Hinkley? Yes, it’s the same PG&E from the Erin Brockovich movie. It’s a shit company with a shit name already.