I haven’t done a New Year’s blog post in a few years, but I figured this was a great year to do it.

This has been a year of change for both myself and Investors Underground, and I’m excited about what 2024 has in store.

As you’ve seen at IU, we’ve done more in the last few months than we have in the last five years combined. A lot has gone into this, and I wanted to share how we got here and where we’re headed.

Reflecting on a 20+ Year Trading Career

As crazy as it sounds, I’ve been trading for over 20 years.

Where did it begin for you? 🤔

Here's my first two set ups (left) in my college dorm room and one in my apartment in Boston 🖥🖥🖥 and now..

Reply with your first and current 🔥

Then and now 👇 pic.twitter.com/gol75n8QPR

— Nathan Michaud (@InvestorsLive) December 5, 2020

It has been an amazing journey with a lot of lessons learned along the way.

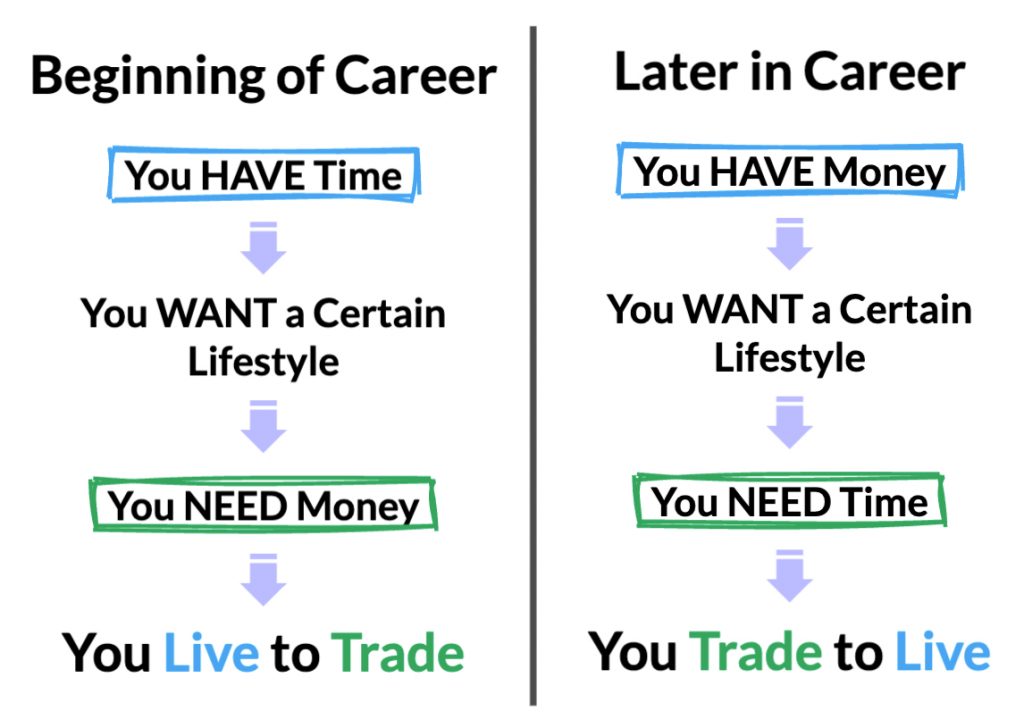

The longer you pursue this career, the more you realize the importance of taking a purposeful approach to balancing life and trading. It’s easy to obsess about the markets 24/7, and at certain stages of your career, this is exactly what you need to be doing. At other stages, it can’t be detrimental to your other life goals.

I’ve spent the past year working on some personal changes, and I want to share some thoughts that may benefit traders at different stages of their journeys.

Forget the market for a second.

It’s important to remember why we trade in the first place. It’s not so we can sit behind a computer and press buttons all day. It’s so we can create the lifestyles we want for ourselves and our families. We all start out with this goal, but we may get lost along the way.

There’s a good short story that illustrates this concept:

An American investment banker was at the pier of a small coastal Mexican village late one morning when a small boat docked. Inside the small boat was just one fisherman who had already caught several large fish. The American complimented the fisherman on the fish and asked how long it took to catch them.

The fisherman replied, “only a little while.”

The American then asked why didn’t he stay out longer and catch more fish?

The Mexican said he had caught plenty enough to provide for his family’s needs for quite a while and even to give some fish away to others in the village.

The American then asked, “but what do you do with the rest of your time?”

The Mexican fisherman said, “I sleep late, play with my children, take siestas with my wife, and stroll into the village where I sip wine, and play guitar with my amigos. I have a full and busy life.”

The American scoffed. “I am an experienced businessman and can help you,” he said. “You should spend more time fishing, and with the proceeds, buy a bigger boat. With the proceeds from the bigger boat, you could have a fleet of fishing boats, open up your own cannery and control all of the distribution,” he said. “Of course, you would need to leave this small coastal fishing village and move to a bigger city to run the expanding enterprise.”

The Mexican fisherman asked, “But, how long will that all take?”

To which the American replied, “Oh, 15 to 20 years or so.”

“But what then?” asked the Mexican.

The American laughed and said, “That’s the best part. When the time was right, you would sell your company and become very rich. You would make millions!”

“Millions – then what?” asked the Mexican.

The American said, “Then you could retire. Move to a small coastal fishing village where you could sleep late, play with your kids, take siestas with your wife, and stroll to the village where you could sip wine and play guitar with your amigos.”

“I already do that,” said the Mexican fisherman.

The point is simple but impactful.

