I was on vacation last week and really didn’t keep an eye on anything with the markets. Was glad to come back Monday to see nothing had changed and was ready for another crazy week.

Sale this week is a quarterly IU membership for $597 and I will add in our Textbook trading course as well. https://www.investorsunderground.com/checkout/?product=9&promo=ELITEQ Just email me once you checkout and let me know your username and I will add Textbook to your account. [email protected]

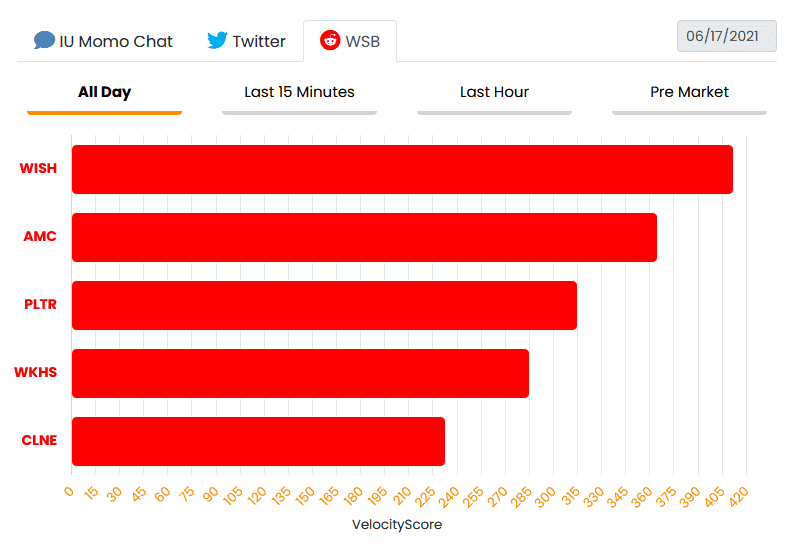

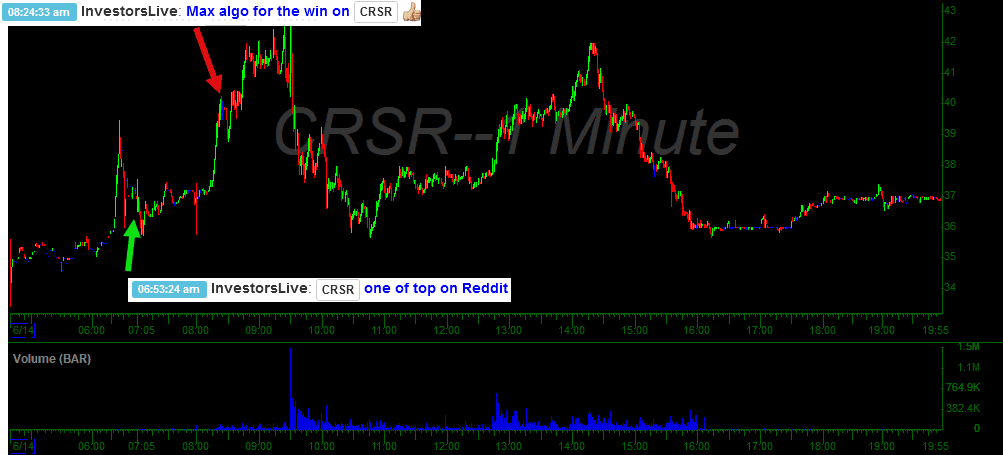

CRSR Tracking

I get asked daily if we use discord for our chatroom. We don’t. Our chat was built from the ground up to make it the most user friendly and feature laden room out there. With all of the wild moves in the Wall St Bets names, our IT guy Max built an algorithm to track the most popular tickers on WSB, Twitter and in our own chat. You can drill down to different time frames and know what names have the most eyes on them. This was a huge help in several trades this week. Here is a screen shot of how it looks.

Nate used it on Monday to get a trade going on CRSR.

