Yesterday was one of my favorite trades in a while. The reason for that is because it’s straight out of the educational courses and lined up perfectly on the one minute chart.

Most important things to understand here are:

1. Low float

2. Major volume

3. Trend hold

They key was to be patient and wait for theopportunity to enter. I definitely did not want to just chase randomly on the name. My goal was a $1.80-1.90 consolidation after the trend held for potential re-push through $2s for EOD run.

The most important piece of the puzzle here is the RECLAIM, which I’m sure you’ve already read about if you’re reading this. I’ve discussed the reclaim many times and it’s importance. As I wrote, it was a MAJOR reason for running into many major losses in May-July which were easily avoidable.

In short, the reclaim is the area of support that everyone starts to trust (both longs and shorts). When it snaps, shorts pile in and longs bail, but what happens if it reclaims that support level? What now? This was a big area for my failures in May-July, as I would get some of the best entries on particular names only to size in on the crack (ruining a great average to anticipate disaster) and see it reclaim that level a few minutes later.

Well what happens next?

All those shorts I just added, I have to make a decision – do I size down? or cover? As I wrote in the post “Eh, I was just up $5k now I’m flat — maybe I’ll be patient and see what it does?” Then … next push and I’m red.

What causes this?

All those traders that just bailed because support cracked may find comfort knowing that it’s now back above that level and will re-add. All those that chased the short on the crack for fear of missing out now have a terrible average and emotional attachment so they cover into the first pop back over prior support. This has a nice little domino effect to people like me, where I was just up a bunch and now have much more size than the original short and end up covering into the push. Make sense?

Well, when you’re not fighting a trade and have a clear view here’s how it went down – I’d suggest reviewing the parts in red as they are most important in the chat logs.

Additionally pay attention to my comments about $2.35 where they were absorbing everything. This was SO important to my interest yesterday in the long. Stocks don’t need to go straight up, but when I see LARGE absorption (like a sponge) at a particular level it’s likely shares coming off the street into tighter hands and, if the trend holds and RECLAIMS that level, we’re going to have a squeezer as shown.

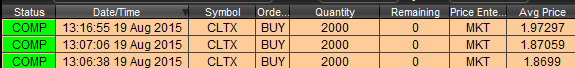

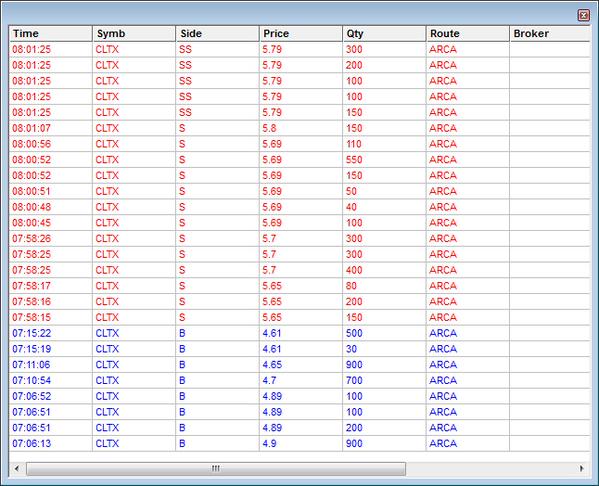

Here are a few of my trades

Here is a Free Video Lesson

Here are the Chat Logs

[Aug 19, 2015 9:41:18 AM EDT] Muddy CLTX r/g

[Aug 19, 2015 11:49:01 AM EDT] OddStockTrader CLTX break

[Aug 19, 2015 11:52:16 AM EDT] Muddy CLTX more on 1 recross

[Aug 19, 2015 11:53:22 AM EDT] Muddy CLTX so nice 1.30

[Aug 19, 2015 11:59:47 AM EDT] OddStockTrader CLTX lovely

[Aug 19, 2015 12:00:19 PM EDT] Muddy CLTX para shot

[Aug 19, 2015 12:00:25 PM EDT] InvestorsLive nice alert CLTX

[Aug 19, 2015 12:07:20 PM EDT] ModernRock CLTX yahoo shows floatr Float: 4.94M

[Aug 19, 2015 12:11:34 PM EDT] InvestorsLive CLTX thru $2

[Aug 19, 2015 12:14:21 PM EDT] InvestorsLive CLTX has SSR on if you are on short side — be careful and realize if you short into weakness you may just get swipped offer the offer and squeezed

[Aug 19, 2015 12:22:23 PM EDT] InvestorsLive if CLTX reclaims $2.50 going to start to get crazy so far lots of shares rotating up there — anyone with small account just b/c ETB does not mean its a good short best to stay far far far away

[Aug 19, 2015 12:22:34 PM EDT] InvestorsLive so far its ‘heavy’ but accuming will watch a wash 2.10-2.20 range and see if it holds

[Aug 19, 2015 12:22:52 PM EDT] InvestorsLive but later on — if that 2.50 level reclaims — do NOT fight the trend

[Aug 19, 2015 12:23:41 PM EDT] InvestorsLive 0 interest in a long unless a washout — lotta shares were accuming 235 range but can slam back nicely under 2

[Aug 19, 2015 12:27:05 PM EDT] InvestorsLive I really wanted 180-190 to scoop CLTX got tiny so far on bids NOTHING Id take offers on — bu tgot real small and I am not trading any size rest of day just FYI

