It was a short week this week but definitely not short on trading setups. It seems like every week since I started doing this I always say how crazy the last week was and then when I write a new one it makes the last week seem tame in comparison. From news to intra-day offerings, things that seem to happen only a few times a year all happened this week. One big difference was there was a lot more opportunity on the short side than in the last few weeks.

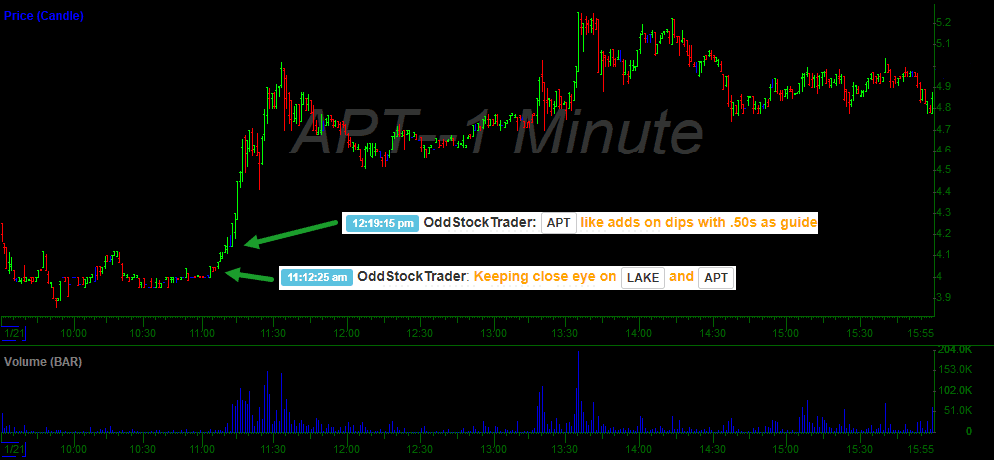

China virus sympathy play

On Tuesday there were more and more headlines about the respiratory illness going on in China. Most people remember the Ebola days and what that did to LAKE. @Oddstocktrader brought the sympathy name to chat with his plan laid out for APT. Having a list of sympathy names on hand for any sector can help get you on them first.

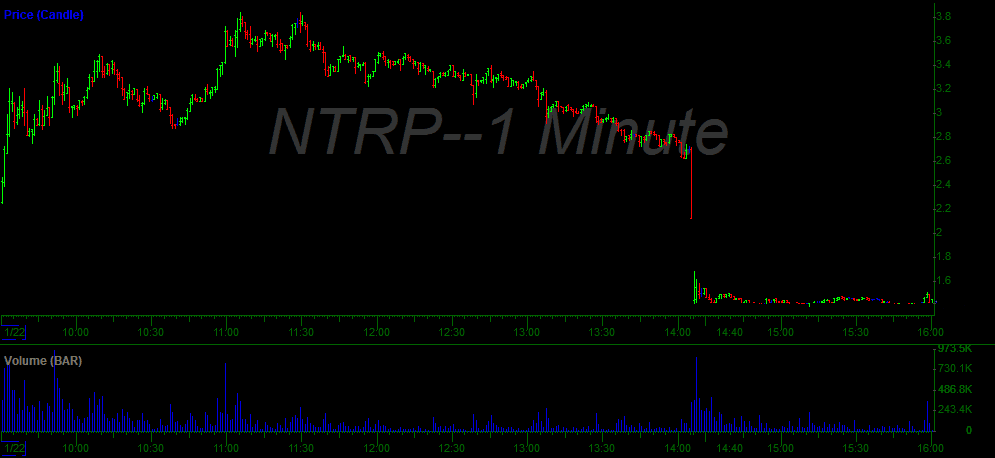

NTRP Offering

On Wednesday Nate covered his game plan to get short on NTRP in the pre-market live broadcast and then via his play by play in chat. $3.40 was his key level and rode it right down into an intra-day offering.

