We’ve been using the ABCD chart pattern at Investors Underground for a long time to nail long trades with minimal risk and maximum reward. This chart pattern allows you to enter a trade with a set risk and, most importantly, a solid plan.

The ABCD pattern is discussed in detail on the Textbook Trading and Tandem Trader DVD’s, however, this blog post will cover the basics.

What is the ABCD Chart Pattern?

The ABCD pattern is a chart pattern we use in chat to identify potential long trade setups. We generally use this pattern intraday, however, it can be applied to different timeframes.

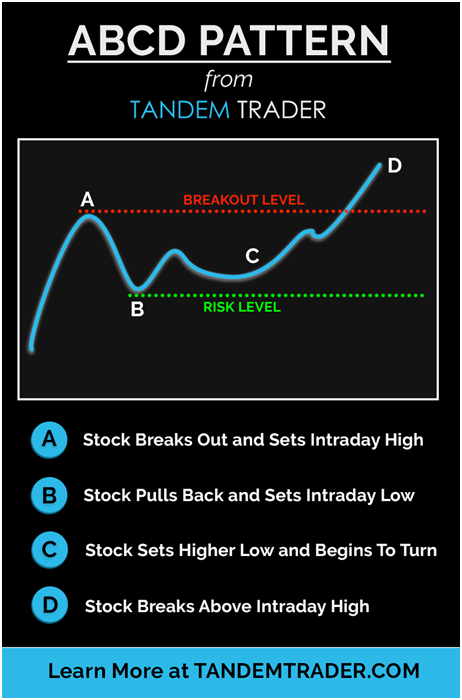

The pattern is characterized by an initial spike (A), during which the stock price reaches the high-of-day. This spike is followed by a healthy pullback as profit takers inevitably begin to sell their shares. Once buyers overpower sellers, an intraday low is established (B). At this point, we are looking for the stock to show strength by setting a higher low (above point B) on the next dip. Once this higher low is established (C), we begin planning our trade with a risk at B. Essentially, we are planning for the stock to break above point A for an intraday breakout, and managing our risk accordingly. Once the stock breaks above point A, the trade plan has proven to be successful and we consider taking profits at point D.

ABCD Chart Pattern Clip from Tandem Trader

If you want to learn more about the ABCD pattern, check out Textbook Trading and Tandem Trader.

If you want to trade ABCD patterns, as well as many other profitable patterns, live with our team, join us in the Investors Underground chat room.

I have done just that, memorized the pattern that is.

I see ABCD everywhere.

Simple and it makes sense.

BREXIT Friday one day charts are all ABCD´s.

Remembering not trying to predict, only being ready to react.. I get that too.

I am not in FOREX, just saying, ABCD is solid.

Cam and the IU crew rock!!!!

PS: Question, Why is ABCD pattern not Elliot Wave?

I am telling you guys,, is pure genious!!!

ABCD is everywhere!!!!

It is Tuesday and it happened…..

BTW I meant “Cam and Nate and the IU crew rock!!! (left Nate out)

Textbook ABCD for HOD break $LEDS

Does it work best on any particular time frame?

This is the defining moment: I thought you couldn’t do better, but this is the best of many best tutorial posted so far! The ABCD pattern is explained to perfection, the plan is well laid out, and the risk clearly explain! Then the 20min live Tandem clip just blew me away. But one of the strongest moments was the opening video, freeze picture at (0:50): Cam standing patiently watching Nate talk away, two well built healthy good looking young men, casual T-shirts with trading monitors in the background, and on the wall shelves; personal items like music, liquors etc! Are you kidding me, I want in….! Excellent production guys! Thanks.

Awesome! Learn more of that trading patterns. Thank you.

very helpful. thnx nate and cam. focusing in on this pattern type for now as i continue learning the ins and outs of the trading game. really appreciate all your content. has changed the game for me tremendously.

Does it work on any time frame? I trade only based on the five minute.