First and foremost before you get lost in this blog post my goal is two fold:

Share my thoughts AND ask for yours.

So, I’m asking you a) what two things you learned this year (strength and weakness) and b) what is one improvement for next year?

We can all use this as an opportunity to learn from each other.

It would be great if you could leave a comment below in the following format:

1. I learned that my weakness was:

2. I learned that my strength was:

3. In 2016 I want to focus most on:

I’m looking to get your feedback and compile a list of some of the best changes for 2016.

Secondly I want to start out by saying that I never have monetary goals. I’ve found that each time you reach a monetary goal, you’re never satisfied. It’s most important (and I’m not trying to sound cliche) to find a happy medium and some sort of balance in your life with friends, family and things that truly make you happy.

To get into it further I’ll give you an example:

All I wanted to do was to get to $100k in a bank account then once there I was going to buy a car. I never bought the car I wanted because when I had $100k, I needed $200k, then that quickly became a goal of $500k cash. Well, these were nice lofty goals, but who the hell would stop at $500k? Clearly the next target is $1 million. And, of course, once $1 million is in your account, then clearly its $2 million then $5 million, $10 million, $25 million, then the goal ultimately becomes a hundred millionaire. See the trend? You’re never going to be fucking happy if you base your goals on monetary numbers.

Additionally, goals should be set on the PROCESS. Becoming a better trader doesn’t just mean making more money. Becoming a better trader can mean becoming more patient, working on entries, and minimizing stress levels. It might even include time away from the PC (if you’re an addict like me, this is always a challenge).

Each year it’s good to take a look back at the good, the bad and the ugly. Prior years I had looked back and noticed that had I just set an “oh shit” handle number of $10,000. No MATTER what, if the trade failed, if I was stubborn if I didn’t follow rules, if I had taken the trade off at $10,000 I would have saved in the neighborhood of $250,000-300,000 each year on stubborn losses. This can be as simple as minimizing an $80,000 loss to $10,000. Here’s the thing – very rarely when you’re down over $X on a trade (whatever that # may be) it’s nothing good. Not only are you red, but most times the losses that follow are exponentially higher than you think because you’re sized in, breaking rules and not trading smart.

It happens to all of us, if you want to sit there and say you’re perfect and you never break rules and getting squeezed on a stock could have been avoided — news flash, you’re only lying to yourself. It’s the market guys anything can happy at ANY time. That includes halts, buyouts, squeezes, fat fingers, emotions, you name it.

FRONT SIDE OF MOVES

2015’s biggest goal for me was to stay away from the front side of moves. One of my BIGGEST strengths is nailing the tops on the front sides of moves eight maybe nine times out of ten. HOWEVER, the one time I don’t nail it I find myself “sticking around” waiting to see if I was right or not. Guess what happened to the other eight or nine wins. Poof, gone. It’s not quite as bad as after hours trading but I’d chalk it right up next to it. Mind yo,u I may still play front side of moves but I only use partial size.

The reason I compare this to after hours trading is because many times you may nail things seven or eight outta ten times, two times you have a close call, and that last time you short AMZN on earnings because it’s up $50 bucks and it keeps going up $120 bucks. Or, you buy TWTR because it dropped $4 bucks in a flash but then drops another $3 beyond what you would have ever imagined.

Point is, trading is about giving yourself the edge. I realized that, although I am very good at nailing the tops of the front side of the moves, I need to NOT use size, and work on a scale. ONLY add in if support cracks and forms a PEAK so that I can use set risk AFTER more than one half size has been used.

So, for 2015, l I did EXTREMELY well with this goal. I’d give myself a B+, leaving lots of room for improvement. I likely would have given myself an A however I shorted the front side of WTW yesterday like an idiot and paid for it (my first ‘big’ mistake in over two months).

PATIENCE

The next goal was to really focus on letting winners run. Easy right? Just hold 🙂 Well, You’ll realize after trying it that many times, your patience ends up costing you many profits. There were SO many days I was up massively only to watch it go right back to a nominal profit. But, Brett talks about this in his book which I love – did you do the right thing? Your friends punch numbers in a cubicle for $50 an hour and you just were up $1,000 inside of 30 minutes but you didn’t take it, why? Yes, the plan was a bigger trade but it goes back to flat on the trade and you beat yourself up over it. The key here is you did nothing wrong. You did the right thing; you made a plan and you stuck to it. Sometimes it will work for you sometimes it will work against you.

SIZE UP (NOT BECAUSE WHAT IF?)

Next goal in 2015 was to size up. Not size up because I was greedy, not size up because I needed to make more, but because I was in a position to do so. No debt. At highs. Focused. I wanted to have no regrets. Many remember Michail’s speech at Traders4ACause and, although he has his fair share of comments regarding DVDs, anytime you ride momentum long and he is short and you end up being right; you’re a pimp. It is what it is and I try to see the best in people. So, one thing that stuck to me was in so many words the question he said “Would you have any regrets if you always took the SAFE route?” Between that and Gregg not understanding why I always wired out, and then seeing guys like Eric EXPLODE, all these things came to a head and I decided “yep, I likely would have regrets if I always stayed safe and “content.””

Just double the entry size right? Instead of 1,000 shares just do 2,000 instead of 5,000 shares just start with 10,000 right? EASY. NOPE, dead WRONG.

Scaling a strategy is not about just doubling size. When you double size you fail to account for EMOTIONS. You’re wrong, but are you covering because of your emotions or is it part of the plan? Usually you’d be down $2,500 here but you’re down $5,000 is this part of the plan (YES) but you cover anyway, WHY? (Emotions).

Scaling up is it’s own beast. I started out the first three months of the year straight up nail, nail, nail. I could do no wrong, but then came GENE which was my first front side mistake and it didn’t stop there. I was an idiot and held over night. Well, I woke up down about $80,000 the next day, but minimized it to a $50,000 loss. Happens, no biggy, but I gave back about a sixth of my year at that point (in one trade).

