You can find a compilation of all Alex and I’s webinars here.

If you’d like to get involved in the community, there’s a Tax-Back sale still going on here.

Also if you haven’t seen yet – I’ve started an Audio-Blog series. I narrate all my favorite blog posts for you guys. You can find that here.

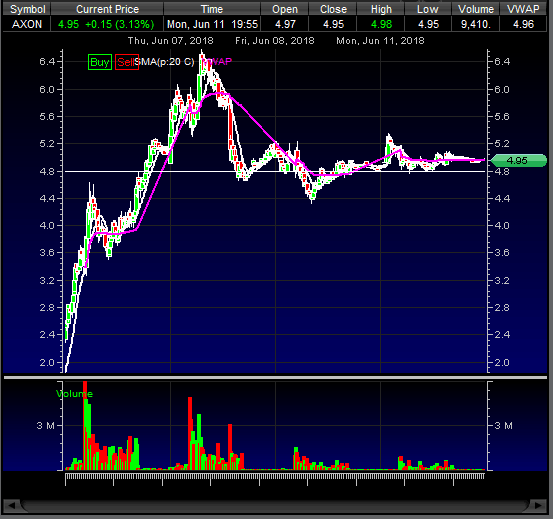

Got a question the other day about what chart I’m choosing to post for each name. It’s not always going to be the daily chart, I’m going to post the chart that I think is most relative to the explanation I’m giving in the write up, be it the daily, 5 day, 3 day, intraday, will vary.

AXON: This has become quite the attention whore. It’s in an absolutely massive consolidation zone here last few days, and for me at least the move is pretty simple. Anywhere in this 4.50-5.20 range bound zone, it’s really a coin-flip/no-trade. I’ve got it on back watch, but the trade comes when we break out of this zone, long or short to be determined, but my bias is that this name is going higher, for some fundamental reasons. My gut and the chart say “well this should have gone by now if it was going to go, or maybe they’re just waiting for T+2 cover games & then probably lower”, so I see the short bias too, but some other things are dragging me to the long bias as well. Basically what I’m saying is: “It’s going up if it doesn’t go down” 🙂 When indecisive, the best thing to do is just wait for a consolidation break, up or down, and join the trend from there.

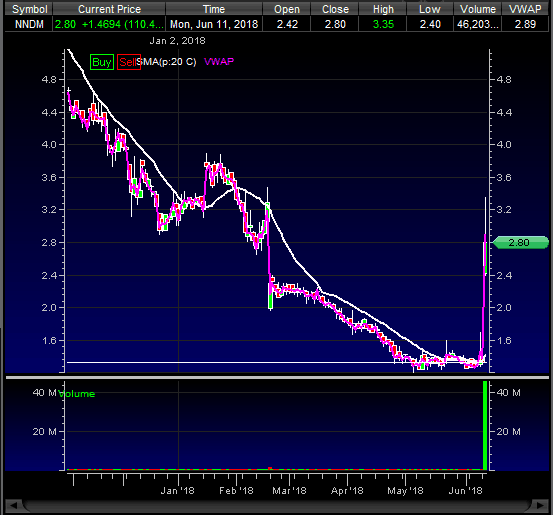

NNDM: Couldn’t get a borrow on this thing today, guess that was a good thing early. It fits the bill for what we’ve seen the last few weeks – random buck runner shows up with blow-your-face-off volume out of nowhere. Anytime something trades almost 50M shares in a day, you should respect it on day 2 – if this goes back 3+ I won’t be stepping in front of it yet. Will wait for a clear rejection, and ideally that 4 spot on the daily is a better area of interest for me, so hoping for another run there tomorrow. Weak open & 2.50 hold and it’s probably a long.

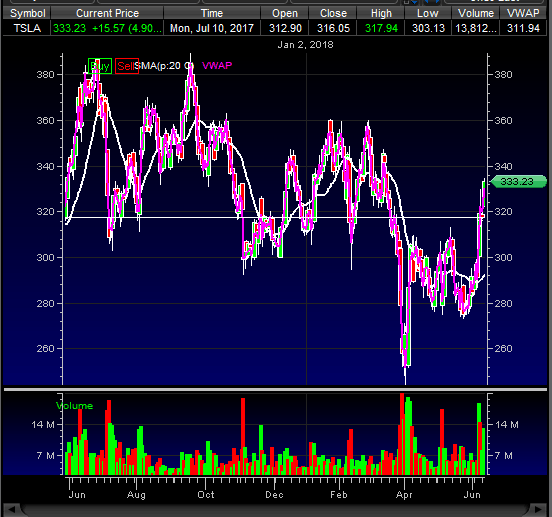

TSLA: This thing continues to be a beast, and if it starts to creep any further 340s+, we’re getting to the point of “well why not just go blow the top off 360 resistance at this point, we’ve come this far” and once you do that you’re at ATHs. I know that’s bold and lofty and probably not going to happen, but you know how crazy this one can get, and just look what it’s done in the last week or two. It’s nothing to get crazy and chase strength with size especially after this move from 300, but just remember there are nearly 39 million shorts (well less now after this squeeze) but there’s still a ton, and they’re getting the heat turned up on them more and more every day, margin calls may come into play, Elon’s always a wildcard, it’s just not something to underestimate. Look for weakness to hold and BTFD until it stops working on this squeeze phase we’re in, especially if the SPY keeps chugging along.

If you’re not an IU member and would like to become one, there’s still a sale going on here. Shoot me a PM anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss trade ideas with you.

See you out there!

– D

Thnx for full explanation

love the watchlist!!!!

NNDM with 50M – longs could see a quick unwind if it dips much below 2.50