Insanity. Total insanity. I don’t know how else to describe it. A comment in the chat described it best “I sold a $3 stock, $5 too early”. This week was pretty clean trends with a ton of range. Let me know if you are having troubles in these market conditions. [email protected]

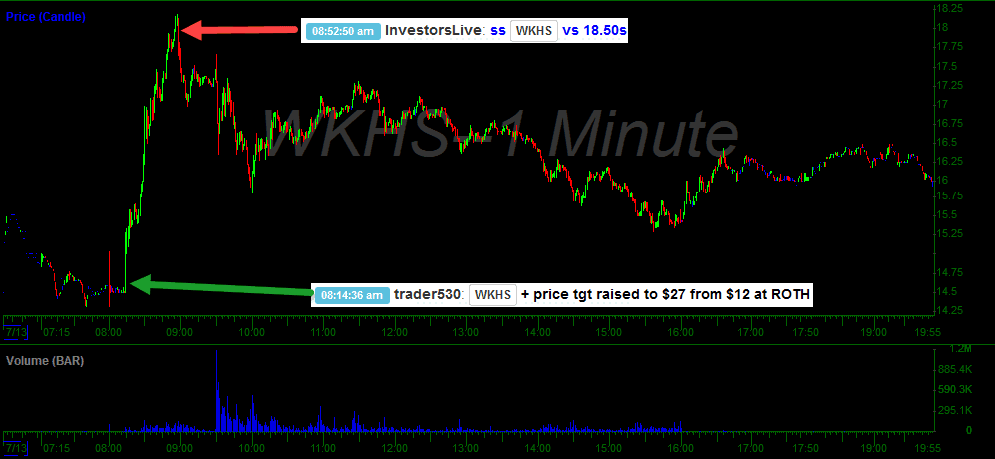

WKHS News

Trader530 brought the news of the new price target and members were able to get long. After the momentum started to fade, Nate got short with a risk level of $18.50 and rode it back down.

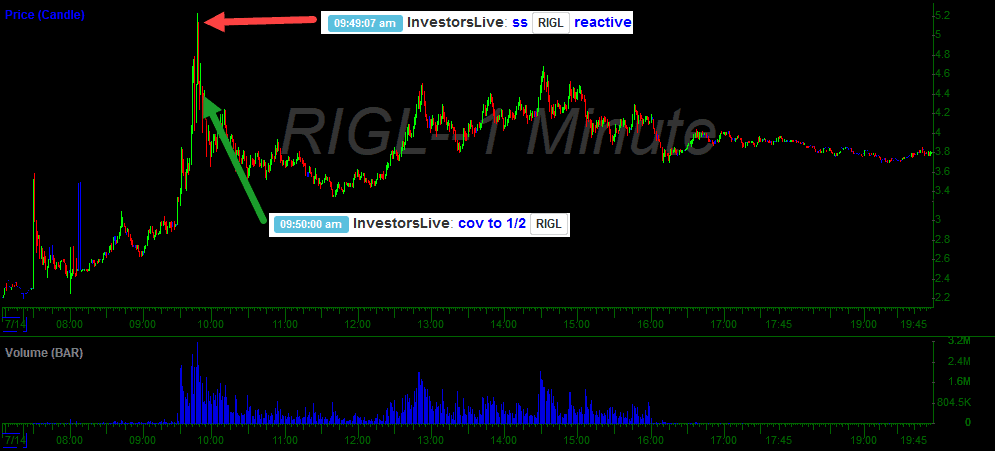

RIGL Reactive Trade

Everything is moving so fast that you have to have orders ready at the key levels or you will totally miss the trade.

