Another great week in the IU community. So many members having record weeks or months is astounding. If you are on your A game right now this will be a year to remember. If you are new or an experienced trader that is having trouble, take a step back and really analyze your trades. Both winners and losers. What trends do you find in both? Reach out to me if you are struggling and I will try and help. [email protected]

This week we have both of our streaming courses plus a quarterly IU membership for $1297 and I am adding in a bonus month making it 4 months total. This gives you every tool we offer to help get you up to speed as quickly as possible. http://investorsunderground.com/s/eU7EB/

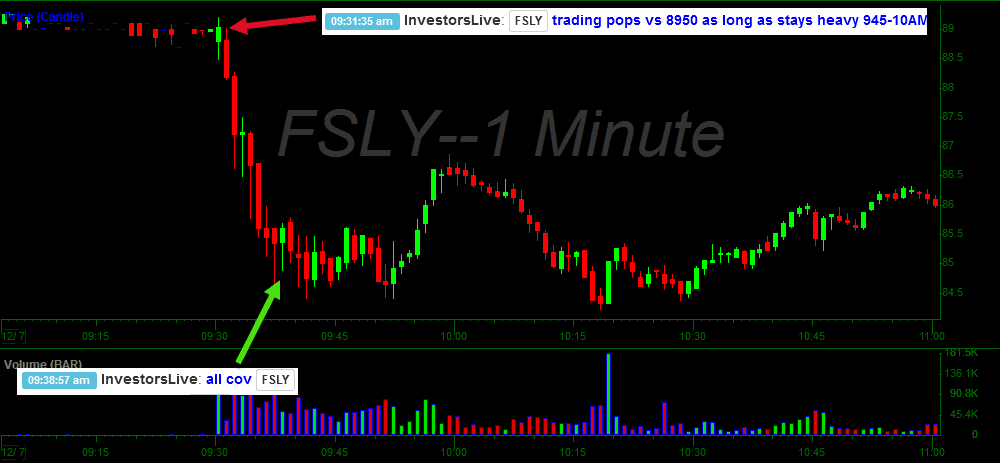

FSLY Fade

Nate shared his trade plan for FSLY on Monday morning. Once he started to see the higher lows (not staying heavy) he covered his remaining shares. Having a trade plan like this allows you to capture more of the move vs. having a static reward level of covering at $87.

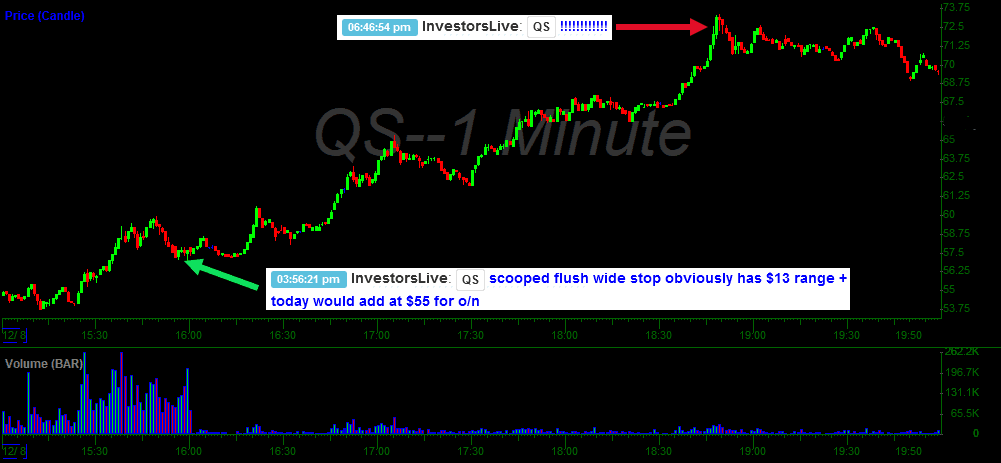

QS Crystal Ball

One thing that Nate is a complete master at is seeing the signs that shorts are soon to be in a big bind on a ticker. Here is a little cheat sheet for new members. If Nate says shorts are likely in a bind, DO NOT SHORT IT. Nate got long with a wide stop considering the range. Then the only fight was trying not to sell it.

GLSI Run

Not a ton to learn on this one. I just added it as it was crazy to watch in real time.

SGMO Change of Plans

Sometimes you change a swing trade to a day trade and day trade to a swing. Nate was anticipating this move taking a couple of days to work out when it ended up only taking a couple of hours.

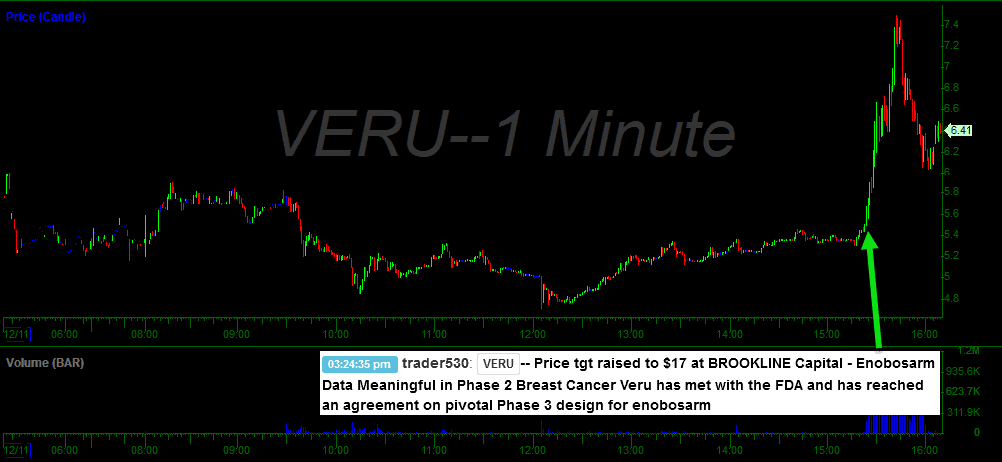

VERU News

Our weekly edition of a great news play. What a awesome way to end the week. Thank you T530!!

Have a great weekend!

0 Comments