Well from this point forward I was playing “catch up” to highs which is never good and you’ll do it too as you progress. You nail a big trade, you’re up $5,000 or $7,000, but it’s not the $50,000 you just lost so you hang on to it. Thirty minutes later you’re flat on the day. Well I went through some of that and, believe me, it’s always easier to trade when you’re at your highs because you’re not chasing anything. No matter if you want to admit it or not, it’s always tough to trade off highs because in the back of your mind you just want to get back to where you were. The key is breaking apart from this thought process.

Anyway, June and July were my worst months. I went through the doubling size, emotional jump up and down, and all over the place always looking at how I started my year and where I was now. Each time I had a draw down or dumb trade I made sure I took the time to publicly humiliate myself and talk about what I had done wrong and how it could have been avoided. Then came AQXP, which just sealed the deal. Despite having a good cover, I still lost a pretty penny and that was bottom. I told myself I’m not going to wire a single dollar into my account. I planned to focus on good trading NOT where I was and trade well; ideally profits follow. And they sure as hell did.

Since August, I’ve never had a better trading run. My scaling came together and my sizing worked super well. When you see or hear big profits many times you think well they’re just trading HUGE but the reality is the initial entries are much smaller than you think. Just ask @ModernRock; he’s the king of tiny entries and scale scale scale using houses $$ as risk.

WIRING OUT OF ACCOUNT

I’ve always been a big advocate of wiring out and I still am. For anyone who is new, it’s IMPORTANT to give yourself the best shot at success. Even when my accounts get big, there are times when I get super aggressive and sloppy with entries because there’s so much available. This can easily be avoided by wiring out and realizing that the profits are real. Understand that they are more than just a number in the account.

The more you store away in your bank account, the better trader you’ll likely become. I firmly believe that once you don’t “have” to make money, you’ll make a lot more. Once your nest egg grows away from the trading account, it allows you to focus less on being right every time and trying to make every trade work, and let your trading account act more naturally like a stock: general trend up, some pulls consolidate break out, squeeze, pull back consolidate push higher etc. I guess, a blue chip stock here not something like AVXL or GBSN 🙂

At any rate I’m beyond that now and focused on excelling as a trader. There will be ups and downs. Profits will get bigger and so will losses. I’ve always had a tough time managing multiple accounts with more than $100k in them. I easily just bought more or shorted more because I could. I’ve been focused on using size for the right reasons not wrong.

I try not to look at the equity in accounts because each time I do I start thinking, “Hey I only need $30k more to break the next $100k barrier” whether it be $200k, $300k, $500k etc. Always a mind fuck when you start competing for psychological break points.

PRIVATE P&L

Who do you talk with on a daily basis? Who is your foundation? Who is your go to friend that no matter how the day goes you can call them up and tell them “hey I rocked today” or “hey I sucked today?” One change I made since August was to keep myself accountable. Everyone cares what people think about them, cares how they look on Twitter, etc, but at the end of the day it’s YOU and YOUR bank account. With that said, I wanted to share my progress with the guys that I chat with on the phone daily so I started a private twitter account and post good bad, or ugly trades. It’s really helped take my trading to the next level. No sense making it public because if it’s good it’s fake and if it’s bad it’s real LOL.

I suggested this to AT09_Trader. He was having a really good run and I didn’t want to see what happened to some others happen to him. Sometimes you get so caught up in what others think of you that when you have a bad trade, you don’t want to let others down so you try to make up for it and end up digging yourself into a deeper hole. Facts are facts; most traders fail. Most will not believe your success. Although many are loud about things on Twitter, when was the last time you saw a successful trader calling out or making fun of others losses and/or gains? So, no reason to feed them. Alex has done wonders and pulled out at the right time. This allowed him to focus on just what he had done for himself and realize that it’s not just numbers in an account. Kid’s 21 and making decisions like he’s 25-27. Happy for him. As I told his father at Traders4ACause, he listens. It’s a good trait not just to me but his peers. He hears, he makes changes and he flourishes.

GETTING LONG MORE OFTEN

One thing about 2014 and early 2015 is I knew the trades that were going to get people in trouble. I knew not to short certain names because of the likelihood of squeezing and I knew to warn chat members like a broken record to stay away (just ask George aka @swedpilot). He used to go long on my short warnings. Well, that’s a lot of missed opportunities. So, the most recent example was FXCM. Typically I’d know not to short it but when it started to break out of the chart at $9.50s I got long. I knew not to short it and told chat be careful because this is the type that can squeeze $15-17 and you know what? I stuck some on long. This was something I’ve been working on for a while and finally just joining the trend and letting names work.