[Aug 19, 2015 12:29:01 PM EDT] InvestorsLive if CLTX stuffs a few times and cant reclaim 2.35 level — nothing to hold just FYI — very thin name needs to rotate traders a few times — idaelly some wash sub $2 tho if they stuff $2.20s

[Aug 19, 2015 12:29:17 PM EDT] InvestorsLive again nothing exciting until 2.35 reclaim due to all the absorb there before

[Aug 19, 2015 12:30:29 PM EDT] InvestorsLive took flat CLTX

[Aug 19, 2015 12:30:37 PM EDT] InvestorsLive ideally 180-190

[Aug 19, 2015 12:32:59 PM EDT] InvestorsLive CLTX absorbed again

[Aug 19, 2015 12:44:14 PM EDT] InvestorsLive nice on CLTX the 1.90s wash now have something to risk off — g’luck careful

[Aug 19, 2015 1:09:41 PM EDT] InvestorsLive CLTX at this point until $2.05 reclaims I’d be careful – I do think there will be an opportunity but as you know if it odesnt forma trend it can grind all day

[Aug 19, 2015 1:10:09 PM EDT] InvestorsLive same direction – so point being if u want to anticipate it go for it but make sure you have a plan — any goo dwashouts may be ok but have a plan cuz if it doesnt grind

[Aug 19, 2015 1:10:22 PM EDT] InvestorsLive its going to do a slow melt — but 2.05 + and 2-3pm + I am 100% watching

[Aug 19, 2015 1:15:52 PM EDT] TexMex started long CLTX 1.90… won’t add more until 2.05+, risking 1.70ish

[Aug 19, 2015 1:17:23 PM EDT] InvestorsLive CLTX gearing — be careful of a chase into 2 just in case a stuff if you didn’t anticipate it watch for higher lows off dips then set risk

[Aug 19, 2015 1:19:52 PM EDT] InvestorsLive CLTX ::up

[Aug 19, 2015 1:23:32 PM EDT] InvestorsLive CLTX TEXT BOOK %%%%% ya

[Aug 19, 2015 1:23:54 PM EDT] hionspd CLTX… awesome call Nate..!!

[Aug 19, 2015 1:25:14 PM EDT] InvestorsLive out most CLTX

[Aug 19, 2015 1:26:56 PM EDT] InvestorsLive all done CLTX

[Aug 19, 2015 3:16:52 PM EDT] InvestorsLive nice trends on CLTX so far watch all dips

[Aug 19, 2015 3:16:54 PM EDT] InvestorsLive 240s as a guide

[Aug 19, 2015 3:24:23 PM EDT] InvestorsLive nice traps CLTX so far

[Aug 19, 2015 3:24:40 PM EDT] InvestorsLive bam

[Aug 19, 2015 3:24:50 PM EDT] InvestorsLive shorts fuked

[Aug 19, 2015 3:26:58 PM EDT] InvestorsLive ::up CLTX nice read — perfect risk can lock into the pops but this may have a big gap to it

[Aug 19, 2015 3:35:53 PM EDT] InvestorsLive Sweet way to end day CLTX ::up

[Aug 19, 2015 3:36:29 PM EDT] InvestorsLive oh man

[Aug 19, 2015 3:40:15 PM EDT] InvestorsLive I’m holding CLTX o/n fwiw

[Aug 19, 2015 3:40:24 PM EDT] InvestorsLive risk obviously but that was a fast buck move for us

OMER Trade

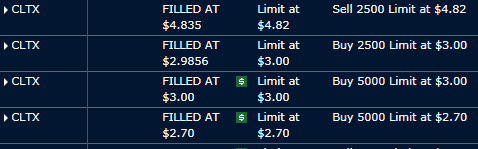

After hours action:

[Aug 19, 2015 4:33:34 PM EDT] InvestorsLive see thing is on these CLTX

[Aug 19, 2015 4:33:38 PM EDT] InvestorsLive they do this huge move AHs

[Aug 19, 2015 4:33:41 PM EDT] InvestorsLive everyone thinks yea right

[Aug 19, 2015 4:33:45 PM EDT] InvestorsLive they fill huge

[Aug 19, 2015 4:33:47 PM EDT] InvestorsLive let it dip

[Aug 19, 2015 4:33:54 PM EDT] InvestorsLive but they sorta trapping

[Aug 19, 2015 4:48:15 PM EDT] InvestorsLive arrite keeping rest over I need to leave lol 7.5k o/n ill be happy or sad tomorrow

[Aug 19, 2015 4:48:26 PM EDT] InvestorsLive 4.835 and 4.75 sold 1/5 1/5

[Aug 19, 2015 4:48:32 PM EDT] InvestorsLive they absorbed everything

[Aug 19, 2015 4:48:36 PM EDT] InvestorsLive just gimme 530-6 or 7

[Aug 19, 2015 4:48:38 PM EDT] InvestorsLive ill be happy tomorrow ha

It is that a b c pattern you talk about. Good to hear Cam´s story. Thanks

What does ‘ETB’ mean? I checked the New Members page for all the acronyms and its not there. I am guessing it is something like Extended ….

Easy to borrow

u have in depth commentary like this every day in chat? thx

i got SI from about a week ago. i earned a year’s income from that and UUUU—i use short dated options just out of the money.. would have liked to see what you could have done with these.

i only do about ten trades a day. BKKT might be a SI, but they don’t have Facebook who is probably the SI buyer. The SI option prices are outrageous– which I like. It means the market maket sees what I see.