It’s important to remember your “why” so you don’t get lost along the way.

Once you start reaching your goals, you need to take a look at your life and make sure you’re living the way you want to before time passes by.

This seems obvious, but it’s easy to get lost along the way. The “hustle culture” that enables your success also facilitates unsustainable habits that may not serve you at later stages of your career.

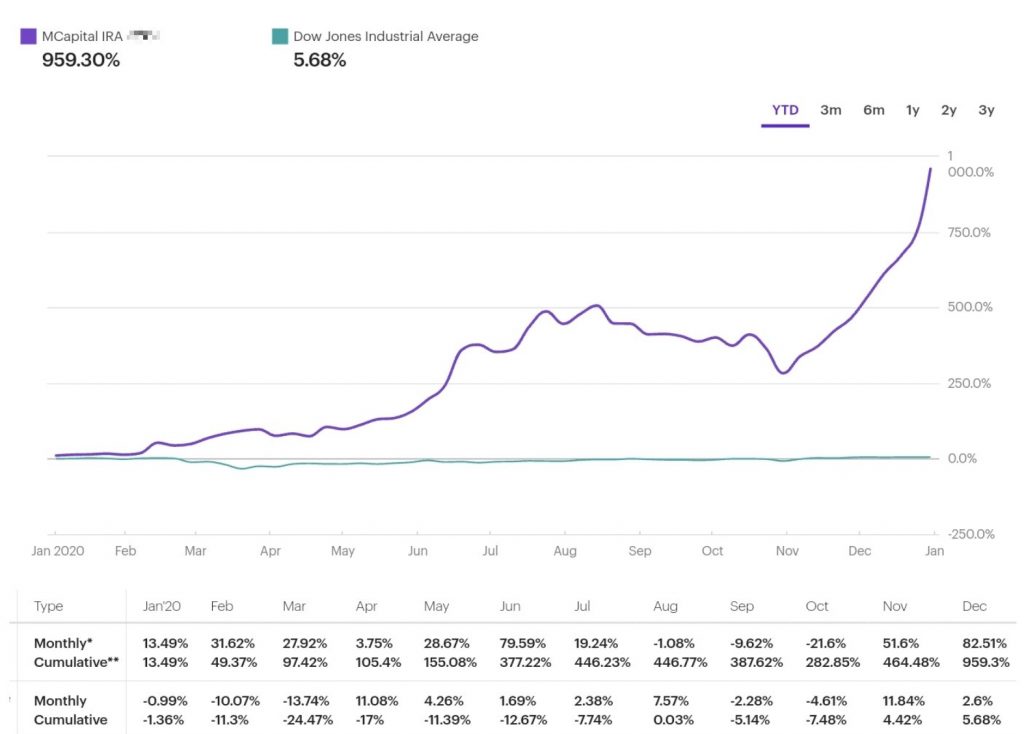

In 2020 and 2021, I surpassed all of my trading goals. The market was hot, and it was a time to capitalize on an abundance of opportunities. Careers were made during these years, and lives were changed.

2020 IRA Performance

So, what do you do when you accomplish your goals ahead of schedule?

If you’re like me and many traders I know, you start moving the goalpost. You set out to make $1 million, you hit it, and then the goal becomes $5 million, $10 million, $20 million, and so on (adjust the numbers to whatever your goals are).

You start obsessing over the next level – a perpetually moving goalpost with no inherent meaning.

You become so accustomed to chasing a dangling carrot that you forget why you’re even doing it.

This obsession can be exacerbated when you see what others are doing and start comparing yourself.

At this point, the problem is YOU. You’re in the endzone, but you’re still running.

This isn’t to say that everyone should trade less or decrease their monetary goals.

If you love trading and have a good balance, stick with it.

If chasing the “next level” lights a fire inside of you, keep up with your pursuits.

If you are still figuring things out and need to make certain sacrifices, that’s okay.

There is no right path. As long as you are acting with purpose and know where you are headed, you are in good shape.

It can be beneficial to check in with yourself periodically to make sure you are on the right track and that you are still acting in a way that is consistent with your goals.

What really matters to you? Is it an extra $X, or is it more time with the family? Is it more time behind the screens, or is it the freedom to set your own schedule?

Most traders will answer the questions differently at different points in their careers and lives (and they should). There’s no right answer as long as you are acting with purpose.

I would encourage all traders to be cognizant of where they are at in their trading journeys and what matters to them.

When you start out, you need to be ALL IN if you want to reach an elite level. If you are fortunate enough to start at a younger age, you have an advantage – no kids, little to no debt, and fewer responsibilities. Like any worthwhile pursuit, trading requires you to make sacrifices, and you need to be selfish at times.

As you progress and start reaching your goals, you need to reevaluate, especially if you have new responsibilities. It can be difficult to break the habits that built you.

We all start out with the goal of making money, and some people may be willing to make extraordinary sacrifices in the pursuit of financial freedom. The concept of finding balance may seem like a “nice” problem to have, and, in a way, it is. When you are in the earlier stages of your journey, it can feel like money will solve all of your problems. Once you start making money, you realize there is more to life. This isn’t to say money is not important. It is. But, it is one of many important things in life.

The New Year is a great time to evaluate your priorities, assess what you’re doing, and make sure you’re on the right track.

Here are some considerations:

- Newer Traders: What’s your ultimate trading goal? What’s your timeframe? What work are you going to do to get there? What sacrifices will you make, and what sacrifices will you avoid? What role will trading play in your life?

