You can find a compilation of all Alex and I’s webinars here.

If you’d like to get involved in the community, there’s a sale still going on here.

Also if you haven’t seen yet – I’ve started an Audio-Blog series. I narrate all my favorite blog posts for you guys. You can find that here.

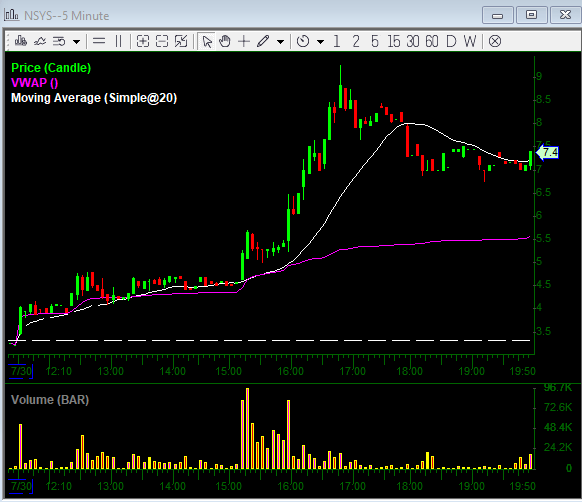

NSYS: The borrow will be hard to come by tomorrow, so if we’re talking about the long idea – this may turn into “Oh I don’t want to miss the next AWX” and chasers will be gung-ho in the morning out of the gate, and then they get absolutely dumped on and bagged by midday. That’s the scenario I think will play out. I wouldn’t be chasing strength in the morning is what I’m saying. If it opens weak and holds for a while, that’s a different story and you may find a spot to long off of with a set risk. But with the volume today, it doesn’t appear this was our notorious new friend Mintbroker buying the float, there wasn’t enough volume churn for him to do that. We’ll see what tomorrow brings, could be a different story. But gut plan is same as always on these, probably look to fade whatever happens early, and patience is typically not the move on super low floats. Lock some if you get a nice win going.

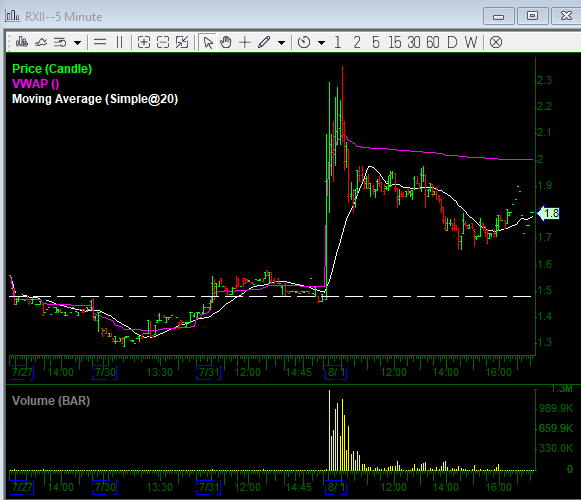

RXII: Maybe we’ll get a second chance on this one. Would try a short on any push back 2.10ish with a risk on the highs from today 2.30 o/u.

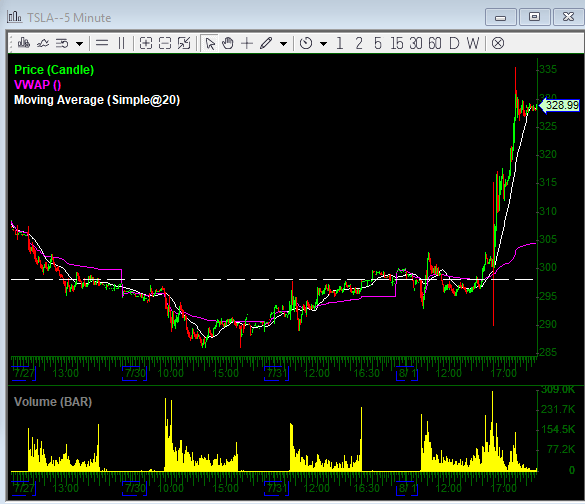

TSLA: Well bears take one on the chin again here. Typically a “surprise” move like this will have some follow through. We’ll see what it looks like out of the gate tomorrow, but if it holds anywhere up here 320+ and bases out a bit, I wouldn’t be surprised to see some follow through higher. I’m completely ignoring the fundamental analysis part of this trade, because it’s not even worth it at this point. Just trade what you see. Being logical has not served bears well. This has proved it can defy gravity if it wants to. Pretty tough trade most days.

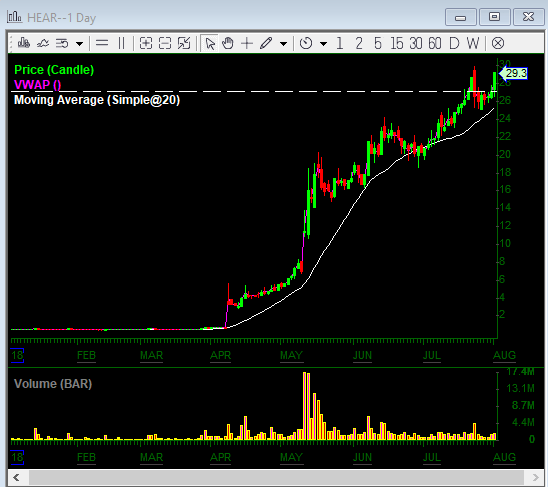

HEAR: I think this one is going to get “Cramer’d” soon. Never a good sign when he loves your stock and it’s not called Nvidia or Apple or a huge company that’s Cramer-proof (sorry CNBC enthusiasts). So the fact he thinks there’s “still upside here” – I have a feeling Earnings in a couple days will be the top or close to it. In my opinion, Turtle Beach is not the next gaming industry titan, there’s better companies with better products out there, but these guys are doing a great job of capturing lightening in a bottle as this industry grows and capitalizing on the hype. I don’t see them in the picture long term though.

If you’re not an IU member and would like to become one, there’s still a sale going on here. Shoot me a PM anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss trade ideas with you.

See you out there!

– D

0 Comments