WRAPPING IT UP

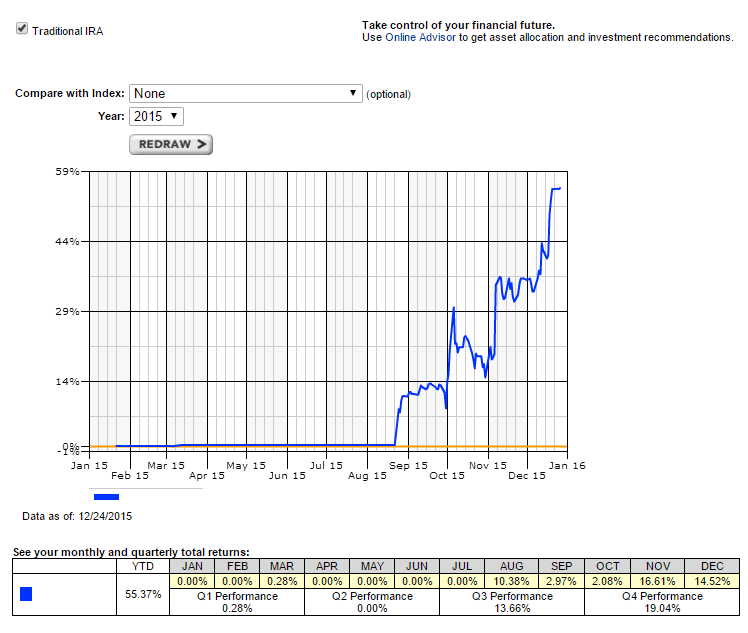

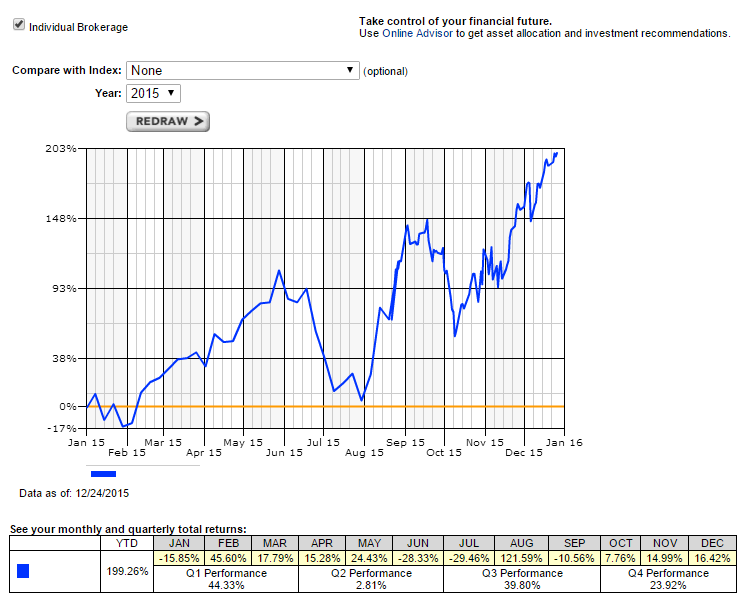

Anyhow, the past six months have been some of my best trading days, despite a daily donation to DGAZ on the way up missing the huge pay day it offered off the $30 fail before it dropped 50%. I started trading our family 401K. It was rolled over into cash last October. This was my long term (aka multi-day swing account) that I started the day the market tanked and had the huge gap down. I’ve also included my regular Etrade account which shows the pull back in June and July. Wedbush and ETC are my main brokers but I will be swapping out ETC for Vision in the new year.

401K Portfolio Growth

Regular ETRADE Account

You can see that as I got aggressive at highs with more money at my disposal, I had to teach myself to not just go large but rather wait and scale in appropriately. Seems silly to even mention but hey when you’re trading with more money more, things play a role (including emotions.)

MY GOALS FOR 2016

Swing more junk stocks short – I will still stay away from way cheap names like KBIO that saved me this year since I don’t short crowded names or cheap stocks over night. I’ve seen Eric flourish as a trader in 2015, it’s been unreal to watch.

Focus on continuing to scale my strategy while maintaining proper risk vs. potential reward.

Focus on not exhausting myself on the front side of moves only to miss the real trade (like DGAZ.) I likely donated nearly six figures to the DGAZ Fund for Dumb Traders Inc. over the course of the last few months. I’m just thankful that the rest of my trading paid for those donations.

One big thing I admire about Eric, Tom, Gregg and Phil (and many other great traders) is there ability to bounce back after a loss. Many times after I suffered a loss I’d go back to what I do best: grinding it out slow and steady. I’d see Eric take a massive hit and the next day he’s right back to where he was the day before. Many times our losses come right before the big pay day, so it’s important to always remember that. If you’re playing basketball and can’t make a shot for the life of you on Tuesday and you have another game Wednesday, are you not going to take any shots for fear of missing? Same idea, but this is where the padding comes in. Wiring out and being sure that you’re doing it for the RIGHT reason – not just to “get back.”

I added VWAP into my strategy this year, which I discuss regularly on webinars. It’s more of a guide than anything else and does it ever do wonders. I’ll go over a recent example of WTW vs. FXCM to show you exactly what I mean in the next webinar.

I hope you all have a fantastic New Years – best of luck in 2016.

Last note – don’t just say you’re going to make changes, actually do them.

YOUR THOUGHTS

I think it would be helpful for everyone if we could start a conversation about strengths, weaknesses, and goals. It would be greatly appreciated if you could comment below in the following format:

1. I learned that my weakness was:

2. I learned that my strength was:

3. In 2016 I want to focus most on:

Thanks for sharing Nate, a lot of great lessons in this post.

Earlier this year i opened up a $2000 account which I blew up in 2 months trying to become a full time trader in 2 months. Boy was I stupid. Ever since then I told myself that I would just study until I felt i was ready to start trading with real money again. I have not been trading since then so it is hard for me to say what my strengths and weaknesses are, but i can definitely share my goals/focus.

3. In 2016 I want to focus most on: After putting law school aside, i told myself that I will become a full time trader one day. My focus right now is to learn from all the successful traders in the IU community as much as possible. I am big on partying and drinking every week but it is about time to forget about that and dedicate my time to studying each day.. I want to go from putting in 1 hour a day reviewing the chat logs and charts, to putting in 2-3 hours a day. I work 9-5 so I am rarely able to be monitor the markets consistently during market hours, and I have to do all my reviews after work. Learning the setups that you teach is my main focus, and starting after the holidays, I will open a demo account with 5k (as I would probably start with this if I switched to real money) and keep a trading journal. My focus is to try and make consistent profits, in order to prove to myself that I can start with real money.