- Career Traders: Are you happy where you’re at or chasing the next level? If you chose the latter, what is the next level, and what will you do when you get there? Are you fulfilled outside of trading?

- Elite Traders: Where’s the endzone? Are you making unnecessary sacrifices to make some extra money? Are you operating on autopilot or living with purpose?

- Everyone: What are your life goals outside of making money? Are you taking care of your health, relationships, etc.?

These are some of the questions I started asking in 2023, and I recognized that I needed a better balance. I started thinking about why I traded instead of continuing to operate on autopilot.

Reflecting on 2023

Every year, I try to put a few thoughts on paper on how I plan to improve in the year ahead.

Over the last two years, I have definitely made significant improvements, but there is still a lot of work to do (let’s face it, trying to shift habits that got me to where I am over 15-20 years is very difficult to do). It’s always easy to revert back to what you’re used to doing.

In 2023, I worked with a few coaches to hold myself accountable and inch closer to my non-trading goals.

I am extremely thankful for Kim Ann Curtin for initially cracking me, Lance Breitstein for making me put a date on the calendar (or I’d owe him $100K to his charity – true story lol), and Dr. Katz for helping me take and achieve some significant steps in the right direction this year.

With all of their help, I’ve really pinpointed a lot of the unwarranted pressure that I put on myself by setting the bar so high, maintaining it, and being afraid to let people down. Keeping the bar at such a high level over the last 15 years has taken a toll, and I realized I needed a change.

The problem with my personality is I am always 200% in.

Whenever my name is on something, I am ALL IN, for better or worse. That goes for trading, IU, T4AC, real estate, etc.

I can multitask like a machine. I’m always ON and rarely hit the OFF switch. I’ve been trading since 2003 and have been running IU since 2008. I think the only full vacation I’ve taken was Hawaii for my honeymoon.

2023 was a year of rebalance and reevaluation.

My priorities have changed since I started trading over 20 years ago, but my behavioral changes were lagging.

Here are a few of the things I worked on.

#1 – Optimize My Trading Style

I’ve been in “hustle mode” for over two decades. When you operate a certain way for this long, it can be difficult to make changes. I wanted to test the waters to see if I could even pull back or if I’d just revert back to my normal self.

In order to do this, I needed to trade SMALLER and trade LESS.

I couldn’t rebalance anything if I was glued to a screen 10 hours a day, taking trades with the same size as 2020 and 2021.

My goal in 2023 was to finetune my top setups and top trading environments where the majority of my gains come from (and stop wasting my time on anything subpar).

I started to focus on:

- Quality > Quantity.

- Trading with an edge vs. trading just to trade.

One SIMPLE change I learned from Kim Ann Curtin was to be self-aware and hold myself accountable. I set a daily alarm for 11:30 AM to ask myself, “Am I trading just to trade, or is there still an edge?” This one simple change can save you hours.

By focusing on edge and “quality over quantity,” I freed up a lot of previously mismanaged time.

#2 – Deploy Capital Outside of Trading

Until recently, I’ve always worked harder, not smarter.

2023 was a pivot in the direction of working smarter, not harder.

Over the last seven years (mainly after 2021), I put a good chunk of capital into properties and other longer-term investments outside of the market, and it was the best decision I made. Not only did it give me a chance to soak in how much was really made in 2020-2021 but it allowed me to keep most of it.

During 2022-2023, the small cap market has become increasingly gamified. Had I been swinging and pushing the size I once was, I’m not so sure I would have been safe over the last year or two.

Taking money out of your account is a great way to limit your risk exposure, especially if it’s not needed for a large cap or swing strategy.

You don’t get a second chance in small caps these days. Things that weren’t really a “risk” in prior markets are now exploited on the regular. One wrong entry can undo weeks, months, or years of gains.

So, how do you avoid this risk? I think the answer is clear: stop trading names with fat tail risk!

Of course, this is easier said than done, so it helped to take money out of my accounts. It’s better to have the option to send money in if needed than not having that option at all because the account is gone.

#3 – Focus on the Future of IU

IU was never a “follow Nate” service. It was never even just a chat room.

Our goal has always been to give traders all of the tools and resources they need to be successful – the tools I wish I had when I started trading.

These tools and resources do not come in the form of “people to copy” (no successful trader copied their way to success). The real value comes from proper guidance, trade ideas/commentary, education, community, etc.

We’ve been working on these types of tools for over 15 years at Investors Underground, and over the past year, we’ve taken this to the next level in two ways:

- We started offering trading tools and technology

- We expanded our team of moderators and educators so you can learn a range of different styles

We’ve re-invested a lot of capital into improving the service to give members the best resources possible.

