Not even a month into 2021 and it is making last year look boring. The number one thing right now is risk management. If you are fighting trades you are doing it wrong. There is just way too much range to play the lets see what it does game. A lot of new traders have made a killing in the last 3-4-5 months but the buy everything going up plan will work until it doesn’t and then there will be a reckoning. We will be ready either way.

Blog readers sale. Quarterly IU membership for $597 and if you shoot me an email ([email protected]) after checkout I will add our Textbook trading course to your account. That way you can learn the setups and our risk management as well as be a part of the chatroom daily. http://investorsunderground.com/s/2RoXX/

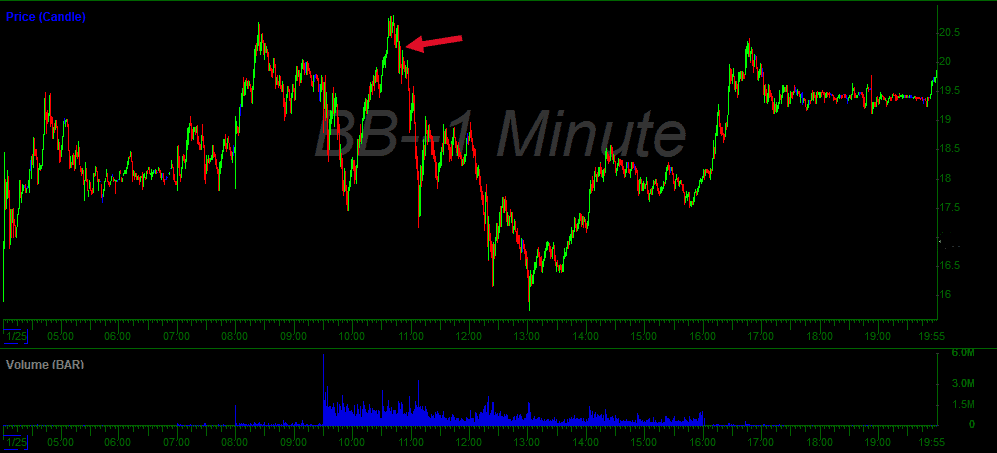

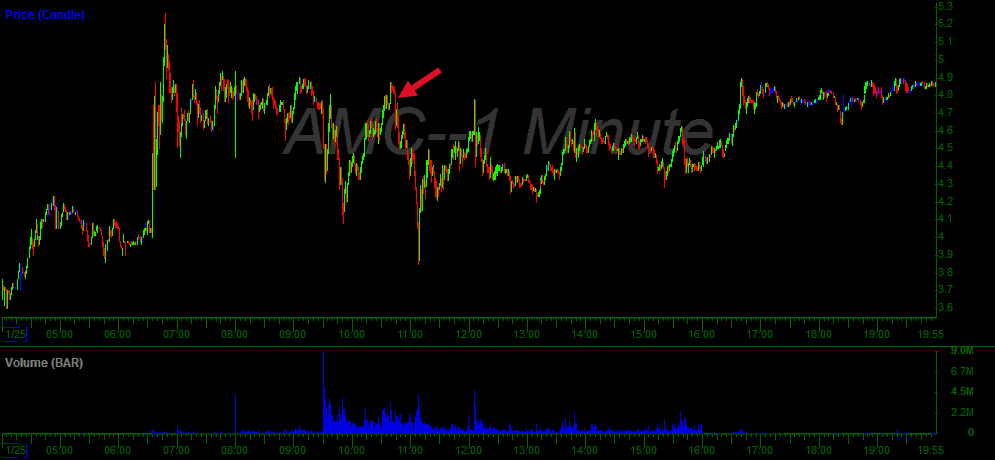

Basket Moves

There were a group of names that retail was all over this week. When one starts to fade, generally they all will. Knowing what is on everyone’s radar can turn 1 decent trade into 3-4.

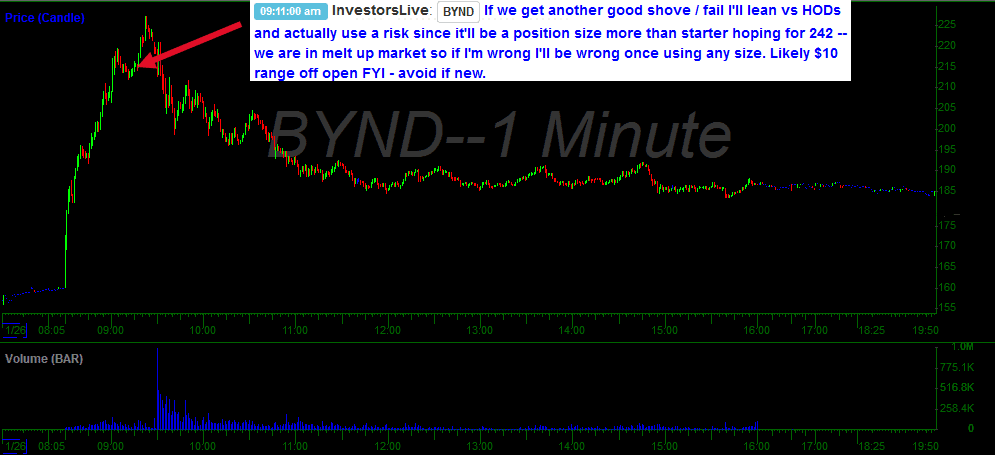

BYND Fade

This is what I was talking about with range. Normally you wouldn’t get into a trade with $10-20 in risk but if you size your trade right and have an exit plan if it goes wrong it can work out well.

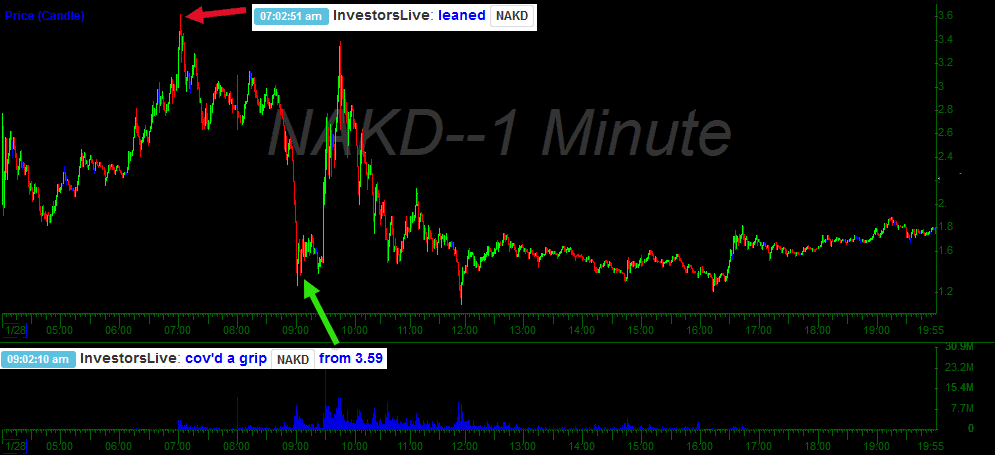

NAKD Short

All of these names have given huge opportunities on both sides all week. Nate got short during pre-market and covered a little bit before the open. Once it ramped up again he was able to reload the short.

CATB Long and Short

TexMex and Nate’s ideas meshed for getting long on this early. They were able to ride it up to the high of day before flipping it short and riding it right back down.

Have a great weekend!

Stupid question…what is a “grip”? See Nate use that a lot in the room. Thanks.

Grip just refers to a bunch. If he covered a grip, he covered a large part of his position.

Thanks!