I hear you Zuzu, one thing I found, in that no matter what pursuit I may choose, is that diligence, discipline, and even sacrifice and compromise is often apart of become successful at any business. I never liked having to face that , but that seems to hold weight with what I have seen… anyway, best to you in 2016, and if you have any thoughts you’d like to share on my post, I’d look forward. Thanks MAx

1. I learned that my weakness was deviating from my trade plan for fear of missing out (FOMO). I prefer a trade with a set risk vs. reward based on the action during the first 15 minutes of the day using 5 minute candles. By then, I have a good idea of what trends I’m looking at and can begin entering the trade. But every now and

again, I see an issue getting away from that plan in the premarket and that

evil FOMO takes over and I’ve now deviated from my plan because I was afraid of

missing a trade.

2. I learned that my strength was actually cutting losses. My 2015 “Ah Ha” moment came when I finally understood what Colm O’shea meant when he said, and I paraphrase, “set your stop at the point you are proven wrong, not at your max risk.” It’s caused me to cut losers very quickly.

3. In 2016 I want to focus most on: Consistency. Is there anything else?

Nice post Nate.

1. I learned that my weakness was: This is an easy one for me. Almost all my trades are shorts on small cap stocks that I’ve researched and my major weakness I have pinned on my twitter page, “I am too influenced by what I know and not enough by what I see/feel.” Since CANF in mid September I’ve gone a great job of either not fighting or avoiding the front side altogether, but it’s almost like an addict fighting the urge sometimes. I know it’s trash, I know it’s going down and I want to be in. Being early and stubborn caused me to give back a lot of profits this year. I really only screwed up bad 6 times, but those 6 times cost me a ton.

2. I learned that my strength was: I think my major strength is not over trading names. I rarely trade more than three stocks on any day and normally just 1 or 2 that I feel I understand. If I don’t feel I understand the “why behind the move I won’t touch it no matter what. I’m also fairly decent at setting stops most of the time except for those trades in point #1. Craig has helped me for a while and really beaten risk management into my head. I just wish I had his patience when it comes to taking profits sometimes, but that’s something to work on I guess.

3. In 2016 I want to focus most on: In 2015 I focused on consistency. I think I did a decent job of that except for a weird patch in September and October. The other months I had 2-4 down days and even in Sept and Oct I was profitable. So for 2016 I want to take on more size. I have a decent sized account and income from a job and both of those things have caused me to hold back a little I feel. Because I’m trading with 6 figures I’ve been concerned abut losing a lot and since I have a decent income outside of trading I’ve viewed this more as side income. I’m a better trader now though. I have confidence in my system and I’m emotionally ready to go to the next level.

4. You didn’t ask for this, but I’ll add it anyway. Probably the biggest thing I learned this year was how to spot a crowed trade. Maybe it’s not so much I learned to spot them, but learned to respect them a hell of a lot more, I owe a lot of that to you and that’s Likely why I’ve avoided huge pain since CANF except for KBIO. Even then this knowledge saved me a TON. For one, I covered 1/3rd at the close that day because it felt so crowded, and 2) I bailed in the mids 4s a/h which hurt like hell but turned out looking pretty good when all was said and done.

Another thing I’ve learned is that having a trading buddy on your level is really good. I talk to Inefficientmarket every day and sometimes by phone and I think it’s helped us both.

Weakness: trading too big, FOMO, revenge, reluctance to take small loses, greed, fat fingers

Strength: focus, drive, risk appetite, persistence, motivation

2016: stay mechanical, trade small, grind it out “As god is my witness, I am hellbent on making this happen”

Nate, this is the same format my martial arts school does at year end. Love it man. Background: Former on-line poker play until April 15, 2011 aka Black Friday when the government halted online poker player in the U.S. I’ve been working a 9 to 5 job since then. I bought IU DVD’s Oct 27th and joined IU Dec 1st.

1. I learned my that my weakness was: I knew nothing about trading

2. I learned that my strength was: NOT jumping into trading like I first did with poker (donated a shit load of money due incompetence) and ultimately I joined one of the top online poker training programs (CardRunners), Investors Underground remind me of CardRunners in some ways. In any case I am leveraging those lesson learned with day trading. I know that I need to know concepts, understand WHY moves are being made, why moves are NOT being made, and review the chat along with the charts for my “Ah ha” moments. I am aware that it’s not about making money with every trade but trading the right way over time which will result in making money.

3. In 2016 I want to focus most on: Starting my trading with a solid foundation provided to me by Nate and the IU members. After two months of studying, observing, and systematically understanding the concepts I am ready to begin.

Here’s to 2016 my dudes!!!

Myth Lord

1. I learned that my weakness was: Not allowing the trade to set up on my terms, or to put it another way, FOMO. I often found myself getting shaken out of trades due to not waiting for solid pullbacks on my longs or waiting for the bounces on the backside of the moves for my shorts. The stupid thought pattern of “the stock has too much momentum to pullback, better get in now”, or, “the bottom is falling out of this stock, better short it now while I can as opposed to waiting for a bounce that might not ever happen”…..result….terrible avg…and easily getting shaken out due to knowing I chased it to some degree. Sometimes hard to find the middle ground with this mentality. I will recognize this pattern, and then I drive the car into the ditch on the other side of the road by second guessing myself with being overly patient and completely missing the move altogether.

2. I learned that my strength was: Risk management. One thing I have been able to do is honor my stops.

3. In 2016 I want to focus most on: Sizing in on the grade a setups, adding to winners, and allowing trades to come to me (and if they dont and I miss the trade, so be it!). I also need to find a balance where I dont start off so small with my initial entry on a trade where I have plans to add, but the trade doesnt give me a good opportunity to add, that I can still feel good about my profits when I have to take it off with just my initial entry.

Hi Nate. Thank you for the great blog. Alway learning with investors underground.

I started trading at the beginning of 2015 but didn’t join IU until after the summer. Before joining IU I didn’t have a clue, I study hard and watch both DVDs, webinars and video lesson. As of last I was up on he year from being down $450. However, a stupid and broke all rules trade on $AVXL & $WTW has put me back at the same point before joining.