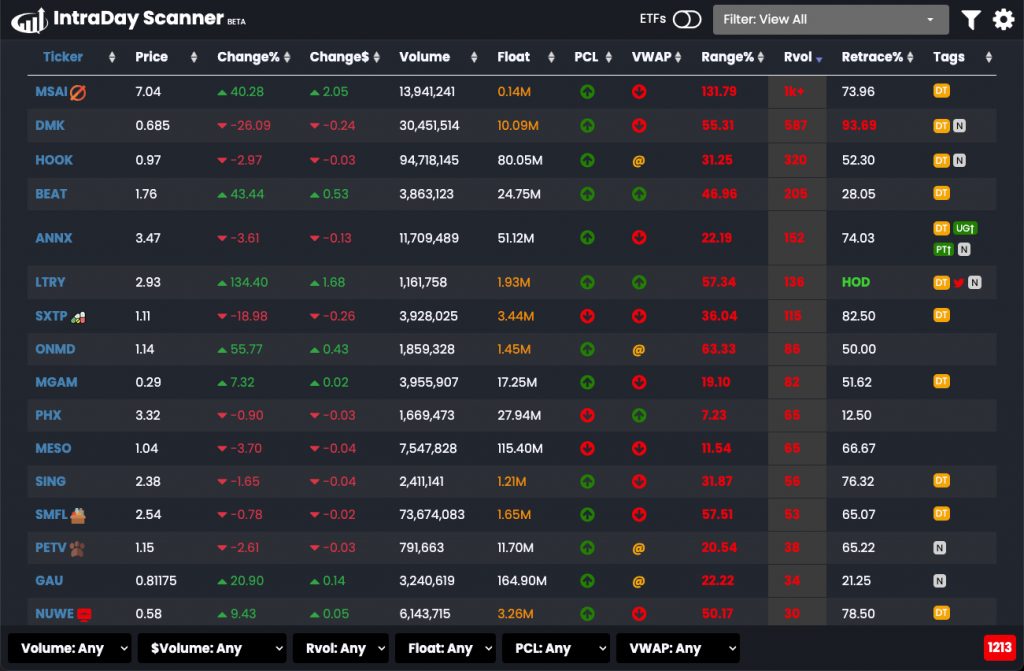

A big problem for traders is that you need to subscribe to a dozen tools to stay ahead, but you only use a small percentage of the features and end up paying the full price. Our goal has been to condense the features you DO use into one ecosystem. We’re only on phase one of the rollouts, but there’s so much more in the pipeline (more on this later in the post).

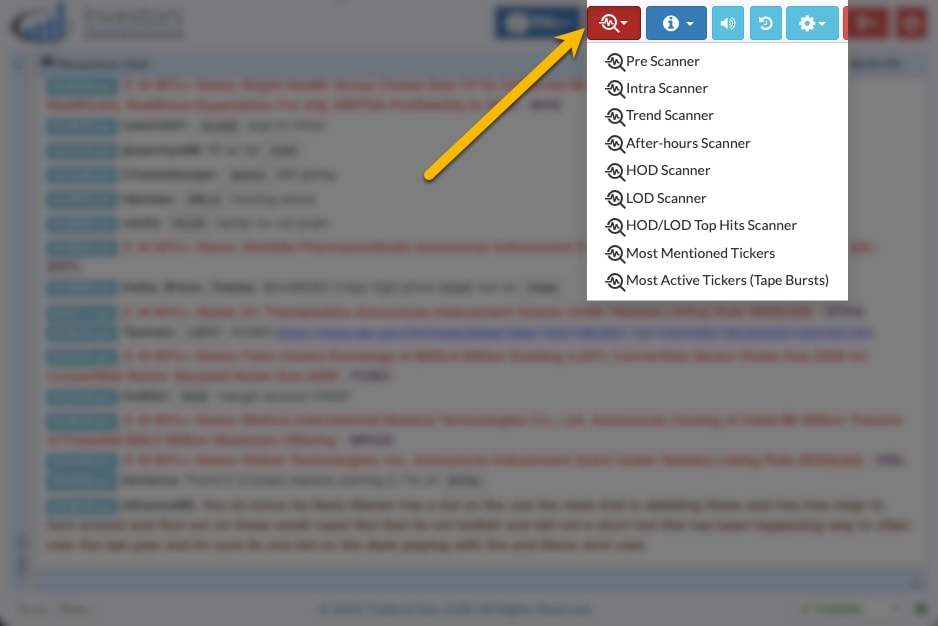

Here are just a few of the tools we built out:

- Stock Scanners (Intraday, Pre-Market, and After Hours)

- AI-Driven News Alerts

- Price Alerts

- Data Scrapers

We also worked on expanding our team so members could learn from and network with a broader range of traders.

We’ve been hiring like crazy and expanding the roles of existing members. This has 10X’ed the resourcefulness of the service.

Members can now learn from a broad range of traders with a broad range of styles and ways of analyzing the market. We introduced more study sessions, watch lists, broadcasts, etc.

I truly believe the service is better than it has ever been, and we still have so much more in store.

2024 Goals

2023 was the year when I recognized I needed to make some big changes. 2024 will be the year I enact a lot of these changes (and I’m holding myself accountable!).

I have a lot I want to accomplish in 2024.

My broad goals are to spend more time with my family, work on my personal growth, and change my approach to trading/business so it is in line with my changing priorities.

Here’s how I plan to do that.

#1 – Spend More Time With Family

It’s crazy to say, but this will be my 21st year trading the markets actively.

Time is flying, and it’s imperative to be aware of that. Since I am in a position to do so, I want to make the most of my kids’ childhood. It’s important to me to shift priorities so I can be involved in their lives and daily activities.

I’m not trying to become the world’s best trader. I want to be the world’s best dad and husband and live the best life.

I only have a few short years before my daughter is far too cool for me. NOW is the time to spend with them. Once they’re out of the house, you’ll see them for the equivalent of ONE YEAR the rest of their life. Pause and let that sink in.

My goal is to disconnect from the day-to-day hamster wheel grind so I can spend more time on other projects and, most importantly, with my wife (she’s been such a champion, truly), kids, and parents.

Here are some goals:

-

- First and foremost, I want to focus more on my wife, Laura. She’s been my biggest supporter throughout my career, but now it’s her turn to stop waiting for me to “settle down at 30,” as I promised.

