You can find a compilation of all Alex and I’s webinars here.

There’s also an IU sale still going on for those interested in getting involved with the community, which you can find here.

Also if you haven’t seen yet – I’ve recently started an Audio-Blog series! Where I narrate all my favorite blog posts for you guys. You can find that here.

GERN: I kind of look at this daily chart like I’d look at a smallcap intraday chart now. Accumulation, acceleration, capitulation into that 60M vol day, now, looking to go after pops ss from here on out.

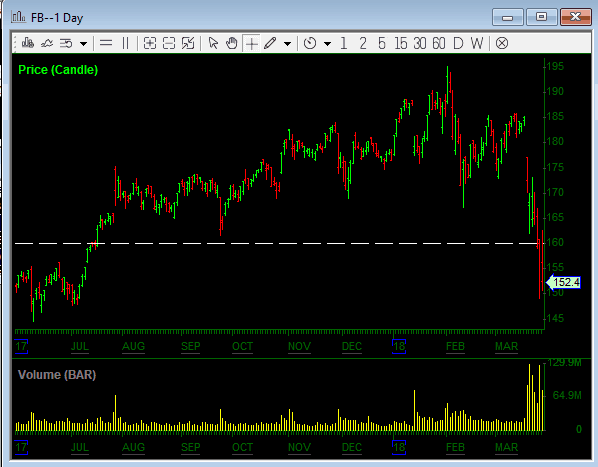

ALL Tech: These things are trading together right now, and all collectively taking a beating. Be careful trying to find bottoms. I’m talking about FB, GOOG, TWTR, SNAP, NFLX, TWLO, DBX, NVDA, AMZN, and more – but those are the usual suspects. If trading them in extremely volatile environments like we’re in now- keep a close eye on the SPY and QQQ and trade these names accordingly. My favorite way to attack is to watch them, and see which ones are diverging or struggling. For instance today, FB had ZERO interest in participating in the market rally. It was limping along higher by default with the market in the morning, but you could just see it. The moves up were very labored and forced, and the moves down were like butter. It clearly wanted lower. So find the ones that are either struggling or diverging, note that, and then whichever the direction of least resistance seems to be – hit them when the market cooperates.

If you’re not an IU member and would like to become one, there’s still a sale going on here. Shoot me a PM anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss trade ideas with you.

See you out there!

– D

Bought pre-rout TWTR to hold for a while, and then stepped away for several hours. Any thoughts regarding holding until rebound or dumping for an $800 loss?

How do I get involved with IU ?