I have learnt a lot since joining IU and many thanks for that. I have many weakness which I have to improve on and understanding I am newbie, baby steps are fine.

For 2015 my main weakness was:

1.) FOMO, I would enter a trade with my risk higher than my reward or once I enter a trade knowing i shouldn’t entered the trade to begin with, instead of letting the trade come to me and havng a educated plan.

My strength for 2015, which aren’t many compared to my weakness: 1.) patience. However, this slightly concernes me, regarding how it come about. For example, 1.) Due to my weakness FOMO my trade entry would be rushed. Once I was in the trade I would re-evaluate (almost making an accurate trade plan while in a trade, which I should of done before hand) and from re-evaluating I would see the trade I should off took with proper set risk vs reward and then the trade working out for me.

However, i have entered trade with a set risk vs reward/educated plan and stuck to the plan and have worked out profitable/cut losses as per plan. Just about controlling my emotions and waiting for the trade to set up.

In 2016 i will be using a sure trader account which will allow me to day trade. I plan to work on 1.) scaling into a trade and adding on to a winner.

2.) finding my niche as trader. This has been impossible to find due to the pattern day trader rule.

Additionally, I believe due to having unlimited trades my FOMO and controlling my emotion of FOMO will greatly improve and allowing my self to be wrong knowing I can get back in anytime. However, I know having unlimited trade arouses more problems, so I be sure to reach within the community once I come across these and needing help to address them if I unable to myself.

Overall, the best decision I made of 2015 was to Join IU. My trading has improved I understand my weaknesses and finding my strengths gradually. I look forward to 2016.

Many thanks,

Ronnie

I found your review Nate of 2015 trading very helpful.

I need to take losses much quicker and certainly have a weakness for getting long.

I love to short too – however will be working on taking losses quicker

and resetting trades – thank you for your insight always valuable to me

Suzi C

Thank you Nate.

I apologize for the immense length but I would like to take this opportunity

to really do this well. Also this is an easy place for me to look back to next

year.

1) Weakness

a) Insecurity about knowledge. Nothing is worse than second guessing

yourself if the set up your reading (short) is correct or if it’s actually the

opposite (long) ex: ABCD pattern after a short run intraday vs. a lower high.

There seems to be an endless thirst of knowledge I keep chasing. Like a black

hole sucking in everything around it. I can’t seem to be satisfied with what I know

and just putting it to the test.

b) Loss of proper education. I joined IU this December the 27th 2015 and

it’s a lot to take in. I was part of another chat room which i didn’t like including

the strategies used, but stayed to be up to date with the market and to not

miss out on new trades intraday via chat alert by members ($LEI just the other

day). Because I couldn’t afford IU for the longest time I had to resort to Nate’s

tweets (along with other mods tweets) as supplemental information. I would feverously look at the chart Nate tweeted about and understand what he meant, why he said it and what his plans were. Albeit I learned A LOT, it wasn’t enough and that

was made evident when I started watching video lessons with commentary. (Sometimes the small bits of info make the largest difference)

c) Small account. My family isn’t particularly financially stable and

being a first gen immigrant I had a difficult time at school all the way thru

college which I dropped out of because I couldn’t stand that rubbish. I’ve

always been drawn to stocks so I made a decision to take my education and future

into my own hands. I’ll be open and say I have less than $1,500 in my trading

account (and it has hurt me tons!). This is because I’m SO afraid of losing

money (which would be difficult to replace if lost) my trades are never allowed

to run their course even though I’m correct 3 mins later… I would either use

too large of a size or use a hard $-loss risk. And as we all know, sometimes

your entry is correct but the stock needs to jiggle a little to shake the weak

hands (or retest some sort of resistance/support (this is where I would have

exited for a loss)) before the trend continues.

d) My entries. Along with my insecurity of knowledge and fear of losing

money (even if it’s just commission) I tend to enter positions that are proving

weakness or strength. Instead of shorting at some sort of lower high,

resistance, or trend break –OR- buying long at some sort of higher low,

support, or ABC, I’ve been waiting for the stock to prove to me its intentions

and enter late. In a way, I’ve been chasing. Not for fearing of missing out,

but rather the fear of being wrong. This has cost me MANY losses and small

gains that otherwise could have been avoided for breakeven or large gains.

e) Market Behavior. The other day Oprah tweeted something and tons of

commercials ran about $WTW. I personally didn’t think that this would spark a

reaction THIS massive (because it wasn’t as big of a deal as her joining $WTW

back in mid-October) so I focused on my watchlist plans. I continuously underestimate

reactions the market has on small things like a tweet or a Shkreli, or a sympathy

play on all low floaters. But that’s ok, because this is something I believe

comes with experience and repetition… even though it’s happened a lot this year

and I keep disbelieving that it’s not a onetime occurrence.

f) Intraday movement significance. For example: watching a stock pop or

wash at the open can sometimes seem like such a small move that I don’t see its

significance until later in the day, or when the market closes and I look back

at today’s $XYZ chart on a full screen instead of a small portion on my monitor,

or I when I compare it to the daily.

g) Holding on for too long. When I nail an entry and I’m dead correct I

sometimes hold on for too long. This is part greed, part size, and part failure

to realize intraday movement significance. Greed and size in this scenario go

hand in hand. I use small position sizes (100-300 shares, never scaled in) and

when I’m correct I fixate on my PnL so that I can make at least $20 to cover

commission. After that $20 minimum is met, I look for a $50 or so profit so I can

exit and be happy but it sometimes doesn’t come because (this is where the

intraday movement significance comes into play) I may not realize it, but the

stock has fallen a lot and it hits some type of support and quickly snaps back.

To me, during the moment it just looks like it’s down a little but the fact of

the matter is that I literally could have nailed the top for a short and bottom

for a cover and it doesn’t register to me. This seems to be contingent upon my

PnL as if the more I make, the larger the wash REALLY was.