- Do better at meaningful, well-thought-out gifts. Good intentions aside, I’m always the last-minute guy. I suck at Birthdays and Christmas. This is my last year of December 24th shopping 🙂 A good gift is never forgotten.

- Take two real vacations in 2024 (no working!). I haven’t taken a real vacation in 15 years. It’s time. I want to disconnect fully without feeling the pressure to show up for a broadcast or a scan. The community has grown so much with so much talent, and life is short.

- Continue to be my daughter’s best friend. I think daughters are special, and if you are blessed with one, it’s such a unique bond. You only get one shot. I’m already on my way, but there are a lot of times I have to say, “not now, later, etc.” because of changes I haven’t made yet. My busy schedule impacts this (trading during the day, scans and content in the evenings, etc.). I’m putting my daughter and family first, so I will re-evaluate how and what I do and make small changes (such as scans in the morning instead of at night).

- A failed 2023 goal was picking my daughter up at school at least twice a week. I started doing it but then got busy with a million projects. I have scheduled things more and more during market hours, such as haircuts, appointments, and massages, because if I have them planned, I prepare ahead and get off the desk. If I don’t, I will end up trading or working during the time I could be with family or kids. My goal is to pick my daughter up at school more frequently (and, eventually, my son too).

- Get more active with kids on activities we both can enjoy. There is zero reason we are not skiing more. I want to get off my desk and explore.

- I’d like to spend more time with my parents this year. I know what I’d love to have with my kids one day, so I’d like to give that to my parents. That’s one area where I’ve been lacking a bit, as I’ve been eyes on the prize for so long. My love language has been opportunity (house, gifts, etc), but their love language is quality time spent together.

- Make sure people know their value to me.

#2 – Work on Personal Growth

When you get into the routine of staring at the screen all day, it’s easy to neglect your personal goals. You skip a workout here and there, use time to unwind later in the day instead of focusing on growth, etc.

My goal is to find a better balance and make self-improvement a top priority.

Personal Goals

- First things first, I want to be more conscious of how I operate so I can continue to make improvements. I want to work on myself and be aware of how I spend my time. I’ve been caught up in many routines and bad habits that have slowed my own self-development.

- Read at least two PHYSICAL books. I have massive ADHD (self-diagnosed) and can hardly make it through books. I listened to a few audiobooks this year and really enjoyed them (Atomic Habits, specifically). I end up texting myself so many notes to apply to my daily life, but it’s still an area where I need a lot of work because my mind wanders with the other 900 things I have to do (also a work in progress). My goal is to learn something new every day from people who have been there and done it already.

- Decrease my personal social media use and save for within IU. X is pretty much for fun and business. But, the team now has an account for that so now I no longer need to use it as much. We also created some tools to bring the most valuable insights from X into the IU chat room, so I don’t need to be active on social media during the day.

- Avoid negativity. My goal with posting and sharing ideas is truly to help people. Most people respond positively, but the negative comments always stand out. You could have 1,000 positive responses and one negative response, and you’re focused on the negative. In the past, I’ve responded to trolls, but I’m done with that. Life’s too short to focus on the negative.

- Be good with not pleasing everyone. You can’t please everyone, nor should you. Most will find value and are appreciative for most things but there’s always a handful that try to be the loudest. In the past I didn’t always ignore, but I’ve been working on that.

- Bonus Tip for 2024. When you block people, they take it as a badge of honor. They’ll create multiple accounts then you have to deal with it two or three times. The secret is to mute them, and they never know – you’re welcome! Please tell no one this trick.

Fitness Goals

Health and fitness go hand-in-hand with performance. When you live a healthy lifestyle, you are better at everything you do.

Here are my fitness goals for 2024:

- I want to attempt to hit 12K + steps a day as a goal (minimum of 10K). It’s a big goal but easily achieved as long as I take a morning walk with Beckett, a midday stroll, and then a long walk at market close. When I was hitting 12-17K steps this year, my energy was off the charts, and I was at my lowest weight since high school.

- I want to continue to live a mostly sober lifestyle, not for any reason other than I just feel better. I never drank a lot, but even a few drinks can delay your momentum the following morning. I know… it’s boring, but try it. You’ll see how many more things you accomplish and how many goals you hit, especially getting up earlier with a clear head.

- Add an extra day of working out in the morning with Zach (AvidityFitness). I would love to get a midday workout in, something I haven’t allowed myself to do for years.

- More couple workouts with Laura (but she doesn’t know yet). We used to do them with Zach on the weekends, but life got in the way. They were fun.

- Focus on benching more now that my shoulders are better.

- Continue to work on proper form and not rush to get to higher weights. I love deadlifts. I’d love to get to 500 by year-end as long as my form is right (otherwise, avoid it).

- Get back to taking golf lessons and playing golf more. I’d like to get better. I said “no” a lot over the last two years because it was hard to leave the desk. If you left the desk, you missed a potential life changing trade every few days (in 2020-2021). This builds a lot of BAD habits. I was getting good (ie, lose one ball per 18) prior to Aidan being born, and then life kicked into high gear. It’s easy to make excuses about why I can’t get out there, but, at the end of the day, that’s a “me” issue. This summer = more golf.

- Buy a sauna

#3 – Trade to Live

If you review your trades, you’ll probably notice that 80-90% of your profits come from 10-20% of your trades.

Meanwhile, you spend 80-90% of your time on the trades that produce the least and give you the most headaches.