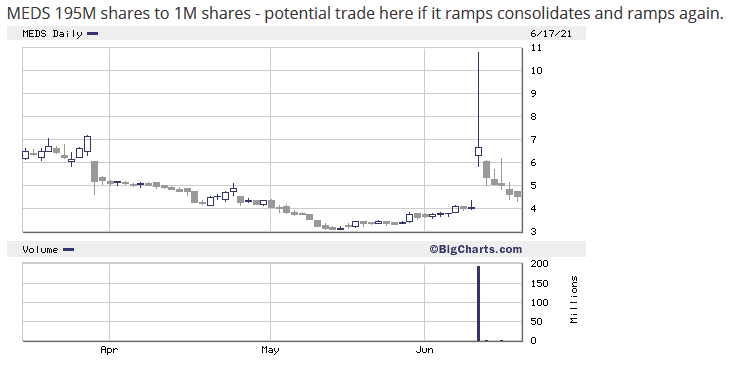

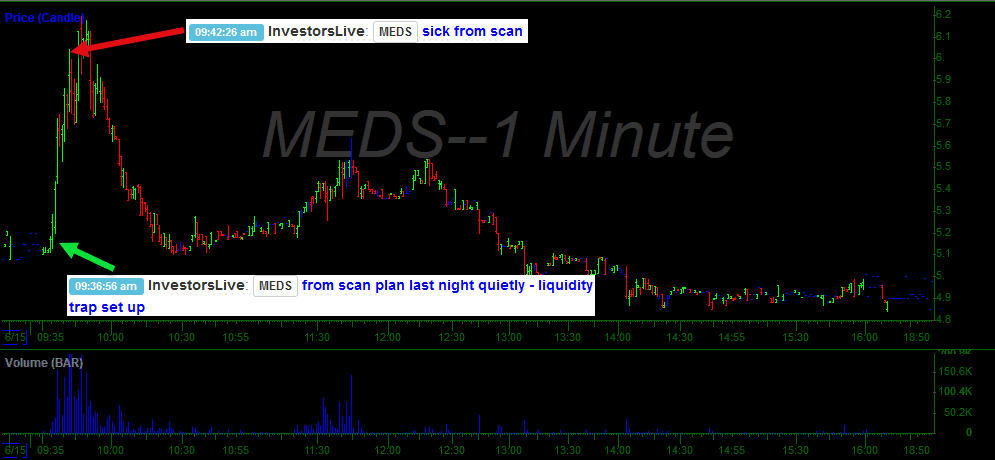

MEDS Trap

Nate laid this idea out on the Monday night scan for Tuesdays trading. Ended up working perfectly.

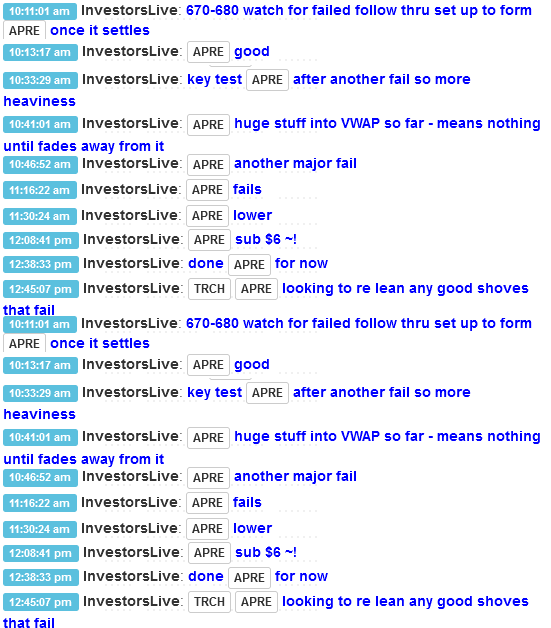

APRE Fade

This is the difference between being spoon fed alerts and actually getting a running commentary as the trade plays out to learn for the next time it happens.

APOP Failed Follow Through

Are you guys getting sick of me posting this setup yet?

UTME All Day Fade

Nate started into this short on Friday figuring that it would settle back down to levels around the previous close. Worked out great.

Have a great weekend.

This excellent and very helpful, tyvm 💰