———————–

2) Strengths

a) Referencing back to 1a): I never settle for just enough, I always

want to learn more and be the best I can be. A strength of mine is always

pushing myself to further my education.

b) Referencing back to 1c): Cutting losses. So far I cut my losses very

well, almost too quickly. This is because of my small account and even though

its size is a curse, it’s also a blessing because I’ve never let a stock get away

from me. I never think “oh it has to do this or that”, or double down or try to

convince myself of false fallacies. I’ve always stuck to my plan and executed,

even though my entries were rubbish. (This of course can change completely with the more I have in my account).

c) Crowded Names. I NEVER short crowded names because I don’t have the

capital to recover a loss of that potential magnitude. Like Nate has said in

his Watchlist “WTW was friggin’ obvious had I just waited for the $22 + para as

expected and as I said I would have been just fine – both washouts would have

been great spots for the covers followed by a late day profit taking pull.”, he

made a silly mistake that could have been avoided but he ended up paying for

it. My strength comes from fear of entering a crowded name long or short and

lose a ton of money. For the time being I’m proud that I don’t let greed take

control and influence me to take a position on these massive runners because I could make sooo much sooo quickly. When the risk is too large, its too large. End of

story.

d) realizing I have so many weaknesses haha

————–

3) My Plan of improvement for 2016 (ill make this one quick, it would

be even longer if I explained fully)

a) In reference to “Insecurity about knowledge”: I know my

understanding and knowledge is adequate enough to trade without blindly

entering positions, so for 2016 my plan is to overthink less, enter trades more

(with proper R/R of course), and not

worry if I’m 100% correct but rather have a good plan and cut losses quickly if

I’m wrong. I need to stop obsessing with 100% precision.

b) In reference to “Loss of proper education”: I am now in the IU

community and have access to all the webinars, video lessons, chat, blogs and

more. I plan to keep up with all the content Nate provides. Especially love the

video lessons!

c) In reference to “Small account” and “My entries”: This one I’m most excited

and nervous about. My plan is to remove PnL from my Das Trader platform. I will

only have the basic information like how many shares, what stock, long or

short, and BP. I will be removing ST commission, SEC fees, ECN fees, NASDAQ

fees, cash value in account, PnL (realized and unrealized) and anything else

that I can fixate on instead of focusing on my entries and exits. This one is a

little more complicated so I’ll just leave it at that.

d) In reference to “Intraday movement significance” and “Holding for

too long”: Since I will remove my PnL I’m pretty sure this one will figure

itself out. My focus will be directed towards what’s important rather if I’ll

make enough to make up for commission. I’ll be focused on the best entries and

exists so holding for too long so I can make $X won’t be an issue anymore. I

will probably be burning commission but once I gain that confidence I can start

scaling in or using slightly larger size. (Trading on paper is very different).

I will also incorporate looking at different time frames into my new 2016 diet.

e) In reference to “Crowded Names”: My plan is to take into account

even something as trivial as a tweet months after the real news. That it can

have a massive impact on the stock, and especially if it’s a repeat like $WTW

then my R/R is solid. Still not going to short it. Not yet at least.

Thank you for reading my post if you made it this far! I’m sure ive

forgotten something so ill add if I remember. Hit me up on the IU chat if you

have any questions or would like to bounce ideas. Happy New Year!

Hey Goon, I also deal with the tendency for ‘wanting more and more information’ , I call in analysis paralysis. Yeah, I have devoted some time what I call Rational Emotional Imagery where I actually visualize myself making a trade , while doing the homework on it, and if need be journal myself through every potential tick, and try to observe my thoughts, and emotions, and how I would feel taking a loss, even if planned, and who I might feel if it was a winner.. I appreciate your post, and would be open to any feedback you’d have on mine.. thanks. best 2016 to you

Hey Max, i do a very similar thing but that caused me to think on the immediate term rather a bigger picture idea. worrying about tick by tick may make you react slightly too emotional. Also, worrying about the emotions you may experience if you win or lose and during the trade (imho) isnt the best thing to do since you should be as emotionless as possible and as detached from the trade as much as possible to fully let the trade take its proper course. i think its best to take the loss as a simple market tuition and learn from your mistake. and same goes for a win, take it as a market refund for a lesson learned. Best of 2016 to you too!

Goon, you’re in the right place, be patient and make this your new higher education.

Briefly about my trading history. I opened a $3000 account in October 2015. I’m not an IU subscriber (can’t afford monthly price yet). I knew the technical side of trading, but didn’t know how it feels to be in the market and learn it from inside. After I made only 3 trades and lost about $100 overall, I realised that I know so little about market / trading itself and decided to move to a paper account. BTW, some say paper account is not so reliable (when it comes to learning your own trading psychology, fears, what you’re good / bad at), because it’s not real money. I don’t know how others feel on paper, but I treat it like real money. When I enter any trade it feels like I have real money on the hook, and actually I don’t control that feeling. On one hand it is good to have that feeling, so you focus on making only right decisions while trading. On the other hand, I realise how bad it is to have your emotions attached to your money, which can lead to wrong decisions while trading. I subscribed to Tim Sykes’ PennyStocking Silver, but only 2 months later I realised, I won’t be able to learn as much from that community as from IU, so I cancelled my subscription and started to follow almost all IU moderators on twitter, soaking up all info from their tweets + watching Nate’s all videos on YouTube channel. Now, finally, what this comment supposed to be about:

1) Weakness.

a) ASSUMPTIONS. This is when I try to see something that’s not there. Even if I size in small and my loss is not so big, at the end I see that this is not the trade that I supposed to be in. Obviously hindsight is easy, but I have to focus only on bread & butter / high probability set ups (higher lows – ABCD; lower highs – the opposite of ABCD, which I called the ‘DCBA’ pattern).

b) FOMO. I realise this shit not so often, but anyway should avoid this as well.

c) EMOTIONS. I realised that this thing never helps, not only in business, but also in making any kind of decisions in life.