For some reason, doing something feels more productive than doing nothing (even when doing less is likely to yield better results and lead to a better lifestyle).

What makes it worse is that many traders tie their life satisfaction (or ego/self-esteem) to their trading performance. If you’re trading well, you’re happy. If you’re not trading well, you’re not happy.

After trading for over 20 years, I can say that this isn’t a great way to live. It’s a cycle/trap that most traders fall into, and it keeps you from finding your true purpose. It also makes trading stressful when it doesn’t need to be.

In the year ahead, I will continue to reevaluate my time spent on the desk and will not exchange it for subpar setups.

I will be focusing on quality over quantity – edge vs. no edge.

I will be trading to live instead of living to trade.

Trading Goals

- Continue to avoid the “HIGH RISK, high reward” trades like I did this year. In the end, the risk just isn’t worth it anymore. When I was 20, maybe. At 38? Not so much.

- Stop exchanging time for subpar setups.

- Focus on the “11:30 AM rule” from Kim Ann Curtain. So simple, yet so effective.

- Continue to only exchange my time at the desk for high quality setups. I did a lot better this year than in prior years when I’d trade just about anything and everything. I excel in times of volatility, and that’s a tough habit to break. Now, I only trade 3-5 names a day, and I’m very strategic about my entries and size. I’d like to continue to cut that to even less, higher-quality setups.

- Focus on tax-free growth in Roth IRA. Take a more active approach as I did in 2020 with the Traditional IRA (yes, “I make too much for a Roth IRA,” but consult your CPA and discuss the backdoor Roth IRA conversion). It’s better to start sooner rather than later. One mistake I made during 2020-2021 was using the Traditional IRA when I made some life-changing money. I wish I had converted it earlier, as it would have been tax-free forever. It’s never a bad time to start one. If you haven’t, it’s good to have it when there is a market cycle that heats up, like recently. You can quickly get it to a level where you can actually trade it regularly.

- Get my kids’ 529 plans rolling. They’ve made a change for January 1 that the money not used for education can be rolled into a Roth IRA up to $35K, which is great.

Business Goals

My philosophy of “trading to live” applies to business as well.

I want to use my time more wisely to build more passive income, expand my real estate portfolio, and continue to give back to the community.

Make sure that the income or wealth you’ve created works for you; otherwise, you’ll always be working for life.

My goal is to get better at managing my businesses and other endeavors so they work for me.

- Build more passive income. I never really planned ahead, and if I want to pump the brakes some and pull back from trading and live a little, I need more things working for me that require no output.

- Re-evaluate ALL investments without emotion and consider if it is worth keeping them or better investing somewhere else. There are some properties I purchased that I absolutely love but just don’t make sense to keep. Yes, I want them, but they need to make sense. If any are costing money or not producing, it’s important to reevaluate.

- Say yes less. I always try to make things happen with everyone and everything. It’s just in my DNA. At some point, you hit your max. For me, that was 2023 with projects, pivoting IU to a technology company, and focusing on spending more time with my children. Now, if I put time and energy into it, it needs to make sense.

- Keep building trading technology at IU. What you’ve seen is only the first version that we’ve recently taken out of beta, and many members have already been able to cancel their scanner services. It’s been a game-changer. What we have on deck (filings, AI news, etc.) will change the industry. We’re excited, and all members who are in prior to the official launch in 2024 will continue to get them as part of their subscription since they’ve helped us beta-test them.

- Continue to “trust the process” with the team at IU. As we add more and more contributors to the mix, I want to work with everyone to help them take the baton and lead the community in the same fashion as I have for 15 years. I’ve always held the bar so high in regard to the quality of what we do. It’s difficult to let others take over key roles, but I’d say we’ve done a damn good job at it! I’m VERY impressed with the current team leading each day. In the end, the more you let people fly, the more they’ll flourish. The proof is the last few months on how great things have become from so many different angles. Case in point – look back at my first Sunday videos versus now. Besides going from black hair to a peppered, “distinguished” look, I’d say the quality has exponentially grown.

- Put more and more traders on the map – or further on the map (make people uncomfortable to become comfortable) through our channels so that traders can learn different styles and concepts from everyone and anyone. There is no ONE right way. The best trading strategies are a cumulation of many different trading strategies that fit what works for YOU and your personality.

