You can find a compilation of all Alex and I’s webinars here.

There’s also an IU sale still going on for those interested in getting involved with the community, which you can find here.

Also if you haven’t seen yet – I’ve recently started an Audio-Blog series! Where I narrate all my favorite blog posts for you guys. You can find that here.

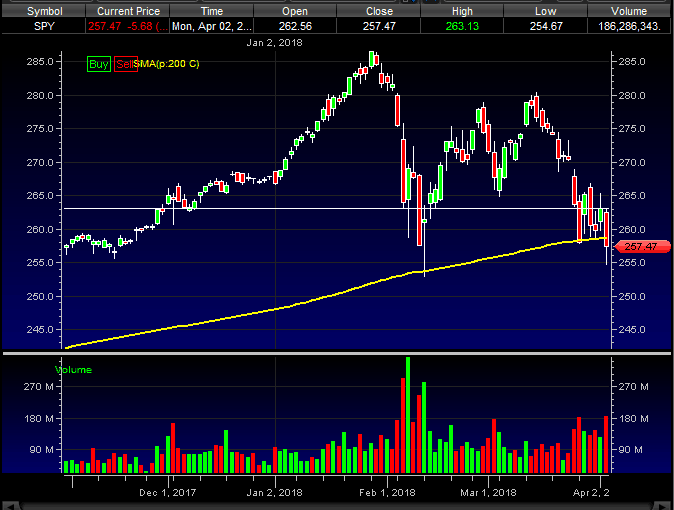

SPY: With all the current volatility, I may actually just trade SPY tomorrow. It’s had fantastic range, best to take advantage while we can, it won’t be around forever. Key here for me is the 259 level, for two reasons. Firstly its right about where the 200ma is (just below high 258s), and 259 was support all last week. So if we try to push tomorrow and fail to reclaim the 200ma and 259, I think it could get bloody again. We are definitely due for a rally day though, so don’t just dive in at that level, see how it reacts first & get confirmation, and if we fail, it may get ugly. But if we push 259 & hold, I’ll likely flip bias and look to get long. If you don’t want to trade SPY, another good one is SSO, or VXX. SSO trade it just like SPY, and VXX trade it inverse of SPY obviously. The biggest key right now is to just not get too bias in either direction. Come in with a complete 50/50 game plan, and react to what we get out of the open.

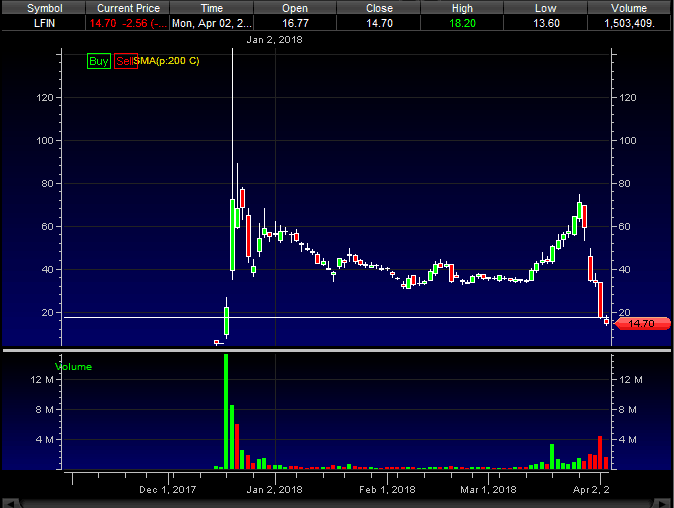

LFIN: What a mess. The jig is completely up here, the only thing stopping it from going lower are momo dip buyers who are just looking for a quick buck, and covers. So keep an eye on it, a rip back towards 18 would be great, but I have a feeling this story ends around $5 where it started in the not too distant future.

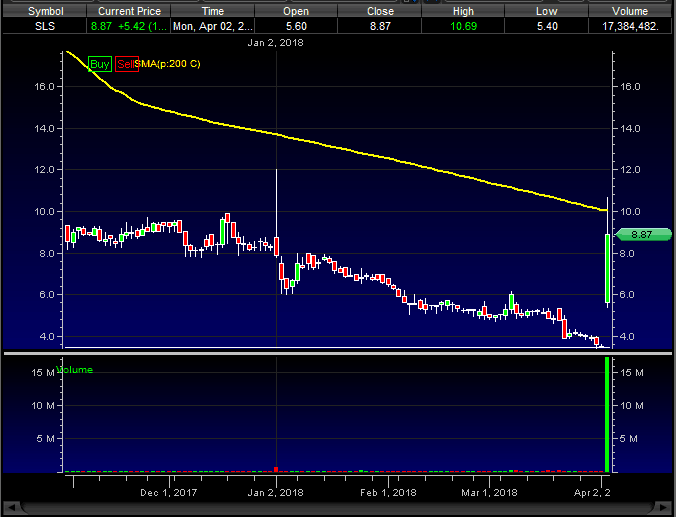

SLS: This is former perennial shitbag GALE, total dead end play here, low floater playing games, be careful near term, the volume was pretty insane today so I wouldn’t rule out a multi-day runner, but this is one I want to go after in a few days once everyone has moved on, and should be a nice short down. Above 8 though I’d be long bias on dips, and once 8 goes, then flip to shorting pops.

If you’re not an IU member and would like to become one, there’s still a sale going on here. Shoot me a PM anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss trade ideas with you.

See you out there!

– D

0 Comments