2) Strength.

a) CUTTING LOSSES QUICKLY. I have never let any trade get the way out of control.

b) SIZE IN VERY SMALL. May be this is because of fear of losing money, but I think it’s not a bad thing when you are a beginner trader.

c) ADMIT MY MISTAKES. After any losing trade, first thing I do is try to find what exactly I did wrong. I always keep in mind that Market is Always Right.

3) Focus on…

moving each point from Weakness into Strength side.

I did the same thing with a paper account, treat it like it is real money, and what I discovered was that I have all sorts of classic psychological stuff (like everyone) that I had no idea I was susceptible to. So it really helped/helps me to see the signs and to try and deal with it, I can’t say I have mastered the ‘self’, but at least I have meet the beast within…

I joined IU this summer and watched all the videos at least twice, and delayed the IU chat subscription for 3 months while I was going through Textbook Trading & Tandem Trading and have since renewed the quarterly IU chat because it was a good value in my opinion.

1. I learned that my weakness was: Being too early on a trade. I end up being upside-down on a trade quickly and have learned to let it play out rather than getting stopped out. When I was upside down, I would move my stop loss and wasn’t as disciplined as I should be. Just because I was successful as a software entrepreneur in my previous life doesn’t automatically mean jack-crap in trading.

2. I learned that my strength was: Not being overly emotional about the trades I made.

Also, I realized it takes 10,000 hrs (roughly 5 years) to have real experience on anything and I only have a 100 hours of trading experience (long way from 10k hours), so I paid DasTrader $150/mo for 2 months for the DATA of DasTrader (in demo-only mode) to learn the software, use the charting tools, the level2 trade montage, watching orders fill, the daily P&L, executing buy/sell LIMIT orders using market prices and practice stop-losses and get a feel for the emotions of big drawdowns and typical emotions a trader goes through, using the full part of a trading day, the morning emotions, the lunch-time lull and after lunch rally and it came with $100k buying power. Also, learned I was up $2,600 on day 1, $1,700 on day 2, and down -$3,500 on day 3, and had many ups and downs since then, but at the end of the day, it all resets to $0 and you get a clean slate. Starting Jan 4th, the training wheels are off and I feel a little more prepared than if I had just jumped into trading directly and paid “stupid tax”.

3. In 2016 I want to focus most on: Having a written trading plan the night before, and being more patient and let the trades come to me. I have a few observations that I’ve learned and have to remind myself.

* Come prepared, trade well and profits follow.

* FOMO (“Fear of missing out”) isn’t a strategy.

* The trend is your friend, don’t fight it.

* Only add to winners (and only winners), don’t double down on losers.

* Failure happens when these rules are violated, if money is lost following these rules, it was just an off day–not failure.

Hey Matt, thanks for sharing . Yeah, I did some paper trading too when I first got into trading. and yes, I also found out that just because I have a pretty good gig in the transportation business niche, I built, doesn’t mean jack in trading. I resonate with that… and I too, am trying to commit the time it takes to have a legit trading plan wrote out on trades I am considering the night before. I would appreciate any comments you have about on my post as well.. thanks.. Max

1. I learned that my weakness was:

A) Poor risk setting and tolerance,

greed- wanting to grow too fast.. thus leading me to want to take more share size with a tighter

stop, (like 1000- 2000 shares with .20 stop , rather than take a share size of

500 that would allow me to have a .50 ) That is not to say that , if I found a

stock/etf trading on good volume and small bid/ask spread that I wasn’t well

found in my choice to take such risk, which might not be a bad idea given my

set risk, but I noticed that tendency to get stars in my eyes, or irrational

home-run thinking, was the driving motivation, rather than sound rational

expectations, and ability to take the trade with an even-keel mindset prior to

hitting click to send ,button

B) Hesitating on some entries,

that as I watched how the stock was trading – after doing a little review of the daily chart-

C) Inability to understand key price levels

on the minute chart as it relates to choosing to enter or exit.

D) Failure to do Emotional preparation homework

& Poor emotional habits that lead to addictive or negative behavior, or

treating others poorly because of how I feel. Mostly distorted misplacement of

blame, and a tendency to blame others of ‘knocking me off my game’ if I don’t

trade well. I still put to much identity of my own self on my performance as a

trader and wealth accumulator. I need to work on ridding that belief, as it is

unhelpful.

I admit that I battle a nagging sense of feeling ‘owned’

too much by the pursuit of wealth in the stock market. I have a negative self-talk that goes like ‘Gee, I guess I can make my

money in my other business, but even if I choose the stock market, I still have

to give it my time, and I don’t want or like the feeling that I ‘have’ to give

money making such time’. I guess the real problem is entitlement. I have built

a good business in another sector, but I still feel like I am entitled to easy

money, or that I shouldn’t have to work, or use my time on it…so really that is

a negative de-motivating factor, because when I do homework and prepare, I feel

anxious, and that anxiety is something I tell myself that I don’t want, and

shouldn’t have to have.. so I am dealing with that inner negative self-talk, as

it keeps me from being enthusiastic and motivated and positive in the ‘joy’ to

pursue trading.

2. I learned that my strength was:

A) IF I did my homework – (Both technically, and Emotionally)

I found I was better able to place trades confidently, and not be left up to

such inner-badgering of negative self-talk, and not repeat the blaming of

others and circumstances for knocking me off my game.. in other words get

better at taking responsibility for my own choices and risks. B) Recognizing

whole and half dollar marks as indicators C) Being patient on entries. D) not

over trading E) feeling better about my decisions, regardless of outcome..