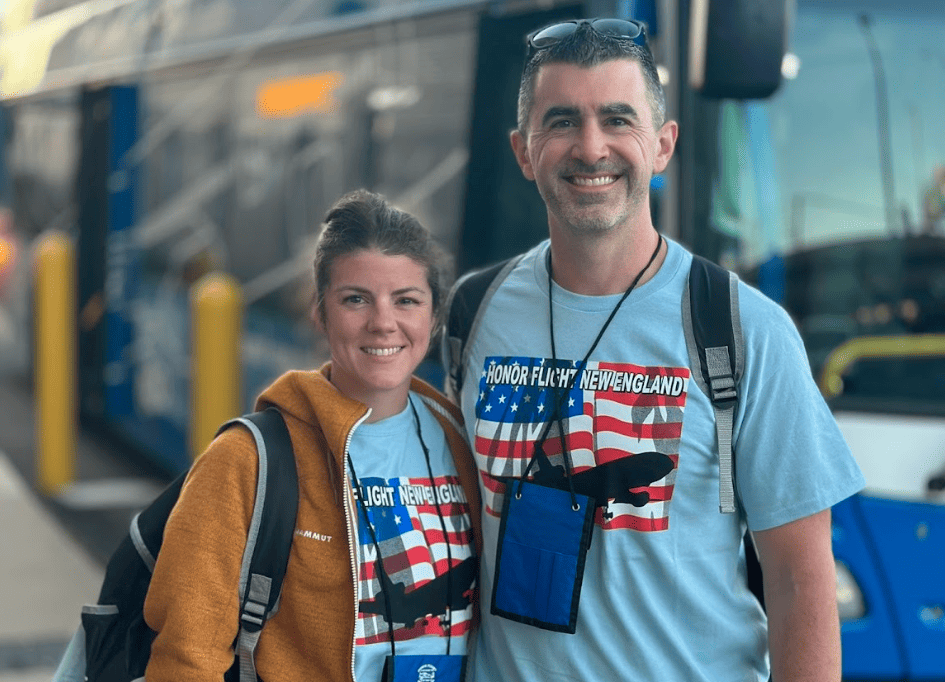

- Continue to build Traders4ACause. This past year was a record-breaking year. The New England Honor Flight was a highlight and exactly why we do what we do, and I want to do more of the boots on the ground where you see the impact and emotions right in front of you.

- Focus on HIGHER quality evergreen content that I enjoy instead of time-sensitive, shorter-term content like Sunday videos that I just do because I once enjoyed (and still do to an extent) but not when it’s “expected.”

- Promote good people doing good things: Lance, Lukas, Brian Lee, Clovers (Jack, Dom, Huddie, Kyle), Ricky, Kristjan, David Hanlin, Stan (GodFather), Eric, Tom, Eduardo, Todd, Zach, and many more adding extreme value to the feed. None of these people need to do what they’re doing. Soak it in while you can. All of these great traders learned within the communities you’re all familiar with and found their way and continually give back gold gems most times for FREE. Pay it forward as others once did for you.

- Re-evaluate all relationships that should have reciprocation and don’t.

- Project T2L/T2G – create a full game plan for 2025 execution.

Here’s how that is going to shape some of the updates at IU.

2024 IU Roadmap

I have been running Investors Underground for over 15 years.

Over the past few years, we’ve added a ton of new resources without changing the subscription price.

Here are just a few:

- Built a custom chat room software from scratch and actively developed new features on a weekly basis

- Built custom stock scanners to help members find trade ideas

- Incorporated more data feeds and scrapers into the chat room

- Introduced AI news alerts

- Introduced the Pre-Market Broadcast video stream to help members create a game plan every day

- Launched a Midweek Study Session with Sam

- Offered weekly Zoom workouts

- Released courses from Cody and Kim Ann Curtin

- Hired new moderators in the chat room

- Added watch lists from other members of the community

IU has come a LONG way since it was just a chat room service with some nightly watch lists, and we plan to continue to build in this new direction.

Technology

Technology has become a big part of what we offer at Investors Underground. We’ve added a ton of custom tools for scanning, setting alerts, researching stocks, analyzing news, etc.

We surveyed members earlier this year, and over 40% of them mentioned that they were able to cancel a paid scanner subscription because of the new tools we offer (at no additional charge).

We plan to continue to build these tools and increase the value of the service.

Our ultimate goal is to provide everything you need under one roof to save you time and money.

Over the next year, we plan to:

- Build more custom trading tools

- Integrate more data into the chat room

- Build out more advanced scanners

- Launch our new filings tool

- Improve the documentation and resources for using these tools

- And MUCH more!

I can’t share ALL of our plans, but we have a ton in store for 2024, and all of it will be available for free to current members.

We build tools to the specs of the traders who actually use them, so if you have any ideas, you can always reach out and let us know.

Expand the Team

Over the past few years, we’ve brought on new team members to add value to the chat room and the community as a whole.

We have members getting more active in chat, members sharing watch lists, members hosting study sessions, and more.

I can truly say this is the best trading community out there, and I want to give a HUGE shoutout to everyone who has become more involved.

I would encourage more traders to get involved if they haven’t already. It truly is a win-win situation.

When you share more, you help out other traders, AND you start building your network. You never know who will take note and where those relationships will go. Ed talked about this recently when he went public with his “4X in 4 Months” challenge.

In 2024, we plan to continue to expand our team by adding new mentors, traders, and educators that add unique value to the community.

Not everyone trades like me, and not everyone should. IU is home to traders with a broad range of styles, and our goal is to provide resources for everyone, whether you are a small cap momentum trader or a large cap swing trader.

As part of this initiative, we plan to:

- Recruit more team members with different trading styles

- Release more trade recap videos

- Release more trade setup instructional videos

- Release courses from other moderators

- Host more live study sessions and broadcasts

If you are interested in joining us or if there is a specific person you’d like to see more content from, please reach out.

Practice What I Preach

In 2024, I plan on sharing insights in a way that aligns with my new focus on “quality over quantity.” I’ll likely adjust the frequency that I post scans and focus on less minute-to-minute action in the chat room and more on bigger-picture ideas. This is in line with my goals – our team will still be sharing all types of commentary in the chat room.

My goals are no longer to find the best trades of the day but rather the best trades overall. I want to share content that reflects that, and hopefully, this new approach will resonate with a larger group of our members (who should also be focusing on quality over quantity).

I would also like to focus more on helping traders become self-sufficient. My approach involves both technology and education.

On the tech side, I will be guiding the development of trading tools that help traders identify ideal setups (think custom scanners for different trade setups, research tools built into chat, etc.). These tools will be available at no additional charge to current members and will likely be an add-on to the core IU service in the future.

