If you’d like to get involved in our community and talk with me in chat, you can do that here.

You can find a compilation of all Alex and I’s webinars here.

Also I’ve started an audio-blog series where I narrate all my favorite blog posts for you guys. You can find that here.

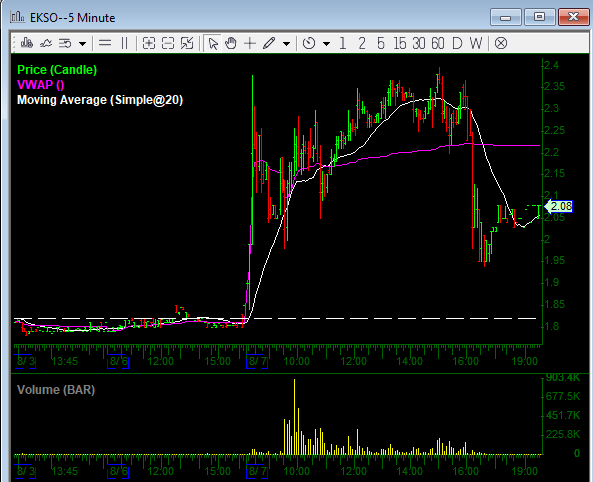

EKSO: Messed this up…had top tick entries 2.36 avg, but cov’d EOD after the VWAP reclaim, thinking maybe “good” e/r and more games tmrw, but clearly I was wrong. Congrats to those who held o/n, nice patience/conviction and payday. Hoping for some straggler covers tomorrow & maybe another push back mid 2s for another shot at it, but if weak open, will be off radar & on to the next.

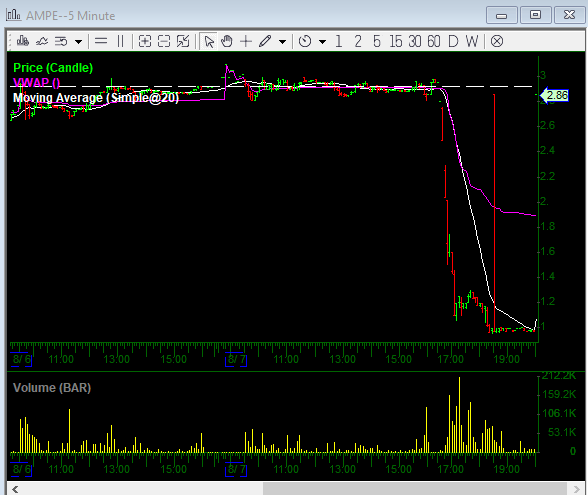

AMPE: In absolute shock…well not really, but can’t believe today was “the day”. I’ve known this company was blowing smoke up investors asses for months, if not years now. And knew the end was near, but figured today would just be a harmless “BLA update” for the BLA that’s never coming, but I tuned into the cc and it was beyond laughable, one of the most sadly disorganized and awful attempts at masking the truth – the guys on the cc basically blew the company up today with their comments, so kudos to them. Should have just kept their mouths shut and said nothing, and maybe some more unsuspecting buyers could have got us back into the 3s before the inevitable bad news, but is what it is. Based on that cc, this thing as as dead as dead gets. Any significant bounce of any kind from this point on is a gift, and I will be looking to short it. Their drug is shit, their management is shit, everything about them is shit, and it’s trading exactly where it belongs right now.

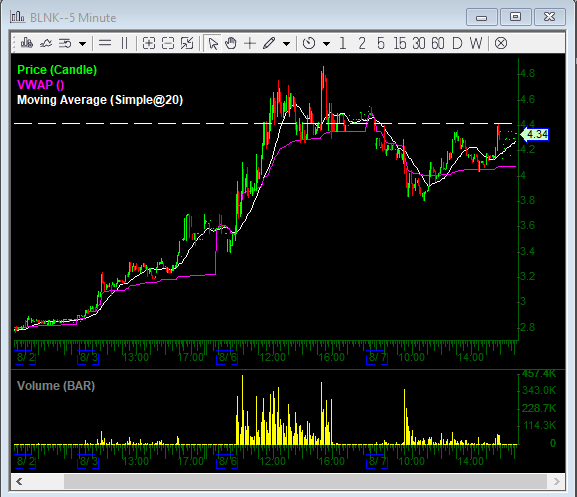

BLNK: Nothing new here, games and more games. Got saved today after the SSR trigger, probably intentional, would seem like a good time to try and issue a PR tomorrow if I was them, maybe get one more good jam day out of this. If it pops through Friday highs and goes 5+, I’m extremely interested in the short. Either that, or a rejection/stuff into the high 4’s and look to attack failed follow thru from there for a breakdown later this week.

Shoot me a message anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss your trade ideas with you. If you’re not an IU member and would like to become one, you can join us here.

See you out there!

– D

Great watchlist and comments D