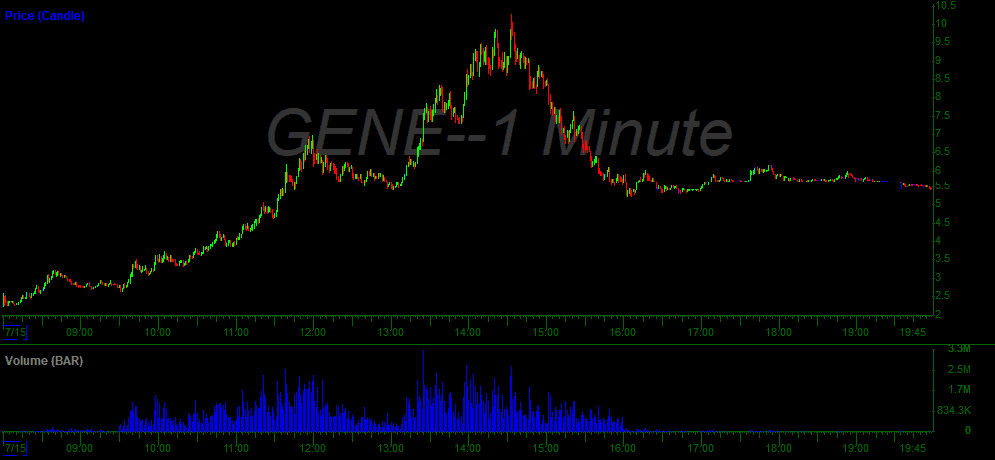

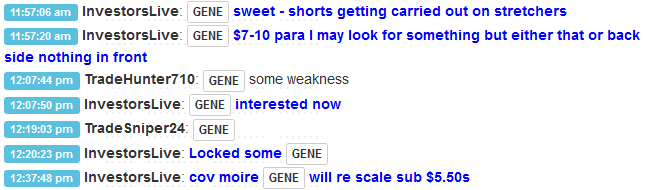

GENE Backside

A lot of trading careers ended on Wednesday. If you got aggressive shorting the front side it was game over. Nate waited for it to finally top out before starting in short.

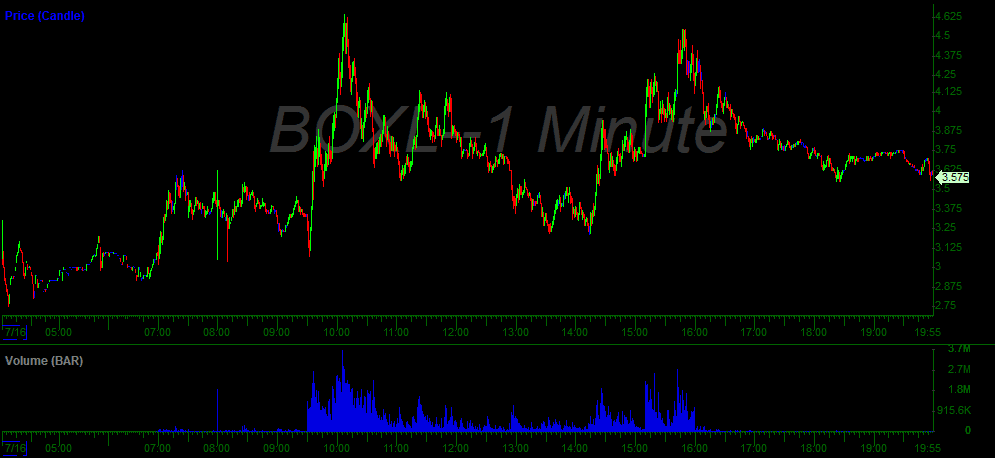

Boxing BOXL

I am adding this one more as a learning moment vs. just showing the trade. As your experience grows you learn to secure borrows on names that you know will be impossible to borrow later. If you start in short and want to cover you will then lose those shares to short again. The solution is to box the trade. If you are short 1k shares and want to temporally cover then you box it by going long the same amount of shares. Some brokers will let you do it in the same account and some you have to use a separate account. Then when you want to re-short it you would sell your long position to be net short again.

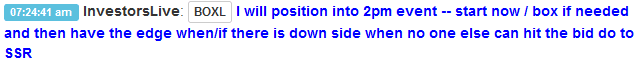

VRNA Momentum

Not a ton to say here but a huge win for the chat!

Have a great weekend!

0 Comments