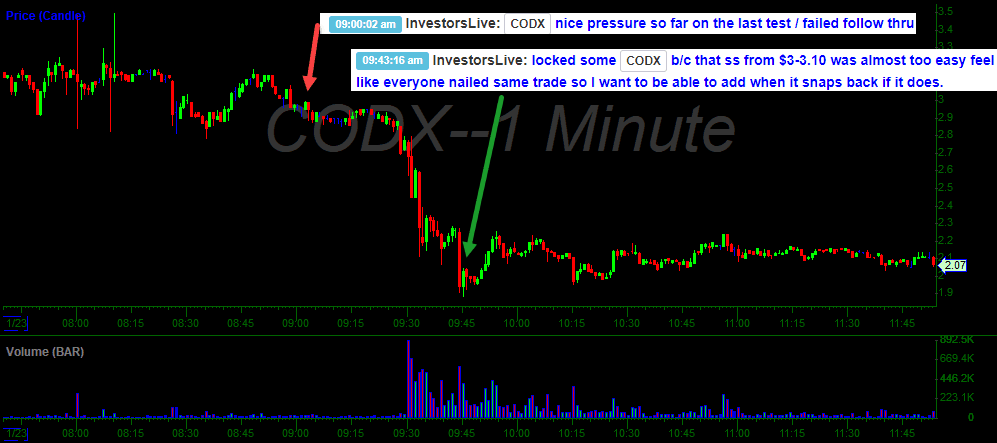

CODX Short

On Thursday @InvestorsLive shared his trade plans on CODX. One thing you will see over and over is finding the key levels in the chart and being ready to react to them. With so many setups coming along it is more important than ever to narrow down your watch list to only your A+ setups. It is too easy to have 30 tickers on watch and miss one after the other when you are trying to not miss a single one.

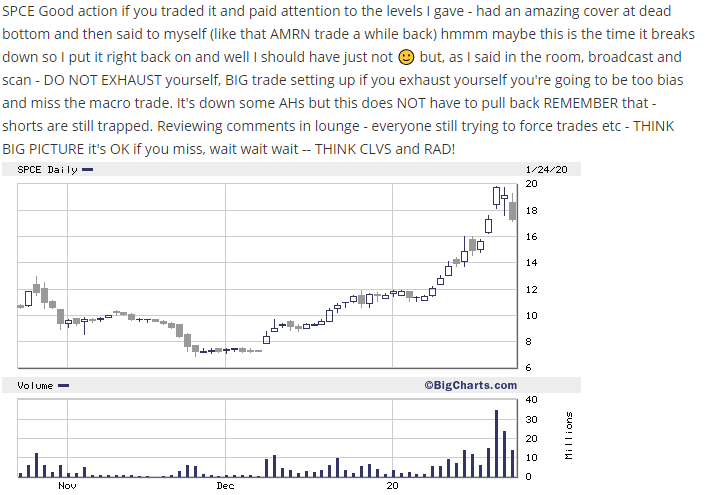

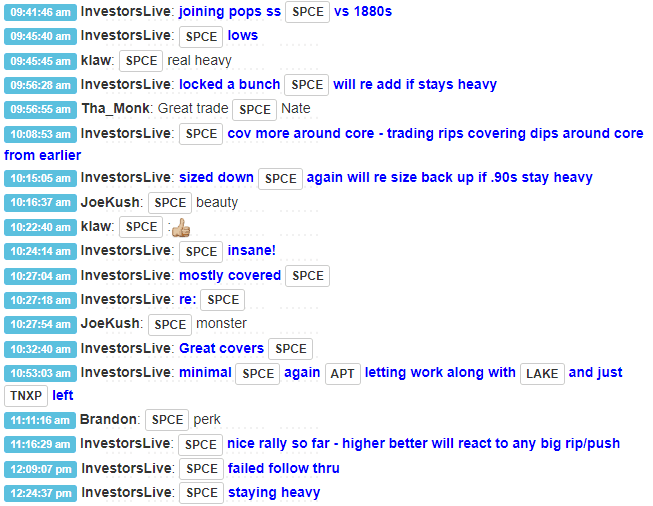

SPCE Scan and Trade

SPCE has been a great trading vehicle all week. Friday was no different. Nate laid out his plan on the scan and then live in chat.

Have a great weekend! Reach out if you are struggling with your trading and I will be happy to help. [email protected]

“With so many setups coming along it is more important than ever to narrow down your watch list to only your A+ setups’ definitely going to narrow down my focus this coming week. thanks!