You can find a compilation of all Alex and I’s webinars here.

If you’d like to get involved in the community, there’s a sale still going on here.

Also if you haven’t seen yet – I’ve started an Audio-Blog series. I narrate all my favorite blog posts for you guys. You can find that here.

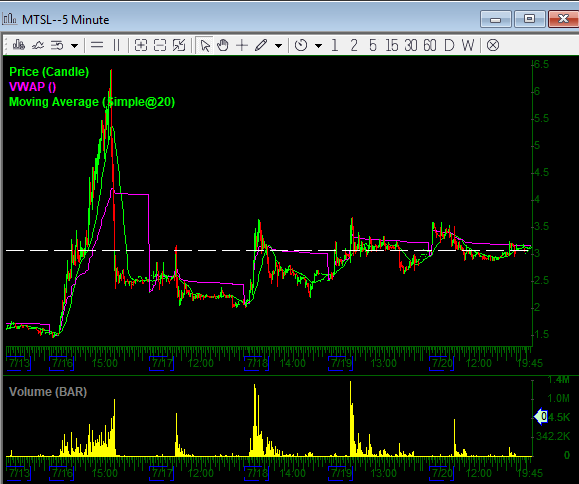

MTSL: Same idea from Friday, this needs to be watched. They continue to play games, roping in shorts & bid propping it, and they’ve been setting up higher lows over the last few days, as you can see in the 5 day chart. Just not typical behavior that a normal pig would exhibit after the big momo day, it should be fading, not building. Over 3.50 this has the potential to go ballistic, that’s the clear line. I wouldn’t be trading it in this 2.50-3.50 range unless you want to try and scalp the channel, but personally I’d rather just wait for it to bust out, or break down. So I’m remaining long bias, but only if it can get through 3.50. If that doesn’t happen soon, no dice & it becomes a short.

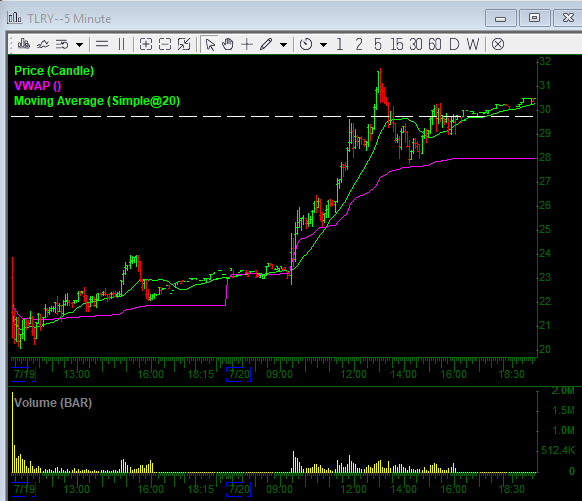

TLRY: Wild IPO. Weed is a hot topic right now with the future prospects of where that industry is going, so this isn’t all that surprising. I think this may need to rest for a day or two, so would be hesitant chasing tomorrow am if it gaps up opens strong again but I think this is heading higher, especially if the market cooperates, so would be looking for entries on weakness, if not tomorrow maybe later in the week. Also keep an eye out for more US Marijuana IPOs, they’ll be coming. Especially after how well this one has done out of the gate.

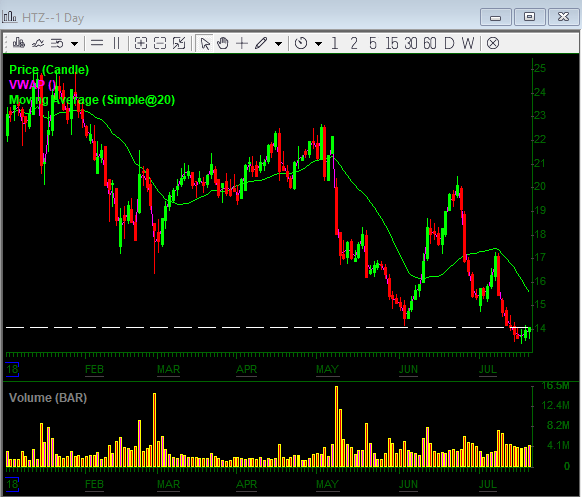

HTZ: Continue to like this long idea on the technical trade, when Hertz bounces it’s usually a multi-day affair, mostly due to the heavy short interest & covering I’d imagine. Also Carl Icahn still has his hand in this cookie jar, and that’s one guy who you usually don’t want to mess with. He’s usually got a plan – we’ll see if that’s the case here as well. Would flip back to short bias if it got under 13.50s consolidation area, but for right now, the r/r much favors the long trade.

SAEX: Total perennial shitbag here, they’re essentially just a shell company who do nothing – this is simply a trading vehicle. Maybe we get one more crack at it, get some chats on it again that’d be nice, we’ll see. Any shove back mid 2s tomorrow is worth the short try.

If you’re not an IU member and would like to become one, there’s still a sale going on here. Shoot me a PM anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss trade ideas with you.

See you out there!

– D

0 Comments