3. In 2016 I want to focus most on: A) EMOTIONAL PREPARATION –

thoroughly exercising myself through imagery of placing trades, journaling how

I will feel if it works against me, for me, or channels side ways. In such

exercise, really try to deal with any challenges that seem to prompt me to

become negative or de motivated or distorted and panicked, and try to

emotionally develop skill for the self-management of those emotions. B) Technical homework preparation

with more targeted plans on the trades that I choose to prepare for… (Have pre-defined risk and share size

determined on given price areas on the stocks I am looking at for chart pattern

recognitions)

1. My main weakness was jumping into trades out of the gate, with a bias and no set risk vs. reward, which in many cases produced big losses and a lot of bad emotions.

2. As for the strength, I realized that If I don’t trade for the first 5-15 minutes of the market open, I have a clear head and can trade the trend that starts forming with much more success.

3. In 2016 my main focus is to wait for the trades to come my way and follow my plan instead of just chasing without set risk vs. reward.

1. I’ve learned that my weakness is feeling safe while in a trade:

In reality the only safe position is flat (I’m lucky I didn’t blow up my account).

2. I’m learning that my strength is a determination to be profitable, maybe the first time I’ve been completely honest with myself. I need trading more than I know.

3. I will be focusing on my learning process which is really a cultivation of awareness.

I’ve only been here for 1 month and know there is no other place I need to be. Thank you all for your contributions.

Nice post Nate, thank you for sharing. I’ve been with IU since June 2015 and I’m blown away with my experiences so far with the numerous learning tools offered and level of professionalism this community of traders is built on. I’m a part time trader, I have a full time job where I’ve made a great living over the past 15 years and this June things changed a bit where I was able to dedicate some morning hours to trading 3-4 days per week. At this point, I’m taking things as they come, not making any monetary goals so I can quit my job and be a full time trader, but I do want to grow as a trader and eventually be in a position where my trading is producing more income than my corporate job and I can seriously consider trading full time.

Weakness: My biggest weakness by far is not keeping losses small. When I go back and look at all my trades for 2015, a lot of my profits are wiped out by a small handful of large losses. These losses were all trades where I did the “add, add, add” to loosing positions hoping to catch the top/bottom and turn the trade around. Further, when I go back and look at the charts of these losers, and ask myself “would I get into this trade here?”, the answer was always no, and most times if I had to, I would enter on the opposite side of the trade (short/long). Stubbornness! No room for it in 2016. If I’m wrong, well then I’m wrong, it’s okay…. It’s NOT okay to keep adding to that wrong position.

Strength: Trading the “go to” stocks where I have the highest winning percentages by using support/resistance ranges, VWAP resistance, lower highs etc… Going back and analyzing my trades for the year, there are certainly a group of names that I have consistently made some good gains on. These aren’t the most sexy/hot trades on twitter or even IU chat, but they put me in position to mitigate a lot of risk and consistently produce profits.

In 2016 I want to be more social with my trading, connect with other traders in IU and eventually find a couple mentors I can learn from, share trading strategies, trading watch lists, daily recaps etc… This will also help me be more accountable for my trades by hearing somebody say to me “what the hell where you thinking when you kept on adding to that loser today?”

I currently document all my trades in excel, save charts of entry/exits, but I don’t normally journal or write out my thought process on why I entered, added, and exited the trade. It’s hard enough for me to remember what I was thinking a couple hours ago let alone a couple weeks ago if I go back and review my trades! LOL In addition to having a group of trading buddies to share why I made the trades I did, I plan to start a blog where I can recap trades and share trading strategies, watchlists etc…

Thanks,

Brandon

1. Getting emotional and bag holding losers that went from day to swing to embarrassed to admit I still owned it. 2. Being coachable and doing the things you teach. 3. Consistency. I have both DVD’s, joined IU in April, ’15, attended T4AC in the fall and bought MOMO book. I’m rarely in chat because i work full time, however I am determined to reach my goal. You have taught me more that I can write about in this post. I’m a small fish, but I’m hungry and willing to put in the work. Look forward to 2016.

1. I learned that my weakness was: Fear of losing which makes me hesitant to get into a position even when I spot a good risk/reward set up. When I see that I missed an opportunity because of my fear of losing I end up getting frustrated and either chase or enter a position that is a weaker set up. This in turn leads to me taking unnecessary losses and becoming even more frustrated and hesitant to enter new trades. I also find myself not letting the chart dictate whether I should get out of, or stay in a position. I was trading off my PnL.

2. I learned that my strength was: At spotting good risk reward setups (for short selling) and staying disciplined when wrong. I did not average down on losers and learned to be more patient. I learned to let the trades come to me rather than try to force a trade that isn’t there.

3. In 2016 I want to focus most on: Continuing to look for good risk reward set ups and not be hesitant to enter a trade out of fear of losing. I need to define my risk, enter the trade and let the chart dictate wether I should get out or stay in. I also need to be ok with taking a loss as long as it was defined before hand and I continue to stay disciplined by not averaging down.

I learned that my weakness is not taking a loss when a trade doesn’t work. I’m new here. Started three months ago. Doubled my account in 15 days, but took three huge losses because I haven’t learned how to take a loss. On those losses I was trading on my own when I shouldn’t have been. “Just because a stock is up doesn’t mean it’s a short”

My strength so far has been taking small profits and stop trading once I hit a daily goal. As well as withdrawing profits at the end of every week. This strategy has allowed me to bounce back quickly from losses and once I conquer that weakness I should do very well here.

In 2016 I would like to work on reaching out to Nate and others. Learning from everyone here and growing as a trader. Maybe finding a trading friend as mentioned by Nate. 600+ traders here and yet I trade alone. Anyone here from Denver CO? Feel free to PM me in chat.

thanks Nate

1. weakness: emotional trading, revenge trading, FOMO

2. strength: entries/exits on chart pattern tops/bottoms, scalping

3. 2016: consistency, scaling in, planning

1. I don’t have the patients to let my winners ride and always exit at a small profit.

2. I ALWAYS respect my risk and never ever hold and hope.

3. Have more patients for 2016 and work on better entries.