On the education side, I want to start sharing more insights on the process behind the trades. Over the past few years, I’ve focused a lot on the “day-to-day” commentary and less on the timeless lessons that serve as the foundational framework for what we do. Yes, we discuss some of these ideas in Sunday Scan, and yes, the lessons taught in our coursework are still as relevant today as they were when we created them. That said, I want to create some next-level resources to share some of the new lessons and strategies I’ve learned since the release of our last course.

Wrapping it Up

There you have it – a look back at 2023, some goals for next year, and a roadmap for what’s to come.

I didn’t get here without the help of some great people.

I wanted to give a special shoutout to Scott Herman and Matt Marino from CenterPoint Securities for just being amazing people year after year. CenterPoint is such a different broker. It almost feels like they share the wins and losses because, at the end of the day, you have a relationship with them, and you’re not just another account number.

Thank you to Kim Ann Curtin for playing an instrumental role in my 2023 pivot which I have yet to thank at the capacity she deserves yet. Truly, she doesn’t know it fully yet, but she forced me to have conversations I didn’t want to have and helped me take pressures that weren’t real off my plate.

And I can’t forget Lance Breitstein, who ended up visiting the beach this summer. A conversation with him and an introduction to Dr. Katz allowed me to check off boxes I’ve been failing to fill for arguably a decade.

A big thank you to Max for his amazing talent and Josh for absolutely spearheading all of the changes you’ve seen at IU that I’ve been waiting five years to accomplish.

And, of course, a huge thank you to the IU team, moderators, and members who make IU such a great community.

Now, I’m turning it over to you.

What are your goals for the next year? What are some changes you want to make? How will you hold yourself accountable?

What tools do you want to see at IU? What content do you want to see more of? Which traders would you like to see more content from?

Drop a comment below, and let’s start a conversation!

I cannot wait to hear about your family vacations!

You are an inspiration my man! Not only have you been (my mentor) the mentor of many, you’ve also been a huge encouragement to us as well. Thank for for sharing your life, heart, mind, and goals with us. Time to get to work making them happen! Looking forward to hearing your progress.

This is Gold! I only follow you and jtrader on X. Even though I’m not a day trader or on your platform, the fact that you mention about spending time with your family and share your thoughts resonates with me and I know when that time will be to make the change into trading. thank you.

Incredible write-up Nate, thank you for all the dedication! One goal for me is to focus on not getting so hard on myself when I miss a setup. The “Next” mentality is so key and something you’ve exemplified each and every broadcast. I’d love to hear more about your shift in 2024 and which tactics/strategies move the bar most in terms of reducing the FOMO meter and being more present in other areas of life.

Great plan Nate and I’m confident you will execute it. All the best buddy!

Nice write-up and full of wisdom. The daughter topic hit me right through the heart. I’ve been dug in like a tick behind my desk for so long that I’ve missed it, she’s already in high school. Thanks Nate.

Very insightful and inspiring read. Can’t wait all the new technology and improvements in IU. Proud IU member🙏.

Very wise advice to remember your “why” for trading and to trade to live, not the other way around. I am in a similar situation myself with two young kids and a full-time career as physician 1/2 of each and every month where I have to go “light” w more A+ swing trades when I am working because the patients matter.

I especially like when you said that statistically when your kids “are gone” out of the house, you may see them for a total of a year in total time until the parent passes. Wow! Truth!

Thank you Nate for A+ content!

Thanks Nate for sharing such a wonderful write-up. It is very rare to get such a valuable insights genuinely from all aspects of the life – the real big picture. I am glad to be a part of IU, My Best wishes to You and everyone!

Thank you for sharing your reflections and thoughts above! This is my second “go” at this profession. My first attempt was in 2008-2009 and I put unrealistic pressure and expectations on myself leading to me quitting after less than a year. I’m almost 4 years into this second attempt and IU was a big part of teaching me the market skills and psychology to put me in a position where I’ve been able to continuously improve (even though it’s slower than I’d like!).

p.s. I’m the guy 1-2 years ago that peppered you with my charts everyday for a few months :). No longer in the room at this time; I’ve been grinding away trying to be self-reliant but contemplating re-joining for the community aspect.

Congratulations on making these changes for yourself man! It’s a huge thing to do and it’s something that I see a lot of people keep putting off.

And thank you for sharing what you know. Sometimes I think about what my path would like look if I didn’t have teachers out there like yourself that already made it and are sharing what they know…I don’t think I would be here today still trading because I don’t know if I could see the path as clearly as I see it with you guys there. So I’m connected to you guys for that always! Thank you.

Going over the post the things that really resonated with me…

– Trading with an edge > Trading just to trade

– Time question of…”Am I trading just to trade, or is there still an edge?” (so powerful and so simple…thanks Kim!)

– Tying my happiness to my trading progress (I’m guilty of this)

– Revisiting the “why trading” question and what sacrifices I’m okay making and which ones I’m not.

Thanks for bringing these things up again for me!

I haven’t been in IU for over a year now (but hope to be back soon) so I don’t know how the new scanners and tools are.

Some things I’d want to see, if you don’t already have them, are:

– # of trades per ticker column on the scanner

– Watchlist’s (this is something I use on Scanz right now to organize what I have on watch for today and what I’m keeping an eye on for later)

– “Market Internals” window like in Scanz that shows the advancers and decliners for the day because it helps give me an idea for the overall market

Great post I enjoyed reading this very much.